Bullish Engulfing Pattern Entry

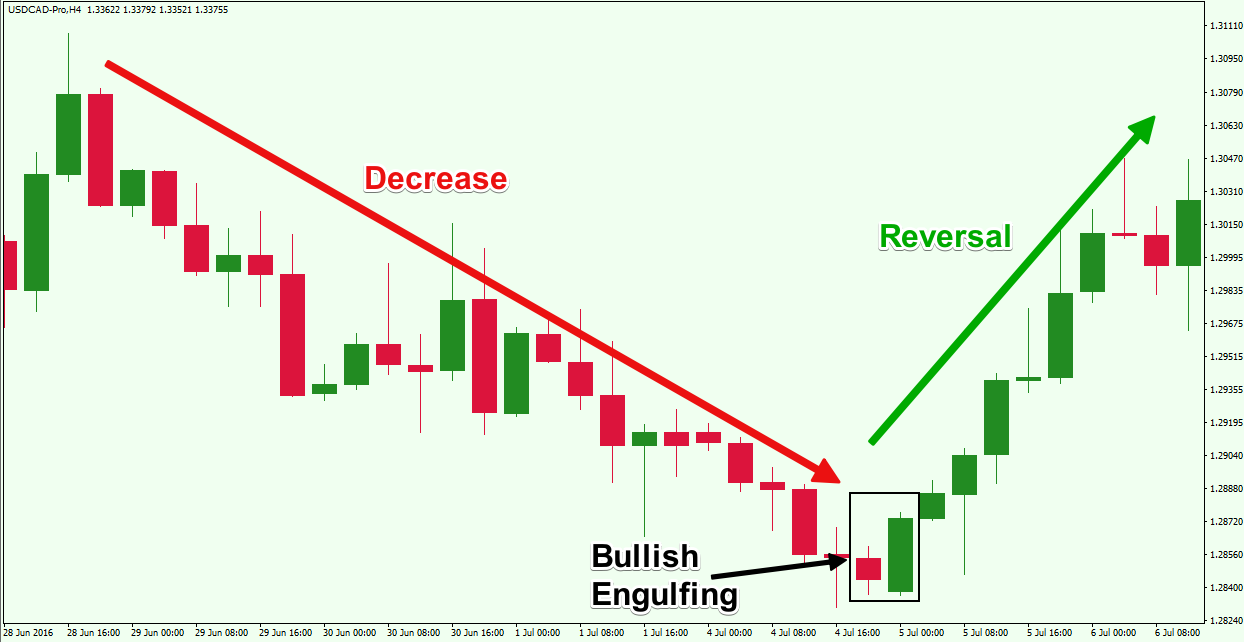

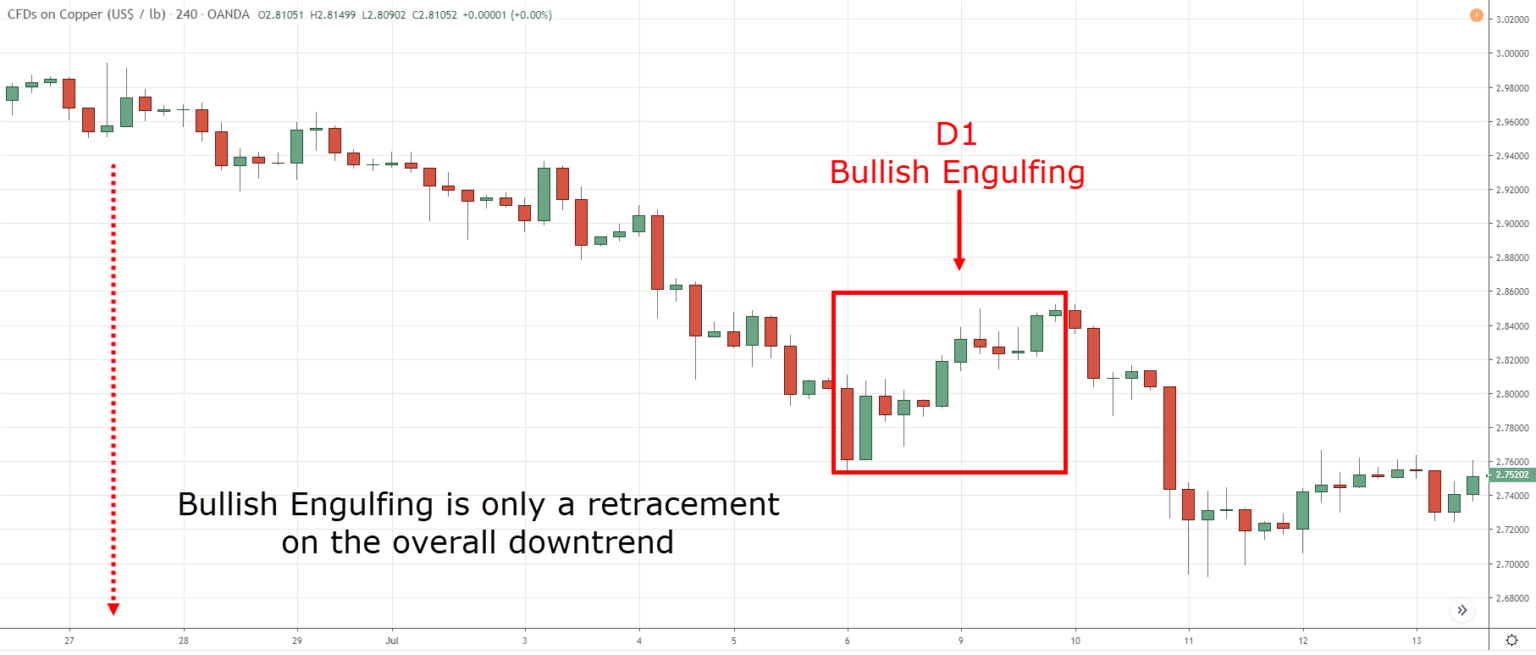

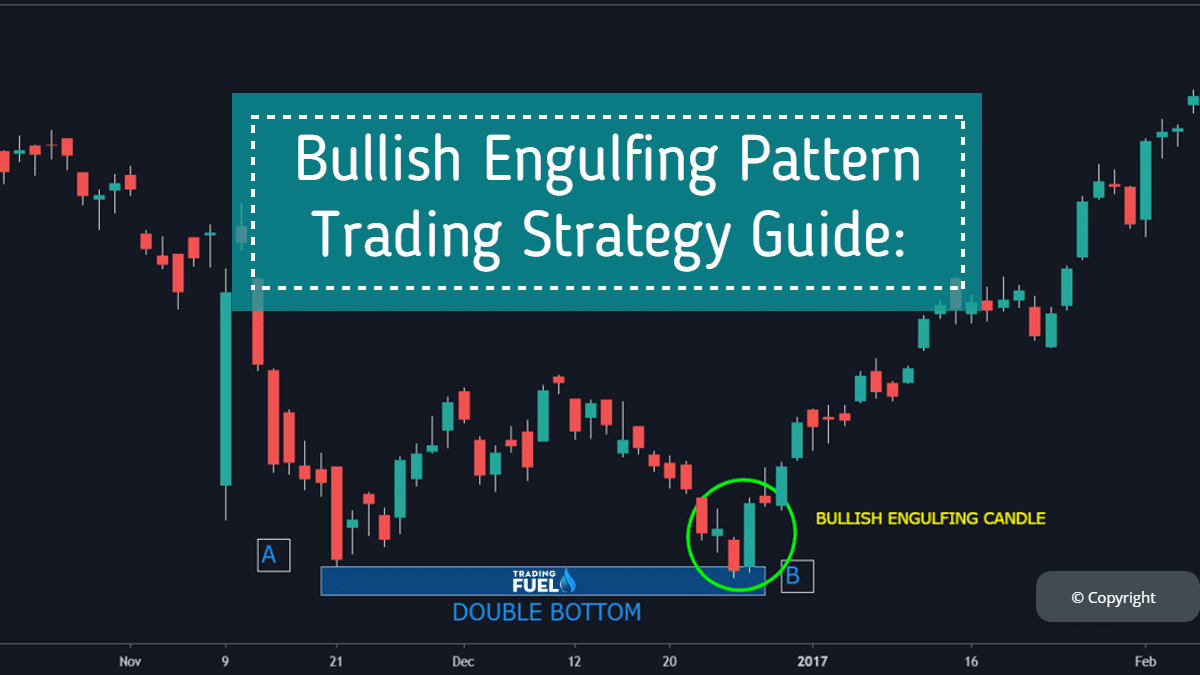

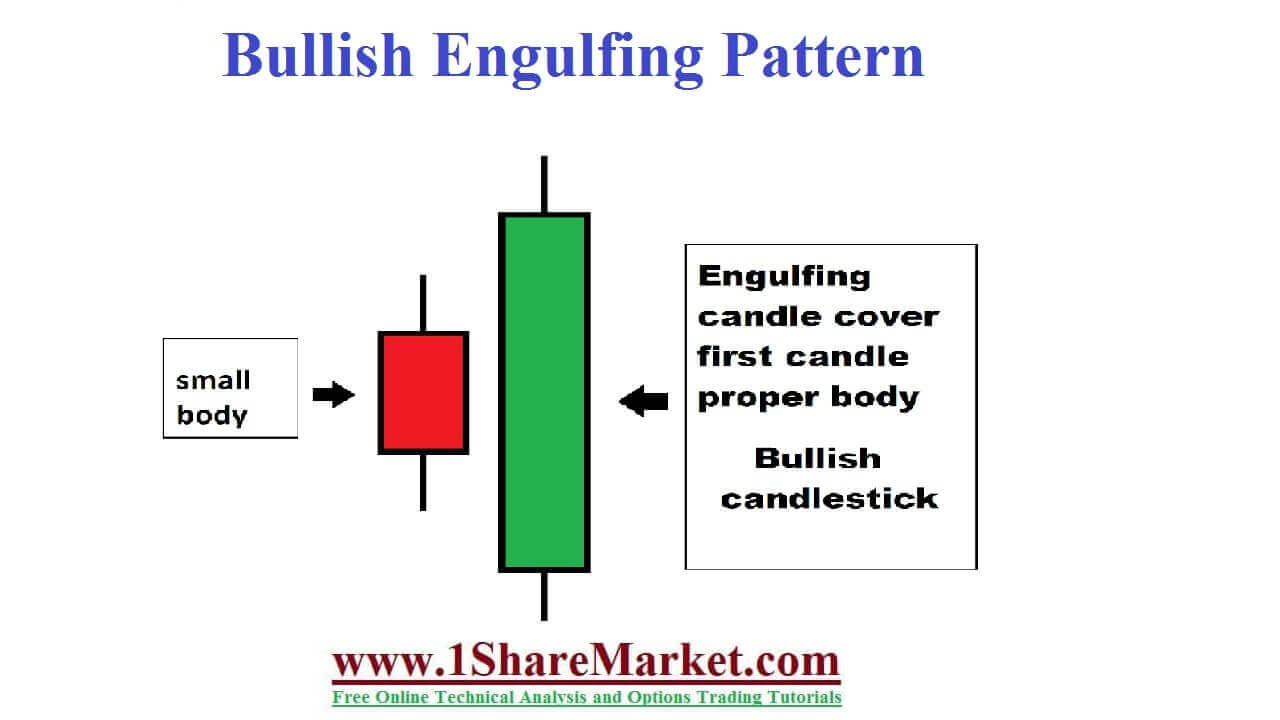

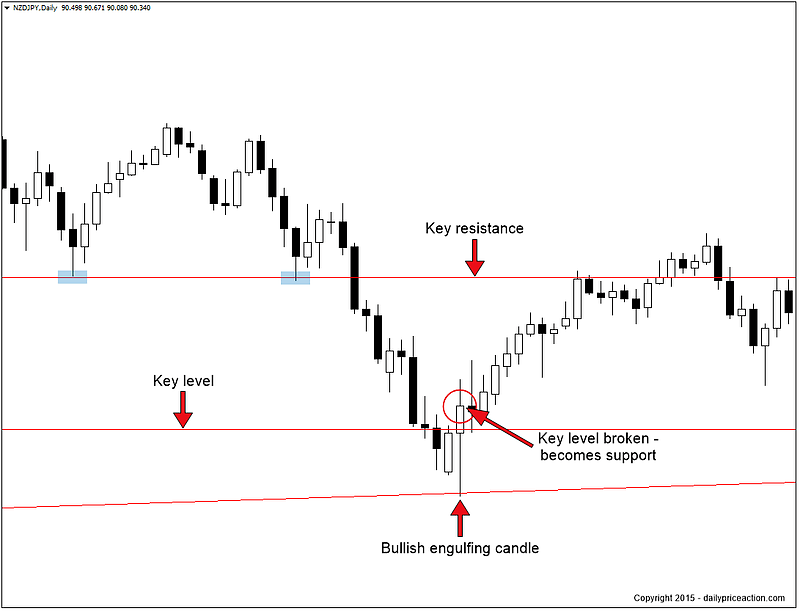

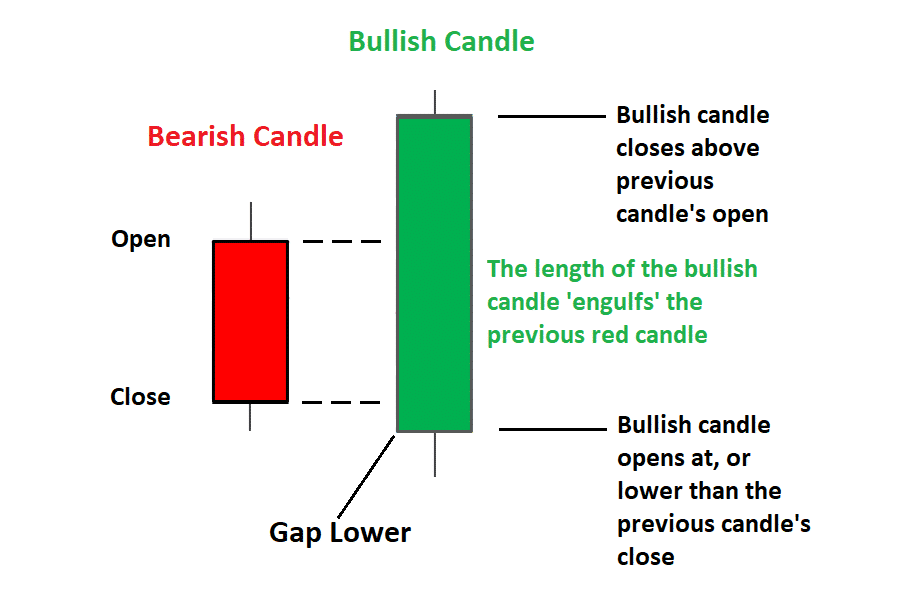

Bullish Engulfing Pattern Entry - The open was a gap down, very bearish sign; The 1 st candles signify that the seller has the upper hand during the whole trading day, and pushes the price lower. The bullish engulfing pattern is a reversal pattern that can be used as a signal of an upcoming reversal in the trend. Much like the hanging man, the hammer is a bullish candlestick reversal candle. It includes two candlesticks, where the second candlestick is a bullish candle, which completely engulfs the preceding bearish candlestick. Web the bullish and bearish engulfing patterns are multiple candlestick patterns that tend to signal a reversal of the ongoing trend in the market. But as the saying goes, context is everything. As the name indicates, it is a bullish reversal pattern that signals a potential beginning of an upward swing. For bearish engulfing patterns, profit targets are placed beneath the sell entry. The second candle is always the opposite color of the first. Web updated on october 13, 2023. After gaining confirmation of the engulfing pattern, a stop loss may be placed upon the market. A small red/black candlestick is followed by a large white candlestick that completely eclipses or engulfs the previous day's candlestick. A bullish engulfing pattern is a chart pattern that forms when a small black candlestick is followed by. Here’s how to recognize one: For bullish engulfing patterns, traders could enter a long position when the price breaks above the. The key to the pattern is the size of the second candle. The body of the 2 nd candle “covers” the body of the first candle. But as the saying goes, context is everything. Web the bullish engulfing pattern is a bullish reversal candlestick that forms after a decline in price. Web the bullish engulfing candle is a reversal pattern that confirms the dominance of the buyer over the seller and indicates a potential reversal in the trend direction. The first one is black and the second is a white one that is taller. The bullish engulfing pattern’s opposite is the bearish engulfing pattern (see: If you are familiar with the bearish “hanging man”, you’ll notice that the hammer looks very similar. The first one is black and the second is a white one that is taller than the prior black candle, engulfing it or overlapping the black candle's body. It includes two candlesticks,. On the first candle, the sellers are in control as. This candlestick consists of a smaller bearish candle followed by a larger bullish candle that engulfs the entire body of the previous candle. Web the bullish engulfing candle is a reversal pattern that confirms the dominance of the buyer over the seller and indicates a potential reversal in the trend. To increase your chances of catching the reversal, consider entering the trade within 20 seconds of the bullish engulfing. Web a bullish engulfing candlestick is a reversal signal in the existing trend as buying pressure increases in the market, further increasing the currency pair prices. After gaining confirmation of the engulfing pattern, a stop loss may be placed upon the. The bullish engulfing candlestick acts as a bullish reversal 63% of the time, which is respectable,. On the first candle, the sellers are in control as. The first candle has a lower close. Much like the hanging man, the hammer is a bullish candlestick reversal candle. To increase your chances of catching the reversal, consider entering the trade within 20. This candlestick pattern involves two candles, with the latter candle ‘engulfing’ the entire body of the prior candle. The first candle (a) must be a down candle, colored red on most charting packages (or black if using a white/black color scheme). Web a bullish engulfing candlestick is a reversal signal in the existing trend as buying pressure increases in the. But as the saying goes, context is everything. Here’s how to recognize one: Once you have those three things, you can move to the next stage of your analysis to determine if it’s a setup worth taking. The bullish engulfing candlestick acts as a bullish reversal 63% of the time, which is respectable,. It includes two candlesticks, where the second. Web a bullish engulfing pattern occurs when a small bearish candlestick is followed by a larger bullish candlestick, and the bullish candlestick completely engulfs the bearish one. Once you have those three things, you can move to the next stage of your analysis to determine if it’s a setup worth taking. A bullish engulfing pattern is a chart pattern that. The context is a steady or oversold downtrend. After gaining confirmation of the engulfing pattern, a stop loss may be placed upon the market. The key to the pattern is the size of the second candle. The first candle (a) must be a down candle, colored red on most charting packages (or black if using a white/black color scheme). Engulfing patterns are powerful signals that can indicate a change in trend direction. Much like the hanging man, the hammer is a bullish candlestick reversal candle. The second candle completely ‘engulfs’ the real body of the. Bullish engulfing pattern explained a bullish engulfing pattern is the most commonly used and easy to interpret form of candlestick pattern that analysts and investors can use to detect the possibility. The bullish engulfing pattern is a reversal pattern that can be used as a signal of an upcoming reversal in the trend. Web trading strategies involving engulfing patterns entry points. Web the bullish engulfing pattern is a bullish reversal candlestick that forms after a decline in price. To increase your chances of catching the reversal, consider entering the trade within 20 seconds of the bullish engulfing. Web the bullish engulfing pattern confirmation helps individuals spot attractive entry points that can generate significant financial gains. The bullish engulfing pattern’s opposite is the bearish engulfing pattern (see: Web take your entry once the bullish engulfing pattern forms. The first one is black and the second is a white one that is taller than the prior black candle, engulfing it or overlapping the black candle's body.

bullishengulfingreversalpattern Forex Training Group

Bullish Engulfing Pattern Trading Strategy Guide

Bullish Engulfing Pattern Trading Strategy Guide (Pro's Guide)

How to Use a Bullish Engulfing Candle to Trade Entries Bybit Learn

Trading the Bullish Engulfing Candle

Bullish engulfing pattern bullish engulfing candlestick pattern

:max_bytes(150000):strip_icc()/BullishEngulfingPatternDefinition2-5f046aee5fe24520bfd4e6ad8abaeb74.png)

Bullish Engulfing Pattern Definition, Example, and What It Means

Bullish Engulfing Pattern The Ultimate Guide Daily Price Action

Bullish Engulfing Candlestick Pattern Entry And Exit YouTube

Bullish Engulfing Pattern An Important Technical Pattern

The Bullish Candlestick Appears Right.

Stock Passes All Of The Below Filters In Cash Segment:

If You Are Familiar With The Bearish “Hanging Man”, You’ll Notice That The Hammer Looks Very Similar.

The Bullish Engulfing Candlestick Acts As A Bullish Reversal 63% Of The Time, Which Is Respectable,.

Related Post: