Bullish Megaphone Pattern

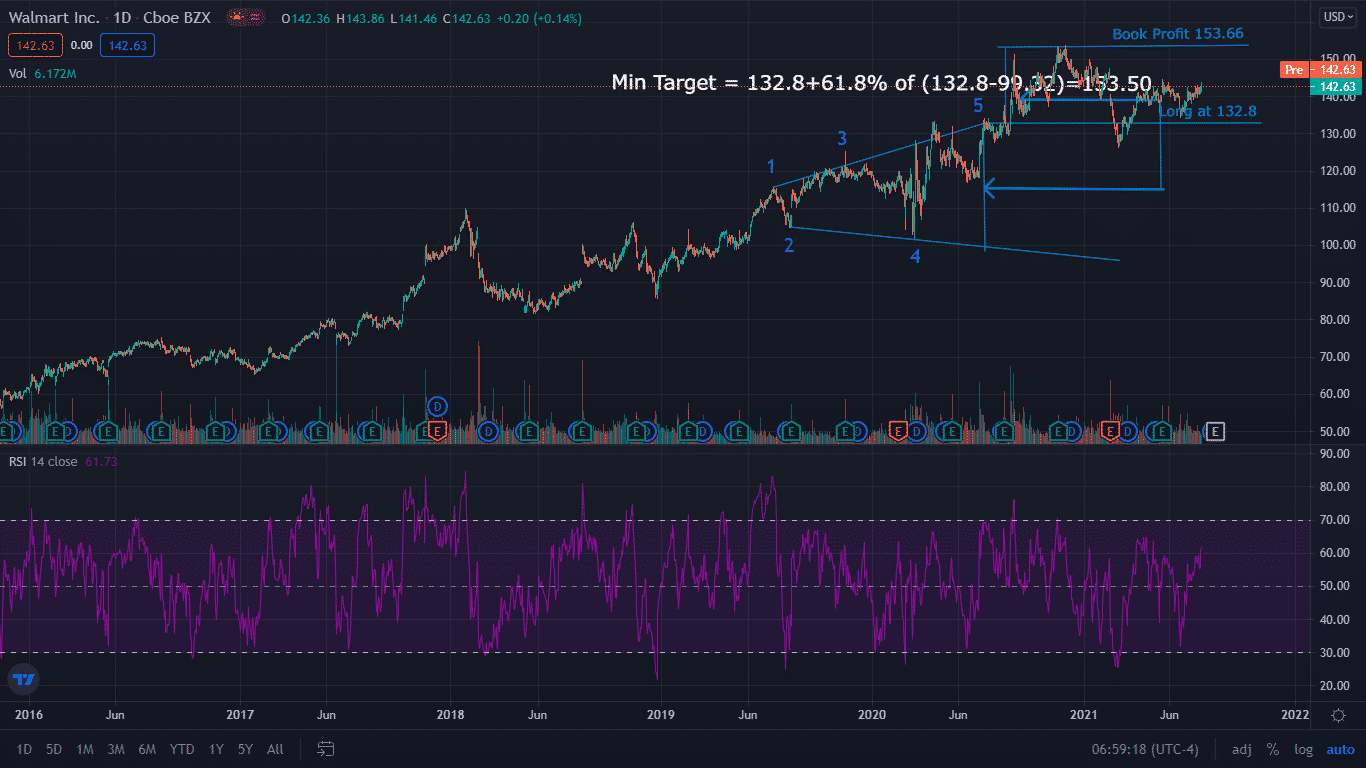

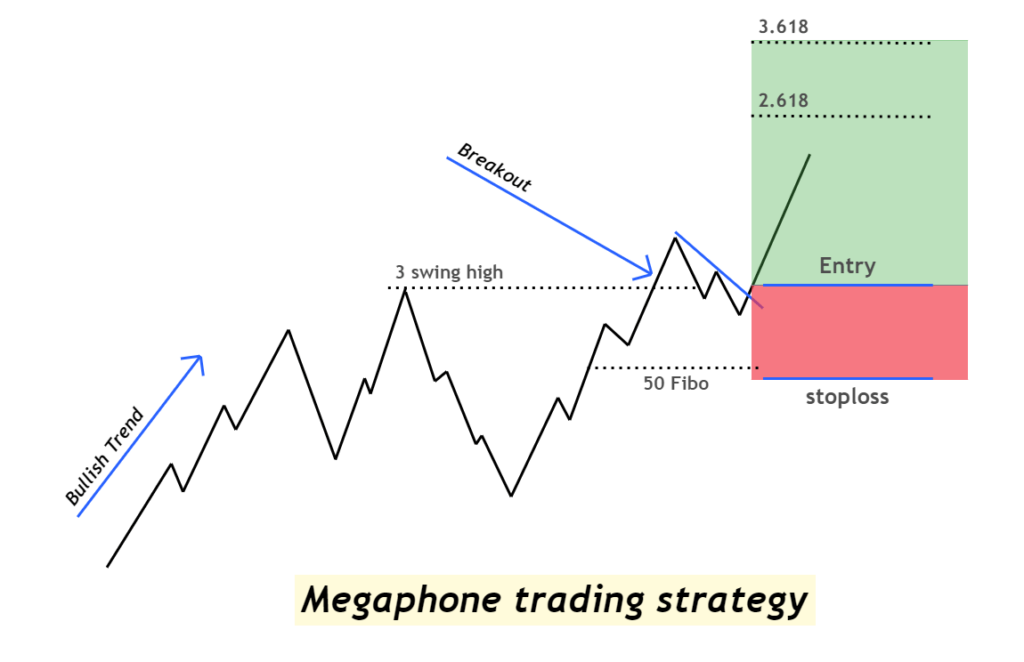

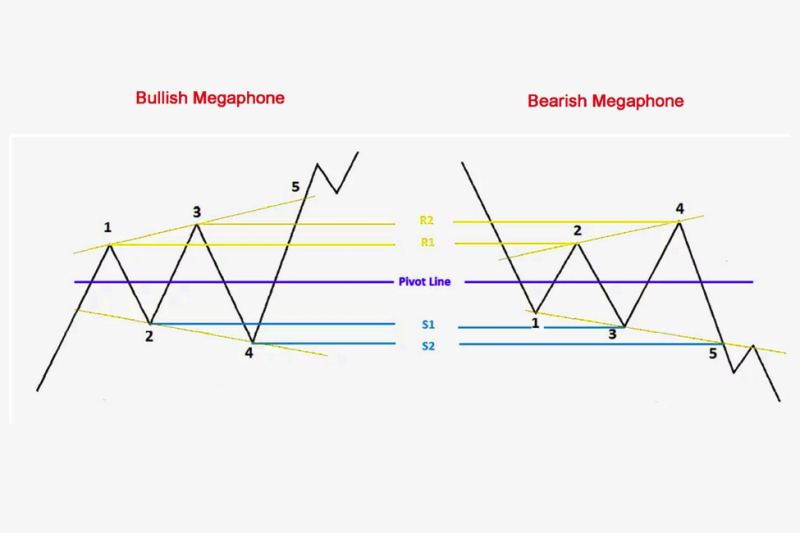

Bullish Megaphone Pattern - Btc/usdt daily chart | credit: Web bullish and bearish patterns. An ascending broadening wedge is confirmed/valid if it has good oscillation between the two upward lines. This pattern is identified by the presence of at least two higher highs and two lower lows, indicating the market’s uncertainty and continuous fight between bulls and bears. Web unknownunicorn3442968 updated nov 30, 2019. If the price trades above the $1,601 at the 5th swing pivot, a megaphone breakout pattern is initiated signaling a continuous trend higher. The pattern is generally formed when the market is highly volatile in nature and traders are not confident about the market direction. The megaphone pattern is significant in stock trading as it can exhibit both bullish and bearish patterns. Though often seen as bearish due to its volatility and uncertainty, its historical performance makes it ambiguous. During periods of high volatility, stocks can show great movement without seeming to show clear direction. Enter a long trade above the high of the bar that closed above $1,601. Web in a bullish trend, a megaphone becomes bearish and indicates a potential reversal to the downside, while in a bearish trend, the pattern becomes bullish and suggests a reversal to the upside. Place a stop near the 3rd swing high ($1,475). Megaphone patterns can be. Web watch our video on how to trade megaphone patterns aka broadening formations. A breakout happens when the price breaks one of the trendlines and closes outside the pattern. The pattern is generally formed when the market is highly volatile in nature and traders are not confident about the market direction. Web a broadening top is a unique chart pattern. The technical pattern looks extremely bullish if it breaks this resistance around $7.60 which is where a cluster of volume has traded these past months. Normally this pattern is visible when the market is at its top or bottom. The height of the megaphone pattern is $650. Traders see this as a red flag signaling that the bulls are exhausting. Megaphone patterns can be observed on various timeframes, from intraday charts to weekly or even monthly ones. The greater the time frame is the better. A breakout happens when the price breaks one of the trendlines and closes outside the pattern. Web reporting from washington. But for almost as long, a subset of. This pattern is identified by the presence of at least two higher highs and two lower lows, indicating the market’s uncertainty and continuous fight between bulls and bears. Web in a bullish trend, a megaphone becomes bearish and indicates a potential reversal to the downside, while in a bearish trend, the pattern becomes bullish and suggests a reversal to the. Megaphone patterns can be observed on various timeframes, from intraday charts to weekly or even monthly ones. Web nevertheless, traders can trade megaphone patterns in two ways. For example, after a strong uptrend, if a megaphone pattern forms that is considered a megaphone top. The megaphone pattern doesn’t last forever and can explode upwards or downwards out of the structure. Normally this pattern is visible when the market is at its top or bottom. If the stock is experiencing a bullish (upward) trend when the megaphone pattern begins, it. An ascending broadening wedge is a bearish chart pattern (said to be a reversal pattern). Web basics of megaphone patterns. Web in a bullish trend, a megaphone becomes bearish and indicates. The pattern is generally formed when the market is highly volatile in nature and traders are not confident about the market direction. It is formed by two diverging bullish lines. Megaphone patterns are also known as the broadening formation because of the way it forms. Web price support reside at the top of the megaphone (which also represents the 2016. The megaphone pattern doesn’t last forever and can explode upwards or downwards out of the structure at any. To clarify, the megaphone pattern acts as a continuation pattern when it appears in a bullish market and the price. Megaphone patterns can be observed on various timeframes, from intraday charts to weekly or even monthly ones. Web trading pcln breakout: Web. The bullish pattern is confirmed when, usually on the third upswing, prices break above the prior high but fail to fall below this level again. The megaphone pattern is significant in stock trading as it can exhibit both bullish and bearish patterns. Web price support reside at the top of the megaphone (which also represents the 2016 lows). Traders see. Btc/usdt daily chart | credit: Trading breakouts means waiting until. The pattern is generally formed when the market is highly volatile in nature and traders are not confident about the market direction. Web bullish and bearish patterns. Web a broadening top is a unique chart pattern resembling a reverse triangle or megaphone that signals significant volatility and disagreement between bullish and bearish investors. A breakout happens when the price breaks one of the trendlines and closes outside the pattern. During periods of high volatility, stocks can show great movement without seeming to show clear direction. Web the first way to trade a megaphone pattern is to trade breakouts. The megaphone pattern is significant in stock trading as it can exhibit both bullish and bearish patterns. Megaphone patterns might be bullish or bearish depending on the trend before it. The megaphone pattern at a market top usually signifies the exhaustion of a bullish trend and hints at an upcoming bearish reversal. The greater the time frame is the better. Though often seen as bearish due to its volatility and uncertainty, its historical performance makes it ambiguous. For example, after a strong uptrend, if a megaphone pattern forms that is considered a megaphone top. Given the pattern's tendency for pullbacks, it's best. Web megaphone pattern in technical analysis chart trading bullish and bearish explanation with guide!👉get my technical analysis course here:

AMBA Bullish Megaphone for NASDAQAMBA by Bixley — TradingView

Megaphone Pattern The Art of Trading like a Professional

What is the Megaphone Pattern? How To Trade It.

MICK bullish megaphone pattern? for NYSEMCK by Peet_Serfontein

S&P500 Bullish Megaphone Pattern Buy on Dips for OANDASPX500USD by

GBPUSD BULLISH MEGAPHONE PATTERN ? for FXGBPUSD by TheAnonymousBanker

🔥 SHIB Bullish Megaphone Pattern for BINANCESHIBUSDT by FieryTrading

Bearish and Bullish Megaphone pattern A Complete Guide ForexBee

Bullish Megaphone Pattern for NSEBRIGADE by PrasantaP — TradingView India

Learn To Spot The Megaphone Pattern • Asia Forex Mentor

Download Our Free Candlesticks Ebook:

If The Stock Is Experiencing A Bullish (Upward) Trend When The Megaphone Pattern Begins, It.

This Can Be A Bullish Or Bearish Pattern, Depending On Whether It Slows Upwards Or Downwards.

When The Trendlines Of These.

Related Post: