Bullish Hammer Pattern

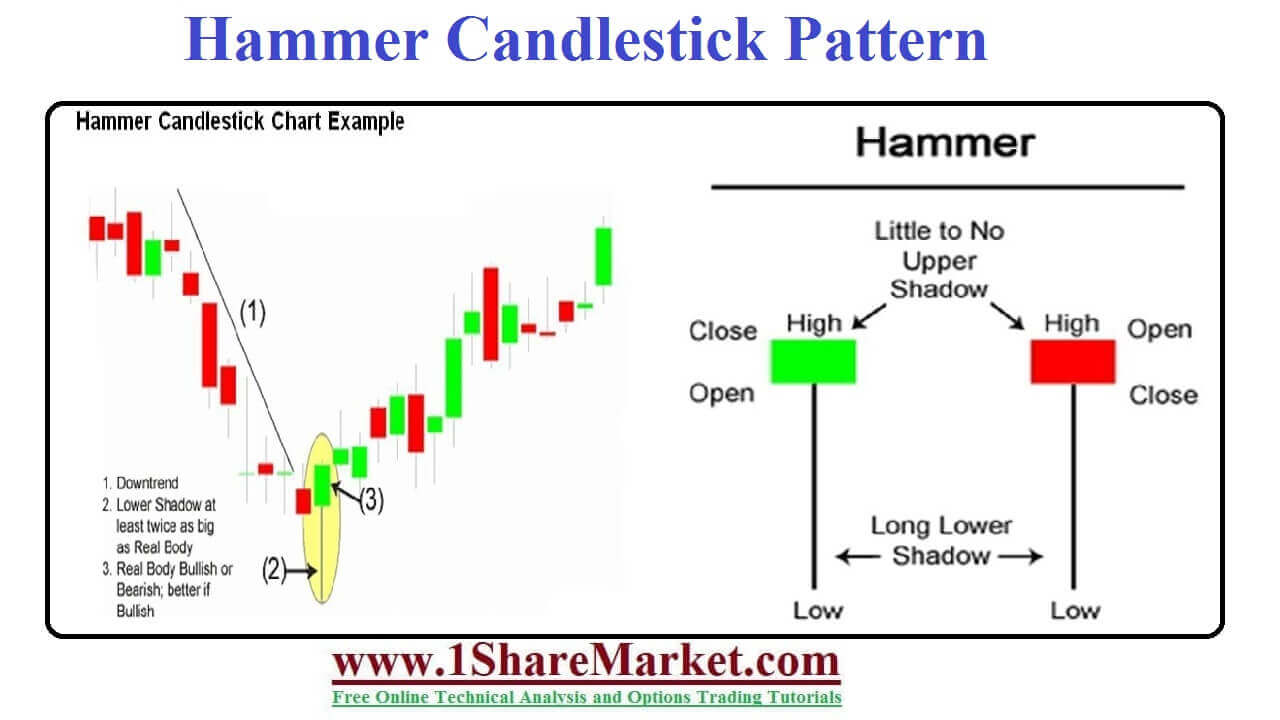

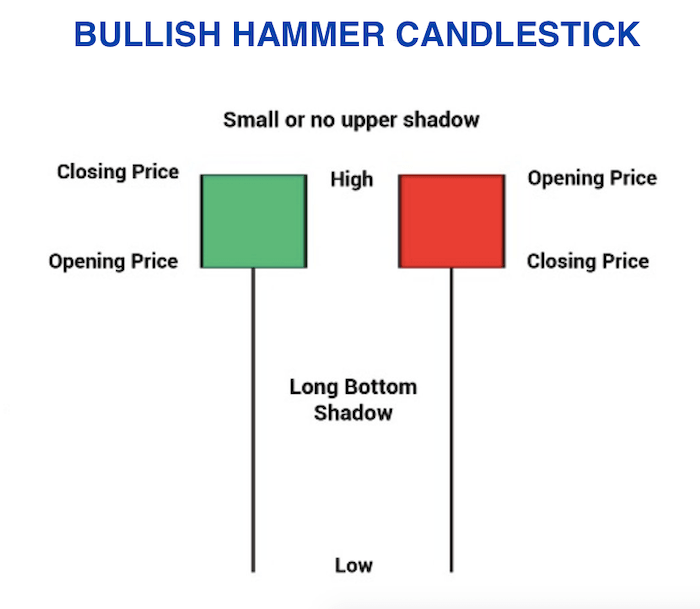

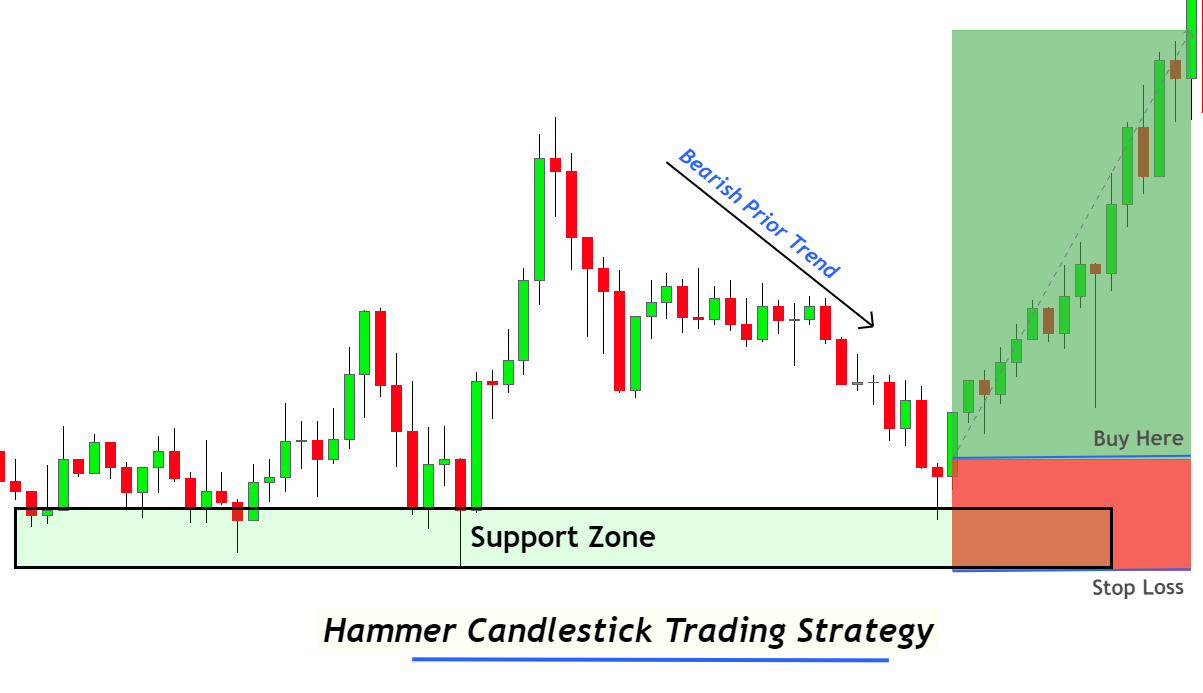

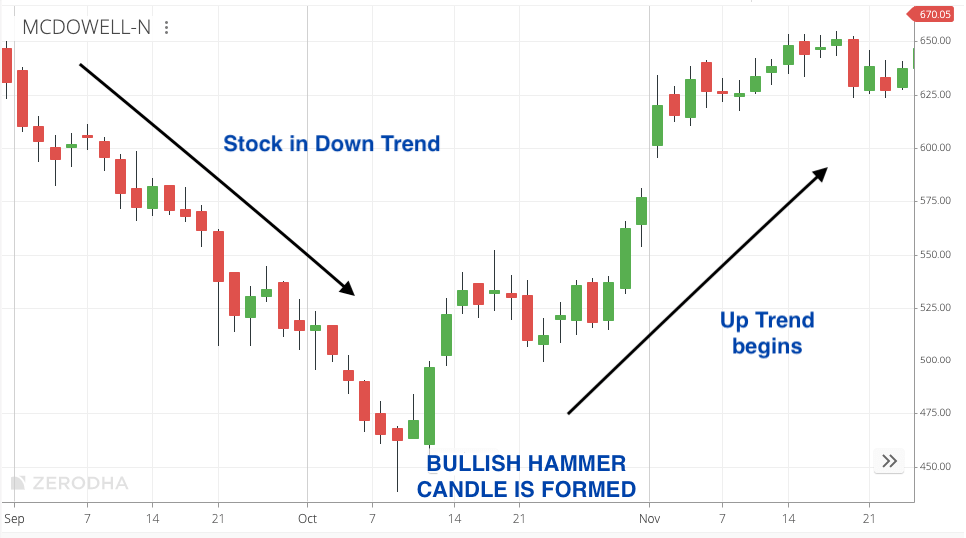

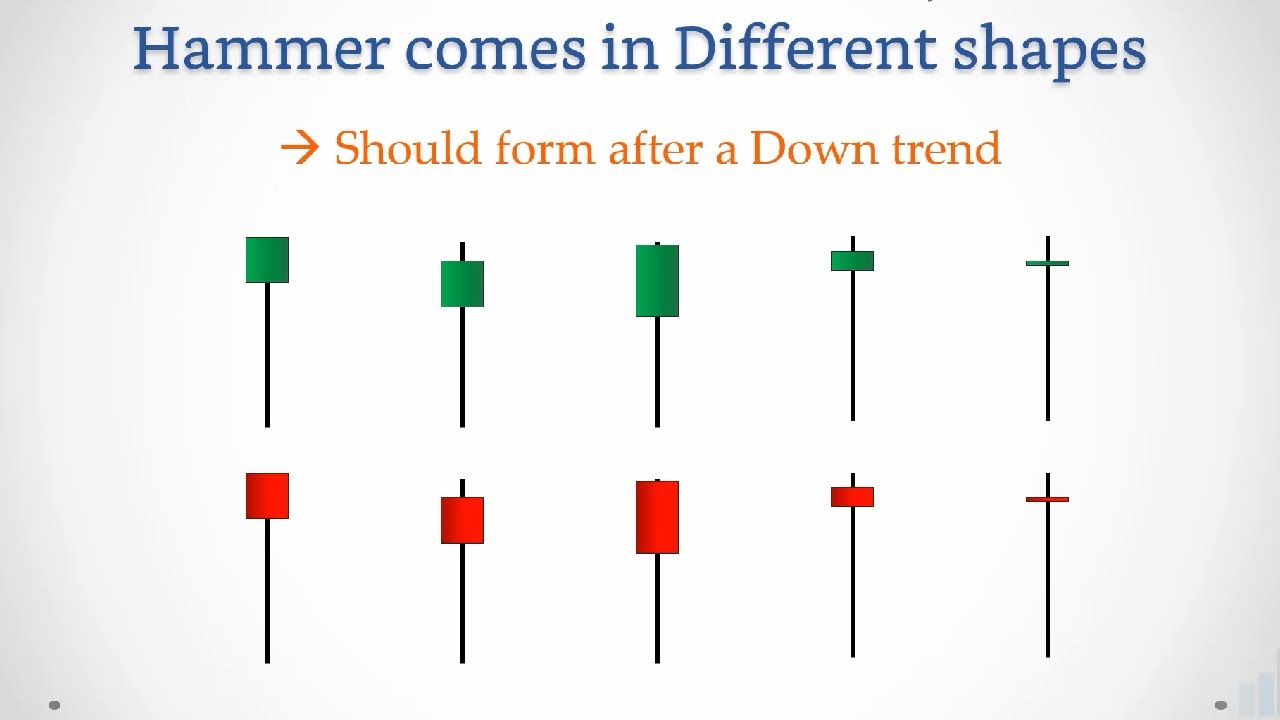

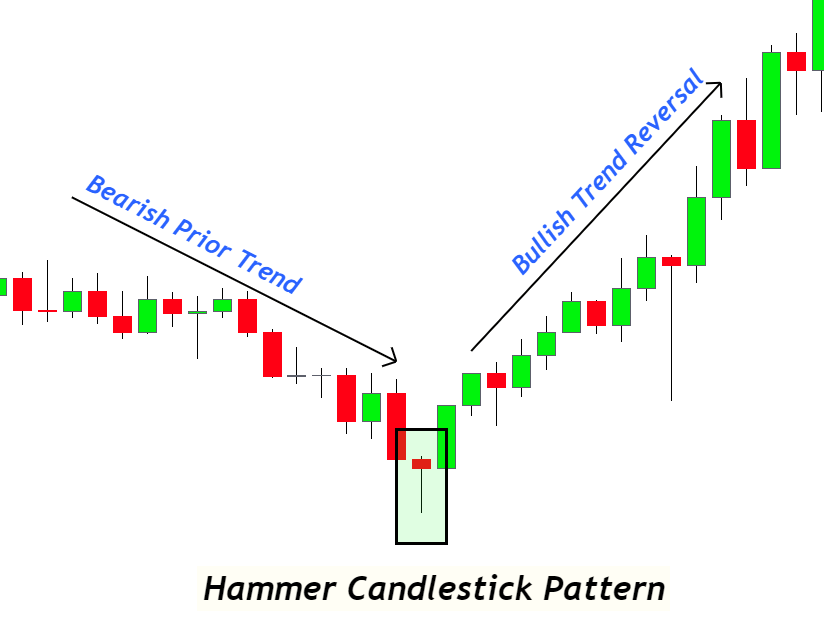

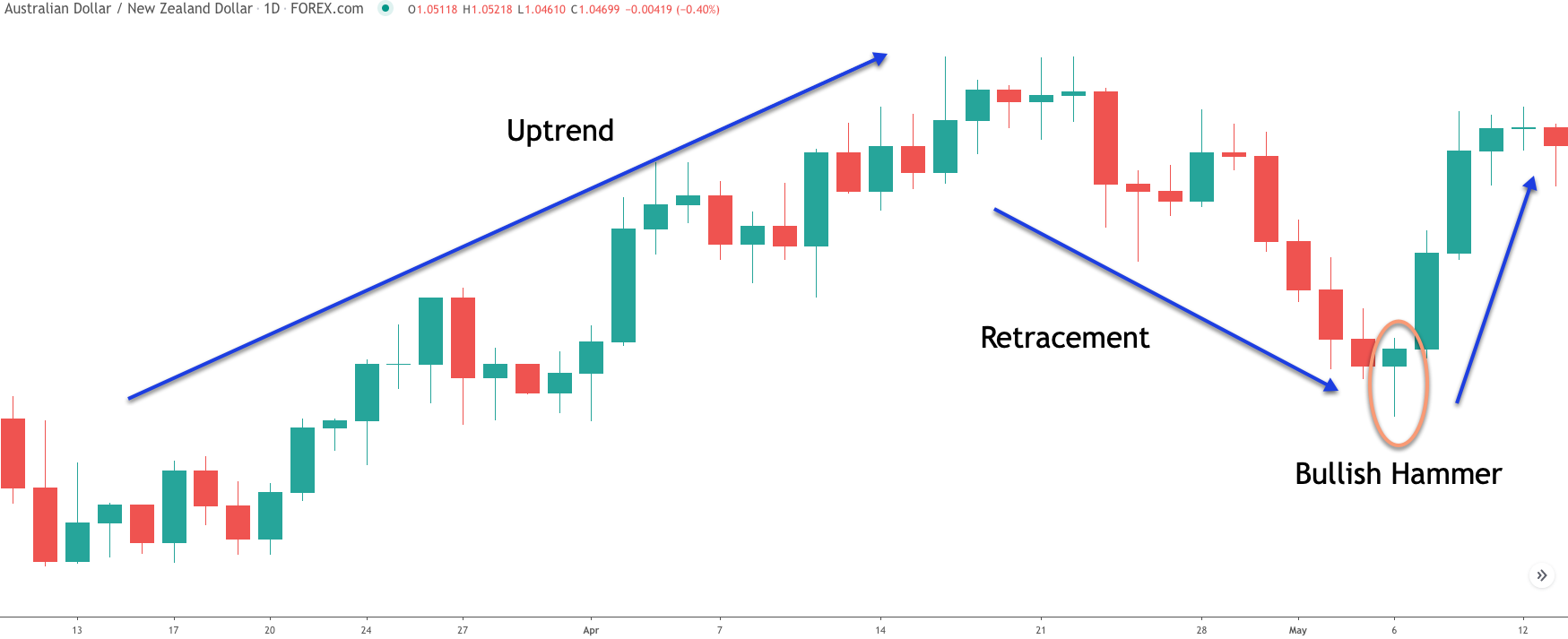

Bullish Hammer Pattern - Updated on october 13, 2023. The hammer candlestick formation is a significant bullish reversal candlestick pattern that mainly occurs at the bottom of downtrends. First things first, we'll walk you through what a candlestick is and how to read candlestick charts. Hammer is a bullish trend reversal candlestick pattern which is a candle of specific shape. How to spot a hammer on a chart. Web the bullish hammer is a significant candlestick pattern that occurs at the bottom of the trend. Learn more about trading the bullish hammer pattern in forex and. It’s a bullish reversal candlestick pattern, which indicates the end of a. 5 day inside candle 2. Web the bullish hammer is a single candle pattern found at the bottom of a downtrend that signals a turning point from a bearish to a bullish market sentiment. It is identified by a small real body at the upper end of the trading range, with a long lower wick that is typically at least twice the size of the real body. How to spot a hammer on a chart. The hammer candle is another japanese candlestick pattern among these 35 powerful candlestick patterns. The context is a steady. If you are familiar with the bearish “hanging man”, you’ll notice that the hammer looks very similar. Traders use this pattern as an early indication that the previous is about to reverse and to identify a reliable price level to open a buy trade. Web bullish hammer candlestick. The hammer is a bullish candlestick pattern that indicates when a security. Open interest data for the 15 may expiry shows a significant call base at the 48,000 strike and a put base at the 47,000 strike. 5 day inside candle 2. Web bullish hammer candlestick. A close above it will confirm the reversal pattern and a close below it will negate the pattern. Much like the hanging man, the hammer is. 6 day inside candle 2. Updated on october 13, 2023. Web zacks equity research may 10, 2024. Web hammer candlestick formation in technical analysis: But as the saying goes, context is everything. Web bullish hammer candlestick. The context is a steady or oversold downtrend. Web is a hammer candlestick pattern bullish? First things first, we'll walk you through what a candlestick is and how to read candlestick charts. Traders use this pattern as an early indication that the previous is about to reverse and to identify a reliable price level to open. The body of the candle is short with a longer lower shadow. Considered a bullish pattern during a downtrend. Web with the broader trend still weak, traders can keep an eye on the high of the bullish reversal hammer. For a complete list of bullish (and bearish) reversal patterns, see greg morris' book, candlestick charting explained. Latest close is greater. While the stock has lost 5.8% over the past week, it could witness a trend reversal as a hammer chart. If you are familiar with the bearish “hanging man”, you’ll notice that the hammer looks very similar. Web the hammer is a bullish reversal pattern, which signals that a stock is nearing the bottom in a downtrend. Web hammer a. The longer, the lower shadow, the more bullish the pattern. First things first, we'll walk you through what a candlestick is and how to read candlestick charts. A minor difference between the opening and closing prices forms a small. Web zacks equity research may 10, 2024. A close above it will confirm the reversal pattern and a close below it. Web is a hammer candlestick pattern bullish? A hammer consists of a small real body at the upper end of the trading range with a long lower shadow. For a complete list of bullish (and bearish) reversal patterns, see greg morris' book, candlestick charting explained. If an investor simply buys every time there is a bullish hammer, it will not. Web the bullish hammer is a significant candlestick pattern that occurs at the bottom of the trend. Web bullish hammer candlestick. Web understanding hammer chart and the technique to trade it. Web hammer (1) inverted hammer (1) morning star (3) bullish abandoned baby (3) the hammer and inverted hammer were covered in the article introduction to candlesticks. Web is a. It is identified by a small real body at the upper end of the trading range, with a long lower wick that is typically at least twice the size of the real body. This article will focus on the famous hammer candlestick pattern. Web sep 25, 2023 12 min read. Web understanding hammer chart and the technique to trade it. It shows that the sellers have lost momentum and. Web a bullish hammer candle is a candlestick pattern used in technical analysis that signals a potential reversal upward. Latest close is greater than p 5 days close. This is one of the popular price patterns in candlestick charting. In japanese, it is called takuri meaning feeling the bottom with your foot or trying to measure the depth. the hammer is a classic bottom reversal pattern that warns traders that prices have reached the bottom and are going to move up. Illustrated guide to hammer candlestick patterns. Scanner guide scan examples feedback. While the stock has lost 5.8% over the past week, it could witness a trend reversal as a hammer chart. It’s a bullish reversal candlestick pattern, which indicates the end of a. Web hammer candlestick formation in technical analysis: Web hammer (1) inverted hammer (1) morning star (3) bullish abandoned baby (3) the hammer and inverted hammer were covered in the article introduction to candlesticks. The trend reversal can be predicted if occurring after the downtrend, this candle has a short body located in the top half of the trading range, absent or very short upper shadow, and long lower shadow.

Hammer candlestick pattern Defination with Advantages and limitation

Bullish Hammer Candlestick Pattern

Bullish Hammer Candlestick Pattern A Trend Trader's Guide ForexBee

Bullish Hammer Candlestick Pattern

Mastering the Hammer Candlestick Pattern A StepbyStep Guide to

Bullish Candle Stick Pattern The Common Investors

Hammer Patterns Chart 5 Trading Strategies for Forex Traders

Bullish Hammer Candlestick Pattern

Hammer Candlestick Pattern A Powerful Reversal Signal Forex

Hammer Candlestick Pattern A Powerful Reversal Signal Forex

Learn More About Trading The Bullish Hammer Pattern In Forex And.

Web The Hammer Is A Bullish Reversal Pattern, Which Signals That A Stock Is Nearing The Bottom In A Downtrend.

The Chart Below Shows The Presence Of Two Hammers Formed At The Bottom Of A Downtrend.

For A Complete List Of Bullish (And Bearish) Reversal Patterns, See Greg Morris' Book, Candlestick Charting Explained.

Related Post: