Bullish Reversal Patterns

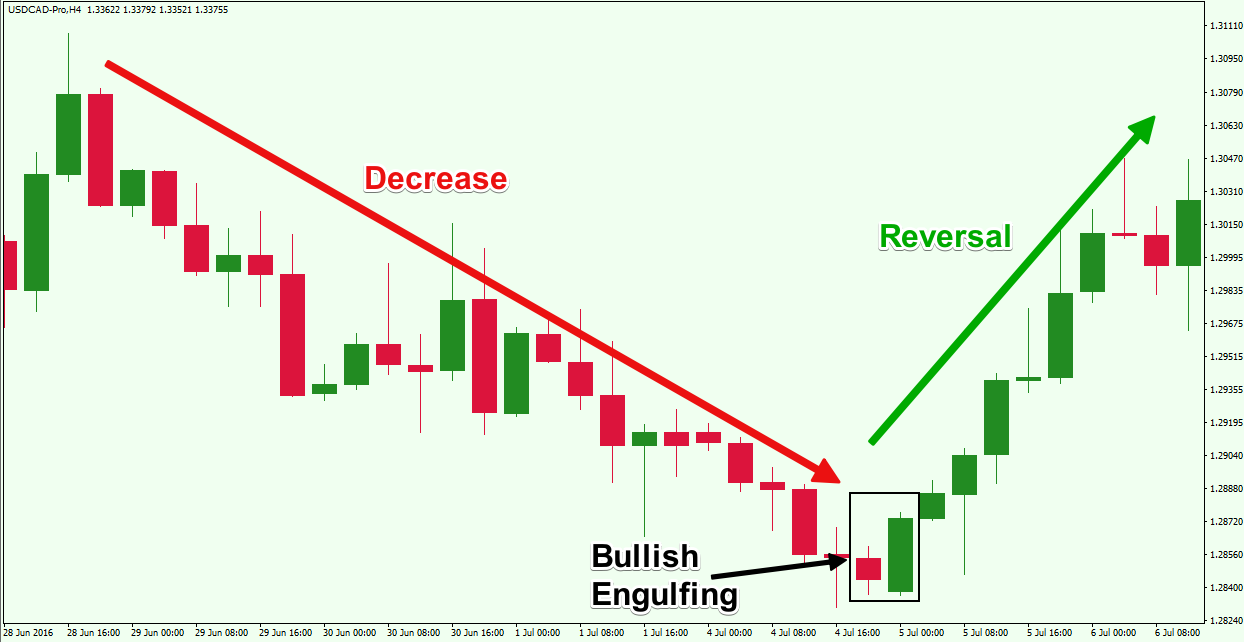

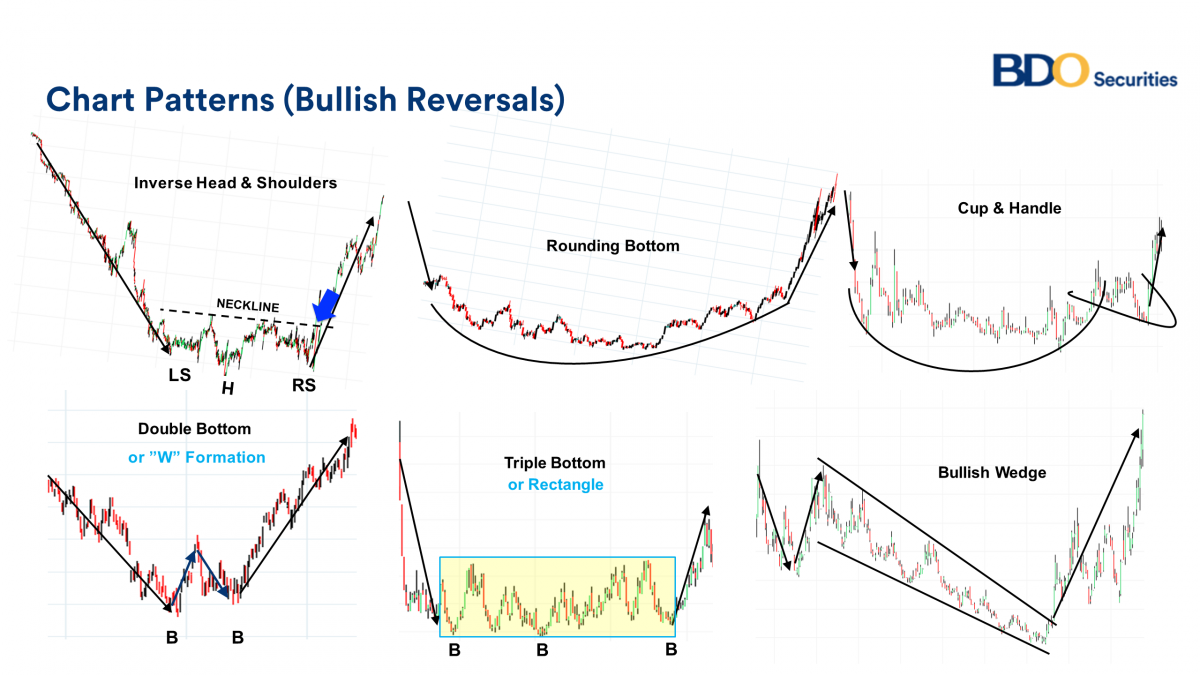

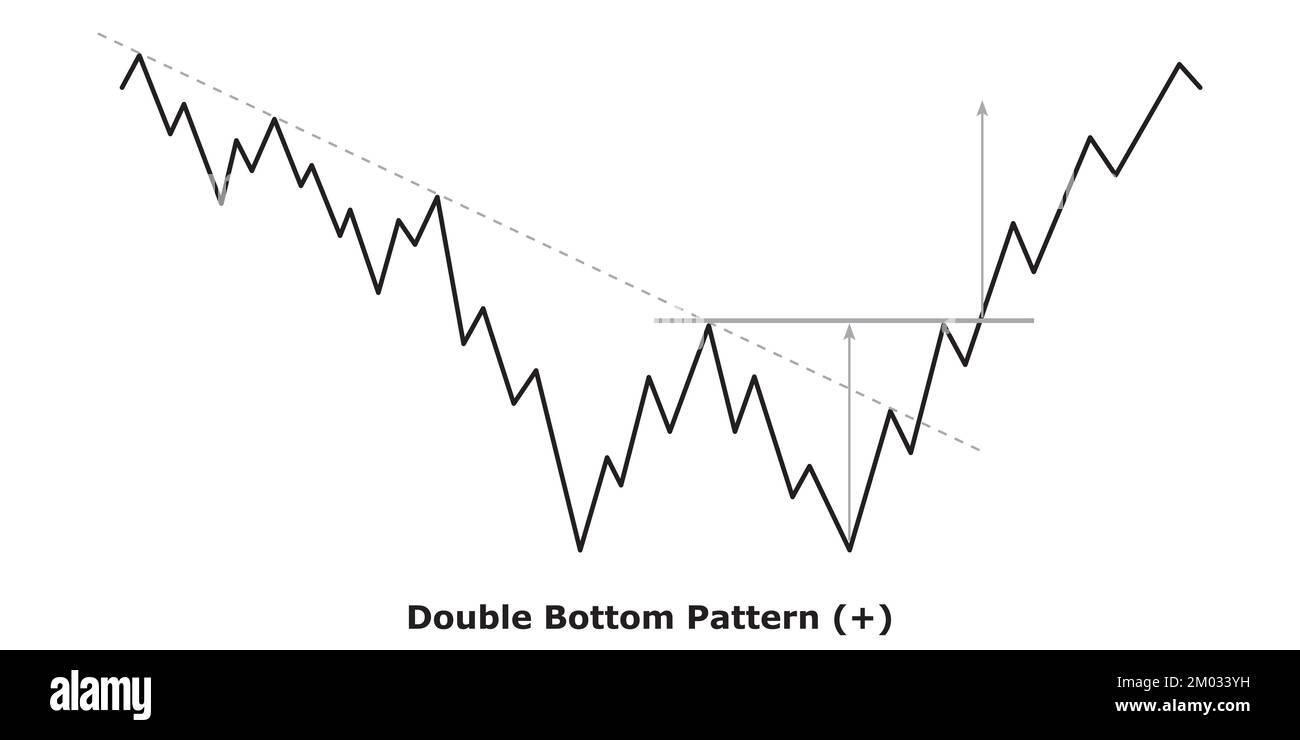

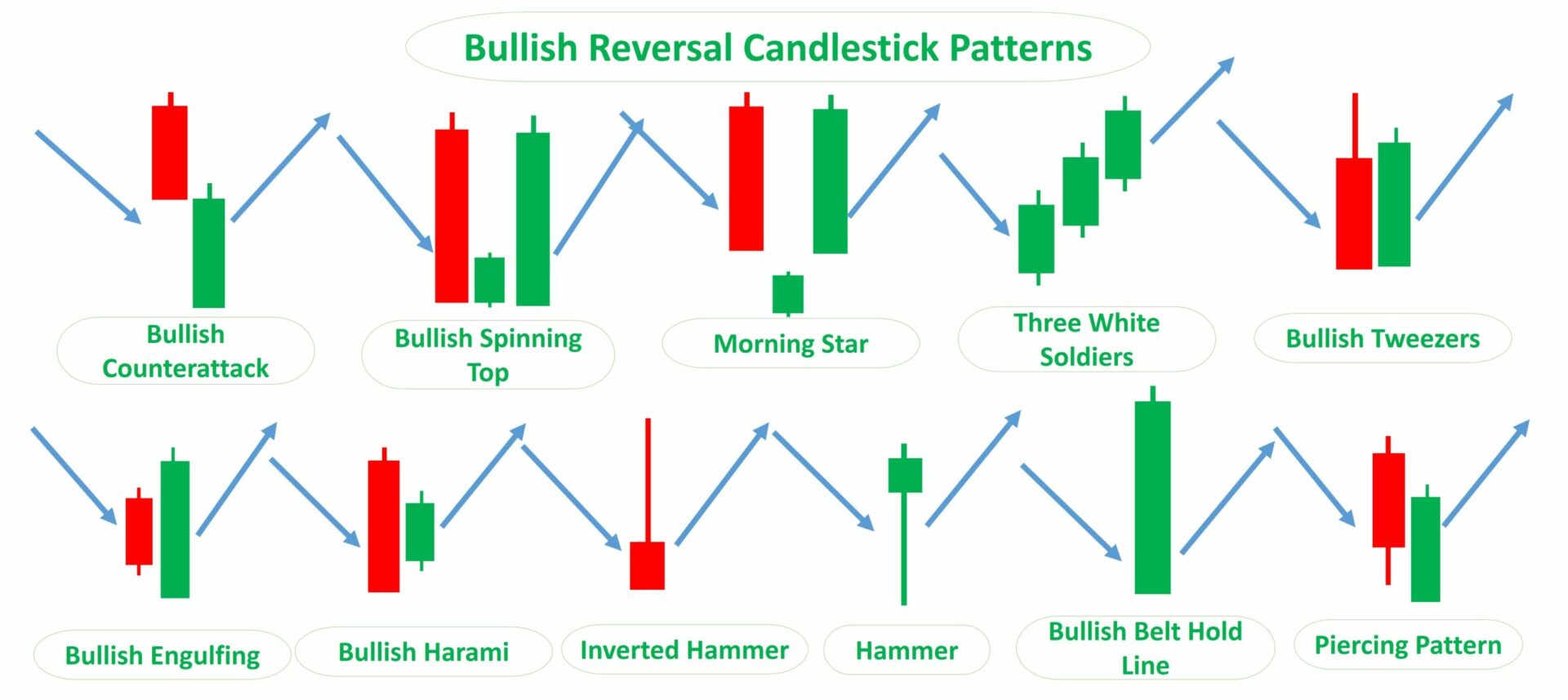

Bullish Reversal Patterns - This shows buying pressure stepped in and reversed the downtrend. For this article, i am going to share 25. Understanding these top bullish patterns can give you an edge in the market by informing your entry positions, and helping you set appropriate price targets. But as the saying goes, context is everything. Web 4.1 candlestick bullish reversal patterns. Stop loss and take profit: This technical pattern, coupled with an uptick in buyer interest, suggests the. Web bullish reversal patterns occur when the market is in a downtrend and forms a bullish reversal pattern. Web the formation of a morning star pattern at the $60,000 support zone further strengthens the bullish case for bitcoin. At capex, we provide traders with all the tools to analyse the markets and identify the bullish reversal. 4.2 candlestick bearish reversal patterns. Bullish reversal patterns appear at the end of a downtrend and signal the price reversal to the upside. Web the formation of a morning star pattern at the $60,000 support zone further strengthens the bullish case for bitcoin. Then you wonder to yourself: Web the pattern is similar to a bearish or bullish engulfing pattern,. This technical pattern, coupled with an uptick in buyer interest, suggests the. Web patterns form over a period of one to four weeks and are a source of valuable insight into a stock’s future price action. Web when a trader is watching for a bullish reversal, any red candlestick followed by a white candlestick could be an alert, but the. Bullish candles show that a stock is going up in price. This movement is largely seen as a. They are identified by a higher low and a lower high compared with the previous day. It can signal an end of the bearish trend, a bottom or a support level. Web reversals are patterns that tend to resolve in the opposite. The other type is bearish candles. When the market is falling and on the verge of recovery, the rounding bottom pattern gives an idea that reversal may be near. Web reversals are patterns that tend to resolve in the opposite direction to the prevailing trend: Web the pattern is similar to a bearish or bullish engulfing pattern, except that instead. Web the pattern is similar to a bearish or bullish engulfing pattern, except that instead of a pattern of two single bars, it is composed of multiple bars. However, the convergence of the emas above this price point may complicate any upward movements, potentially capping gains and adding to the volatility. Seasoned investors would know that in crypto, upward trends. Web bullish candlestick reversal patterns contain the open price at the low of the period and close near the high. Web when viewed together over a period of time, these candlesticks form patterns that traders analyze to gauge trend reversal points, momentum, and potential future price direction. Web a candlestick reversal pattern is a series of one to three candlesticks. Web patterns form over a period of one to four weeks and are a source of valuable insight into a stock’s future price action. So, if you see this pattern in crypto it means only one thing—the bullish trend is ending and a bearish trend will likely take over. This movement is largely seen as a. It can signal an. Certain candlestick patterns tell a story of strong bullish pressure, with little resistance from the selling side. Stop loss and take profit: Bullish reversal patterns appear at the end of a downtrend and signal the price reversal to the upside. For this article, i am going to share 25. Here are bullish and bearish examples of the patterns. Web what are candlestick reversal patterns? This is when momentum begins to shift. The shift can be either bullish or bearish. What is a bullish candle pattern. You’re familiar with reversal chart patterns like head and shoulders, double top, triple top, etc. Web the double bottom reversal is a bullish reversal pattern typically found on bar charts, line charts, and candlestick charts. Web most bullish reversal patterns require bullish confirmation. Seasoned investors would know that in crypto, upward trends are known to turn sour. This is when momentum begins to shift. Bearish abandoned baby (3) engulfing, bearish (2) harami, bearish (2) dark. Before we delve into individual bullish candlestick patterns, note the following two principles: When the sushi roll pattern appears. What is a bullish candle pattern. Understanding these top bullish patterns can give you an edge in the market by informing your entry positions, and helping you set appropriate price targets. Web patterns form over a period of one to four weeks and are a source of valuable insight into a stock’s future price action. It can signal an end of the bearish trend, a bottom or a support level. Certain candlestick patterns tell a story of strong bullish pressure, with little resistance from the selling side. This shows buying pressure stepped in and reversed the downtrend. Web there are certain bullish patterns, such as the bull flag pattern, double bottom pattern, and the ascending triangle pattern, that are largely considered the best. Web a candlestick reversal pattern is a series of one to three candlesticks in a specific order. Web this pattern on a chart mostly indicates the reversal of an upward trend. In other words, they must be followed by an upside price move which can come as a long hollow candlestick or a gap up and be. Solana’s price trend has teased an inverted head and shoulder pattern, a bullish signal that could lead to a significant price surge. For this article, i am going to share 25. When the market is falling and on the verge of recovery, the rounding bottom pattern gives an idea that reversal may be near. Web the formation of a morning star pattern at the $60,000 support zone further strengthens the bullish case for bitcoin.

Bullish Reversal Patterns

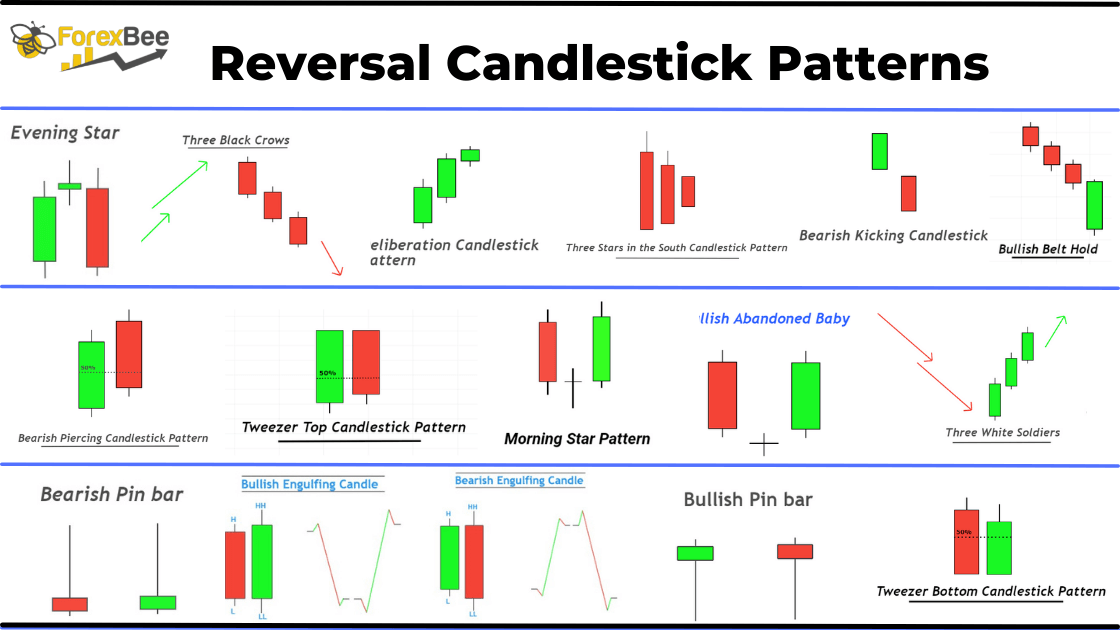

The Most Reliable Candlestick Patterns You Must Know

Top Forex Reversal Patterns that Every Trader Should Know Forex

25 Bullish reversal candlestick pattern every trader must know and how

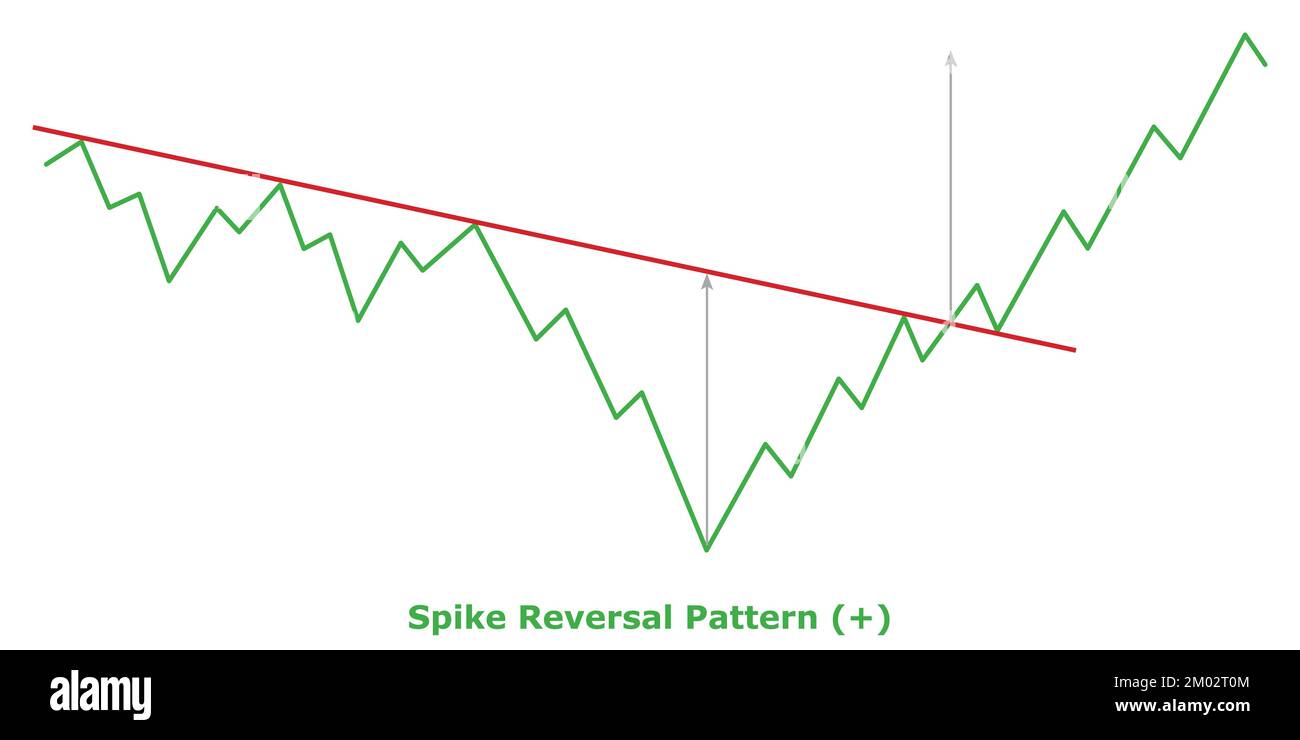

Reversal Patterns

Double Bottom Pattern Bullish (+) White & Black Bullish Reversal

Top Reversal Candlestick Patterns

bullishreversalcandlestickpatternsforexsignals daytrading

Reversal Candlestick Patterns Complete Guide ForexBee

Spike Reversal Pattern Bullish (+) Green & Red Bullish Reversal

Web When Viewed Together Over A Period Of Time, These Candlesticks Form Patterns That Traders Analyze To Gauge Trend Reversal Points, Momentum, And Potential Future Price Direction.

This Movement Is Largely Seen As A.

Web Reversals Are Patterns That Tend To Resolve In The Opposite Direction To The Prevailing Trend:

Some Examples Of Bullish Candles Are The Hammer, Inverted Hammer, And Bullish Engulfing Patterns.

Related Post: