Bullish Reversal Candle Patterns

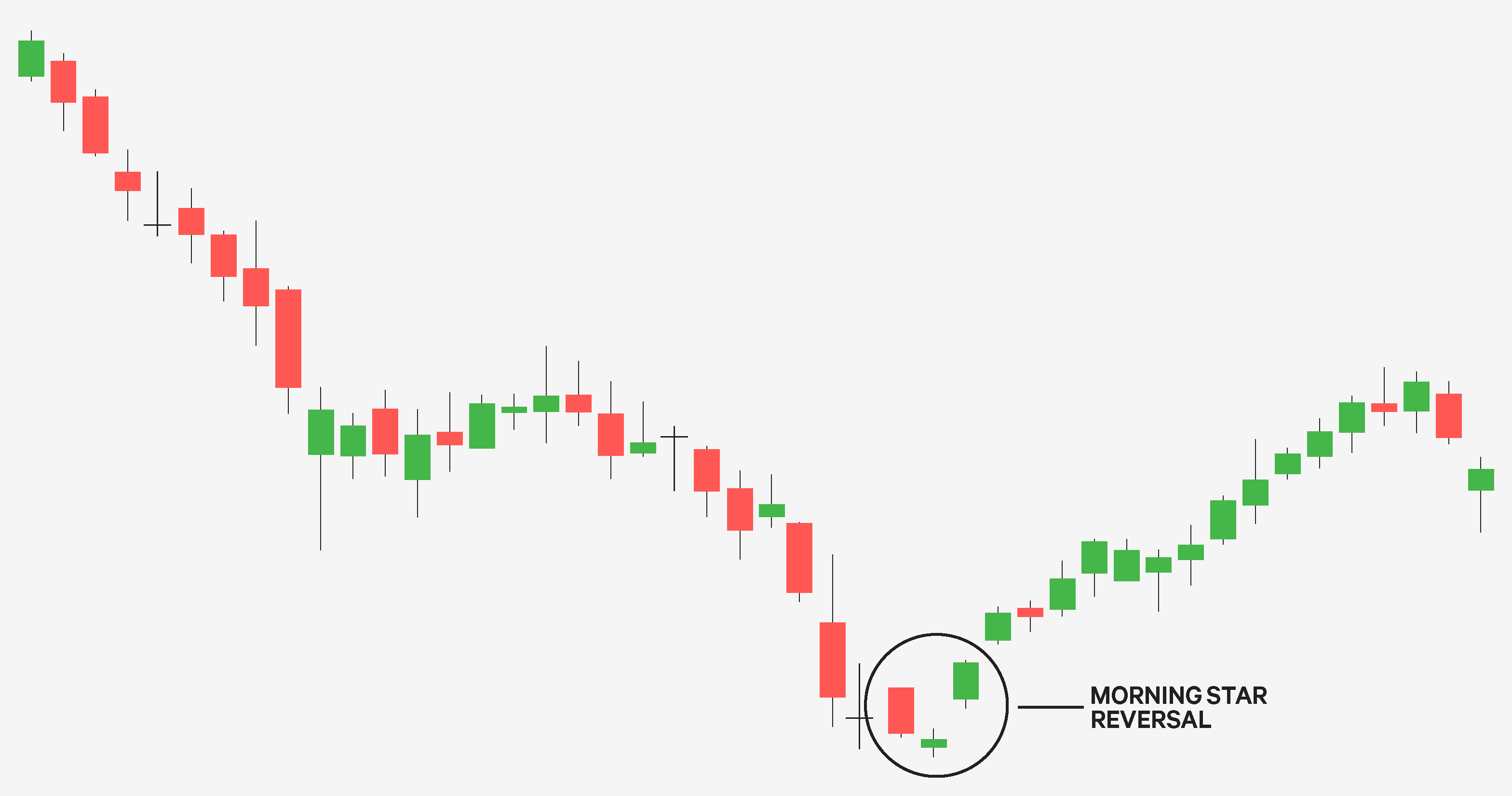

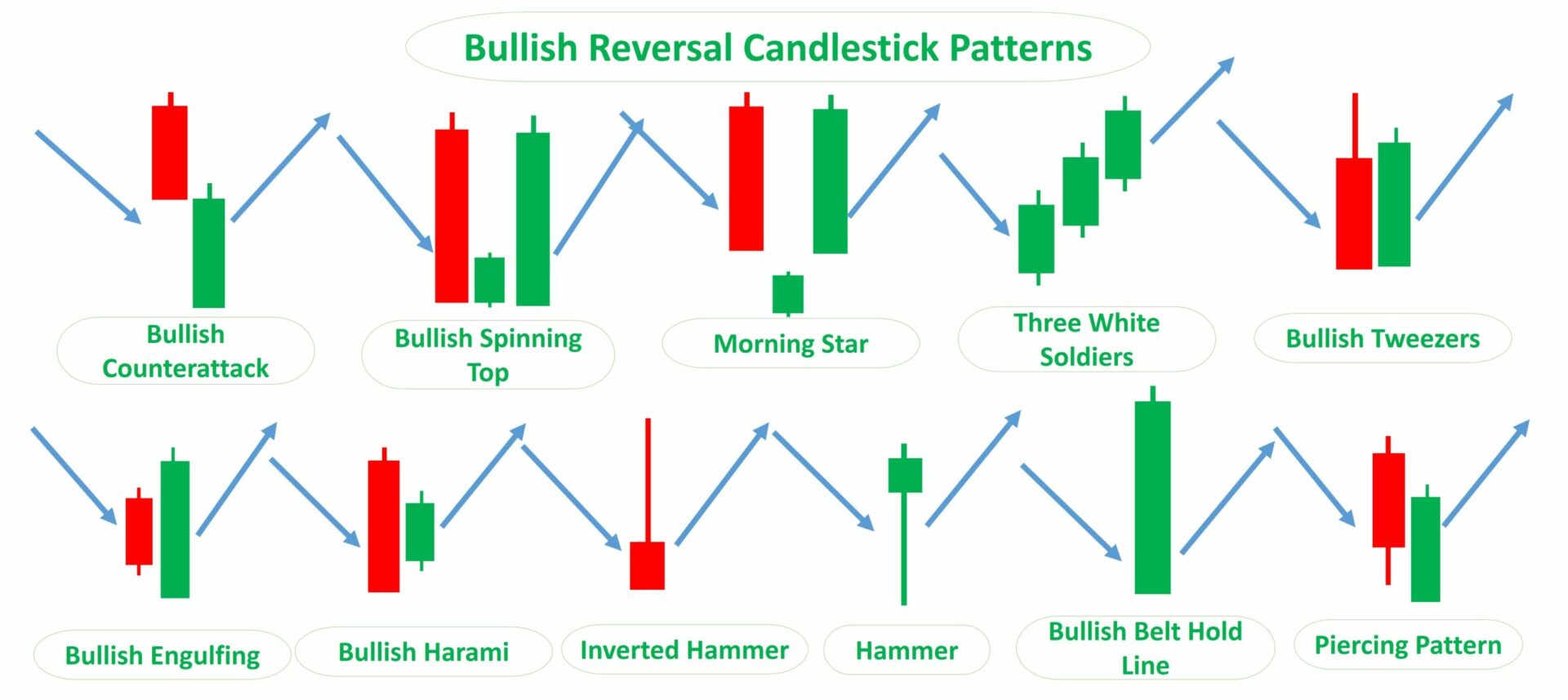

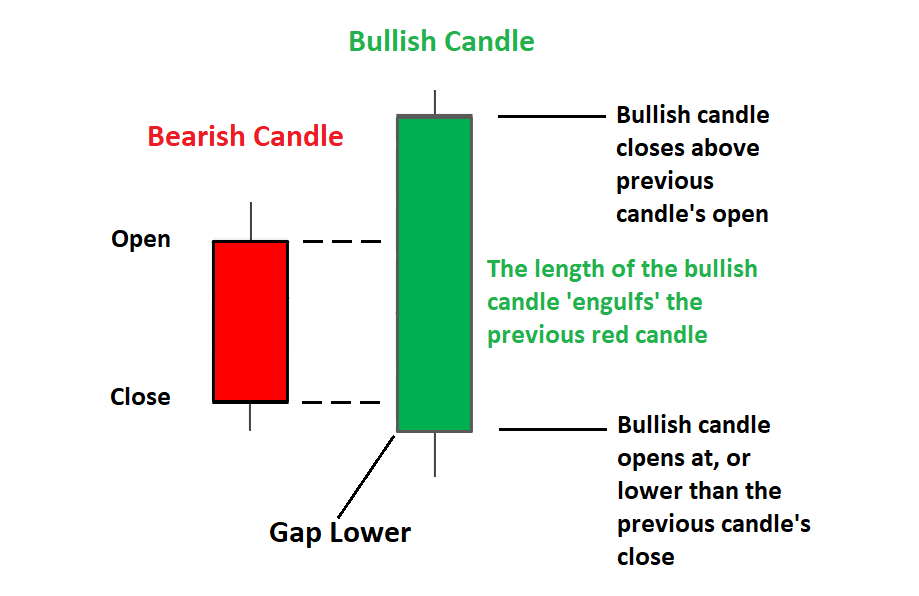

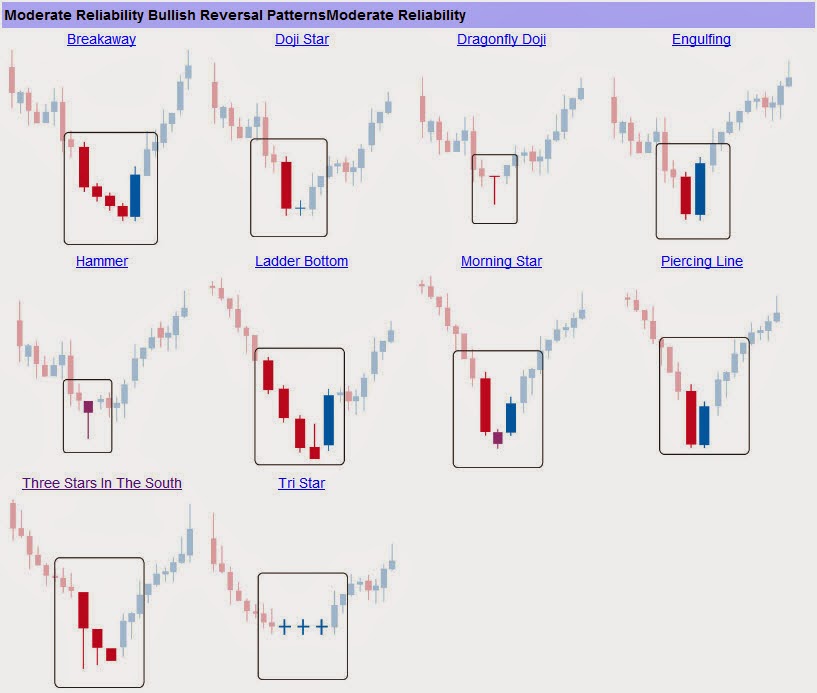

Bullish Reversal Candle Patterns - Here is a bullish example. It can signal an end of the bearish trend, a. The price is moving down, gaps. Bullish two candle reversal pattern that forms in a down trend. Therefore, traders should be on the. Web it is used as a bullish pattern in technical analysis by conventional traders. Web bullish reversal patterns appear at the end of a downtrend and signal the price reversal to the upside. Web some of the most common bullish candlestick patterns include: This shows buying pressure stepped in and reversed. Web when a trader is watching for a bullish reversal, any red candlestick followed by a white candlestick could be an alert, but the piercing pattern is a special. Hammers and inverted hammers marking. Web what are candlestick reversal patterns? For this article, i am going. The price is moving down, gaps. One can use these kinds of patterns to identify a. Web this pattern is also known as a bullish harami pattern, which is also considered as a bullish reversal pattern. Web dragonfly doji candlestick pattern meaning. These specific candle sticks patterns represent terminations of bearish phase and starting of bulls. Web some of the most common bullish candlestick patterns include: Web bullish reversal candlestick patterns are graphic representations of price. It can signal an end of the bearish trend, a. Web this pattern is also known as a bullish harami pattern, which is also considered as a bullish reversal pattern. Web on the weekly chart, kirloskar electric company has broken out above the rounded bottom pattern at 164 with a strong bullish candle, signalling the onset of the uptrend. When. Candlestick chart types have become popular among traders because they tell smaller stories within the larger market. Tall black candle followed by a lower small candle, either white or filled, with a gap between the two bodies. Therefore, traders should be on the. Hammers and inverted hammers marking. Learn at no cost.learn finance easily.free animation videos.find out today. Long green or white candles showing buyers in control. Web reversal candlestick patterns indicate price may soon reverse and change direction. Web below you can find the schemes and explanations of the most common reversal candlestick patterns. Therefore, traders should be on the. Web when a trader is watching for a bullish reversal, any red candlestick followed by a white. Learn at no cost.learn finance easily.free animation videos.find out today. Web what are bullish reversal candlestick patterns? This shows buying pressure stepped in and reversed. The price is moving down, gaps. Web 4.1 candlestick bullish reversal patterns. For this article, i am going. But as the saying goes, context is everything. Web what are candlestick reversal patterns? Web when a trader is watching for a bullish reversal, any red candlestick followed by a white candlestick could be an alert, but the piercing pattern is a special. Web what are bullish reversal candlestick patterns? Web some of the most common bullish candlestick patterns include: Web a reversal candlestick pattern is a bullish or bearish reversal pattern formed by one or more candles. Bullish two candle reversal pattern that forms in a down. Web 4.1 candlestick bullish reversal patterns. Web looking for reversal signals; Therefore, traders should be on the. Web bullish reversal candlestick patterns are graphic representations of price movements in trading that suggest a potential reversal of a downward trend, indicating that the price of. These specific candle sticks patterns represent terminations of bearish phase and starting of bulls. Here is a bullish example. Hammers and inverted hammers marking. Here is a bullish example. This shows buying pressure stepped in and reversed. The price is moving down, gaps. Web the aspects of a candlestick pattern. Web what are candlestick reversal patterns? Web on the weekly chart, kirloskar electric company has broken out above the rounded bottom pattern at 164 with a strong bullish candle, signalling the onset of the uptrend. Candlestick chart types have become popular among traders because they tell smaller stories within the larger market. Bullish two candle reversal pattern that forms in a down trend. The hammer is a bullish candlestick pattern that indicates when a security is about to reverse upwards. Web there are a number of candlestick patterns used by technical traders to spot bullish reversal, bearish reversal, or continuation patterns. If you are familiar with the bearish “hanging man”, you’ll notice that the hammer looks very similar. Tall black candle followed by a lower small candle, either white or filled, with a gap between the two bodies. But as the saying goes, context is everything. Web they are identified by a gap between a reversal candlestick and two candles on either side of it. Here is a bullish example. Web looking for reversal signals; Web when a trader is watching for a bullish reversal, any red candlestick followed by a white candlestick could be an alert, but the piercing pattern is a special. Therefore, traders should be on the. Strong bullish reversal in a downtrend. It can signal an end of the bearish trend, a. Web this pattern is also known as a bullish harami pattern, which is also considered as a bullish reversal pattern.

Bullish Candlestick Reversal Patterns Cheat Sheet Trading charts

How To Draw A Candlestick Chart Reversal Candle Pattern Indicator

25 Bullish reversal candlestick pattern every trader must know and how

Bullish Reversal Candlestick Patterns The Forex Geek

Top Reversal Candlestick Patterns

The Most Reliable Candlestick Patterns You Must Know

What Is A Bullish Reversal Pattern Candle Stick Trading Pattern

Top 6 Most bullish Candlestick Pattern Trade with market Moves

Forex Master Class Candlestick Reversal Patterns

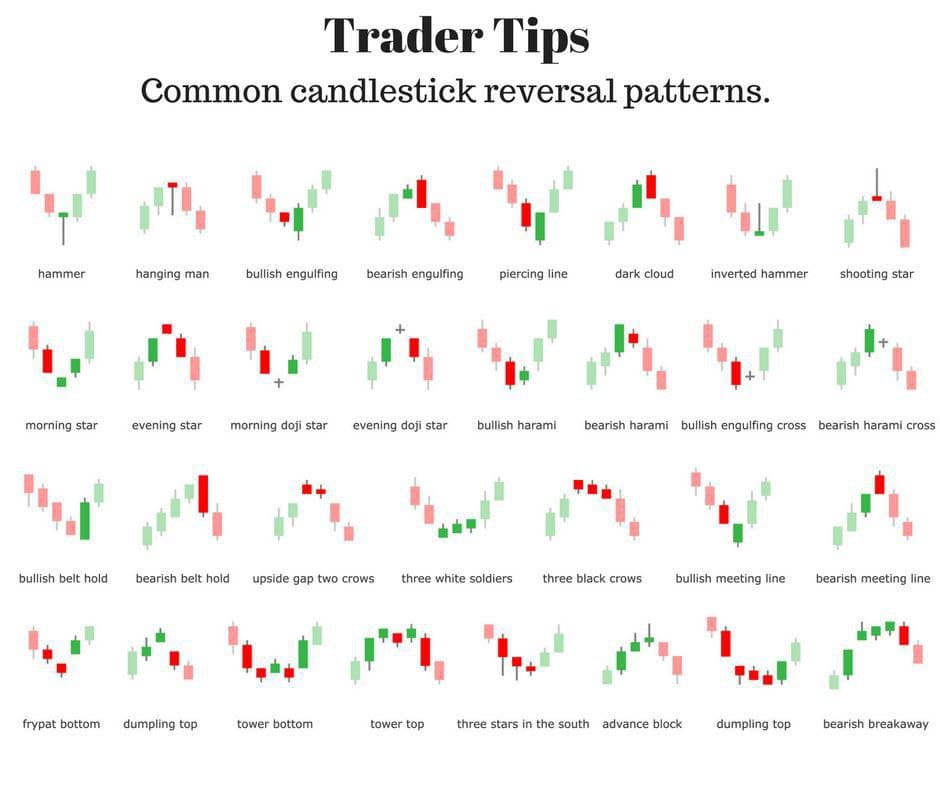

Trader Tips Common candlestick reversal patterns Profit Myntra

Long Green Or White Candles Showing Buyers In Control.

Web What Are Bullish Reversal Candlestick Patterns?

Web It Is Used As A Bullish Pattern In Technical Analysis By Conventional Traders.

Learn At No Cost.learn Finance Easily.free Animation Videos.find Out Today.

Related Post: