Bullish Double Bottom Pattern

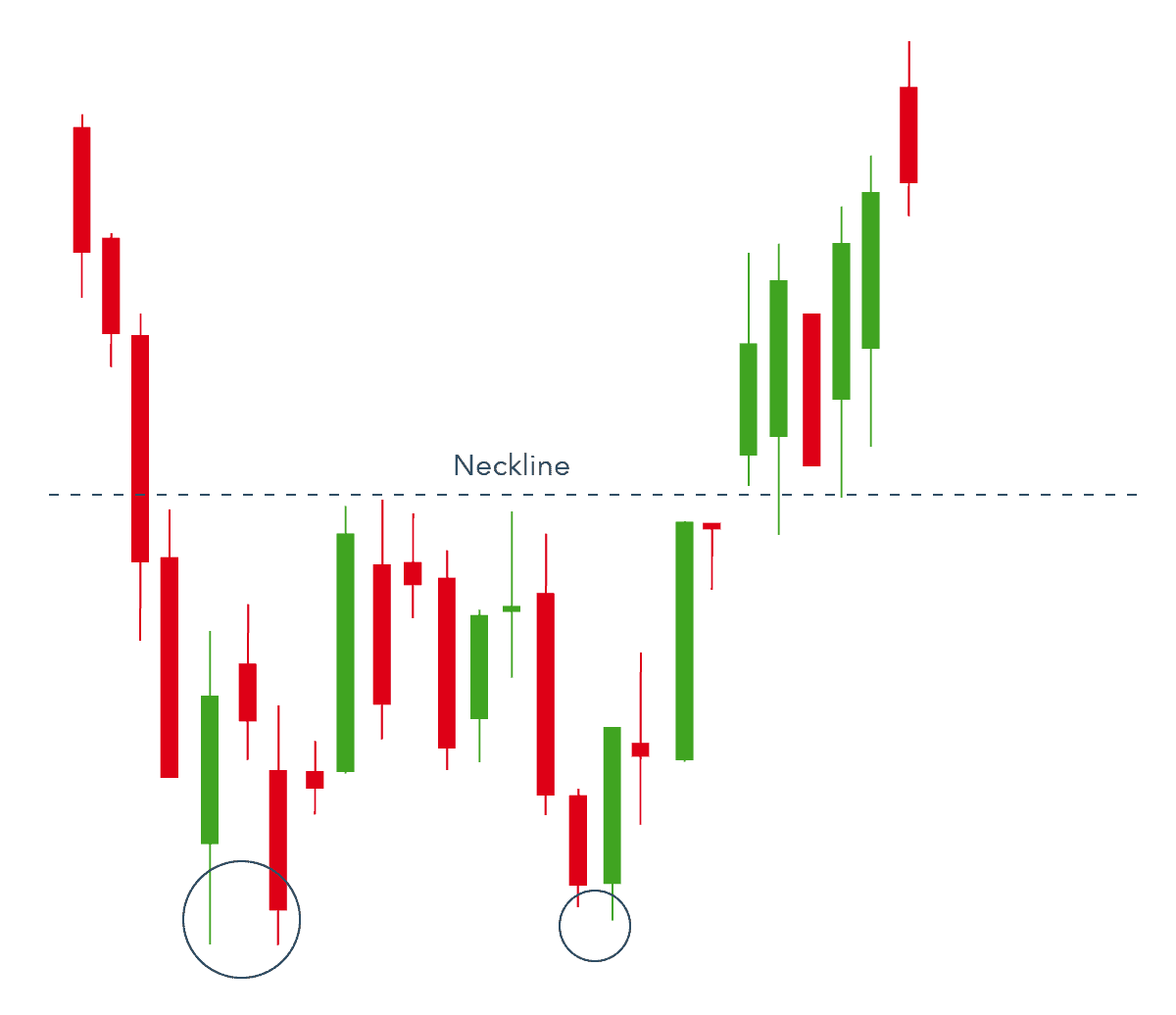

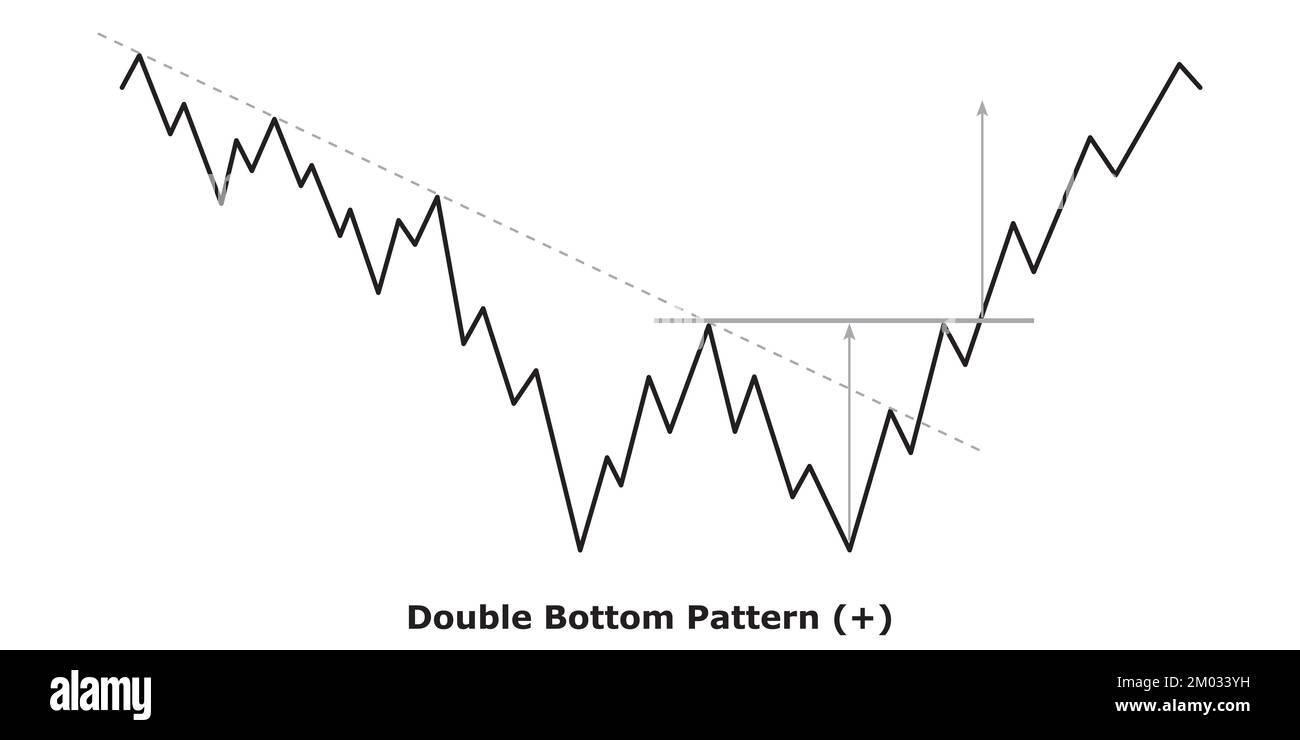

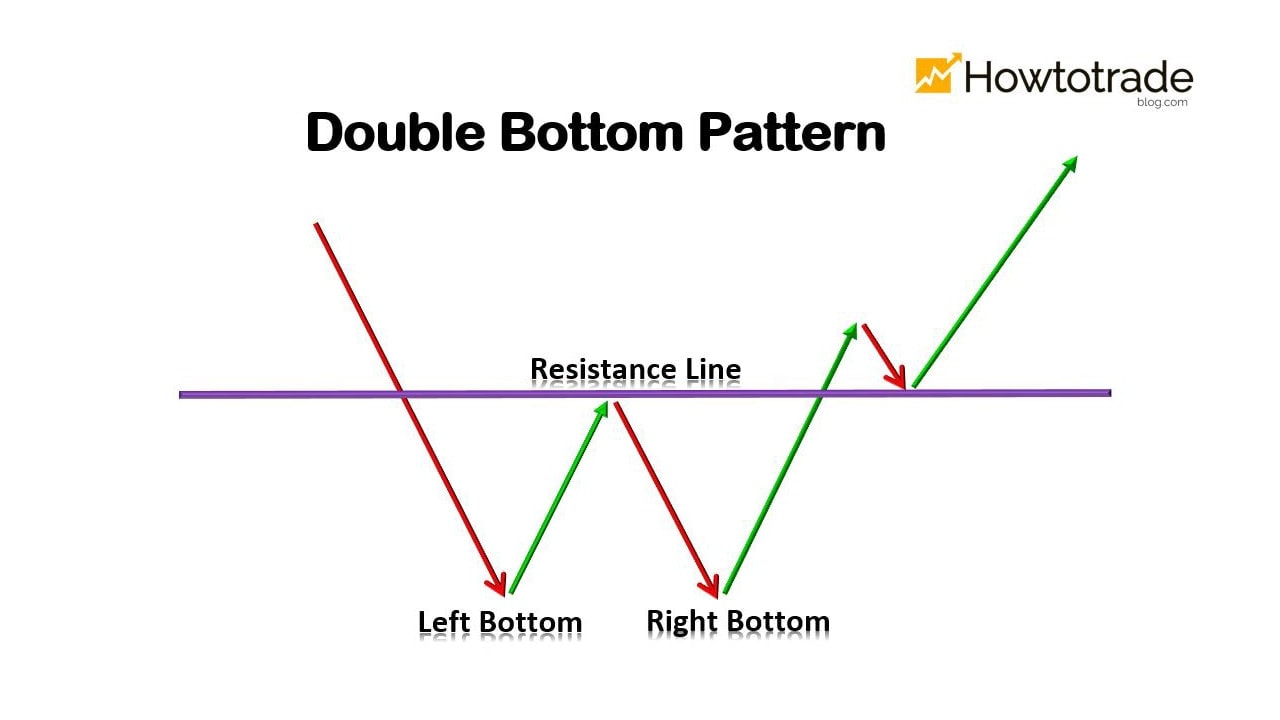

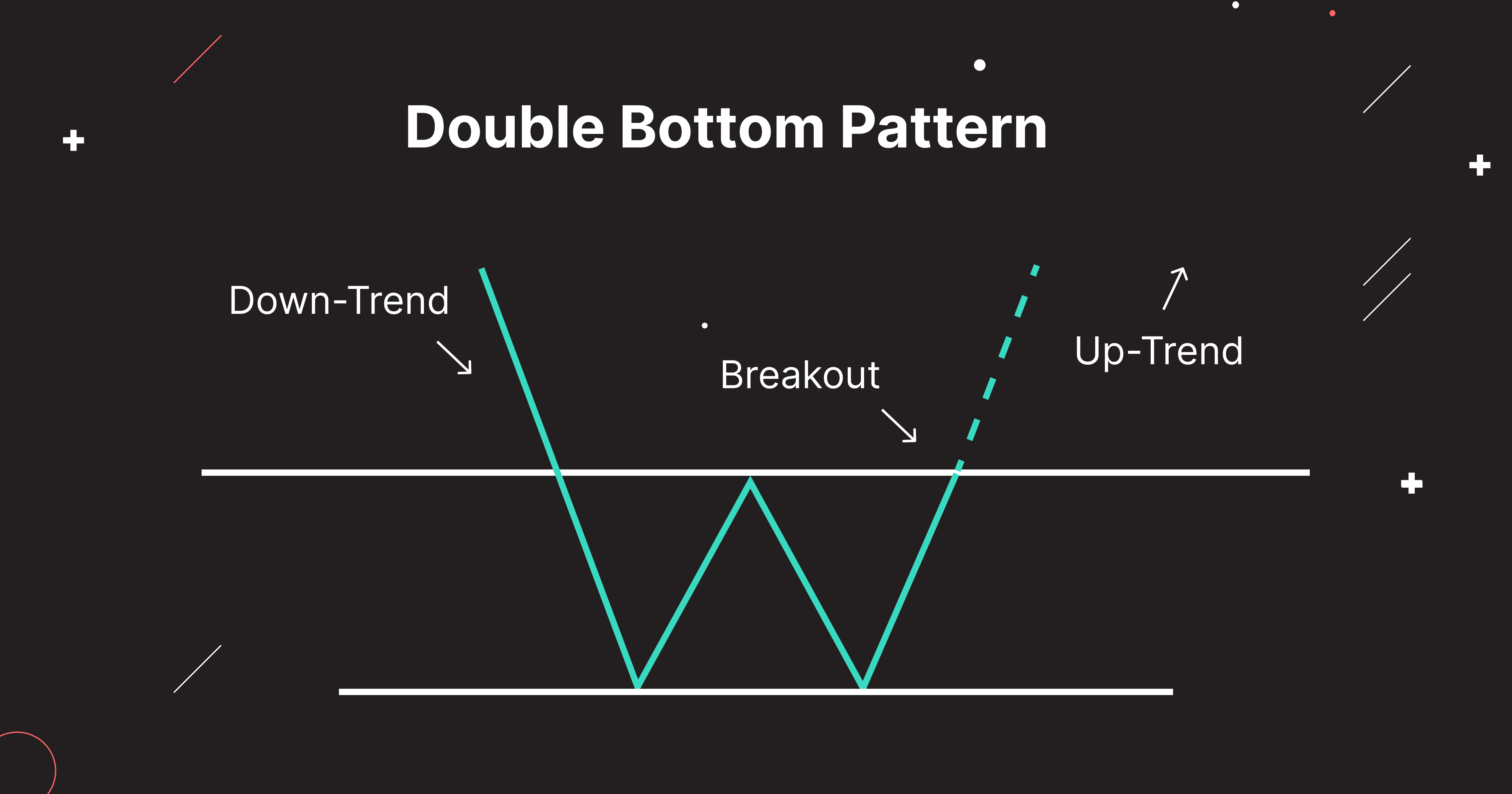

Bullish Double Bottom Pattern - Traders look to enter a long position as the price breaks above the. The most profitable chart pattern is the bullish rectangle top, with a 51% average profit. Now, a double bottom pattern is a bullish trend reversal pattern (and we call the opposite a double top ). Web the double bottom pattern is a reversal pattern that signals a bullish breakout is about to happen. As such, when you identify the pattern and the price rises above the neckline, then you buy the asset. Structural elements of the double bottom pattern. This pattern signals a possible shift from a downtrend to an uptrend, much like its less common relative, the triple bottom pattern, which consists of three consecutive troughs. After a double bottom, common trading strategies. Web research shows the most reliable and accurate bullish patterns are the cup and handle, with a 95% bullish success rate, head & shoulders (89%), double bottom (88%), and triple bottom (87%). Web a double bottom pattern is a classic technical analysis charting formation showing a major change in trend from a prior down move. Now, a double bottom pattern is a bullish trend reversal pattern (and we call the opposite a double top ). The impulse then needs to get sold into; The pattern is seen in a downtrend and may indicate the end of the downtrend, so it is considered a bullish reversal pattern. Web the double bottom pattern is a reversal pattern. Web the double bottom technical analysis charting pattern is a common and highly effective price reversal pattern. Web a double bottom pattern is a bullish pattern in technical analysis that signals a bullish reversal of a downtrend. Web double bottom technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap, dividend. It shows two distinct equal bottoms, which means support is holding. Structural elements of the double bottom pattern. As such, when you identify the pattern and the price rises above the neckline, then you buy the asset. This chart pattern occurs after an extended price decrease in financial markets and consists of two swing low troughs at approximately the same. Web a double bottom pattern is a bullish pattern in technical analysis that signals a bullish reversal of a downtrend. Price needs to establish a bearish expansion towards the lows before reversing with an impulse. Web the double bottom pattern is a bullish trend reversal pattern that occurs when two low levels are forming near a support horizontal level. Web. Traders look to enter a long position as the price breaks above the. Web the double bottom pattern is a bullish reversal pattern that occurs at the bottom of a downtrend and signals that the sellers, who were in control of the price action so far, are losing momentum. Web the double bottom technical analysis charting pattern is a common. Web the double bottom reversal is a bullish reversal pattern typically found on bar charts, line charts, and candlestick charts. Web a double bottom pattern is a bullish pattern in technical analysis that signals a bullish reversal of a downtrend. The pattern is seen in a downtrend and may indicate the end of the downtrend, so it is considered a. Web a double bottom is a bullish reversal trading pattern that consists of two market bottoms that form around the same level, which are followed by a breakout to the upside. Web double bottom technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap, dividend yield etc. The double bottom pattern. In other words, the double bottom is a bullish reversal pattern that forms in an ongoing bearish trend. Structural elements of the double bottom pattern. Traders look to enter a long position as the price breaks above the. It is characterized by two distinct troughs of approximately equal price and a breakout above the intervening reaction high. Web the double. This chart pattern occurs after an extended price decrease in financial markets and consists of two swing low troughs at approximately the same price level, separated by a temporary price bounce. After a double bottom, common trading strategies. Web a double bottom pattern is a bullish trend that hints prices have bottomed out, and a continued downtrend is about to. To create a double bottom pattern, price begins in a downtrend, stops, and then reverses trend. Web the double bottom pattern is a bullish reversal pattern that occurs at the bottom of a downtrend and signals that the sellers, who were in control of the price action so far, are losing momentum. The pattern can signal a potential entry point. Now, a double bottom pattern is a bullish trend reversal pattern (and we call the opposite a double top ). Web a double bottom pattern is a bullish reversal pattern that indicates a reversal in a downtrend. To be able to learn how to trade double bottom pattern, you must first know what it is and how it works in detail. Structural elements of the double bottom pattern. After a double bottom, common trading strategies. Web a double bottom pattern is a proven bullish signal in a bull market. Web a double bottom pattern forms when a security’s price reaches a low, bounces, revisits the same low, and then bounces again, indicating a potential trend reversal from bearish to bullish. The double bottom pattern looks like the letter w. the. Web a double bottom pattern is a bullish pattern in technical analysis that signals a bullish reversal of a downtrend. It is characterized by two distinct troughs of approximately equal price and a breakout above the intervening reaction high. Web the double bottom is a bullish reversal pattern appearing at the end of a bearish trend, signifying a potential reversal. The double bottom pattern entails two low points forming near a similar horizontal price level and signifies a potential bullish reversal signal. In other words, the double bottom is a bullish reversal pattern that forms in an ongoing bearish trend. Web the double bottom pattern is a bullish reversal pattern that occurs at the bottom of a downtrend and signals that the sellers, who were in control of the price action so far, are losing momentum. The pattern is seen in a downtrend and may indicate the end of the downtrend, so it is considered a bullish reversal pattern. The pattern can signal a potential entry point for traders to profit from the expected upward trend.

Bullish Reversal 13 Patterns To Identify a Bullish Move Value of Stocks

Bullish Chart Patterns Cheat Sheet Crypto Technical Analysis

Double Bottom Pattern (Bullish) for BINANCEBTCUSDT by Mrsf — TradingView

Binance on Twitter "A double bottom is bullish chart pattern that

Double Bottom Pattern Bullish (+) White & Black Bullish Reversal

/https://blogs-images.forbes.com/adamsarhan/files/2016/02/SPX-Double-Bottom-1200x637.jpg)

A Bullish Double Bottom Pattern Forming On Wall Street

What Is A Double Bottom Pattern? How To Use It Effectively How To

Double Bottom Bullish Reversal Chart Pattern

A double bottom represents a bullish chart pattern that is shaped in a

TOP 5 Bullish Patterns For Crypto Trading

Web Research Shows The Most Reliable And Accurate Bullish Patterns Are The Cup And Handle, With A 95% Bullish Success Rate, Head & Shoulders (89%), Double Bottom (88%), And Triple Bottom (87%).

The Most Profitable Chart Pattern Is The Bullish Rectangle Top, With A 51% Average Profit.

It Signals With An 88 Percent Accuracy That The Current Downward Trend May Be Coming To An End And Could Reverse Into An Upward Trend Soon.

It Shows Two Distinct Equal Bottoms, Which Means Support Is Holding.

Related Post: