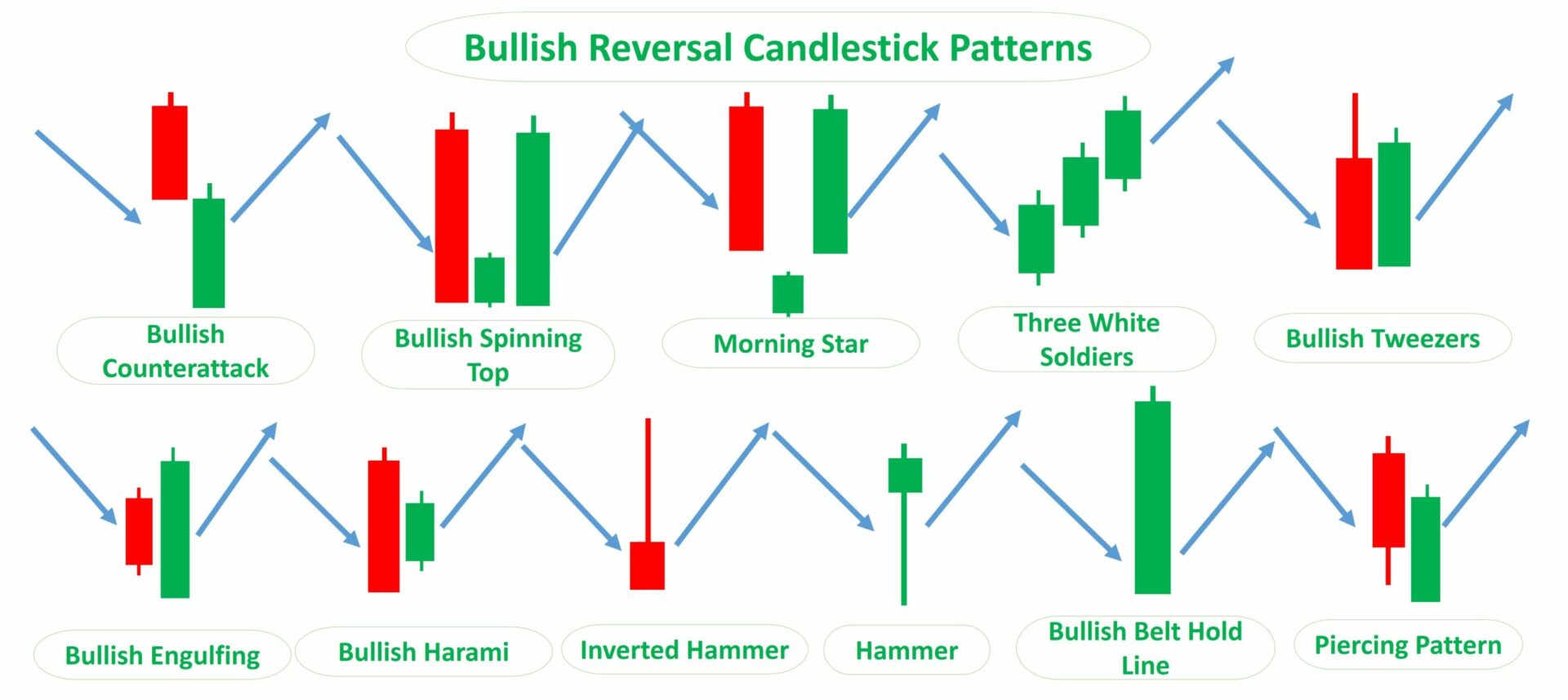

Bullish Reversal Candlestick Patterns

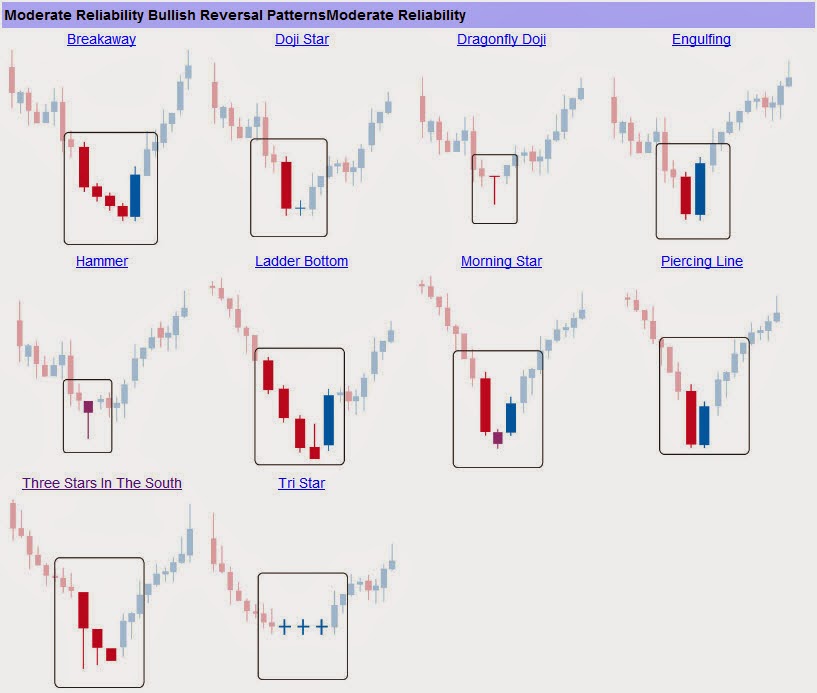

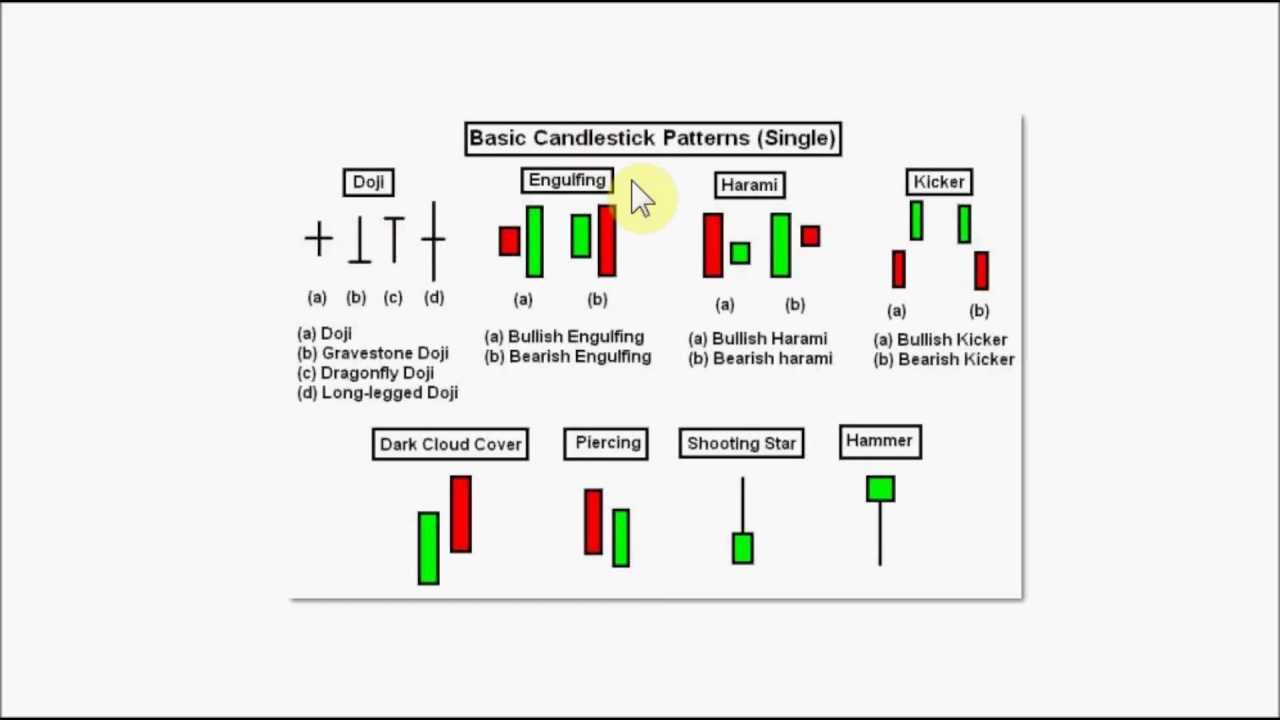

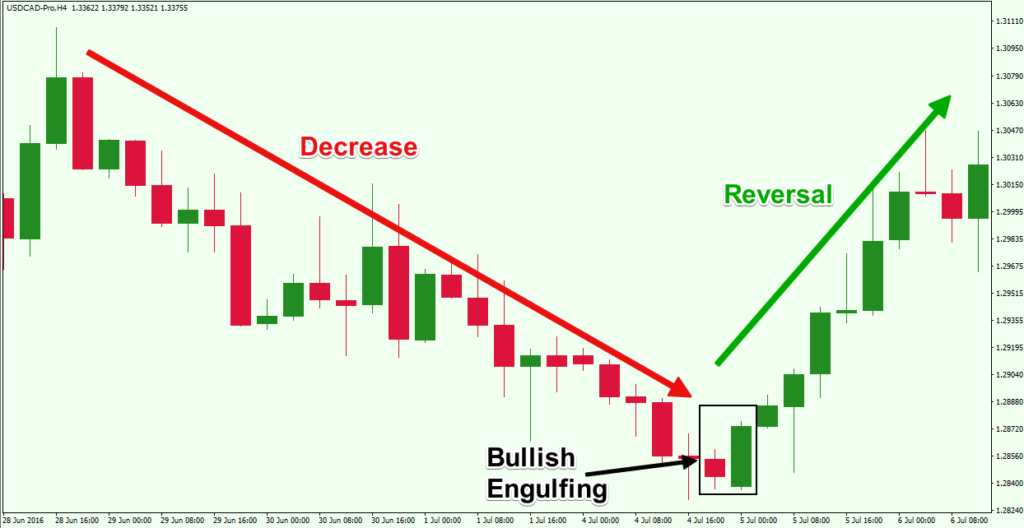

Bullish Reversal Candlestick Patterns - This tips the supply/demand relationship in favor of the bulls. The shift can be either bullish or bearish. 7 key things that changed for. How to find high probability bullish reversal setups. This is when momentum begins to shift. Otherwise, it’s not a bullish pattern, but a continuation pattern. It's a hint that the market's sentiment might be shifting from selling to buying. Web bullish candlestick reversal patterns contain the open price at the low of the period and close near the high. What is a bullish candle pattern. Web the aspects of a candlestick pattern. Candlesticks are graphical representations of price movements for a given period of time. Otherwise, it’s not a bullish pattern, but a continuation pattern. It can signal an end of the bearish trend, a bottom or a support level. In general, a bullish candlestick formation indicates buying pressure is starting to overwhelm selling momentum that tend to precede upside price moves.. Important bullish reversal candlestick patterns to know. Bullish candlesticks are one of two different candlesticks that form on stock charts. There are dozens of bullish reversal candlestick patterns. This tips the supply/demand relationship in favor of the bulls. Web what are candlestick reversal patterns? Web before we delve into individual bullish candlestick patterns, note the following two principles: One can use these kinds of patterns to identify a potential reversal in assets’ prices. How to find high probability bullish reversal setups. They are commonly formed by the opening, high,. They are typically green, white, or blue on stock charts. 7 key things that changed for. Web bullish candlestick reversal patterns contain the open price at the low of the period and close near the high. They are commonly formed by the opening, high,. And when you learn to spot them on charts, they can signal a potential change in trend direction. Web for the bullish pattern, enter long after. This occurs after a prolonged down trend. What is a bullish candle pattern. Web a bullish reversal candlestick pattern signals a potential change from a downtrend to an uptrend. Web bullish reversal candlestick patterns: Web what are candlestick reversal patterns? One can use these kinds of patterns to identify a potential reversal in assets’ prices. And when you learn to spot them on charts, they can signal a potential change in trend direction. Web a reversal candlestick pattern is a bullish or bearish reversal pattern formed by one or more candles. Web looking for reversal signals; Web the bullish reversal. At this point, bulls should overpower bears and push prices higher and make close to the opening price. Candlestick chart types have become popular among traders because they tell smaller stories within the larger market story. Web bullish reversal candlestick patterns. Web there are a number of candlestick patterns used by technical traders to spot bullish reversal, bearish reversal, or. Web 4.1 candlestick bullish reversal patterns. There are certain bullish patterns, such as the bull flag pattern, double bottom pattern, and the ascending triangle pattern, that are largely considered the best. Web bullish candlestick reversal patterns contain the open price at the low of the period and close near the high. Web what are candlestick reversal patterns? Web bullish reversal. Web hammer is a single candlestick bullish reversal pattern. Web let's examine some of the most common bullish reversal candlestick patterns next. Therefore, traders should be on the lookout for signs of a potential reversal, such as bullish candlestick patterns, a break above key resistance levels, or a shift in trading volume indicating increased buying activity. Candlesticks are graphical representations. Web the aspects of a candlestick pattern. If you are familiar with the bearish “hanging man”, you’ll notice that the hammer looks very similar. Conversely, the bearish candlestick reversal occurs at the top of trends and leads to a market move from an uprising trend to a downtrend. It can signal an end of the bearish trend, a bottom or. And when you learn to spot them on charts, they can signal a potential change in trend direction. How to find high probability bearish reversal setups. Otherwise, it’s not a bullish pattern, but a continuation pattern. Web let's examine some of the most common bullish reversal candlestick patterns next. Much like the hanging man, the hammer is a bullish candlestick reversal candle. What is a bullish candle pattern. Web 9 min read. While the stock has lost 24.3% over the past week, it could witness a trend reversal as a hammer chart pattern was formed. There are certain bullish patterns, such as the bull flag pattern, double bottom pattern, and the ascending triangle pattern, that are largely considered the best. One can use these kinds of patterns to identify a potential reversal in assets’ prices. Web bullish reversal patterns should form within a downtrend. Web looking for reversal signals; The hammer is a bullish candlestick pattern that indicates when a security is about to reverse upwards. This occurs after a prolonged down trend. Web a downtrend has been apparent in definitive healthcare corp. The shift can be either bullish or bearish.

Top Reversal Candlestick Patterns

Bullish Candlestick Reversal Patterns Cheat Sheet Trading charts

6 Reliable Bullish Candlestick Pattern TradingSim

25 Bullish reversal candlestick pattern every trader must know and how

Forex Master Class Candlestick Reversal Patterns

Candlestick Charts Part Two Single Candlestick Reversal Signals

Top Forex Reversal Patterns that Every Trader Should Know Forex

The Most Reliable Candlestick Patterns You Must Know

Using 5 Bullish Candlestick Patterns To Buy Stocks

bullishreversalcandlestickpatternsforexsignals daytrading

Therefore, Traders Should Be On The Lookout For Signs Of A Potential Reversal, Such As Bullish Candlestick Patterns, A Break Above Key Resistance Levels, Or A Shift In Trading Volume Indicating Increased Buying Activity.

Web Bullish Reversal Candlestick Patterns.

While A Bear Trap Mimics A Downward Trend, It Ultimately Leads To A Reversal In Price Direction.

Web Before We Delve Into Individual Bullish Candlestick Patterns, Note The Following Two Principles:

Related Post: