Bullish Wedge Patterns

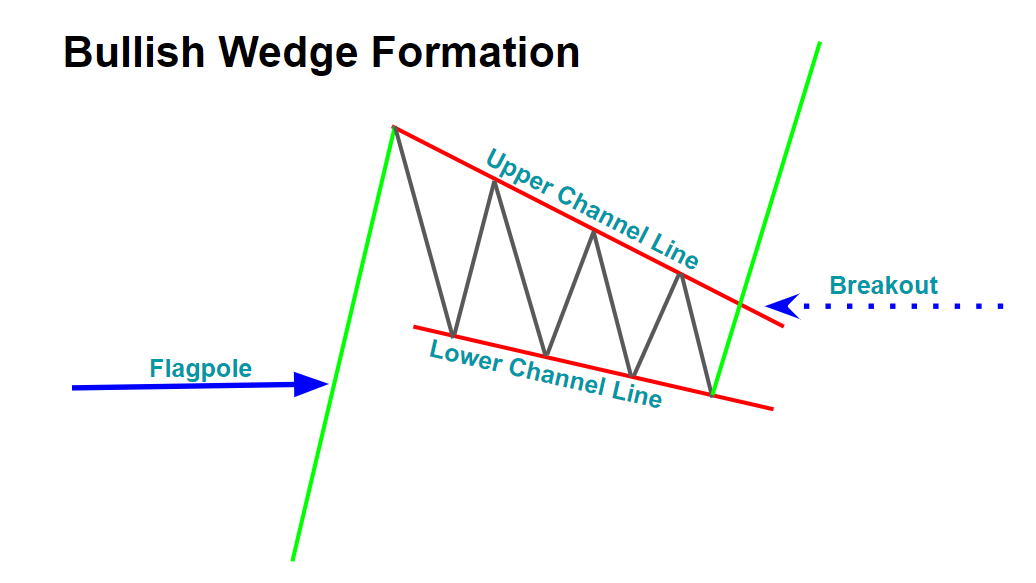

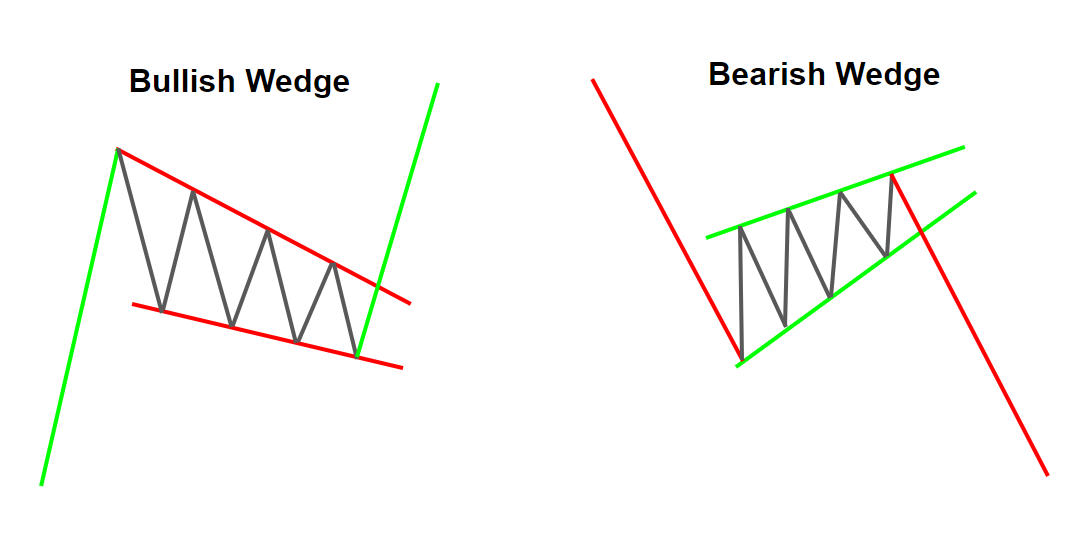

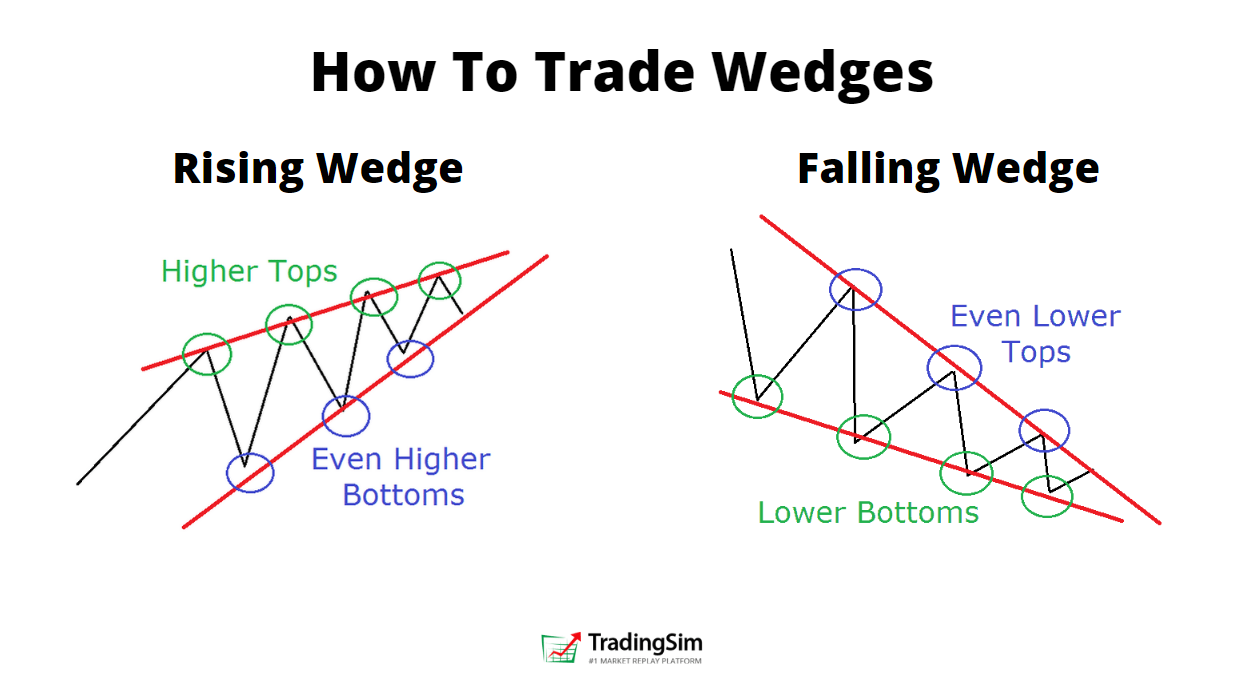

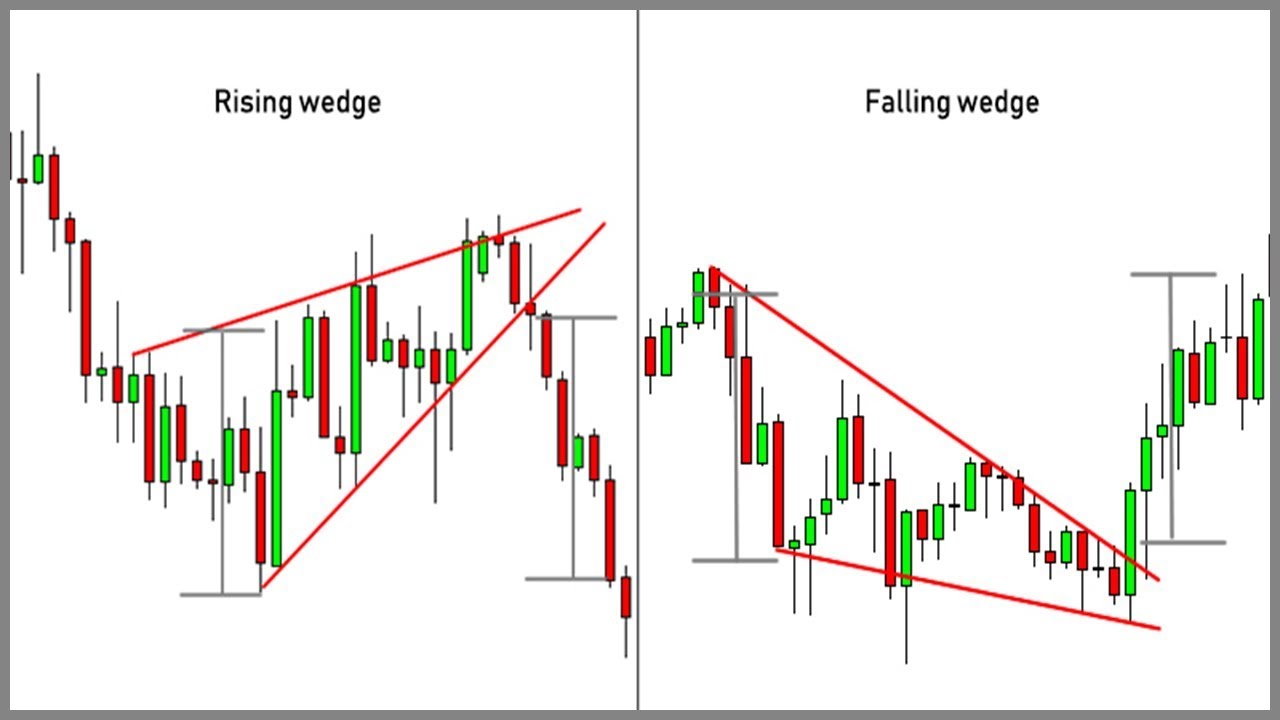

Bullish Wedge Patterns - The two forms of the. Web a falling wedge is a bullish chart pattern that takes place in an upward trend, and the lines slope down. First, the converging trend lines; Web dealerify_hunter jun 26, 2023. It suggests a potential reversal in the trend. When the pattern occurs, it can be. Web the falling wedge is typically bullish and often appears in uptrends. Web the falling wedge pattern is a technical formation that signals the end of the consolidation phase that facilitated a pull back lower. There are dozens of popular bullish chart patterns. But the key point to note is that the upward. Web that advance broke out of a prior descending bullish wedge and expanded the top boundary line of the pattern. In either case, this pattern holds three common characteristics: A wedge pattern can signal either bullish or bearish price reversals. The two forms of the. Web a falling wedge is a bullish chart pattern that takes place in an upward. Web that advance broke out of a prior descending bullish wedge and expanded the top boundary line of the pattern. First, the converging trend lines; But the key point to note is that the upward. Web a falling wedge is a bullish chart pattern that takes place in an upward trend, and the lines slope down. Web rising wedge patterns. Web wedge patterns are a subset of chart patterns, formed when an asset’s price moves within converging trend lines, resembling a wedge or triangle. Web the rising wedge is a bearish chart pattern found at the end of an upward trend in financial markets. Web at first glance, an ascending wedge looks like a bullish move. Web that advance broke. There are dozens of popular bullish chart patterns. This pattern is at the end of a bullish wave, by creating close price. What is the difference between a. Web a falling wedge pattern consists of multiple candlesticks that form a big sloping wedge. This pattern is formed when the market consolidates while making lower lows and lower. Web dealerify_hunter jun 26, 2023. Can wedge patterns be used to predict the exact price movements of a stock? The two forms of the. The formation of an ascending broadening wedge pattern beginning from the 2016 lows of $1045.40, along with an inverted head. As outlined earlier, falling wedges can be both a. This pattern is at the end of a bullish wave, by creating close price. A wedge pattern can signal either bullish or bearish price reversals. A rising wedge is a bearish chart pattern that’s found in a downward. Web wedge patterns are a subset of chart patterns, formed when an asset’s price moves within converging trend lines, resembling a wedge. A rising wedge in an up trend is usually considered a reversal pattern. It is characterized by downward sloping support and resistance. But the key point to note is that the upward. Third, a breakout from one of the trend lines. The pattern is deeper now showing less price. Web the falling wedge is a bullish chart pattern that signals a buying opportunity after a downward trend or mark correction. There are dozens of popular bullish chart patterns. ' bullish wedge pattern ' #reels #treding #tradingforex #tradingtips #tradingstrategy #market #stockmarket. It is the opposite of the bullish. The two forms of the. Second, a pattern of declining volume as the price progresses through the pattern; The two forms of the. Web at first glance, an ascending wedge looks like a bullish move. After all, each successive peak and trough is higher than the last. Here is list of the classic ones: ' bullish wedge pattern ' #reels #treding #tradingforex #tradingtips #tradingstrategy #market #stockmarket. After all, each successive peak and trough is higher than the last. Web the falling wedge is typically bullish and often appears in uptrends. What is the difference between a. Web that advance broke out of a prior descending bullish wedge and expanded the top boundary line of. The pattern is deeper now showing less price. Web a falling wedge is a bullish chart pattern that takes place in an upward trend, and the lines slope down. ' bullish wedge pattern ' #reels #treding #tradingforex #tradingtips #tradingstrategy #market #stockmarket. Web that advance broke out of a prior descending bullish wedge and expanded the top boundary line of the pattern. The bearish candlestick pattern turns bullish when the price breaks out. There are dozens of popular bullish chart patterns. Web rising wedge patterns are bigger overall patterns that form a big bullish move to the upside. Here is list of the classic ones: This pattern is at the end of a bullish wave, by creating close price. After all, each successive peak and trough is higher than the last. Second, a pattern of declining volume as the price progresses through the pattern; This pattern is formed when the market consolidates while making lower lows and lower. A rising wedge is a bearish chart pattern that’s found in a downward. Web at first glance, an ascending wedge looks like a bullish move. A rising wedge in an up trend is usually considered a reversal pattern. The formation of an ascending broadening wedge pattern beginning from the 2016 lows of $1045.40, along with an inverted head.

What is Falling Wedge Bullish Patterns ThinkMarkets EN

Topstep Trading 101 The Wedge Formation Topstep

Topstep Trading 101 The Wedge Formation Topstep

Swing Trading Wedge Patterns Simple Effective Stock Trading Strategy

Gold Bullish Falling Wedge for OANDAXAUUSD by Go_Hans_Fx — TradingView

Wedge Patterns How Stock Traders Can Find and Trade These Setups

Rising and Falling Wedge Patterns How to Trade Them TradingSim

5 Chart Patterns Every Beginner Trader Should Know Brooksy

Bullish rising wedge pattern endmyte

Falling Wedge Patterns How to Profit from Slowing Bearish Momentum

Web The Rising Wedge Is A Bearish Chart Pattern Found At The End Of An Upward Trend In Financial Markets.

Can Wedge Patterns Be Used To Predict The Exact Price Movements Of A Stock?

Web Can A Wedge Pattern Form In Both Bullish And Bearish Markets?

But The Key Point To Note Is That The Upward.

Related Post: