Business Credit Application Templates

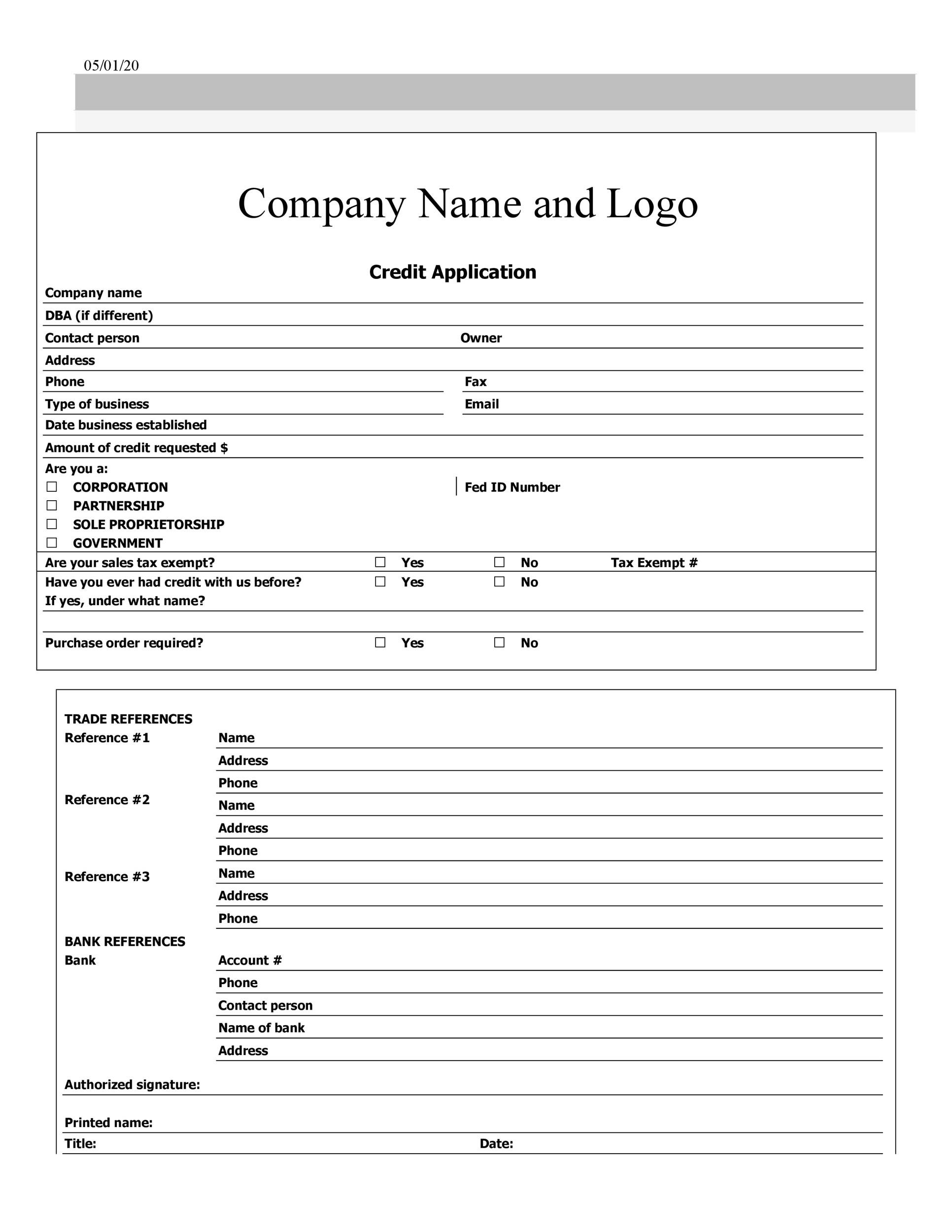

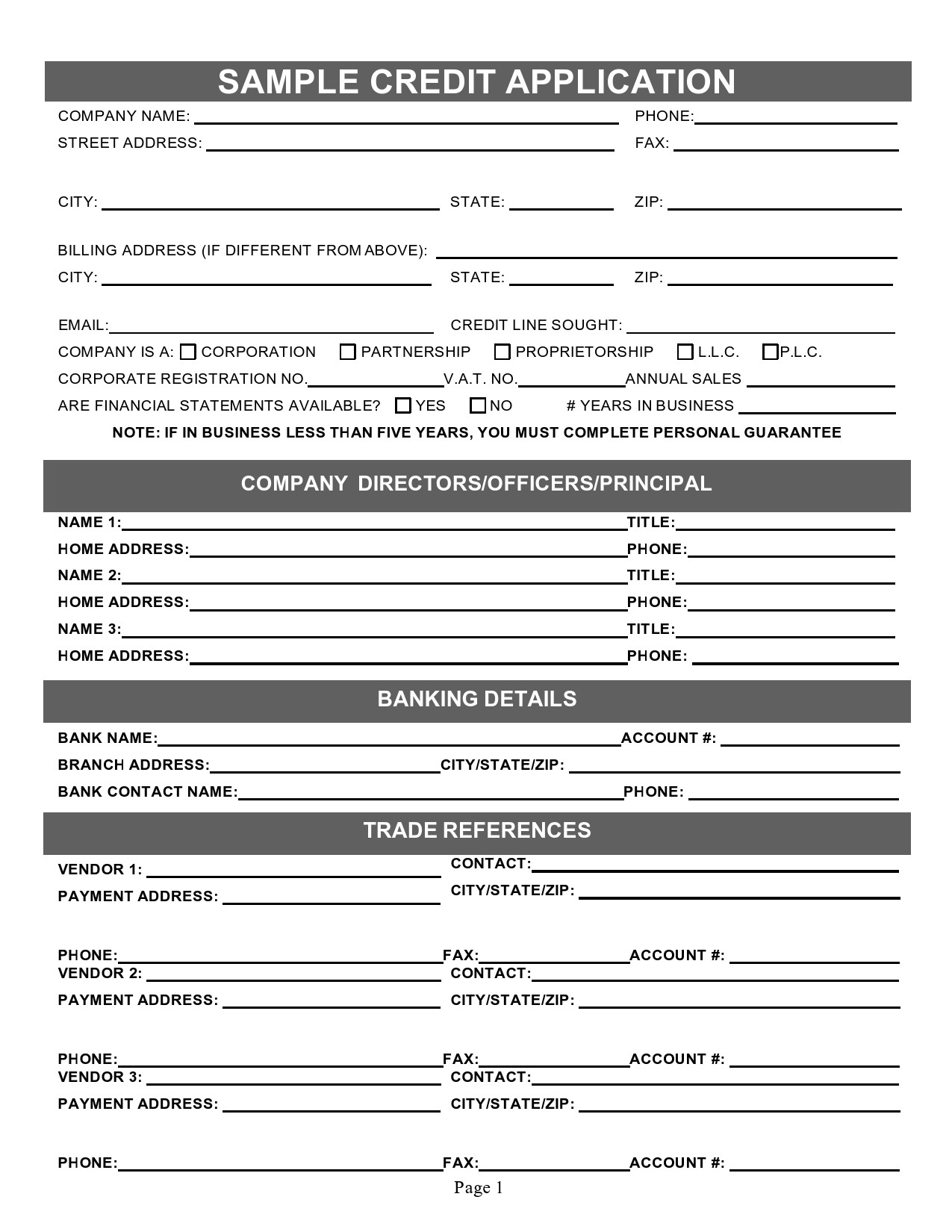

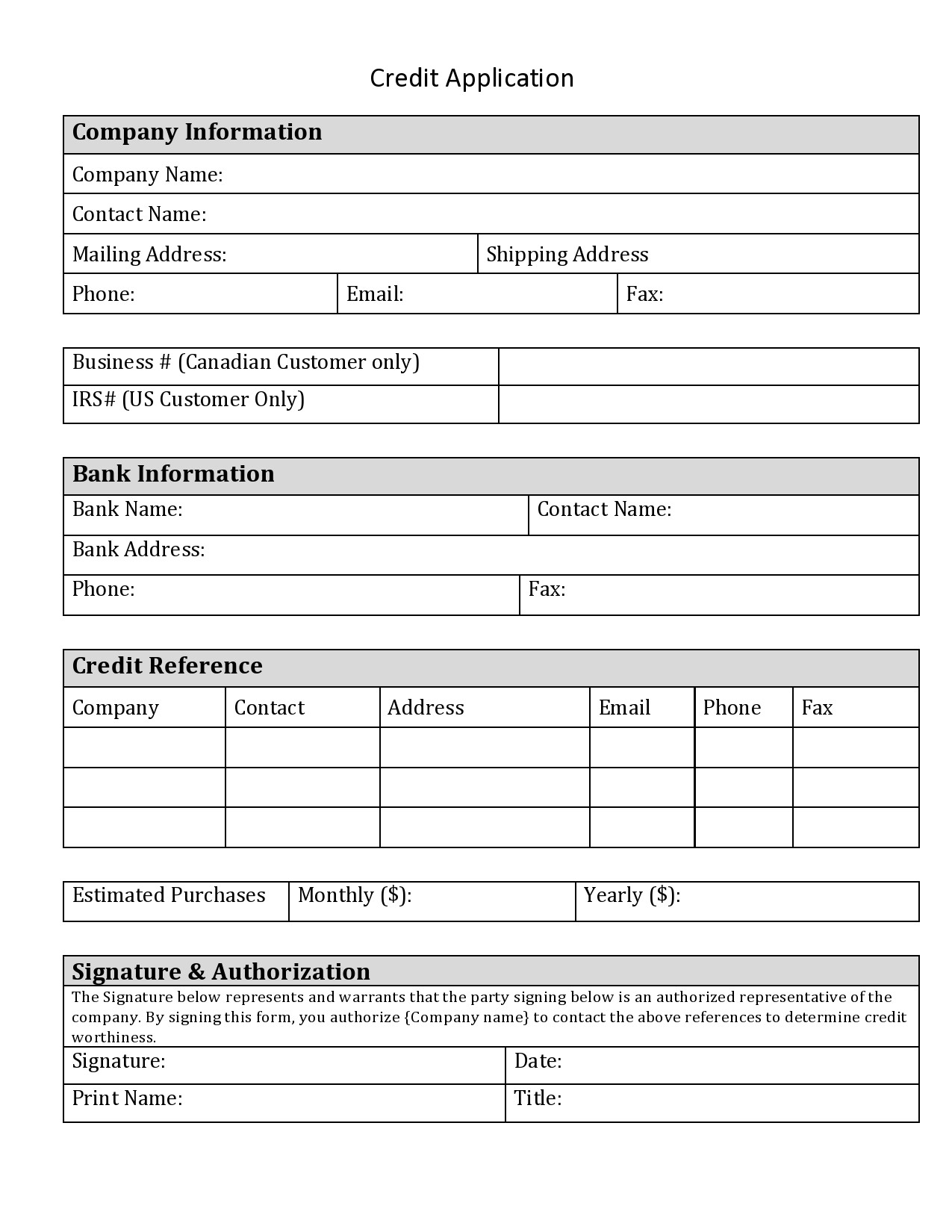

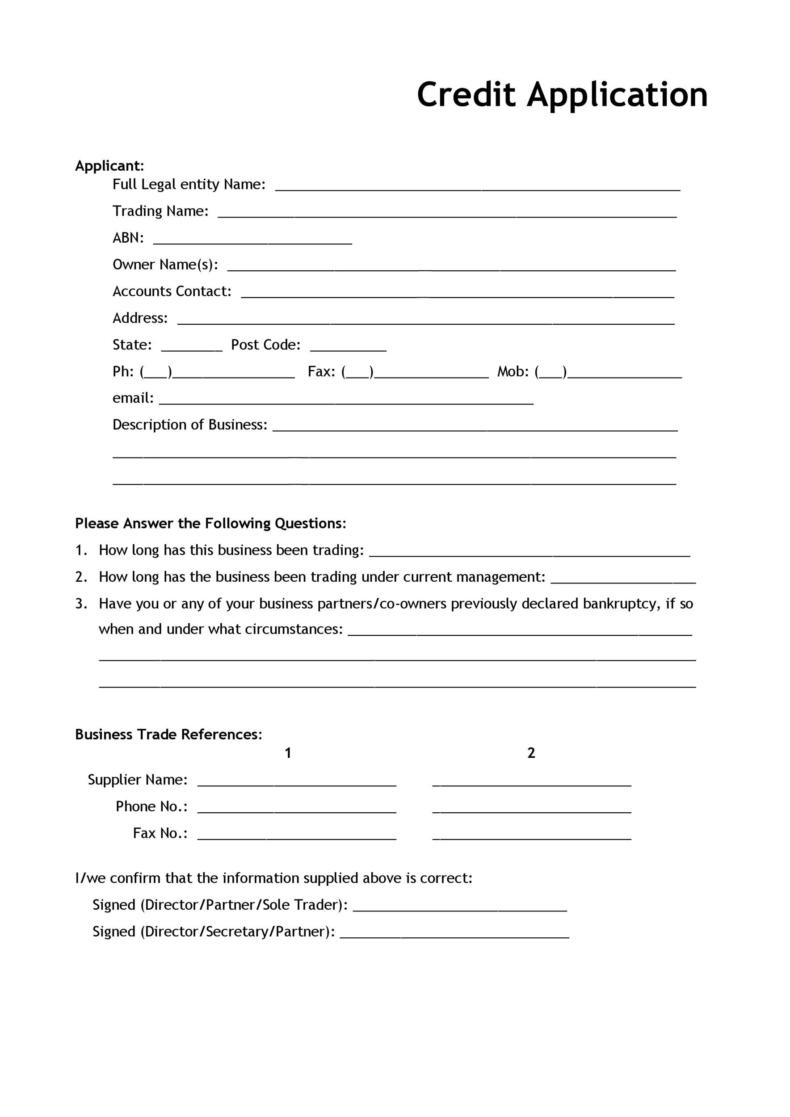

Business Credit Application Templates - Web presenting a business credit application is crucial in helping lenders manage and evaluate credit risks. Steps to approve a business credit application. First, it’s a data collection tool and second, it’s a contract. Get 3,000+ templates to start, plan, organize, manage, finance and grow your business. Download this free template to ensure your business credit application contains all the necessary fields required to capture complete customer. After receiving a customer’s credit application form, you’ll need to analyze their information to determine if they qualify for a line of credit and how much that might. However, today, businesses prefer online credit applications as they are more accessible. Web you can use the credit application template for two purposes. This template typically includes sections for business details, such as legal name, type of business, years in operation, owner information, and financial data like bank accounts,. Web a business credit application is a form that enables a registered entity to apply for a line of credit, term loan, revolving tradeline, or a private net 30 account. This template typically includes sections for business details, such as legal name, type of business, years in operation, owner information, and financial data like bank accounts,. Ensure all required fields on the business credit application are filled out accurately. When writing on the business credit application template, remember that it’s a simple request for a credit extension. Web here are. However, today, businesses prefer online credit applications as they are more accessible. Download this free template to ensure your business credit application contains all the necessary fields required to capture complete customer. After receiving a customer’s credit application form, you’ll need to analyze their information to determine if they qualify for a line of credit and how much that might.. Web business in a box templates are used by over 250,000 companies in united states, canada, united kingdom, australia, south africa and 190 countries worldwide. For the latter, it defines the obligations and rights of the creditor and the customer. It collects identifiable information about the business to determine its creditworthiness. Manual credit applications can be. A business credit application. It collects identifiable information about the business to determine its creditworthiness. A business credit application serves dual purposes: Manual credit applications can be. Web you can use the credit application template for two purposes. For the latter, it defines the obligations and rights of the creditor and the customer. This template typically includes sections for business details, such as legal name, type of business, years in operation, owner information, and financial data like bank accounts,. Ensure all required fields on the business credit application are filled out accurately. Web you can use the credit application template for two purposes. Web a business credit application is a form that enables. However, today, businesses prefer online credit applications as they are more accessible. Web business in a box templates are used by over 250,000 companies in united states, canada, united kingdom, australia, south africa and 190 countries worldwide. A business credit application serves dual purposes: Take your business to new heights with faster cash flow and clear financial insights —all with. Ensure all required fields on the business credit application are filled out accurately. Take your business to new heights with faster cash flow and clear financial insights —all with a free novo account. After receiving a customer’s credit application form, you’ll need to analyze their information to determine if they qualify for a line of credit and how much that. In the past, business credit applications used to be sent in a physical form; Web a business credit application is a form that enables a registered entity to apply for a line of credit, term loan, revolving tradeline, or a private net 30 account. Web a business credit application is a formal document that a company submits to a creditor. Web presenting a business credit application is crucial in helping lenders manage and evaluate credit risks. Web here are some business credit application templates you can use in your operations or as inspiration for creating your own: Ensure all required fields on the business credit application are filled out accurately. This template typically includes sections for business details, such as. If used correctly, lenders can identify companies to watch out for when extending credit. However, today, businesses prefer online credit applications as they are more accessible. In the past, business credit applications used to be sent in a physical form; A guide to credit applications for business owners that includes what lenders ask for, what to do if you are. A business credit application serves dual purposes: Web a business credit application is a form that enables a registered entity to apply for a line of credit, term loan, revolving tradeline, or a private net 30 account. However, today, businesses prefer online credit applications as they are more accessible. Ensure all required fields on the business credit application are filled out accurately. If used correctly, lenders can identify companies to watch out for when extending credit. Web here are some business credit application templates you can use in your operations or as inspiration for creating your own: In the past, business credit applications used to be sent in a physical form; A guide to credit applications for business owners that includes what lenders ask for, what to do if you are denied, & how these impact your credit score. It collects identifiable information about the business to determine its creditworthiness. Provide comprehensive details about the business, including financial information and. For the latter, it defines the obligations and rights of the creditor and the customer. Download this free template to ensure your business credit application contains all the necessary fields required to capture complete customer. Web you can use the credit application template for two purposes. This template typically includes sections for business details, such as legal name, type of business, years in operation, owner information, and financial data like bank accounts,. After receiving a customer’s credit application form, you’ll need to analyze their information to determine if they qualify for a line of credit and how much that might. First, it’s a data collection tool and second, it’s a contract.

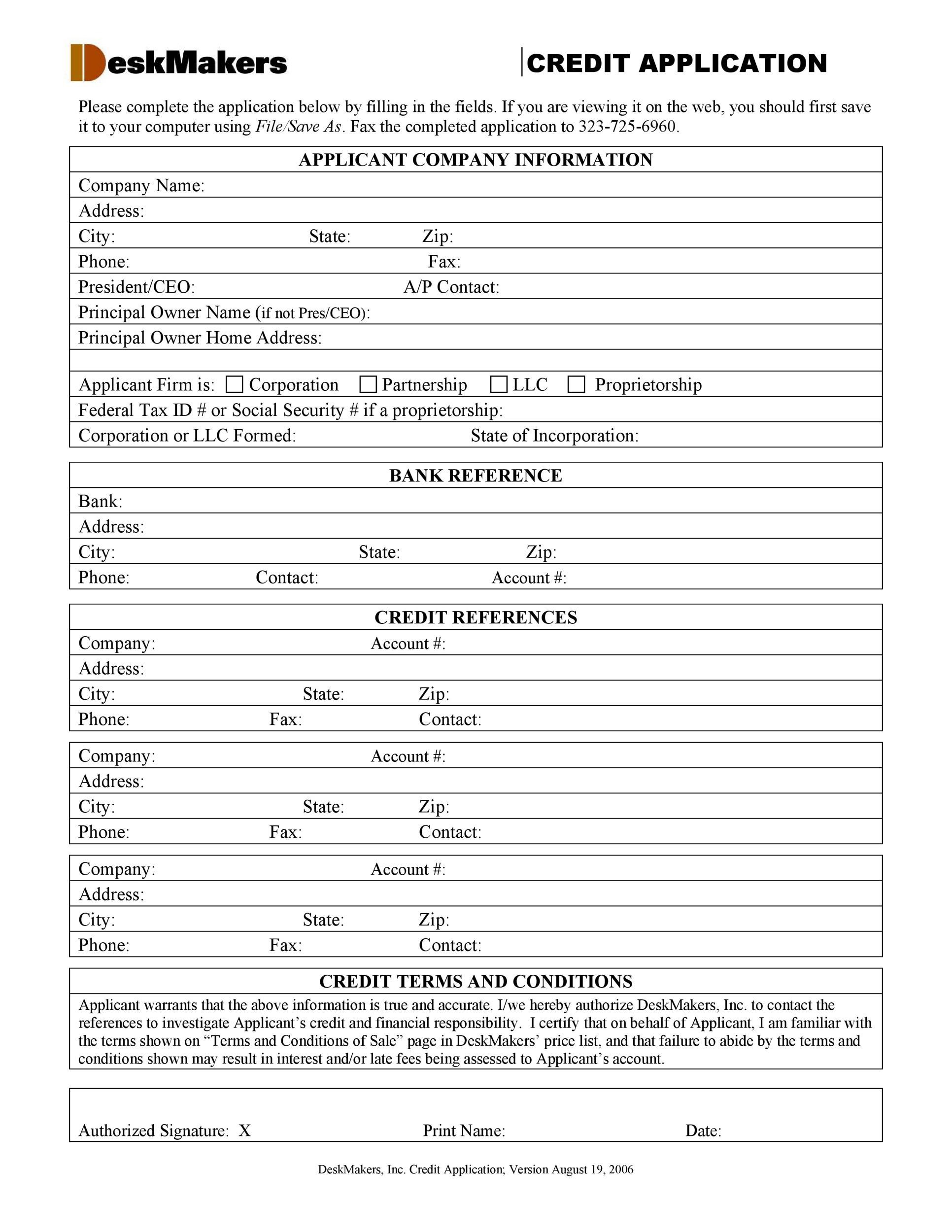

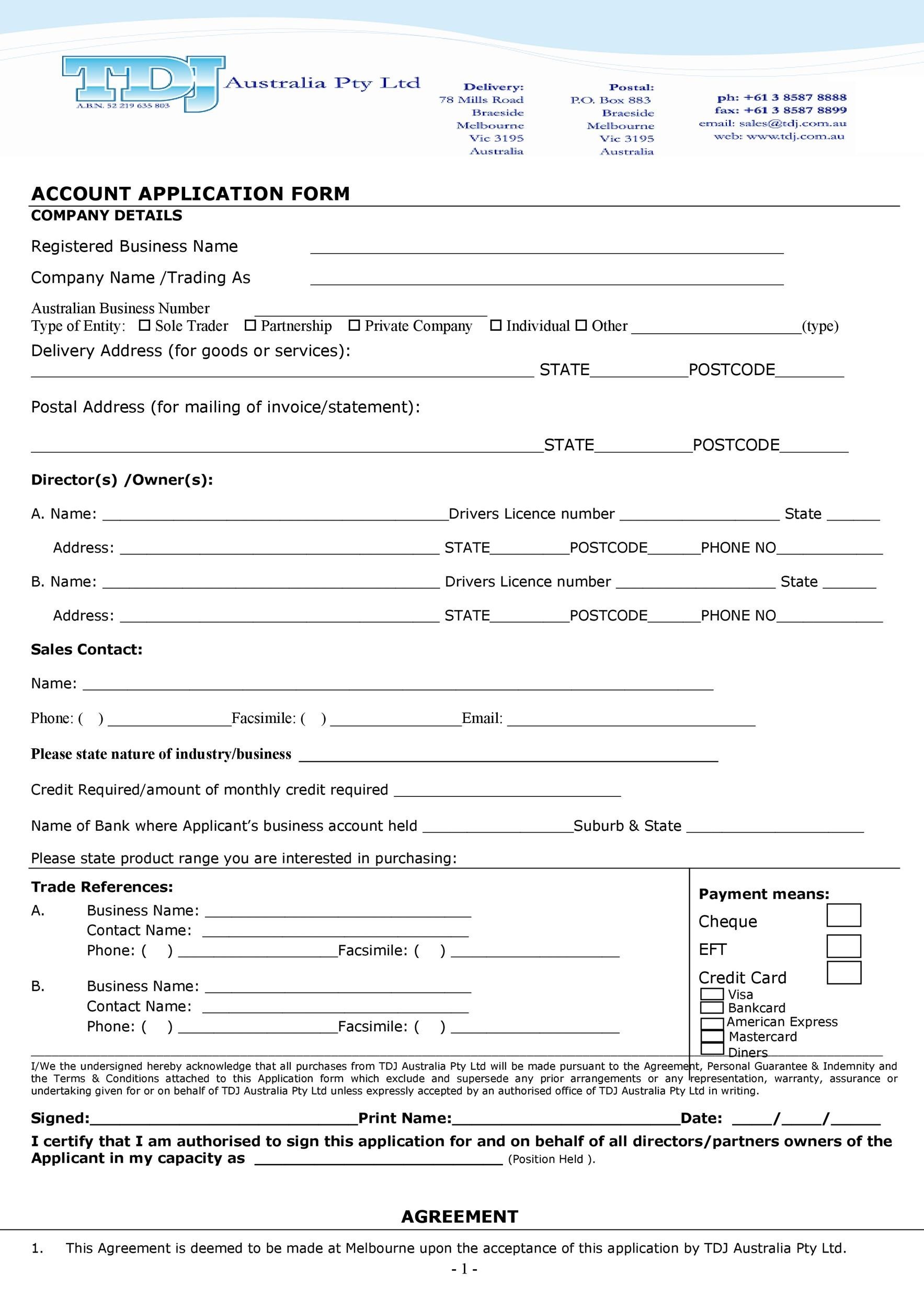

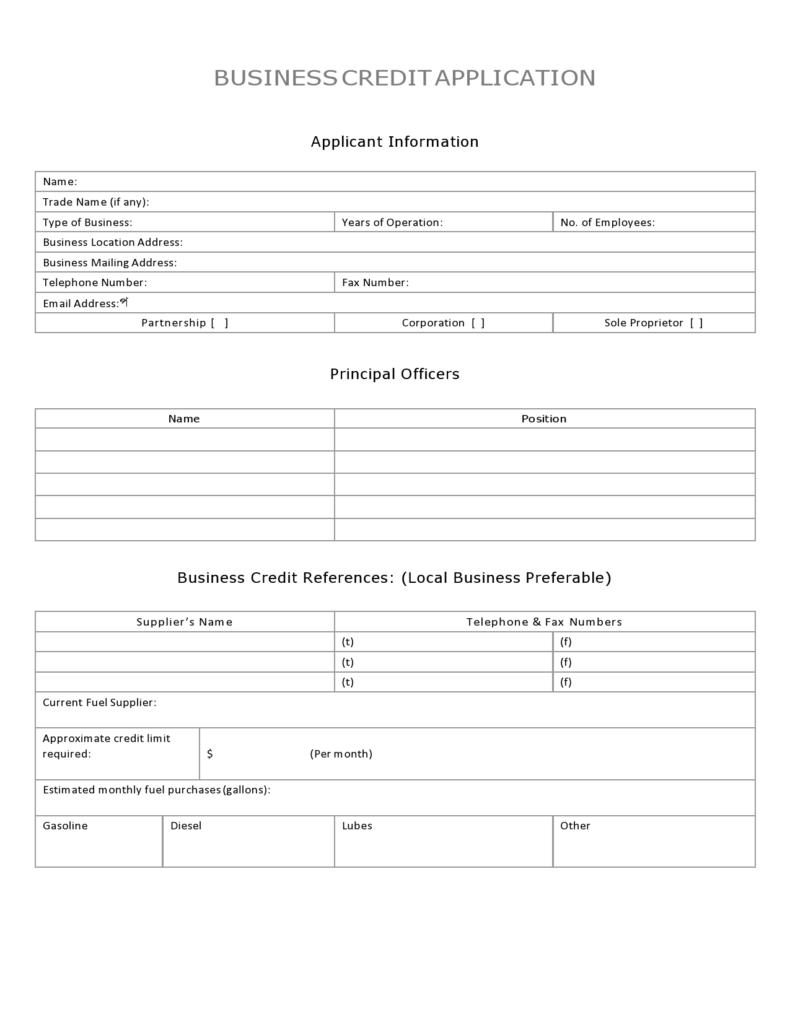

40 Free Credit Application Form Templates & Samples

48 Blank Business Credit Application Templates (100 FREE)

![9+ Business Credit Application Form Templates Download [Word, PDF]](https://www.opensourcetext.org/wp-content/uploads/2021/06/caf-1.jpg)

9+ Business Credit Application Form Templates Download [Word, PDF]

48 Blank Business Credit Application Templates (100 FREE)

![Free Printable Business Credit Application Templates [Word, PDF, Excel]](https://www.typecalendar.com/wp-content/uploads/2023/05/business-credit-application-template-pdf.jpg)

Free Printable Business Credit Application Templates [Word, PDF, Excel]

40 Free Credit Application Form Templates & Samples

40 Free Credit Application Form Templates & Samples

Free, Printable Business Credit Application Template (Plus, How to Use

40 Free Credit Application Form Templates & Samples

48 Blank Business Credit Application Templates (100 FREE)

Web A Business Credit Application Is A Formal Document That A Company Submits To A Creditor When Applying For A Line Of Credit.

Manual Credit Applications Can Be.

Take Your Business To New Heights With Faster Cash Flow And Clear Financial Insights —All With A Free Novo Account.

Web Tips For Using Business Credit Application Templates.

Related Post: