Bullish Continuation Pattern

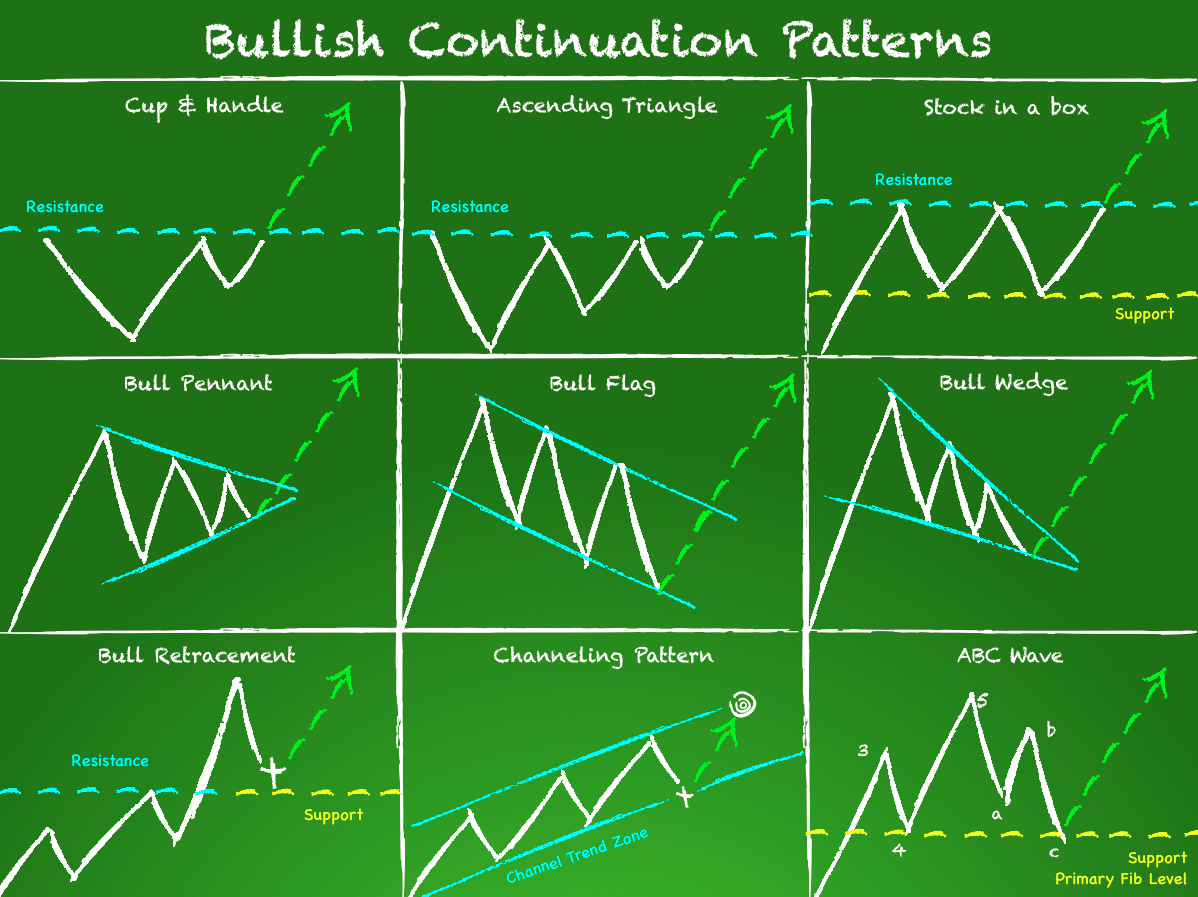

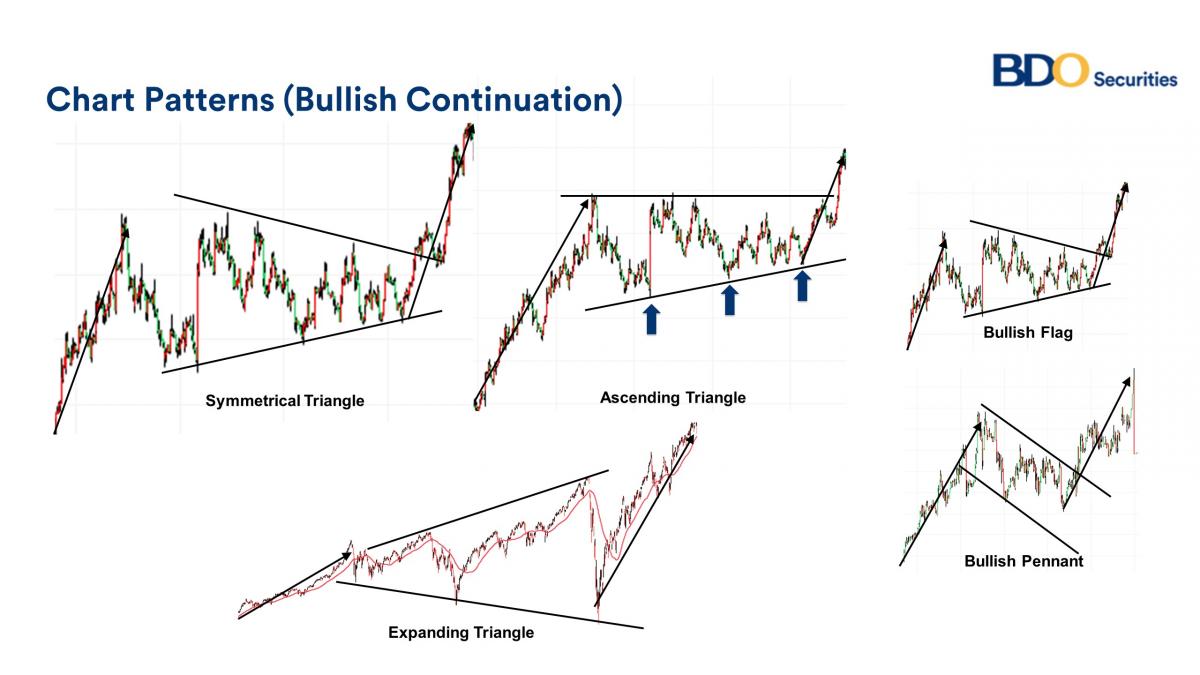

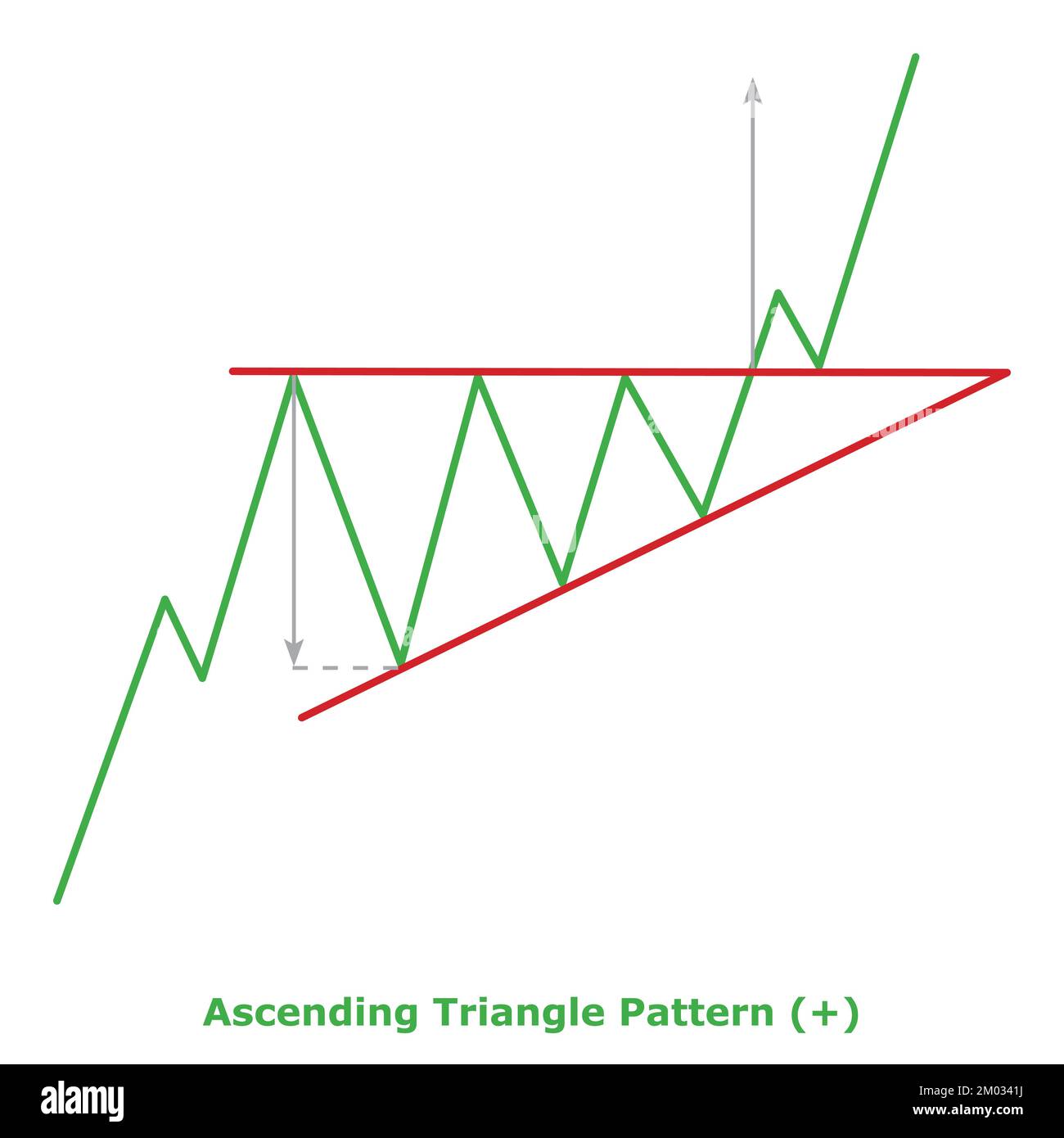

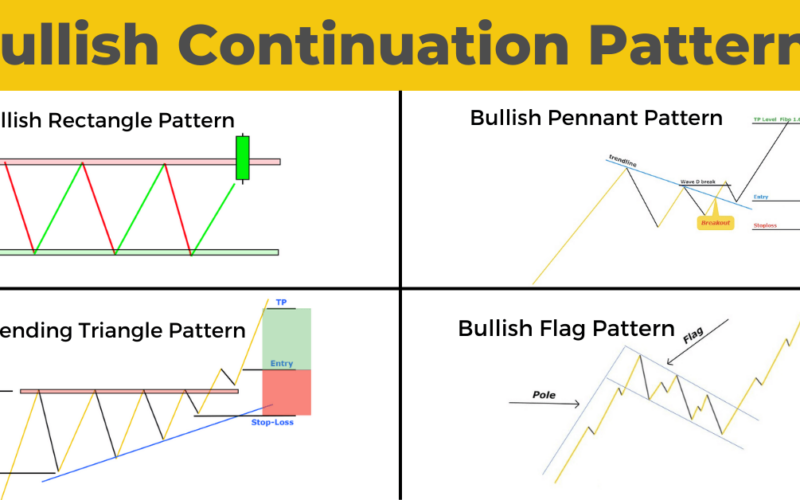

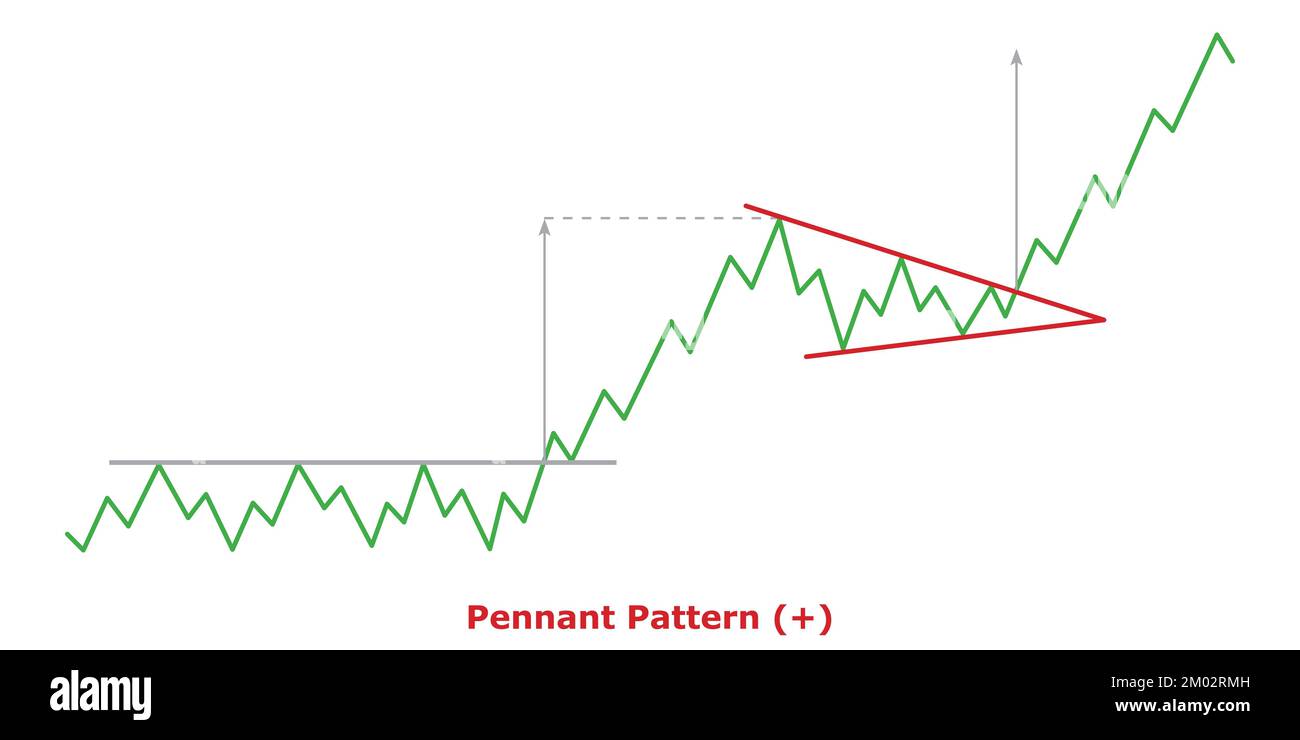

Bullish Continuation Pattern - Bullish flag is also called as a pole and flag pattern. Web a bullish pennant pattern is a continuation chart pattern that appears after a security experiences a large, sudden upward movement. Web rising three methods is a bullish continuation candlestick pattern that occurs in an uptrend and whose conclusion sees a resumption of that trend. Automatic pattern recognition with tradingview. Web continuation candlestick patterns uptrend and downtrend. Web the bullish continuation pattern occurs when the price action consolidates within a specific pattern after a strong uptrend. For example, the price of an asset might consolidate after a strong rally, as some bulls decide to take profits and others want to see if their buying interest will prevail. Web bitcoin’s price has failed to continue its upward trajectory since dropping from the $75k level. As it looks like a flag. Similar to flags, pennants are small consolidation patterns that often follow a sharp price movement. The portion between black lines. 4.2 abcd or gun pattern; Web crypto analyst ali martinez predicts bitcoin could rally to $76,610 if it breaks crucial $64,290 level. However, instead of a rectangular shape, pennants take the form of a small symmetrical triangle with converging trendlines. First, you will see a strong upward movement, which shows the buying pressure. These patterns suggest that the forex. Bearish continuation candlestick patterns form when a falling price pauses, consolidates and then continues moving lower. The portion between black lines. Web 3 advantages of using continuation patterns; First, you will see a strong upward movement, which shows the buying pressure. The decisive (fifth) strongly bullish. Follow us on google news. The 2 vertical lines before the upside tasuki gap pattern represent the range of the previous candles. Web continuation candlestick patterns uptrend and downtrend. Web bullish continuation candlestick patterns. Web pennants are continuation patterns where a period of consolidation is followed by a breakout used in technical analysis. 7 how do you trade continuation patterns? Web continuation patterns are price patterns that show a temporary interruption of an existing trend. These patterns suggest that the forex. Web 3 advantages of using continuation patterns; Continuations tend to resolve in the same direction as the prevailing trend: The continuation of a trend is secured once the price action breaks out of the consolidation phase in an explosive breakout in the same direction as the prevailing trend. 4.2 abcd or gun pattern; Automatic pattern recognition with tradingview. Web a bullish continuation pattern is a pattern that. Bearish continuation candlestick patterns form when a falling price pauses, consolidates and then continues moving lower. Follow us on google news. Web pennants are continuation patterns where a period of consolidation is followed by a breakout used in technical analysis. First, you will see a strong upward movement, which shows the buying pressure. Web the bullish continuation pattern occurs when. 4.2 abcd or gun pattern; Japanese candlestick continuation patterns are displayed below from strongest to weakest. Here’s a table of the characteristics and significance of the upside tasuki gap bullish continuation candlestick pattern. However, instead of a rectangular shape, pennants take the form of a small symmetrical triangle with converging trendlines. Web in early 2023, tesla’s bullish pennant pattern presents. It's important to look at the volume in a pennant—the period of. Web bitcoin’s price has failed to continue its upward trajectory since dropping from the $75k level. Follow us on google news. A bullish candle forms after a gap up from the previous white candle. These patterns suggest that the forex. However, instead of a rectangular shape, pennants take the form of a small symmetrical triangle with converging trendlines. It develops during a period of brief consolidation,. The you will see, stock will trade sideways for some time. Web #1 upside tasuki gap. Is when the price reaches the same horizontal support and resistance levels multiple times. The 2 vertical lines before the upside tasuki gap pattern represent the range of the previous candles. 7 how do you trade continuation patterns? Web bitcoin’s price has failed to continue its upward trajectory since dropping from the $75k level. Scanning for bullish chart patterns. Bullish flag is also called as a pole and flag pattern. Analysts identify a bullish falling wedge pattern on bitcoin's daily chart, indicating bullish rally for btc ahead. Bearish continuation candlestick patterns form when a falling price pauses, consolidates and then continues moving lower. A bullish candle forms after a gap up from the previous white candle. Web the bullish continuation pattern occurs when the price action consolidates within a specific pattern after a strong uptrend. In contrast to symmetrical triangles, which have no definitive slope and no bias, falling wedges definitely slope down and have a bullish bias. Web rising three methods is a bullish continuation candlestick pattern that occurs in an uptrend and whose conclusion sees a resumption of that trend. For example, the price of an asset might consolidate after a strong rally, as some bulls decide to take profits and others want to see if their buying interest will prevail. Web bullish continuation candlestick patterns. Web 3 advantages of using continuation patterns; Scanning for bullish chart patterns. 7 how do you trade continuation patterns? Web continuation patterns are an indication traders look for to signal that a price trend is likely to remain in play. Now, a chart with any bull pattern formations will be clearly marked. Web go to tradingview and click indicators > technicals > patterns. Automatic pattern recognition with tradingview. This price action forms a cone that slopes down as the reaction highs and reaction lows converge.

Bullish Continuation Chart Patterns And How To Trade Them? Equitient

Are Chart Patterns Reliable? Tackle Trading

Top Continuation Patterns Every Trader Should Know

Top Continuation Patterns Every Trader Should Know

Continuation Patterns

Ascending Triangle Pattern Bullish (+) Small Illustration Green

Bullish Continuation Patterns Overview ForexBee

Bullish Continuation Chart Patterns And How To Trade Them? Equitient

Pennant Pattern Bullish (+) Green & Red Bullish Continuation

Flag Bullish Continuation Pattern ChartPatterns Stock Market Forex

Web A Bullish Continuation Pattern Is A Pattern That Signals The Upward Trend Will Continue In A Bullish Direction After A Price Breakout And A Bearish Continuation Pattern Is A Pattern That Signals The Downward Trend Will Continue In A Bearish Direction After A Price Breakdown.

Technical Analysis By Tradingrage The Daily Chart On The Daily Chart, The Btc Price Has Been Trapped Inside A Large Descending Channel Pattern, Making Lower Hig…

Web Bitcoin’s Price Has Failed To Continue Its Upward Trajectory Since Dropping From The $75K Level.

Web The Falling Wedge Is A Bullish Pattern That Begins Wide At The Top And Contracts As Prices Move Lower.

Related Post: