Bullish Flag Patterns

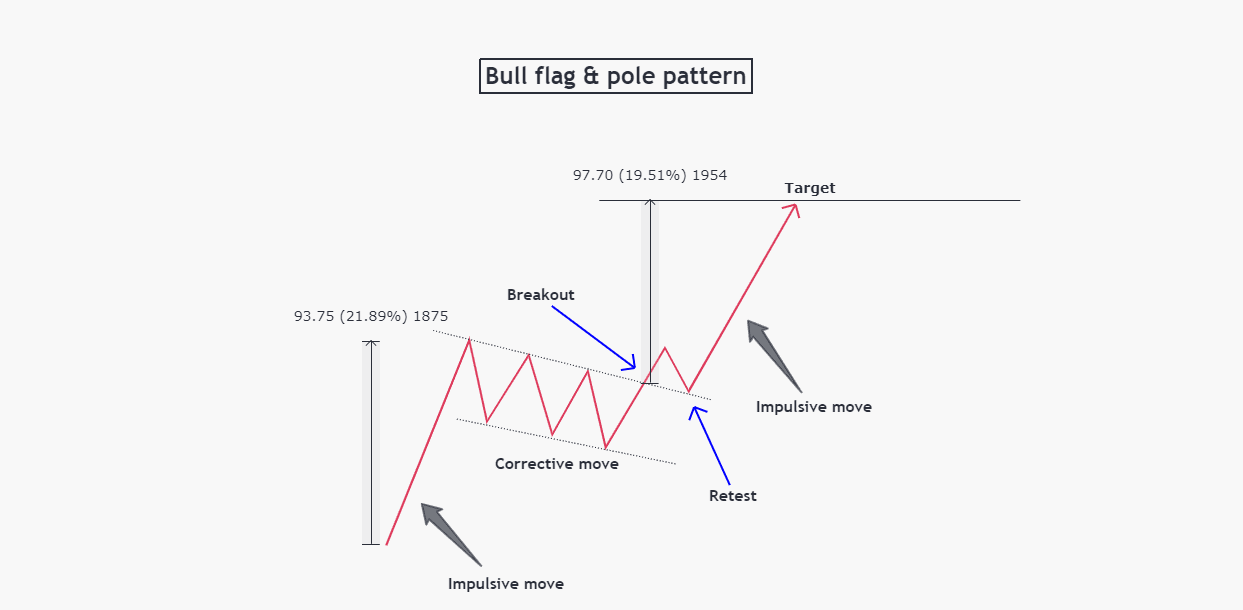

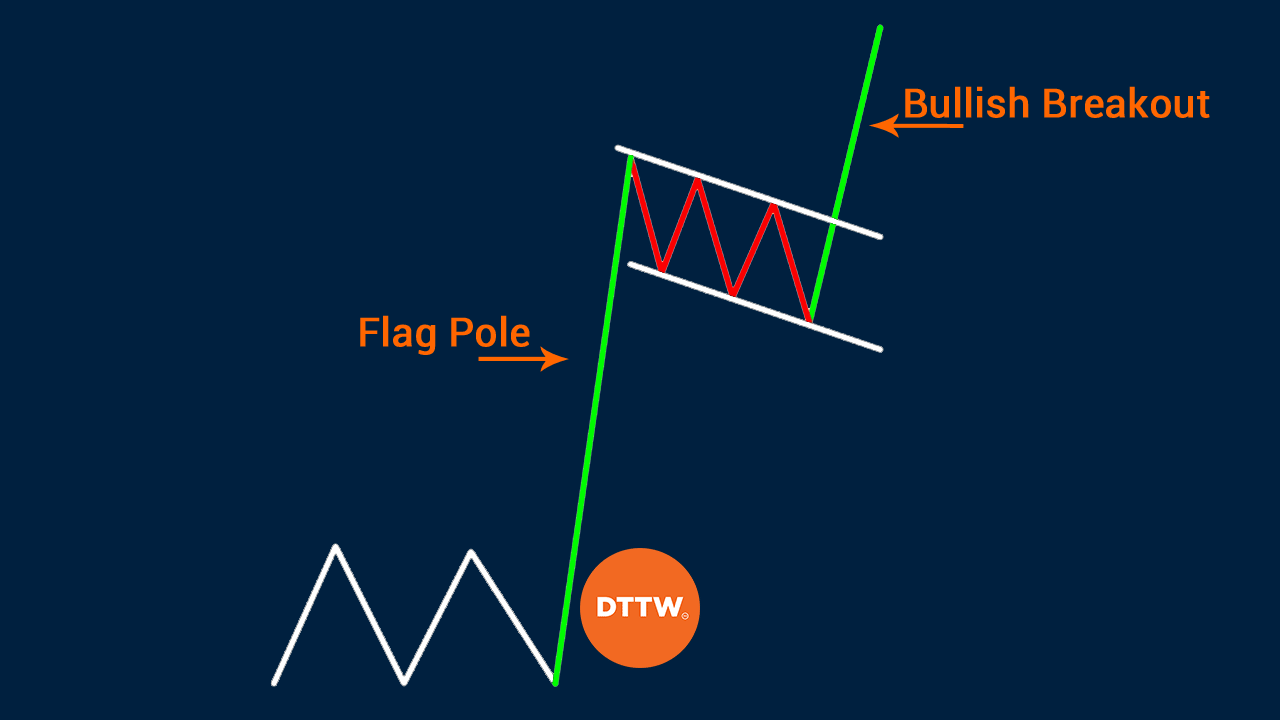

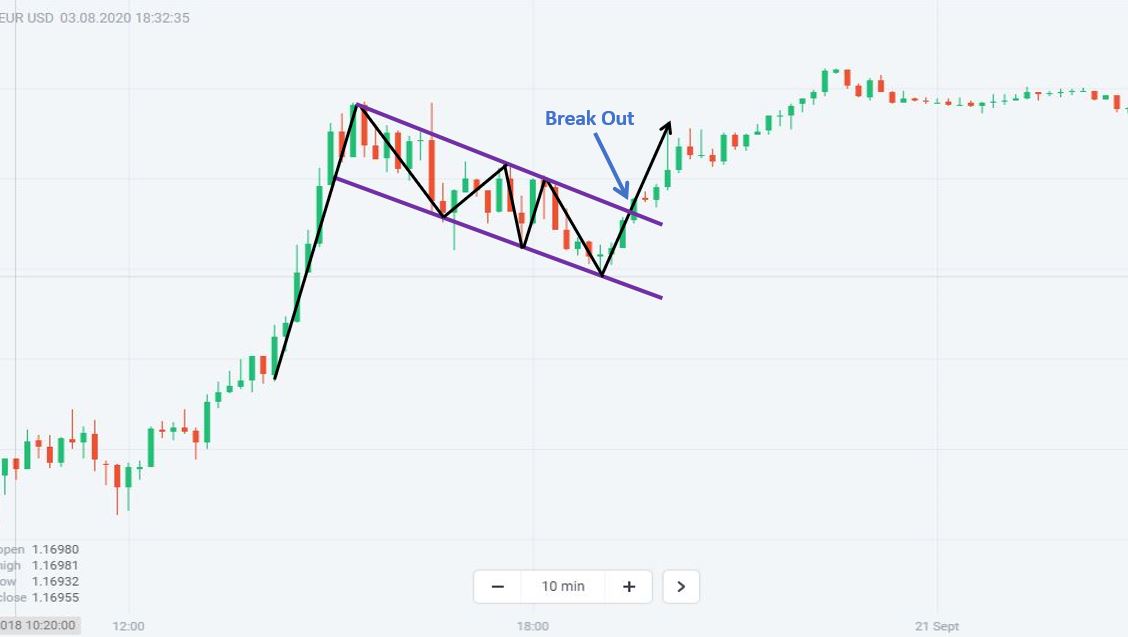

Bullish Flag Patterns - ) less than equal to daily. Web the strong support level at $2,285 was discussed in april 2024 and proved to be strong support. Web a flag pattern is highlighted from a strong directional move, followed by a slow counter trend move. This pattern is easily recognizable by its initial sharp rise in prices, forming the ‘flagpole,’ followed by a more moderate downward or sideways price movement, creating the ‘flag’ itself. It forms when the price retraces by going sideways to lower price action on weaker volume followed by a sharp rally to new highs on strong volume. As can be observed, the pattern resembles a flag on a pole. A bull flag pattern is a sharp, strong volume rally of an asset or stock that portrays a positive development. Understanding these top bullish patterns can give you an edge in the market by informing your entry positions, and helping you set appropriate price targets. Web a bull flag pattern means the market price of a financial market is in a bullish trend and the market chart is indicating further price increases after a price breakout from the flag's resistance line. Web a bullish flag is a technical analysis figure that implies a continuation of the main trend after some correction. Pole is the preceding uptrend where the flag represents the consolidation of the uptrend. Web a bullish flag pattern is a continuation chart pattern commonly observed in trading. It forms when the price retraces by going sideways to lower price action on weaker volume followed by a sharp rally to new highs on strong volume. Chart patterns trend analysis wave. As can be observed, the pattern resembles a flag on a pole. The main trend forms a flagpole, and the correction forms a parallel flag channel. The above chart highlights a bull flag. A bull flag must have orderly characteristics to be considered a bull flag. Web the bullish flag is a continuation pattern. Research on 1,028 trades shows that standard loose flag patterns have a failure rate of 55%. Pole is the preceding uptrend where the flag represents the consolidation of the uptrend. Web a flag pattern is highlighted from a strong directional move, followed by a slow counter trend move. Web a bull flag pattern means the market price of a financial. Web bullish flag patterns [theeccentrictrader] — indicator by theeccentrictrader — tradingview. This indicator automatically draws bullish flag patterns and price projections derived from the ranges that constitute the patterns. Web the bullish flag pattern frequently occurs on every financial markets time frame. It helps trades identify the stage which the trend is currently in. The most profitable chart pattern is. Web updated may 26, 2021. In contrast, a high tight bull flag pattern has a success rate of 85% with an average gain of +39%. Web bull flag patterns are one of the most popular bullish patterns. The flagpole represents a strong price movement, followed by a period of consolidation, forming the flag. They consist of either a large bullish. It forms when the price retraces by going sideways to lower price action on weaker volume followed by a sharp rally to new highs on strong volume. Bullish flag formations are found in stocks with strong uptrends and are considered good continuation patterns. The main trend forms a flagpole, and the correction forms a parallel flag channel. The pattern may. Web the bullish flag pattern frequently occurs on every financial markets time frame. Understanding these top bullish patterns can give you an edge in the market by informing your entry positions, and helping you set appropriate price targets. They consist of either a large bullish candlestick or several smaller bullish candlesticks up, forming the flag pole, followed by several smaller. Currently, the market is poised within this bull flag pattern, and a decisive break above the $2,375. The strong directional move up is known as the ‘flagpole’, while the slow counter trend move lower is what is referred to as the ‘flag’. Web a flag pattern is highlighted from a strong directional move, followed by a slow counter trend move.. Web the strong support level at $2,285 was discussed in april 2024 and proved to be strong support. The bull flag chart pattern looks like a downward sloping. Stock passes all of the below filters in cash segment: Web a bullish flag is a technical analysis figure that implies a continuation of the main trend after some correction. Web updated. Web a flag pattern is highlighted from a strong directional move, followed by a slow counter trend move. Chart patterns trend analysis wave analysis. Conservative traders may look for additional confirmation of the trend continuing. Web a bull flag pattern forms when there is a steep rise in the price of the underlying asset, followed by a period of consolidation. ) less than equal to daily. Web bullish flags can form after an uptrend, bearish flags can form after a downtrend. They consist of either a large bullish candlestick or several smaller bullish candlesticks up, forming the flag pole, followed by several smaller bearish candlesticks pulling back down for consolidation, which forms the flag. Web a flag pattern is highlighted from a strong directional move, followed by a slow counter trend move. It forms when the price retraces by going sideways to lower price action on weaker volume followed by a sharp rally to new highs on strong volume. A bull flag pattern is a sharp, strong volume rally of an asset or stock that portrays a positive development. The vertical rise forms the pole and the following period of consolidation forms the flag. It consists of two primary components: The pattern may be used to buy. The bull flag chart pattern looks like a downward sloping. It helps trades identify the stage which the trend is currently in. The bullish flag pattern is usually found in assets with a strong uptrend. The price in the channel should not fall below the middle of the flagpole. Bullish flags signal the continuation of a preceding uptrend. The main trend forms a flagpole, and the correction forms a parallel flag channel. Web the bullish flag is a continuation pattern.

How to Trade Bullish Flag Patterns

Bull Flag Chart Patterns ThinkMarkets

Bullish flag chart pattern Basic characteristics & 3 examples

how to trade bull flag Hung Corbitt

Bullish Pennant Patterns A Complete Guide

What is Bull Flag Pattern & How to Identify Points to Enter Trade DTTW™

Bull Flag Chart Pattern & Trading Strategies Warrior Trading

What Is A Bull Flag Pattern (Bullish) & How to Trade With It Bybit Learn

How To Trade Bullish And Bearish Flag Patterns Daily Price Action

What Is Flag Pattern? How To Verify And Trade It Efficiently

The Flagpole Represents A Strong Price Movement, Followed By A Period Of Consolidation, Forming The Flag.

The Above Chart Highlights A Bull Flag.

It Is The Opposite Of The Bearish Flag Pattern.

Web The Bull Flag Pattern Is A Popular Chart Pattern Used In Technical Analysis To Identify A Potential Continuation Of A Bullish Trend.

Related Post: