Bullish Flag Pattern

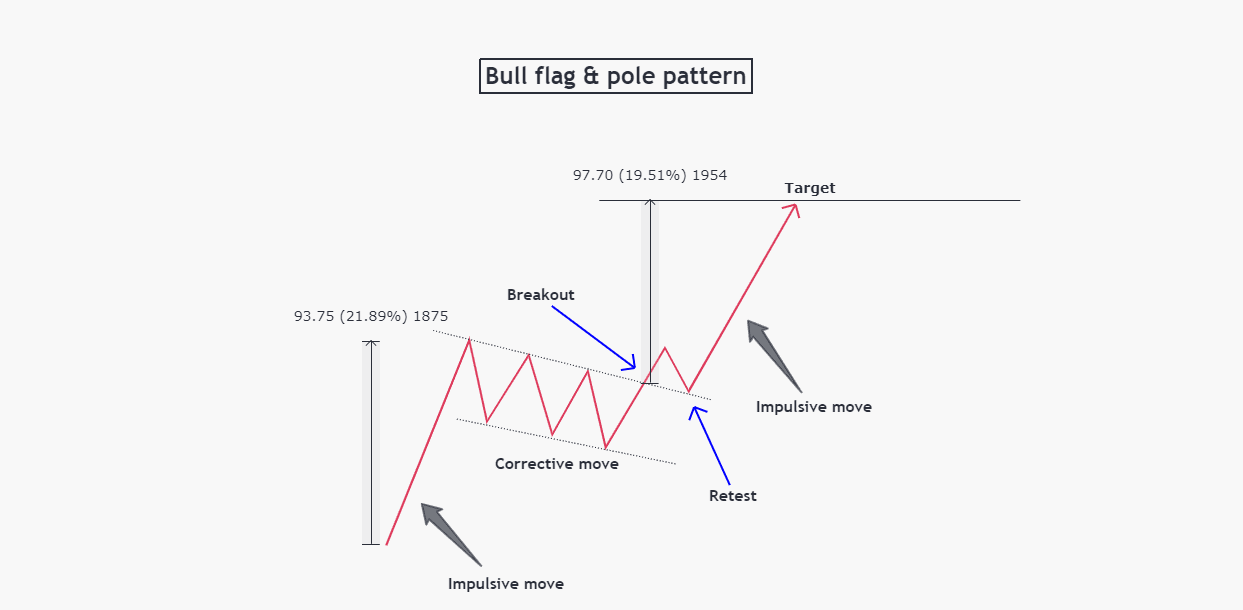

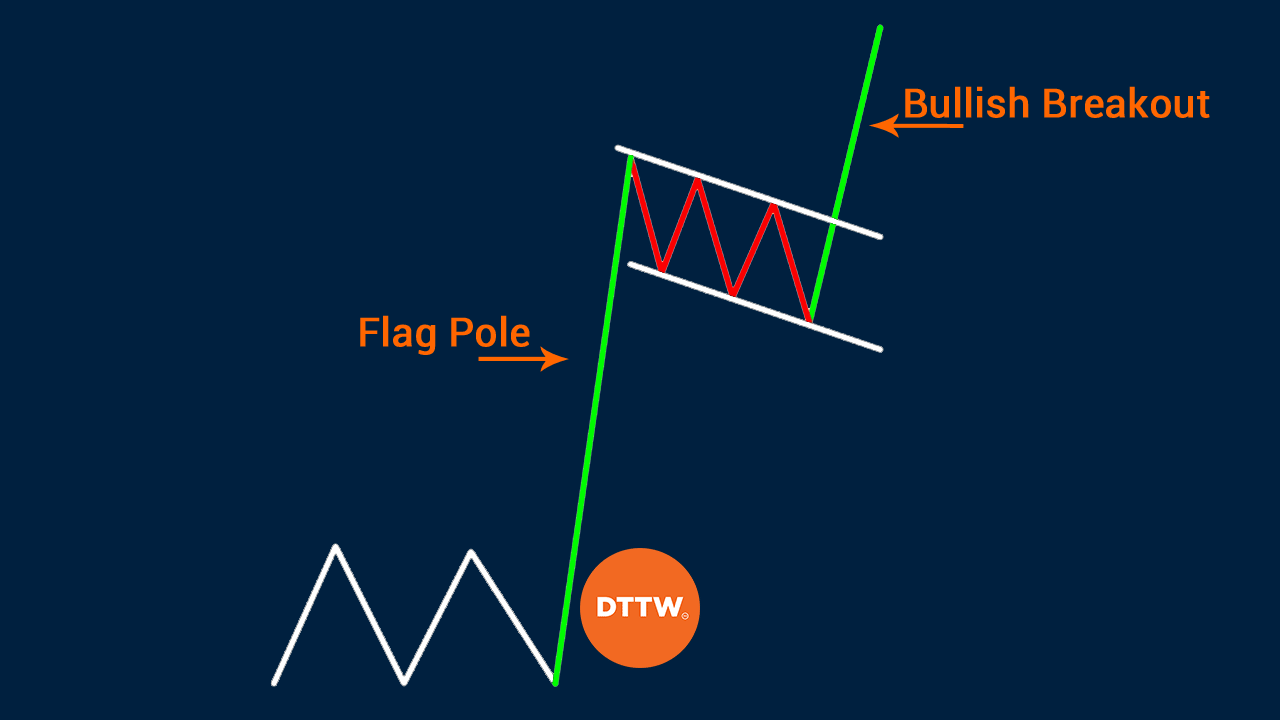

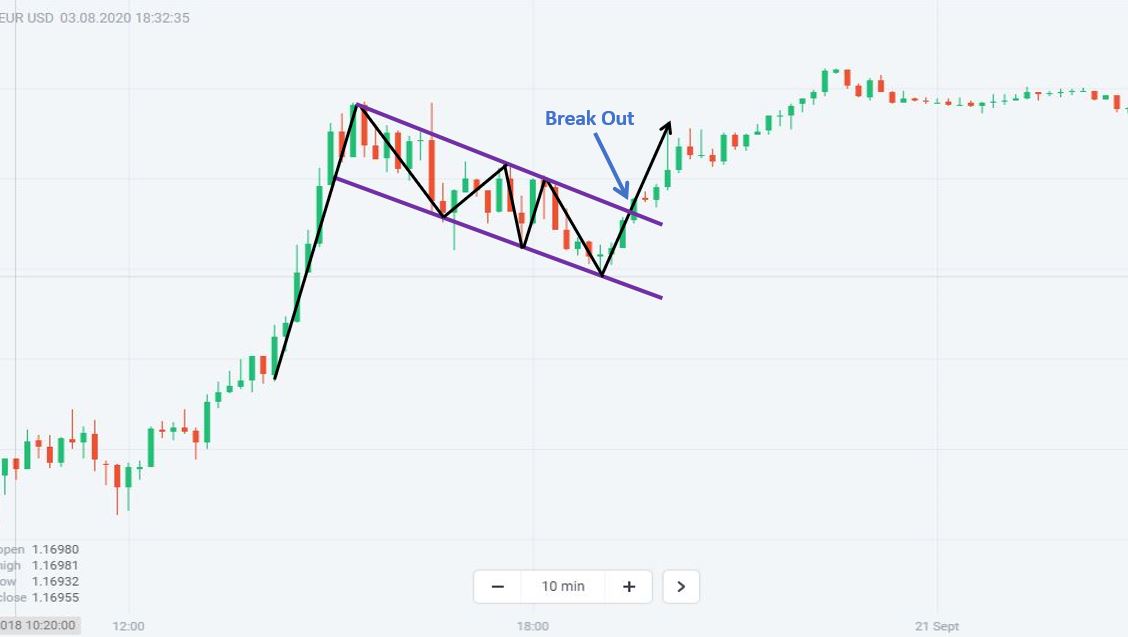

Bullish Flag Pattern - Web a bullish flag pattern signals a continuation of an uptrend and bearish flag pattern suggests a continuation of a downtrend. Web learn what a bull flag is, how it indicates demand and supply in a stock, and how to trade it. Web there are certain bullish patterns, such as the bull flag pattern, double bottom pattern, and the ascending triangle pattern, that are largely considered the. Learn how to identify, analyze and trade bullish flag formations with examples, tips and faqs. Web learn about flag patterns, a technical analysis tool for identifying continuation of a trend after a pause or consolidation. For a bearish flag or pennant, a break below support signals that the previous decline has resumed. The bullish flag pattern is usually found in assets with a strong uptrend. The vertical rise forms the pole and the following period of consolidation forms the flag. Web a flag pattern is highlighted from a strong directional move, followed by a slow counter trend move. The strong directional move up is known as the ‘flagpole’, while the slow counter trend move lower is what is referred to as the ‘flag’. Web learn what a bull flag is, how it indicates demand and supply in a stock, and how to trade it. Web a bullish flag is a technical analysis figure that implies a continuation of the main trend after some correction. Web a flag pattern is highlighted from a strong directional move, followed by a slow counter trend move. Bullish. Web a bullish flag pattern signals a continuation of an uptrend and bearish flag pattern suggests a continuation of a downtrend. The main trend forms a flagpole, and the correction forms a. Bullish flag formations are found in stocks with strong uptrends and are considered good continuation patterns. The pattern consists of a flagpole. Find out how to scan and. The bull flag is not a reversal pattern. Web a bull flag pattern is a bullish continuation pattern that indicates further price trend increases. Web learn what a bull flag is, how it indicates demand and supply in a stock, and how to trade it. Web learn about flag patterns, a technical analysis tool for identifying continuation of a trend. As can be observed, the pattern resembles a flag on a pole. They are called bull flags because the pattern resembles a flag on a pole. Web a bullish flag is a technical analysis figure that implies a continuation of the main trend after some correction. Web for a bullish flag or pennant, a break above resistance signals that the. Find examples of bullish and bearish flags, how to. Bullish flag formations are found in stocks with strong uptrends and are considered good continuation patterns. Web learn what a bull flag pattern is, how to spot it on a chart, and how to use it to enter long positions. It is called a flag pattern because it resembles a flag. Web learn about flag patterns, a technical analysis tool for identifying continuation of a trend after a pause or consolidation. Web bullish flags are a continuation pattern found in stocks with a strong uptrend. Web learn how to identify and use the bullish flag pattern, a technical analysis tool to predict upward movements in financial markets. Web a bullish flag. Find out how to scan and backtest stocks. Web for a bullish flag or pennant, a break above resistance signals that the previous advance has resumed. Web bullish flags are a continuation pattern found in stocks with a strong uptrend. Bullish flag formations are found in stocks with strong uptrends and are considered good continuation patterns. Find examples of bullish. Web learn how to identify and use the bullish flag pattern, a technical analysis tool to predict upward movements in financial markets. See examples, diagrams, and tips for bull flag patterns on candlestick. Web learn what a bull flag pattern is, how to identify it, and how to trade it with low risk and high reward. It has a downward. Web learn what a bull flag pattern is, how to spot it on a chart, and how to use it to enter long positions. Web learn how to identify and use the bullish flag pattern, a technical analysis tool to predict upward movements in financial markets. Web a bull flag is a powerful pattern seen on price charts, indicative of. See examples, diagrams, and tips for bull flag patterns on candlestick. For a bearish flag or pennant, a break below support signals that the previous decline has resumed. Web a bullish flag pattern signals a continuation of an uptrend and bearish flag pattern suggests a continuation of a downtrend. Find examples of bullish and bearish flags, how to. Web learn. Bullish flag formations are found in stocks with strong uptrends and are considered good continuation patterns. Web a bullish flag pattern signals a continuation of an uptrend and bearish flag pattern suggests a continuation of a downtrend. See examples, diagrams, and tips for bull flag patterns on candlestick. The bullish flag pattern is usually found in assets with a strong uptrend. The vertical rise forms the pole and the following period of consolidation forms the flag. As can be observed, the pattern resembles a flag on a pole. It has a downward slope after an uptrend and it. They are called bull flags because the pattern resembles a flag on a pole. Volume should be heavy during the advance or decline that forms the flagpole. Web what is a bullish flag pattern? Web learn what a bull flag pattern is, how to spot it on a chart, and how to use it to enter long positions. Web a flag is a price pattern that moves counter to the prevailing trend and shows a sharp increase or decrease in price action. Web a bullish flag is a technical analysis figure that implies a continuation of the main trend after some correction. Web bullish flags are a continuation pattern found in stocks with a strong uptrend. Web a bull flag pattern is a bullish continuation pattern that indicates further price trend increases. It is called a flag pattern because it resembles a flag and.

How to Trade Bullish Flag Patterns

Bull Flag Pattern New Trader U

How To Trade Bullish And Bearish Flag Patterns Daily Price Action

Bullish Flag Chart Pattern

Learn about Bull Flag Candlestick Pattern ThinkMarkets EN

Bullish flag chart pattern Basic characteristics & 3 examples

What is Bull Flag Pattern & How to Identify Points to Enter Trade DTTW™

What Is A Bull Flag Pattern (Bullish) & How to Trade With It Bybit Learn

Bullish Flag Chart Pattern

Bullish Pennant Patterns A Complete Guide

Web Learn What A Bull Flag Pattern Is, How To Identify It, And How To Trade It With Low Risk And High Reward.

Web There Are Certain Bullish Patterns, Such As The Bull Flag Pattern, Double Bottom Pattern, And The Ascending Triangle Pattern, That Are Largely Considered The.

For A Bearish Flag Or Pennant, A Break Below Support Signals That The Previous Decline Has Resumed.

Web Learn What A Bull Flag Is, How It Indicates Demand And Supply In A Stock, And How To Trade It.

Related Post: