Bump And Run Pattern

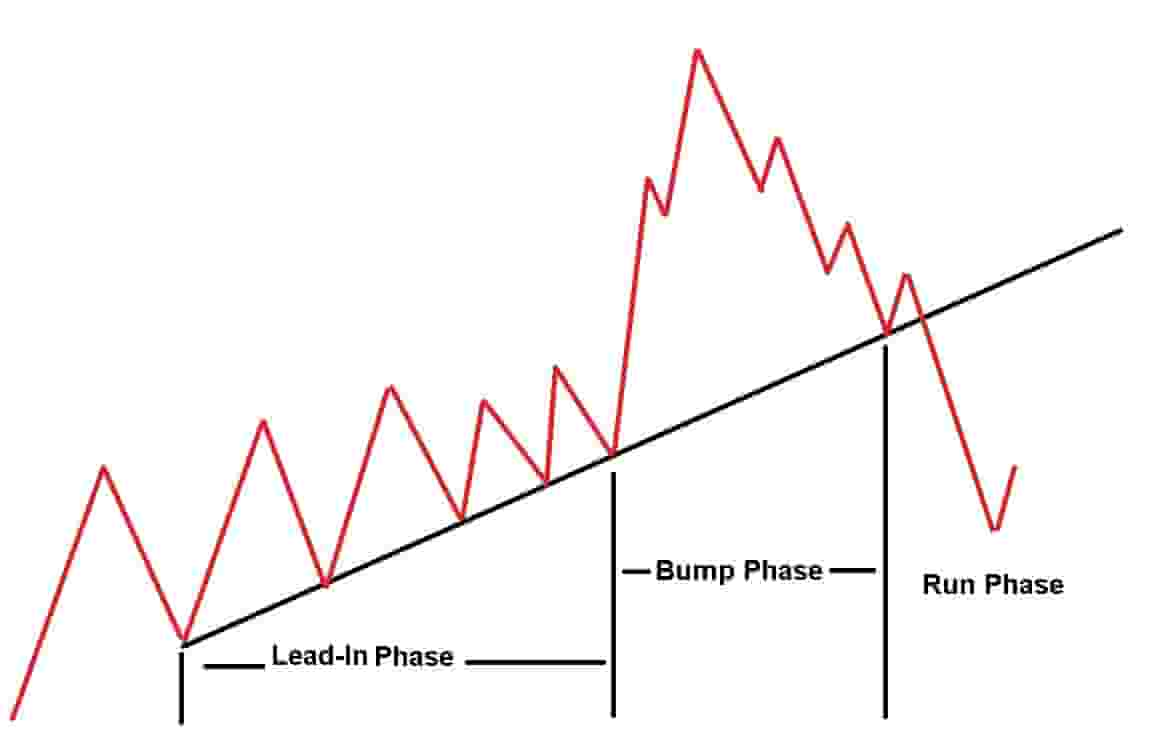

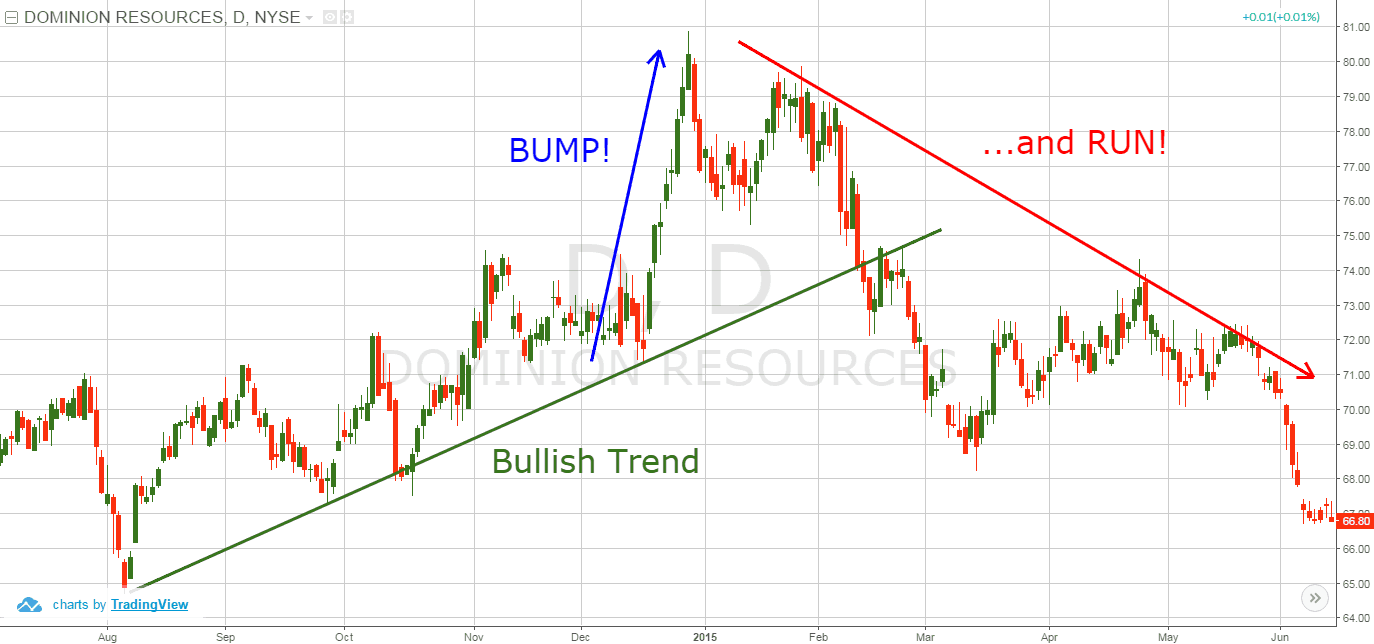

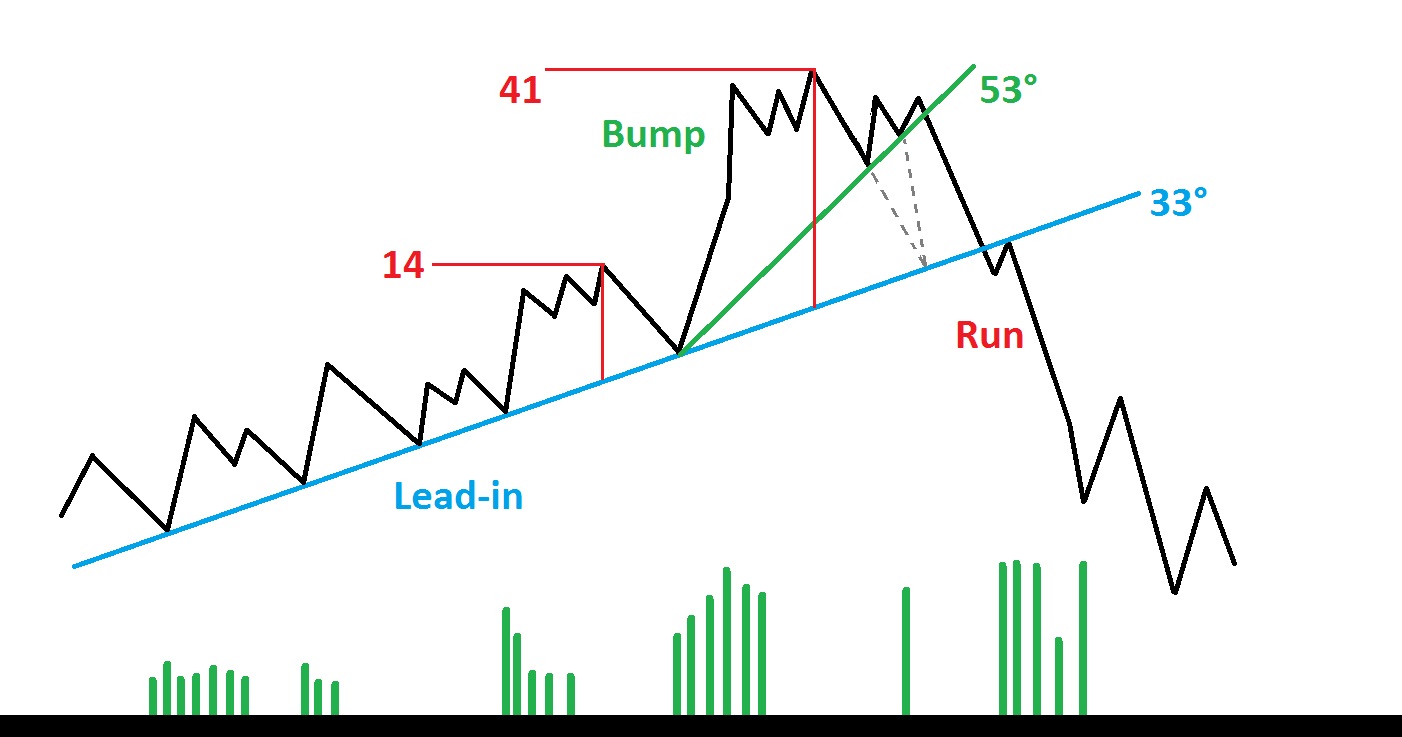

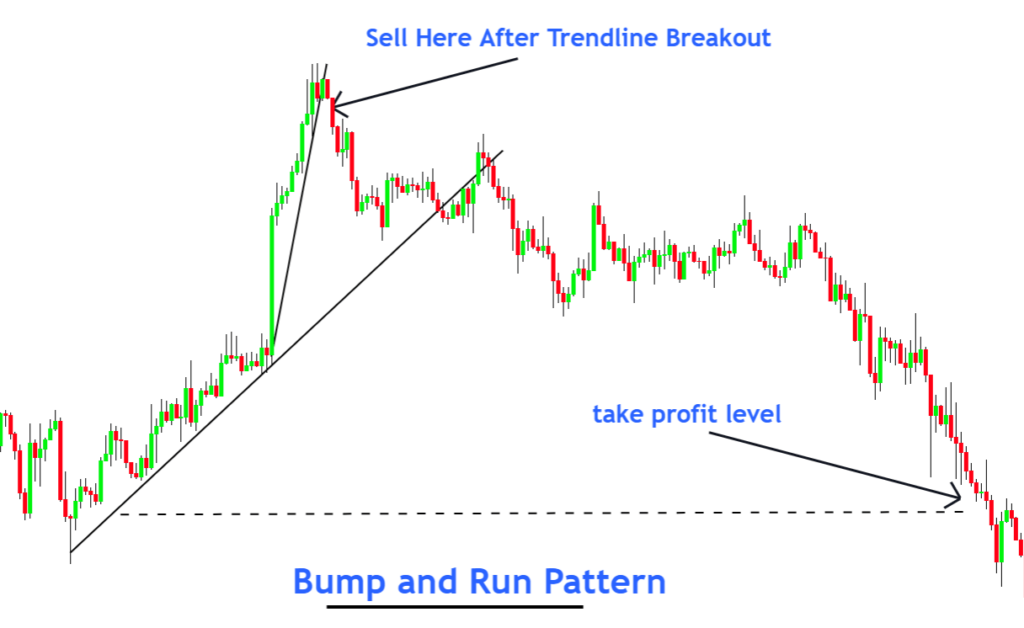

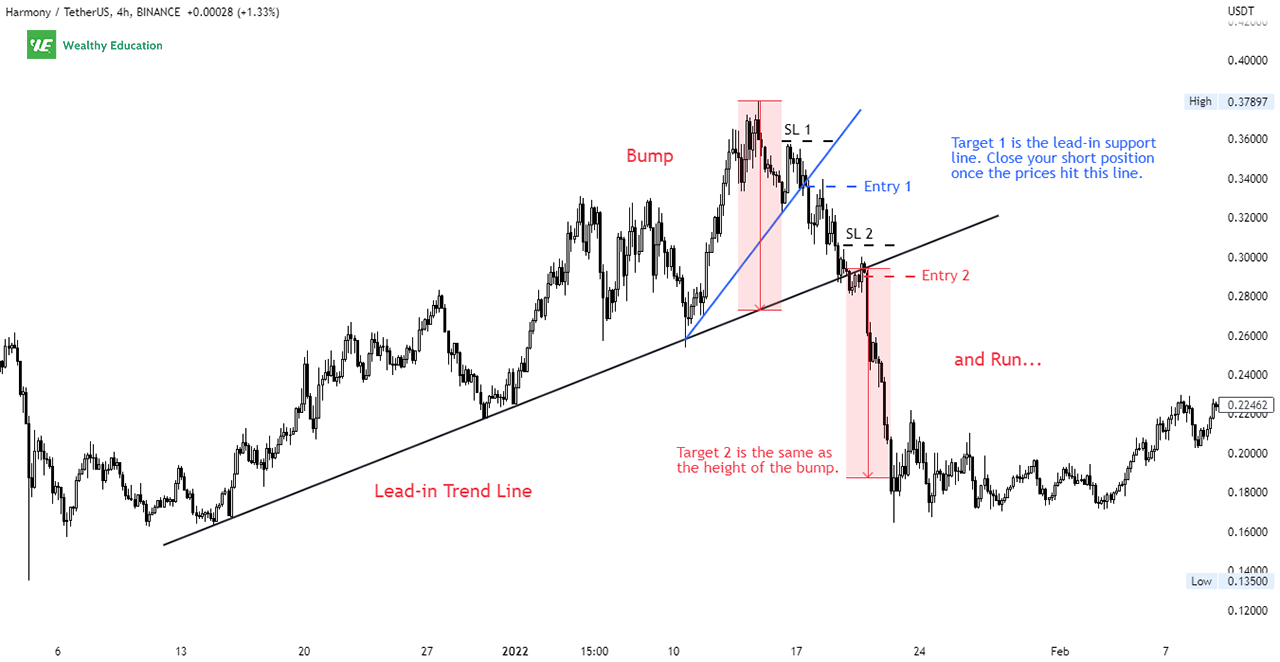

Bump And Run Pattern - The bearish bump and run pattern starts with a standard bullish trend. Web the bump and run reversal bottom (barr) pattern is a technical chart pattern that signals a potential trend reversal from a downward to an upward trend. Bump and run reversal looks. The bump and run, also known as the bump and run reversal pattern, identifies potential price reversals in financial markets. Bump and run is a market pattern consisting of two phases determining the price trend reversal. Web the bump and run reversal pattern (barr), discovered by thomas bulkowski, is formed when there is a sharp rise or fall in the price of an asset due to excessive speculation. Web as the name implies, the bump and run reversal (barr) is a reversal pattern that forms after excessive speculation drives prices up too far, too fast. Web the bump and run pattern, also known as the barr pattern, is a chart pattern that provides insights into stock price movements. Web a bump and run pattern is a bearish reversal pattern that happens after prices rise too far, too fast. Web updated on may 13, 2022. Web the bump and dump reversal pattern is an advanced chart pattern that helps traders spot the end of a trend and the start of a new one. Web in technical analysis, a bump and run reversal pattern (barr), also known as a bump and run reversal top, is a bearish reversal chart pattern that forms when. Bump and run. The bump and run pattern is a reversal pattern that occurs during a strong uptrend. Web bump and run reversal pattern trading strategyas the name implies, the bump and run reversal (barr) is a reversal pattern that forms. Web the bump and run reversal bottom (barr) pattern is a technical chart pattern that signals a potential trend reversal from a. It consists of three phases: Web a bump and run pattern is a bearish reversal pattern that happens after prices rise too far, too fast. Web as the name implies, the bump and run reversal (barr) is a reversal pattern that forms after excessive speculation drives prices up too far, too fast. Web the bump and run pattern, also known. Bump and run reversal looks. The bump and run pattern is a reversal pattern that occurs during a strong uptrend. Web the bump and dump reversal pattern is an advanced chart pattern that helps traders spot the end of a trend and the start of a new one. Web bump and run reversal pattern trading strategyas the name implies, the. Web updated on may 13, 2022. Web the bump and run reversal bottom (barr) pattern is a technical chart pattern that signals a potential trend reversal from a downward to an upward trend. It consists of three phases: Web what is the bump and run pattern? The bump and run, also known as the bump and run reversal pattern, identifies. Web in technical analysis, a bump and run reversal pattern (barr), also known as a bump and run reversal top, is a bearish reversal chart pattern that forms when. Bump and run reversal looks. The bump phase, the bump trend line, and. The bearish bump and run pattern starts with a standard bullish trend. Web updated on may 13, 2022. The bump and run pattern is a reversal pattern that occurs during a strong uptrend. Web the bump and run reversal pattern (barr), discovered by thomas bulkowski, is formed when there is a sharp rise or fall in the price of an asset due to excessive speculation. Web updated on may 13, 2022. Web bump and run reversal pattern trading. Web as the name implies, the bump and run reversal (barr) is a reversal pattern that forms after excessive speculation drives prices up too far, too fast. It is a rare chart pattern, and traders use it in stocks, ind. Web updated on may 13, 2022. The bearish bump and run pattern starts with a standard bullish trend. It consists. The bearish bump and run pattern starts with a standard bullish trend. The bump phase, the bump trend line, and. Web in technical analysis, a bump and run reversal pattern (barr), also known as a bump and run reversal top, is a bearish reversal chart pattern that forms when. Bump and run reversal looks. Web as the name implies, the. It consists of three phases: The bump and run pattern is a reversal pattern that occurs during a strong uptrend. Web the bump and run pattern, also known as the barr pattern, is a chart pattern that provides insights into stock price movements. The bump and run, also known as the bump and run reversal pattern, identifies potential price reversals. Web bump and run reversal pattern trading strategyas the name implies, the bump and run reversal (barr) is a reversal pattern that forms. Web the bump and run pattern, also known as the barr pattern, is a chart pattern that provides insights into stock price movements. The bump and run, also known as the bump and run reversal pattern, identifies potential price reversals in financial markets. Web a bump and run pattern is a bearish reversal pattern that happens after prices rise too far, too fast. Web as the name implies, the bump and run reversal (barr) is a reversal pattern that forms after excessive speculation drives prices up too far, too fast. Bump and run is a market pattern consisting of two phases determining the price trend reversal. It is a rare chart pattern, and traders use it in stocks, ind. Gamestop (gme) bump and run stocks. Web the bump and dump reversal pattern is an advanced chart pattern that helps traders spot the end of a trend and the start of a new one. The bearish bump and run pattern starts with a standard bullish trend. It consists of three phases: Web updated on may 13, 2022. Web bump and run is a market pattern consisting of two phases determining the price trend reversal. Web in technical analysis, a bump and run reversal pattern (barr), also known as a bump and run reversal top, is a bearish reversal chart pattern that forms when. Bump and run reversal looks. The bump and run pattern is a reversal pattern that occurs during a strong uptrend.

Bump And Run Reversal Chart Pattern Definition With Examples

What is Bump And Run Reversal? Run chart, Chart, Bump

Bump And Run Reversal Chart Pattern Definition With Examples

Bump And Run Reversal Chart Pattern Definition With Examples

2 Key Market Phases In Bump And Run Pattern YouTube

Bump And Run Reversal Pattern (Updated 2023)

5 Tips for Confirming and Trading the Bump and Run TradingSim

Bump and Run Reversal (BARR) di Thomas Bulkowski Trading Bull Club

Bump and Run Pattern Bullish & Bearish Chart Pattern ForexBee

Bump And Run Reversal Pattern (Updated 2023)

Web The Bump And Run Reversal Pattern (Barr), Discovered By Thomas Bulkowski, Is Formed When There Is A Sharp Rise Or Fall In The Price Of An Asset Due To Excessive Speculation.

Web The Bump And Run Reversal Bottom (Barr) Pattern Is A Technical Chart Pattern That Signals A Potential Trend Reversal From A Downward To An Upward Trend.

Follow Us On Google News.

The Bump Phase, The Bump Trend Line, And.

Related Post: