Bullish Pennant Chart Pattern

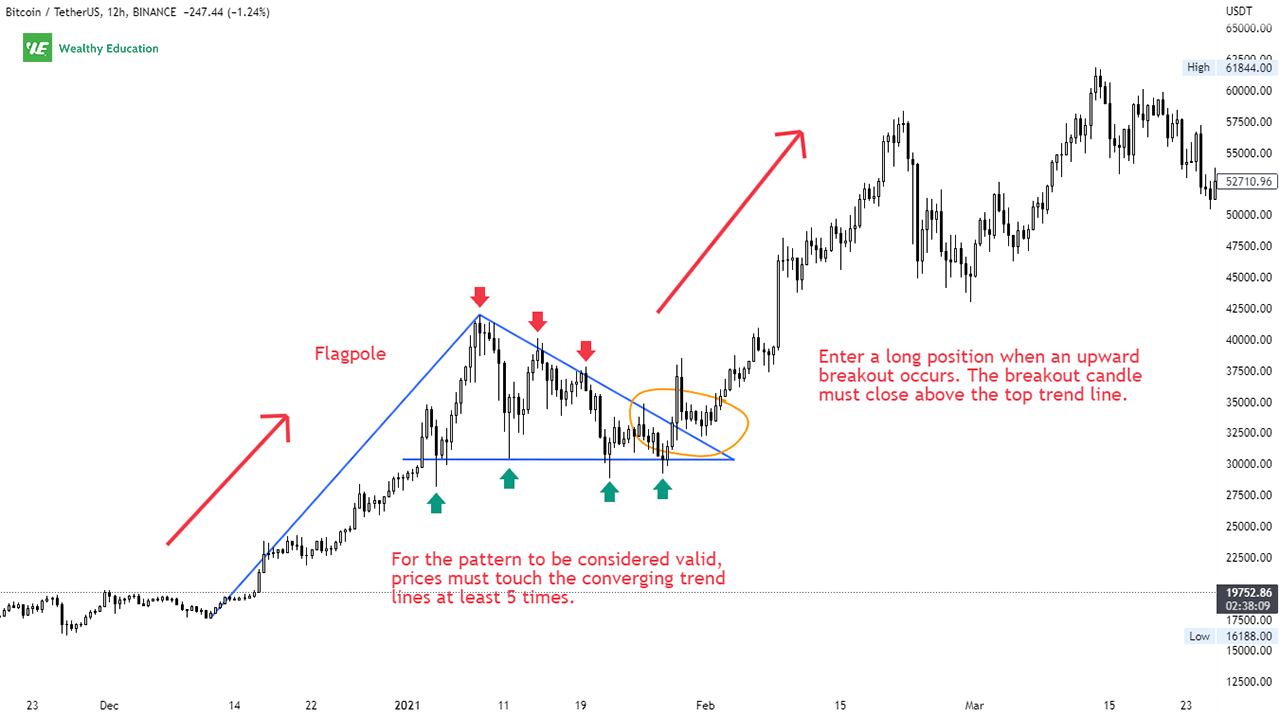

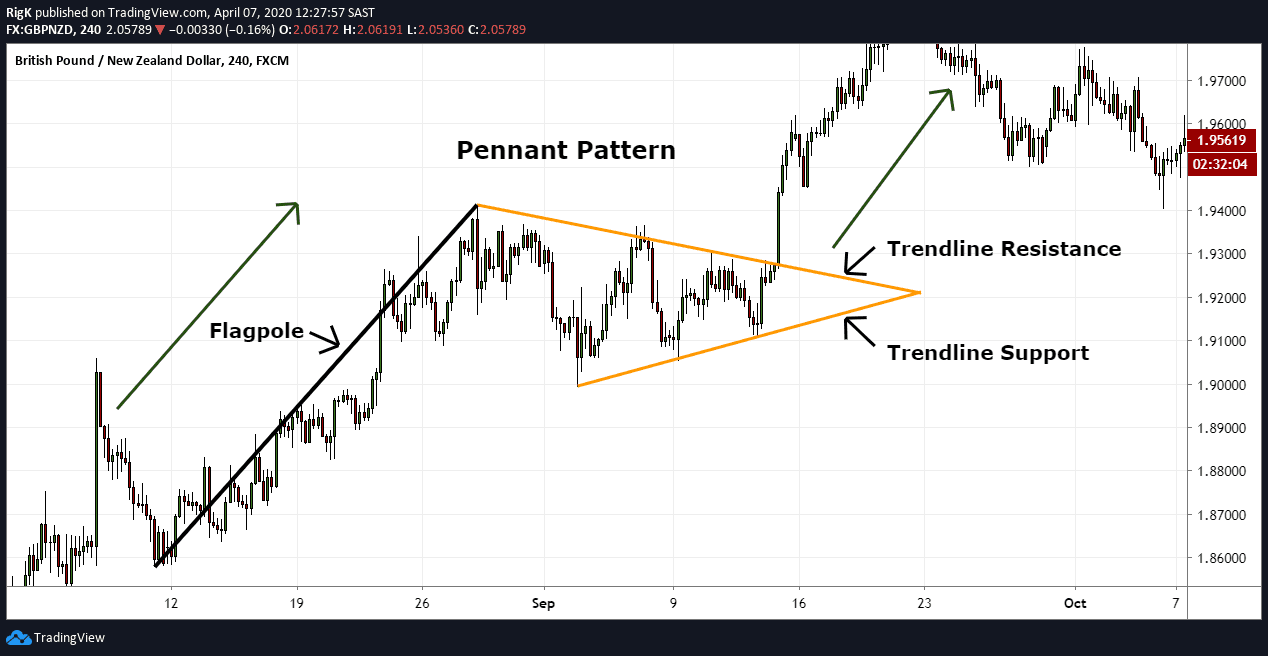

Bullish Pennant Chart Pattern - What is the difference between a bullish pennant and a bull flag? Web a bullish pennant is a technical analysis figure that implies the continuation of the main trend after the consolidation area. If you appreciate our charts, give us a quick 💜💜 understanding the bullish pennant pattern: Web in this guide, we unveil the secrets of bullish pennant pattern, exploring its psychology, identification, and trading strategies. The bullish pennant pattern is a formation that occurs after an uptrend. Unlike the flag where the price action consolidates within the two parallel lines, the pennant uses two converging lines for consolidation until the breakout occurs. Bull pennants are similar to bull flags. Web what is a bullish pennant pattern? You can see below that the nzdusd is capped by the 200dma (red) but developing a bullish pennant. The breakout from this consolidation typically occurs to the upside, signaling a continuation of the uptrend. Volume should be heavy during the advance or decline that forms the flagpole. Web bullish on disgruntled. They're formed when a market makes an extensive move higher, then pauses and consolidates between converging support and resistance lines. You can see below that the nzdusd is capped by the 200dma (red) but developing a bullish pennant. It has a small consolidation. The bullish pennant is among the strongest continuation patterns, as it frequently precedes up trend extension. Web bullish pennant pattern is an uptrend confirmation pattern that is formed after a sharp increase in the currency pair prices. It consists of a strong price movement called the pole or flagpole, followed by a consolidation period that forms the pennant. During the. Written by internationally known author and trader thomas bulkowski. This bull flag target and then slightly above that is the double bottom breakout target. Web the nzdusd is setting up for a bullish breakout this week and target above the.6150 level and closer to.6200 if the us cpi data comes in weaker than the market expects. Galas next targets if. A bullish pennant is a technical trading pattern that indicates the impending continuation of a strong upward price move. The bullish pennant pattern is a formation that occurs after an uptrend. Bull pennants are similar to bull flags. A bullish pennant pattern occurs in strong uptrends. It is characterized by a pennant (a small symmetrical triangle) that forms as the. If you appreciate our charts, give us a quick 💜💜 understanding the bullish pennant pattern: Bearish and bullish are two kinds of pennant chart patterns. The macd indicator has moved above the neutral level while the relative strength index (rsi) is approaching the overbought point. They're formed when a market makes an extensive move higher, then pauses and consolidates between. This bull flag target and then slightly above that is the double bottom breakout target. Web pennants are small consolidation patterns that sometimes appear midway into a move. Web for a bullish flag or pennant, a break above resistance signals that the previous advance has resumed. Web bullish on disgruntled. Web the bull pennant pattern is a technical analysis indicator. Traders follow this pattern to predict whether a market is getting ready to resume a previous trend after a period of consolidation. Web bearish pennant or bear pennant shows a bear rushing toward the stocks for the continuous downfall, dropping its name into the category of continuous bearish chart pattern. The macd indicator has moved above the neutral level while. Web bullish pennant pattern is an uptrend confirmation pattern that is formed after a sharp increase in the currency pair prices. Web bullish on disgruntled. The bearish pennant pattern occurs after a significant decrease in a financial instrument’s price. Web bullish pennant chart pattern. Web what is a bullish pennant pattern? Unlike the flag where the price action consolidates within the two parallel lines, the pennant uses two converging lines for consolidation until the breakout occurs. The bullish pennant emerges post an uptrend, forming a small symmetrical triangle (the pennant) during consolidation. The breakout from this consolidation typically occurs to the upside, signaling a continuation of the uptrend. Identified by measuring. It consists of a strong price movement called the pole or flagpole, followed by a consolidation period that forms the pennant. Web bullish pennant patterns occur after an uptrend and indicate a potential continuation of the upward movement. After a big upward or downward move, buyers or sellers usually pause to catch their breath before taking the pair further in. A bullish pennant is a technical trading pattern that indicates the impending continuation of a strong upward price move. Web for a bullish flag or pennant, a break above resistance signals that the previous advance has resumed. If you appreciate our charts, give us a quick 💜💜 understanding the bullish pennant pattern: Read for performance statistics, trading tactics, id guidelines and more. Web what is a bullish pennant pattern? After a big upward or downward move, buyers or sellers usually pause to catch their breath before taking the pair further in the same direction. You can see below that the nzdusd is capped by the 200dma (red) but developing a bullish pennant. Web the bullish pennant pattern is an important continuation pattern in technical analysis that signals a potential further rise in prices after a period of consolidation. Web a bullish pennant is a reliable chart pattern that signals a potential continuation of an upward trend in trading. Web the bull pennant pattern is a technical analysis indicator that signals the extension of an uptrend. What is a bullish pennant? Difference between pennants and wedges. Bull pennants are similar to bull flags. Therefore, the pair will likely continue. They're formed when a market makes an extensive move higher, then pauses and consolidates between converging support and resistance lines. Web a pennant pattern is a continuation chart pattern, seen when a security experiences a large upward or downward movement, followed by a brief consolidation, before continuing to move in.

Bull Flag Chart Patterns The Complete Guide for Traders

Pennant Patterns Trading Bearish & Bullish Pennants

Bullish Pennant Patterns A Complete Guide

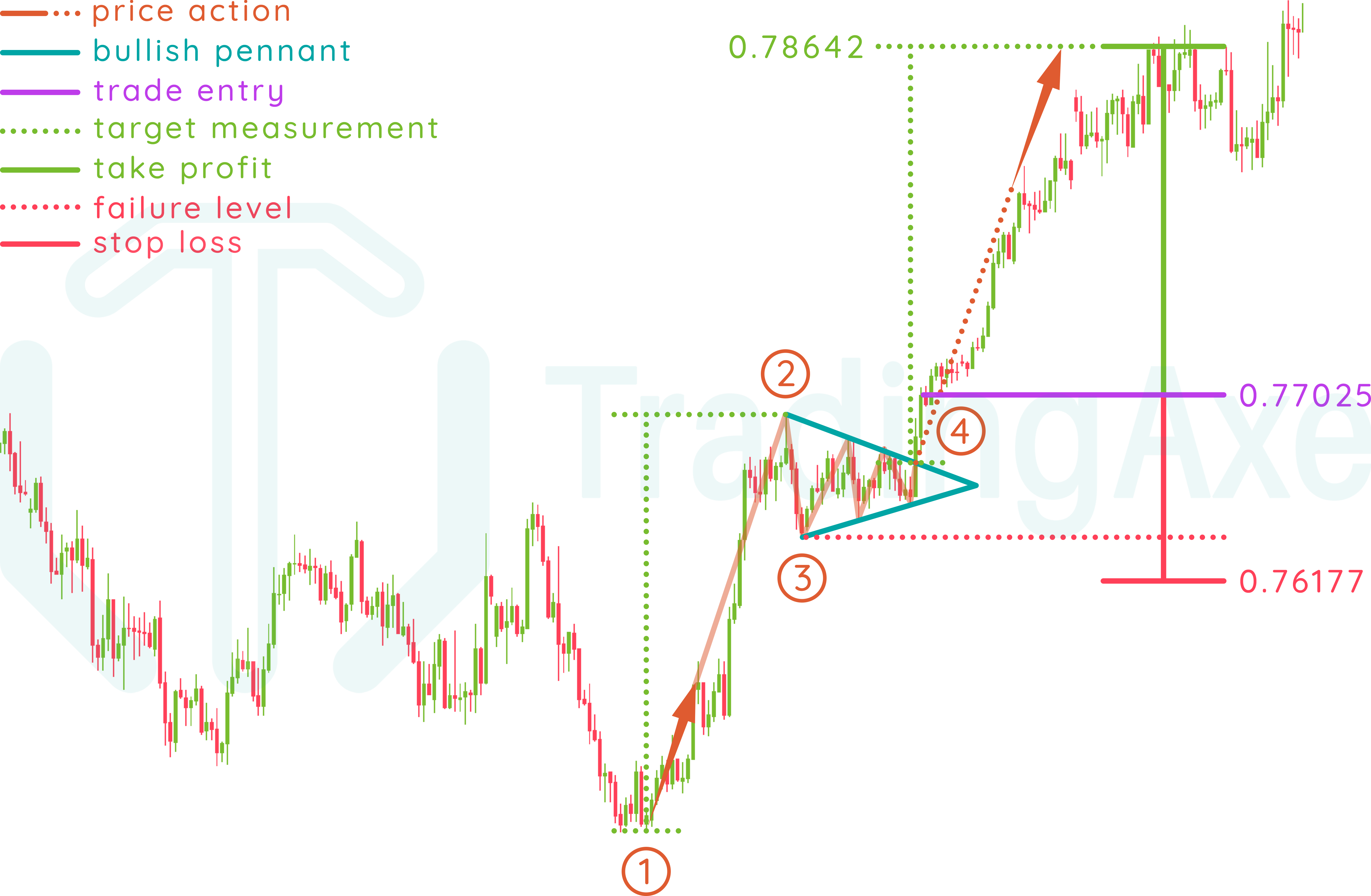

How To Trade Bullish Pennant Chart Pattern TradingAxe

Pennant Patterns Trading Bearish & Bullish Pennants

Bull Pennant Pattern (Updated 2023)

Bullish Pennant Patterns A Complete Guide

Pennant Patterns Trading Bearish & Bullish Pennants

Pennant Chart Patterns Definition & Examples

How To Identify and Trade Pennant Patterns? Phemex Academy

The Purpose Of Identifying A Bull Pennant Pattern Is To Signal Potential Buying Opportunities For Traders And Investors.

Web The Nzdusd Is Setting Up For A Bullish Breakout This Week And Target Above The.6150 Level And Closer To.6200 If The Us Cpi Data Comes In Weaker Than The Market Expects.

Web Bullish On Disgruntled.

Identified By Measuring The Pennant's Pole Height, Which Is The Vertical Distance Between Points (1) And (2), That Measurement Is Then Applied From The Breakout Rate (4) Stop Loss:

Related Post: