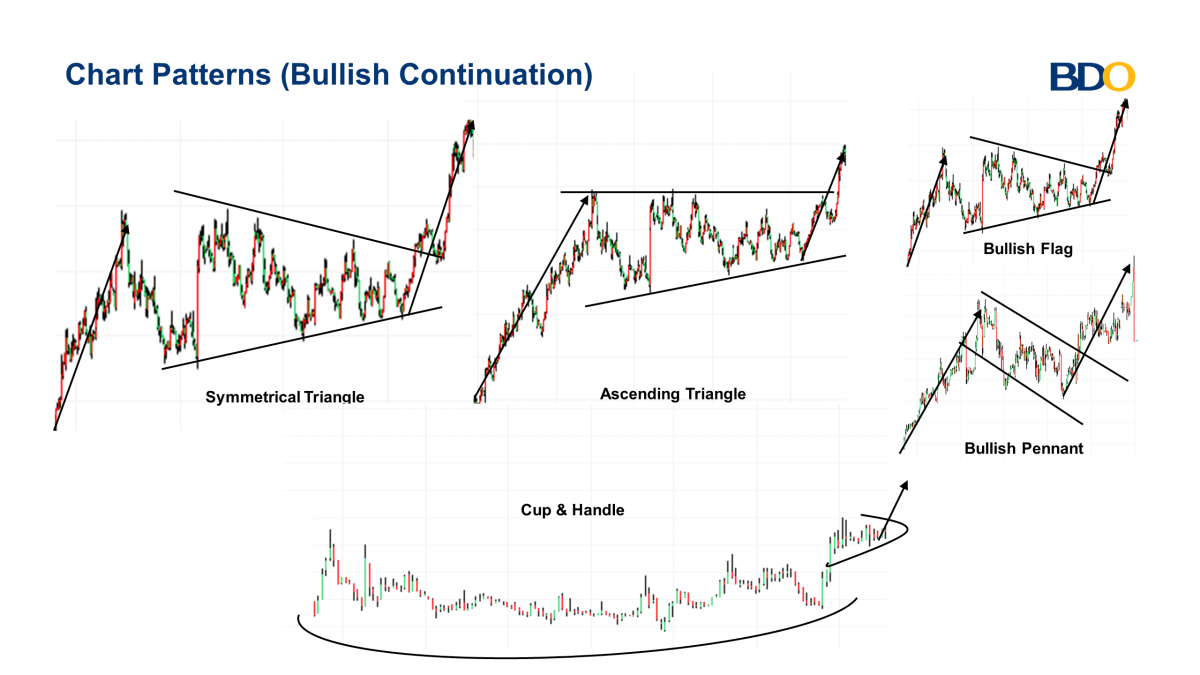

Bullish Consolidation Pattern

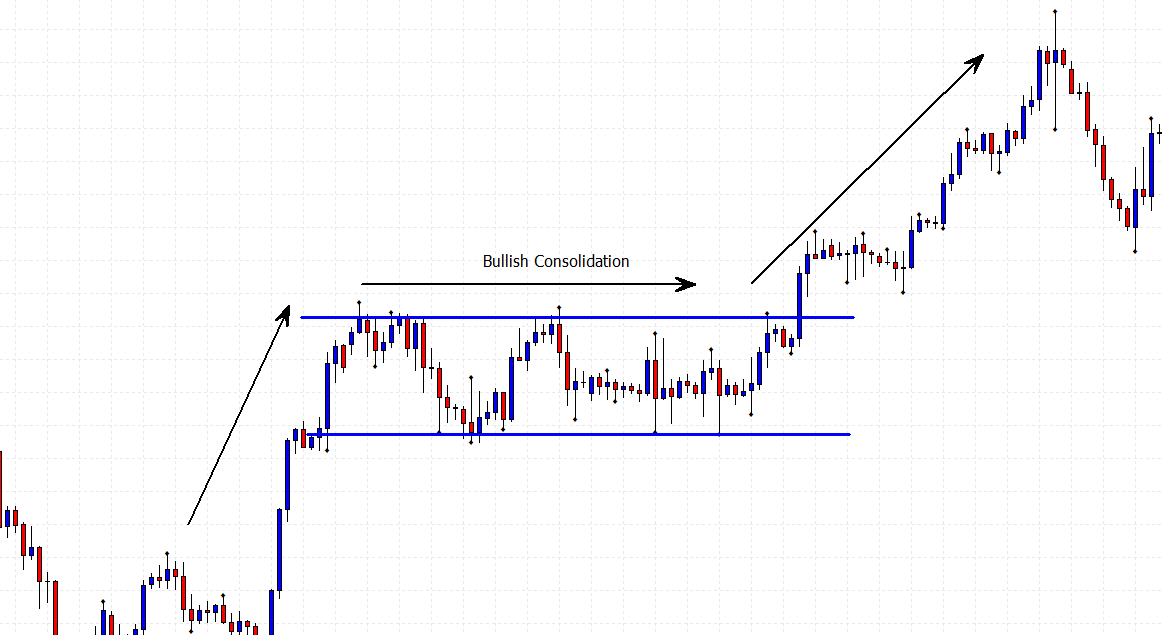

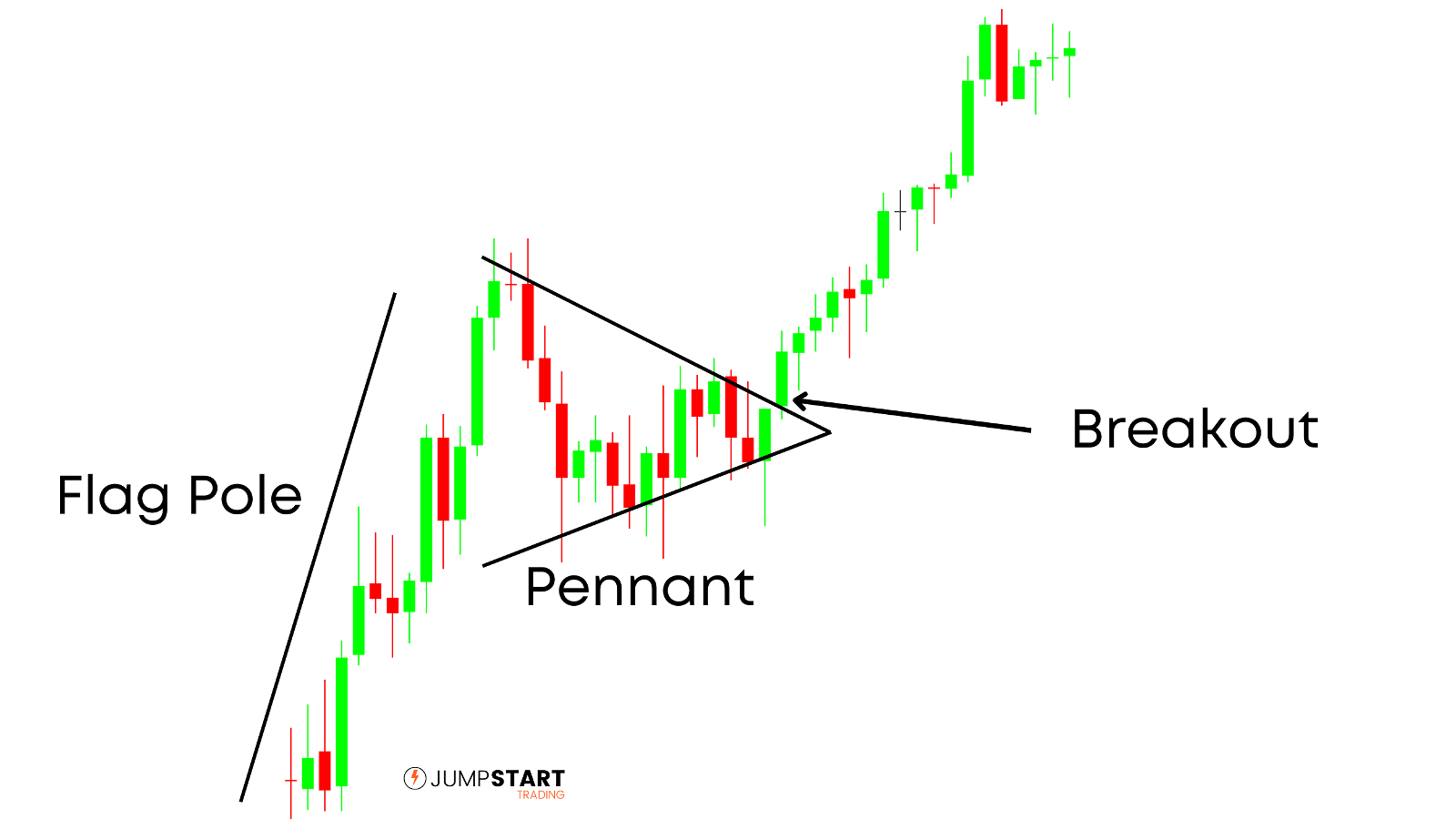

Bullish Consolidation Pattern - Web the bullish continuation pattern occurs when the price action consolidates within a specific pattern after a strong uptrend. The breakout is confirmed by the price closing above the upper resistance level. Web what is a bullish reversal candlestick pattern? There are dozens of bullish reversal candlestick patterns. Featured image from defense.gov, chart from tradingview The continuation of a trend is secured once the price action breaks out of the consolidation phase in an explosive breakout in the same direction as the prevailing trend. Bitcoin has been pulling back this week following a test of. Web despite the current consolidation within this pattern, the analyst remains optimistic about the potential for a breakout. This pattern suggests that buyers are more aggressive than sellers and that the price is likely to break out to the upside. Web for a bullish breakout, once the height of the pattern has been established, add the difference to the breakout level. Web go to tradingview and click indicators > technicals > patterns. The upward trend must resume after the flag has finished its consolidation phase to be regarded as a bullish flag pattern. This price movement can be viewed as the market becoming “more volatile” with its price range expanding prior to a breakout occurring. Web opposite its symmetrical triangle counterpart,. Web the bull flag consolidation must contain a sequence of lower highs and lower lows. Web the bullish continuation pattern occurs when the price action consolidates within a specific pattern after a strong uptrend. If this isn’t fulfilled, the pattern fails. Web bitcoin's recent price action shows consolidation within a bull wedge pattern, with two trend lines to watch for. The opening price, the closing price, and the high and low of the day. Web bitcoin's recent price action shows consolidation within a bull wedge pattern, with two trend lines to watch for a potential breakout. This pattern is characterized by its upward movements. It's important to look at the volume in a pennant—the period of. 🟢 rising three rising. Bullish flag formations are found in stocks with strong uptrends and are considered good continuation patterns. Then, you need to draw support and resistance trend lines at the top and bottom of the price range. The continuation of a trend is secured once the price action breaks out of the consolidation phase in an explosive breakout in the same direction. Scanning for bullish chart patterns. Web written by tim bohen. The hammer or the inverted hammer. This price movement can be viewed as the market becoming “more volatile” with its price range expanding prior to a breakout occurring. Web bullish continuation patterns appear midway through an uptrend and are easily identifiable. Identifying consolidating stocks involves looking for those that have steady support and resistance levels, trade in a narrow. Web despite the current consolidation within this pattern, the analyst remains optimistic about the potential for a breakout. The hammer is a bullish reversal pattern, which signals that a. Web the bull flag consolidation must contain a sequence of lower highs and. The breakout is confirmed by the price closing above the upper resistance level. The bullish sentiment surrounding shib comes amidst a broader rally in. Web the consolidation has settled gamestop into both a bull flag pattern and a quadruple inside bar pattern above an important support zone near the $15.20 mark, where there’s confluence with the. The upward trend must. The breakout from this consolidation typically occurs to. Bullish flag formations are found in stocks with strong uptrends and are considered good continuation patterns. This pattern suggests that buyers are more aggressive than sellers and that the price is likely to break out to the upside. This price movement can be viewed as the market becoming “more volatile” with its. This pattern is characterized by its upward movements. In addition, the color of the candlestick body tells if the opening or closing price is higher. There are dozens of bullish reversal candlestick patterns. Since the breakout level is $47.50 and the height 10 points, the minimum. The breakout from this consolidation typically occurs to. It typically occurs when the market is. The presence of higher lows and higher highs throughout the past few weeks indicates a healthy uptrend, with the current pullback seen as a natural consolidation phase. The hammer or the inverted hammer. Stocks under consolidation trade in a limited range. Web it is used as a bullish pattern in technical analysis by. This pattern suggests that buyers are more aggressive than sellers and that the price is likely to break out to the upside. Web pennants are continuation patterns where a period of consolidation is followed by a breakout used in technical analysis. The continuation of a trend is secured once the price action breaks out of the consolidation phase in an explosive breakout in the same direction as the prevailing trend. The opening price, the closing price, and the high and low of the day. Web we will focus on five bullish candlestick patterns that give the strongest reversal signal. It typically occurs when the market is. If this isn’t fulfilled, the pattern fails. Web bullish continuation patterns appear midway through an uptrend and are easily identifiable. Web the bullish continuation pattern occurs when the price action consolidates within a specific pattern after a strong uptrend. Bitcoin has been pulling back this week following a test of. Further, the candlesticks chart showing an upward. Web the consolidation pattern in forex is a chart pattern defined by sideways price movements within a range before a breakout in a new direction. Web go to tradingview and click indicators > technicals > patterns. Web the consolidation has settled gamestop into both a bull flag pattern and a quadruple inside bar pattern above an important support zone near the $15.20 mark, where there’s confluence with the. It's important to look at the volume in a pennant—the period of. Since the breakout level is $47.50 and the height 10 points, the minimum.

Mempelajari Jenis Bullish Continuation Pattern dan Cara Membacanya

Bullish Pennant Patterns A Complete Guide

Bullish Pennant Patterns A Complete Guide

Bull Flag Pattern Explained How to Identify and Trade this Bullish

Bullish Consolidation 123Breakout Pattern for POLONIEXBTCUSDT by

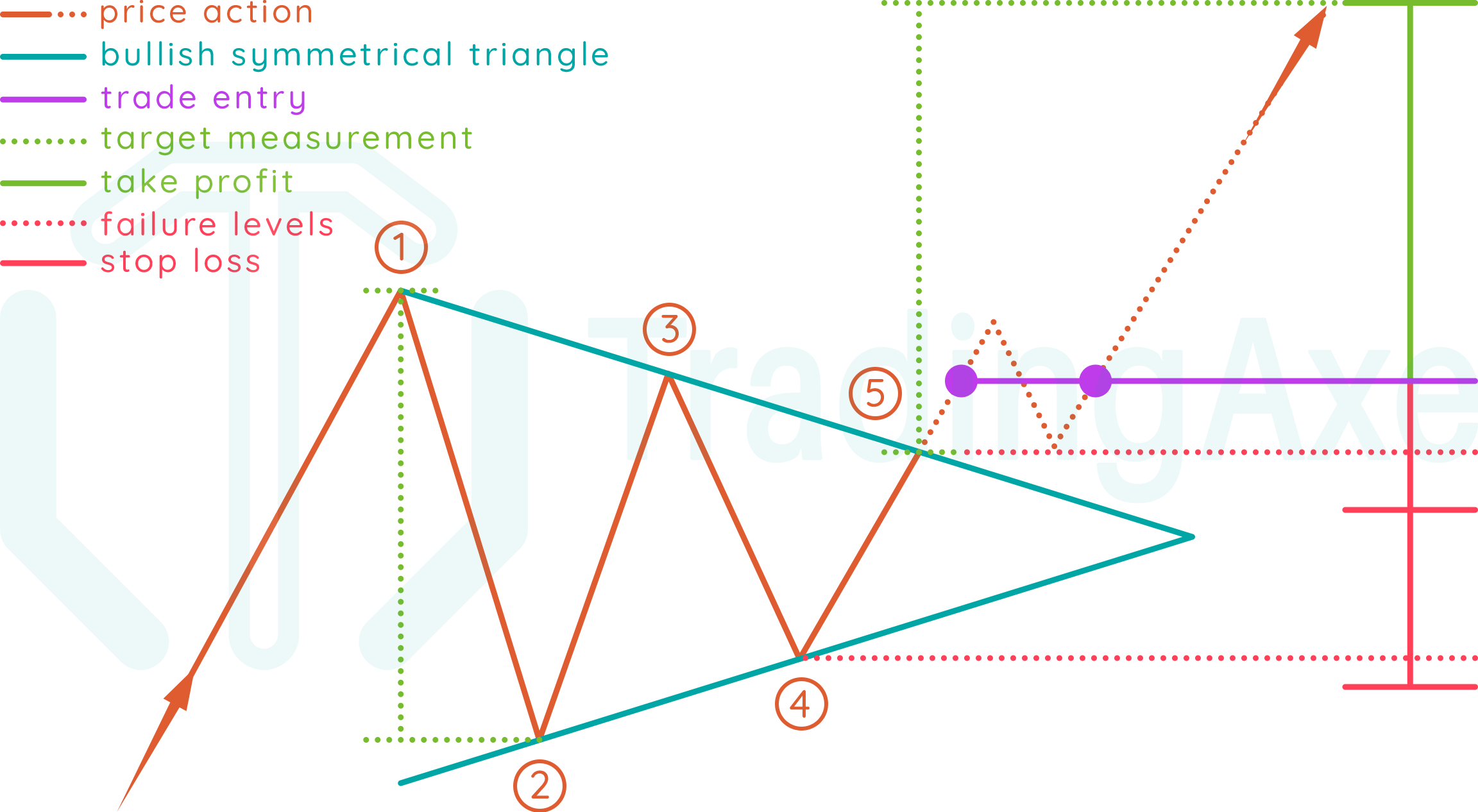

How To Trade Bullish Symmetrical Triangle Chart Pattern TradingAxe

How To Catch High Profiting Moves With Continuation Price Patterns

How to Use the Bullish Rectangle Chart Pattern Market Pulse

How To Catch High Profiting Moves With Continuation Price Patterns

Day Trading Patterns A Complete Guide (with Examples!)

This Can Be Contrasted With A Falling Three Method.

In Addition, The Color Of The Candlestick Body Tells If The Opening Or Closing Price Is Higher.

Web 📈 4 Common Bullish Patterns.

A Legitimate Breakout Occurs When Price Action Breaks Through The Upper Level Of Resistance.

Related Post: