Bullish Shooting Star Candlestick Pattern

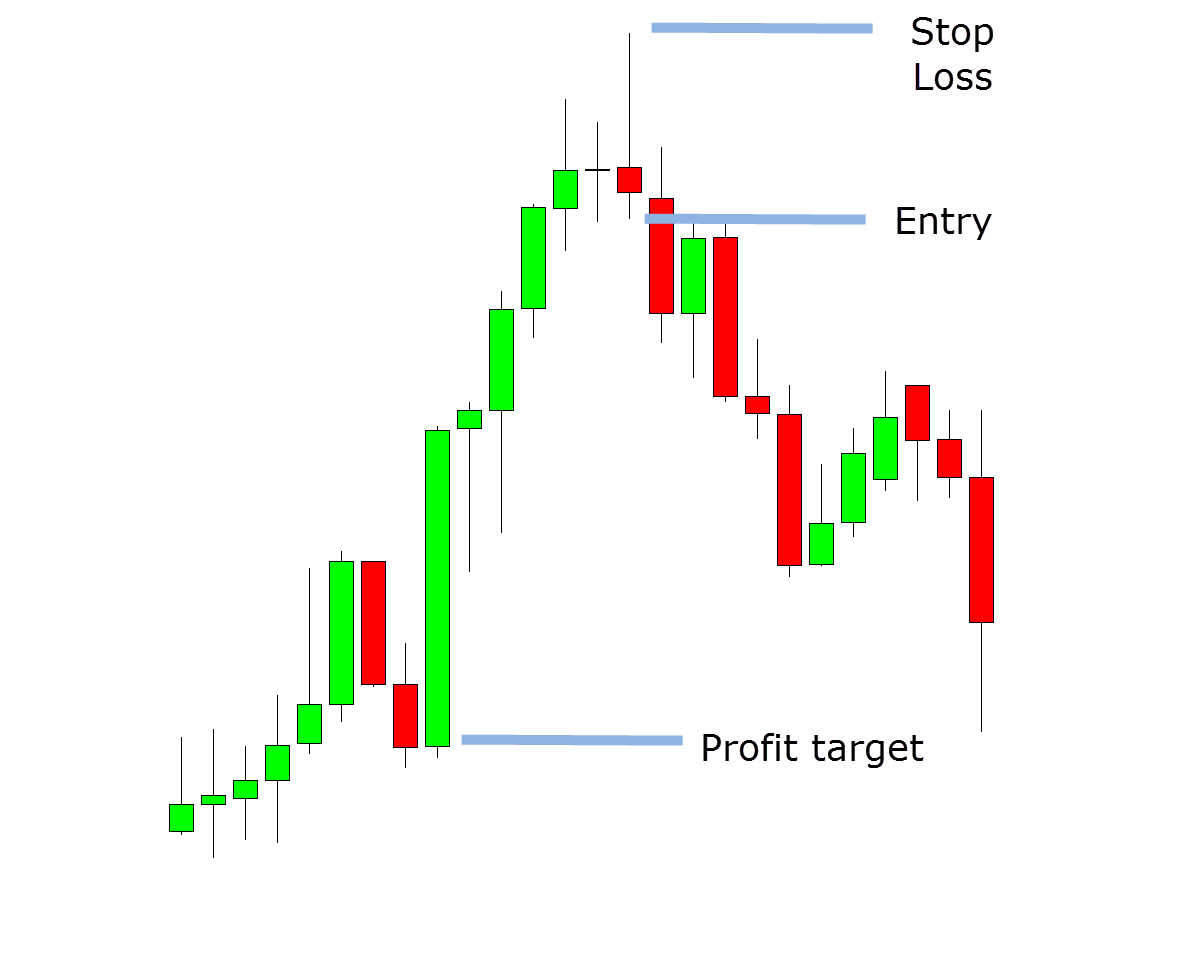

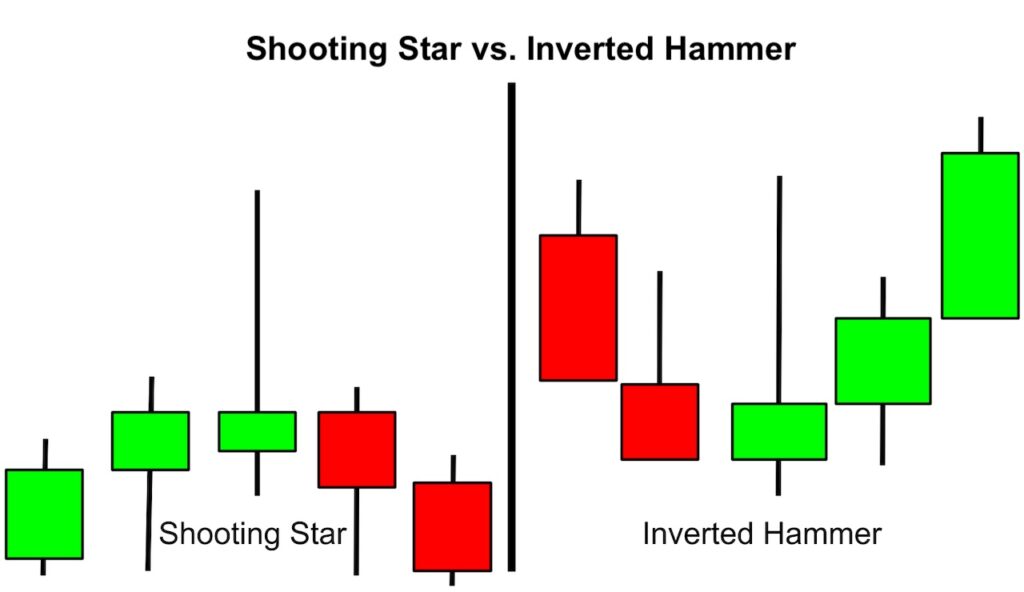

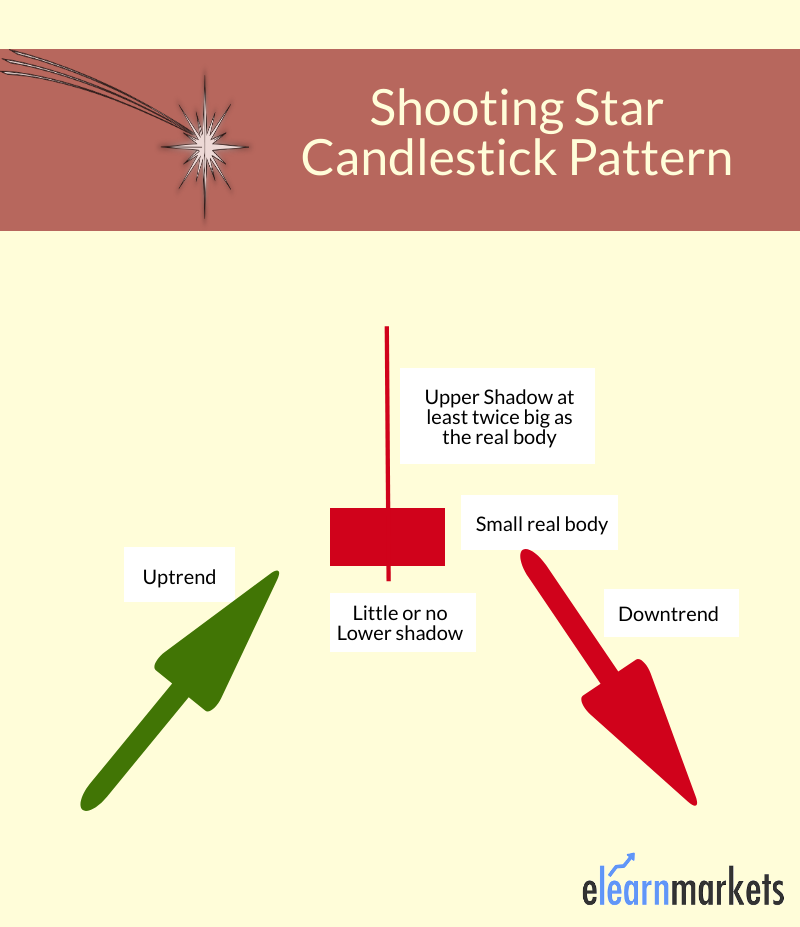

Bullish Shooting Star Candlestick Pattern - Web is there a bullish shooting star pattern? Web a shooting star is a type of candlestick pattern that forms when the price of the security opens, rises significantly but then closes near the open price. Web a shooting star candlestick is a pattern seen on price charts when an asset’s price initially rises after opening but then falls back near the opening price by the. Web a shooting star candlestick is a price pattern that is formed when the price of security opens and first advances and then declines and falls to a price close to the opening. Web shooting star a black or white candlestick that has a small body, a long upper shadow and little or no lower tail. Web here we introduce the shooting star pattern — a notable figure in candlestick charts that traders often view as a signal of bearish reversals. Web the shooting star pattern is a bearish reversal pattern that consists of just one candlestick and forms after a price swing high. Web this candlestick pattern appears when bullish traders cause the stock price to increase significantly during the trading day. Web a shooting star candlestick pattern is a bearish formation in trading charts that typically occurs at the end of a bullish trend and signals a trend reversal. If a stock is in a bullish uptrend and you identify a shooting star candle, then there is a solid chance that the trend will reverse. Web a shooting star is a bearish reversal candlestick pattern that occurs at the end of an uptrend. Web shooting star a black or white candlestick that has a small body, a long upper shadow and little or no lower tail. Said differently, a shooting star is a type of candlestick that forms when a security opens, advances significantly, but then. Web a shooting star candlestick pattern is a bearish formation in trading charts that typically occurs at the end of a bullish trend and signals a trend reversal. The long upper shadow must be at. Web a shooting star is a bearish reversal candlestick pattern that occurs at the end of an uptrend. Web a shooting star candlestick is a. Web the shooting star is a triple candlestick pattern that is similar to the evening star in that it is a bearish top reversal pattern that may appear in an uptrend and warns of a possible. Web is there a bullish shooting star pattern? Web the shooting star pattern is a bearish reversal pattern that consists of just one candlestick. The bullish version of the shooting star formation is the inverted hammer formation that occurs at bottoms. A shooting star is a bearish candlestick with a long upper shadow, little or no lower shadow, and a small real body near the low of the day. Similar to a hammer pattern, the shooting star has a long shadow that shoots. Web. However, towards the end of the. Considered a bearish pattern in an uptrend. Web the shooting star candlestick pattern consists of a single candlestick with a small body at the bottom and a long upper shadow. A shooting star is a bearish candlestick with a long upper shadow, little or no lower shadow, and a small real body near the. Web here we introduce the shooting star pattern — a notable figure in candlestick charts that traders often view as a signal of bearish reversals. Web the shooting star candlestick pattern is a bearish reversal pattern. Web how to trade the shooting star candlestick pattern. Web shooting star a black or white candlestick that has a small body, a long. Web what is a shooting star pattern in candlestick analysis? It’s characterized by a small lower body and a. Web the shooting star candlestick pattern consists of a single candlestick with a small body at the bottom and a long upper shadow. Web a shooting star candlestick pattern is a bearish formation in trading charts that typically occurs at the. A shooting star is a bearish candlestick with a long upper shadow, little or no lower shadow, and a small real body near the low of the day. Web the shooting star is a triple candlestick pattern that is similar to the evening star in that it is a bearish top reversal pattern that may appear in an uptrend and. It appears after an uptrend. Web is there a bullish shooting star pattern? However, towards the end of the. It is seen after an asset’s market. Web a shooting star is a bearish reversal candlestick pattern that occurs at the end of an uptrend. Web the shooting star candlestick pattern is a bearish reversal pattern. However, towards the end of the. When this pattern appears in an ongoing uptrend, it reverses the trend to a downtrend. This guide will help you understand. Web a shooting star candlestick pattern is a bearish formation in trading charts that typically occurs at the end of a bullish. The long upper shadow must be at. Web is there a bullish shooting star pattern? Web in this article, we'll explore: Web this candlestick pattern appears when bullish traders cause the stock price to increase significantly during the trading day. Web a shooting star candlestick pattern is a bearish formation in trading charts that typically occurs at the end of a bullish trend and signals a trend reversal. Web the shooting star is a triple candlestick pattern that is similar to the evening star in that it is a bearish top reversal pattern that may appear in an uptrend and warns of a possible. Web a shooting star candlestick is a pattern seen on price charts when an asset’s price initially rises after opening but then falls back near the opening price by the. Web a shooting star is a bearish reversal candlestick pattern that occurs at the end of an uptrend. Considered a bearish pattern in an uptrend. If a stock is in a bullish uptrend and you identify a shooting star candle, then there is a solid chance that the trend will reverse. However, towards the end of the. Web what is a shooting star pattern in candlestick analysis? Similar to a hammer pattern, the shooting star has a long shadow that shoots. For pages showing intraday views, we use the current session's data with new price data appear on. Web the shooting star candlestick pattern is a bearish reversal pattern that signals a potential shift in market sentiment from bullish to bearish. Web the shooting star pattern is a bearish reversal pattern that consists of just one candlestick and forms after a price swing high.

A Complete Guide to Shooting Star Candlestick Pattern ForexBee

Shooting Star Candlestick Pattern How to Identify and Trade

How to Use Shooting Star Candlestick Pattern to Find Trend Reversals

How to Use Shooting Star Candlestick Pattern to Find Trend Reversals

Shooting Star Candlestick Pattern How to Identify and Trade

How to Trade the Shooting Star Candlestick Pattern IG Australia

How To Trade Shooting Star Candlestick Patterns

Shooting Star Candlestick Pattern Beginner's Guide LiteFinance

Bullish Shooting Star Candlestick Pattern The Forex Geek

What Is Shooting Star Candlestick With Examples ELM

Web Shooting Star A Black Or White Candlestick That Has A Small Body, A Long Upper Shadow And Little Or No Lower Tail.

Said Differently, A Shooting Star Is A Type Of Candlestick That Forms When A Security Opens, Advances Significantly, But Then Closes The Day Near.

It Indicates That The Bulls May Have Lost Control, And The Bears Could.

Web How To Trade The Shooting Star Candlestick Pattern.

Related Post: