Bullish Candlestick Patterns

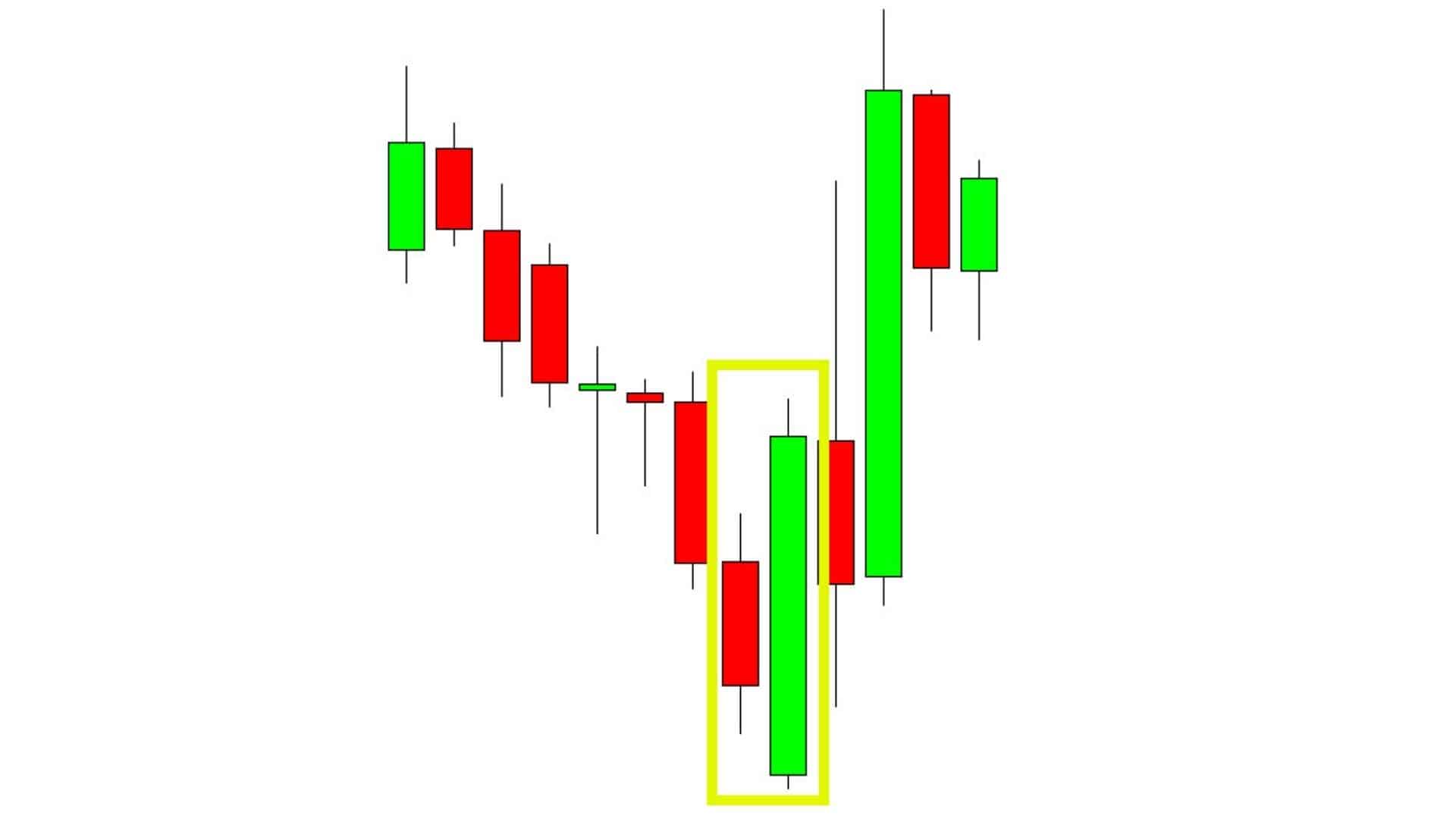

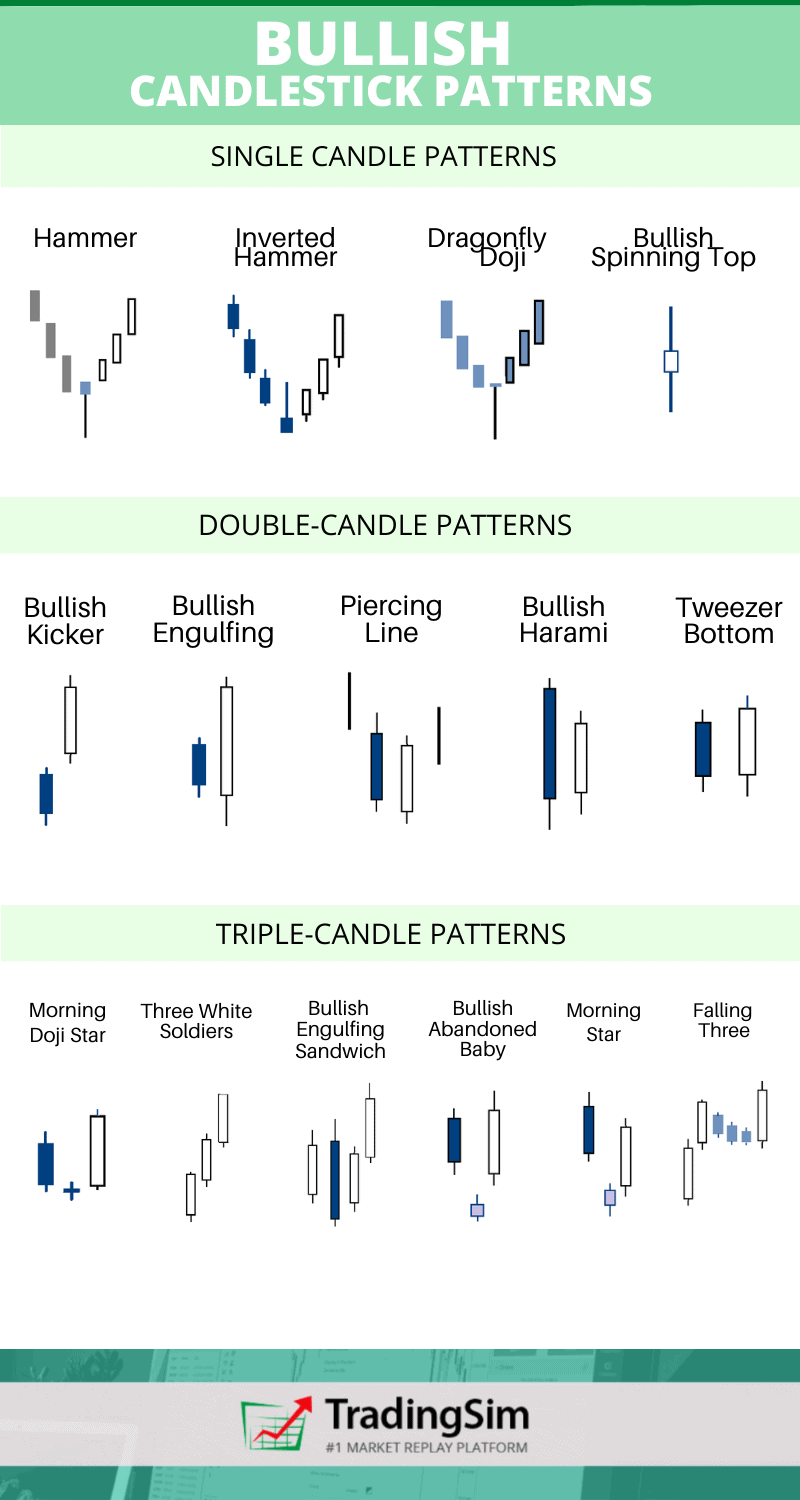

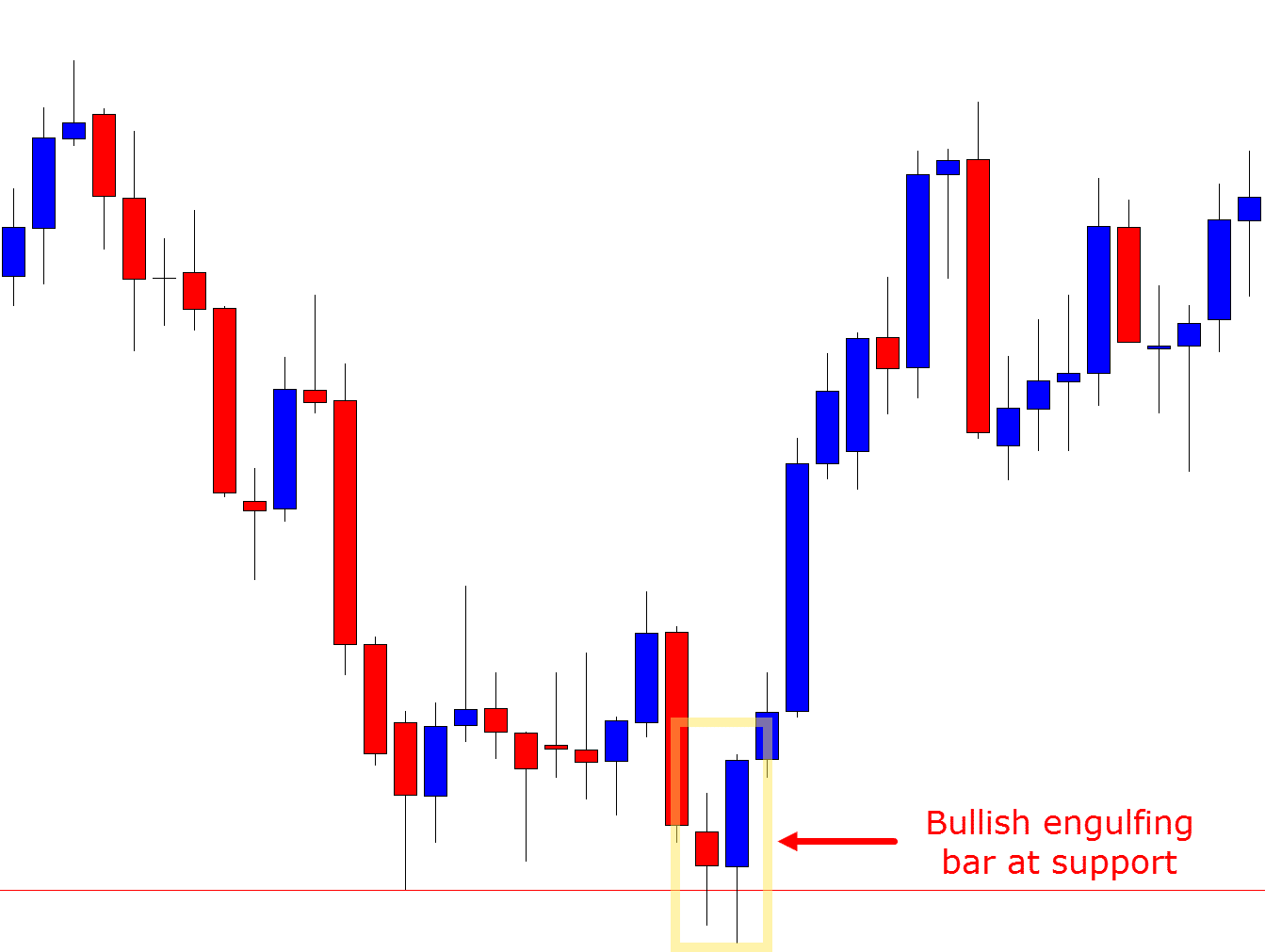

Bullish Candlestick Patterns - The hammer or the inverted hammer. Web we will focus on five bullish candlestick patterns that give the strongest reversal signal. This shows the presence of sellers in the market. Web six bullish candlestick patterns. We already learnt how to identify the. Followed by a larger green candle that completely engulfs the body of the first candle, showing buyers have overwhelmed sellers. But as the saying goes, context is everything. Web bullish engulfing candlestick. Much like the hanging man, the hammer is a bullish candlestick reversal candle. Identify the bullish candlestick pattern. The hammer candlestick pattern is formed of a short body with a long lower wick, and is found at the. Web six bullish candlestick patterns. We already learnt how to identify the. Bullish patterns may form after a market downtrend, and signal a reversal of price movement. Much like the hanging man, the hammer is a bullish candlestick reversal candle. If you are familiar with the bearish “hanging man”, you’ll notice that the hammer looks very similar. The hammer is a bullish reversal pattern, which signals that a. They are an indicator for traders to consider opening a long position to profit from any upward trajectory. This shows the presence of sellers in the market. Identify the bullish candlestick pattern. If you are familiar with the bearish “hanging man”, you’ll notice that the hammer looks very similar. But as the saying goes, context is everything. Web bullish engulfing candlestick. They are an indicator for traders to consider opening a long position to profit from any upward trajectory. We already learnt how to identify the. Web using bullish candlestick patterns in trading involves identifying these patterns on the price chart and then using them to make such trading decisions that help maximise the returns. Web this candlestick closes above the middle of the first long black body and indicates buyer intention to push prices higher. Here are the steps to use bullish candlestick pattern in. Web bullish engulfing candlestick. Web using bullish candlestick patterns in trading involves identifying these patterns on the price chart and then using them to make such trading decisions that help maximise the returns. Bullish patterns may form after a market downtrend, and signal a reversal of price movement. Followed by a larger green candle that completely engulfs the body of. The hammer candlestick pattern is formed of a short body with a long lower wick, and is found at the. Bullish patterns may form after a market downtrend, and signal a reversal of price movement. The hammer or the inverted hammer. They are an indicator for traders to consider opening a long position to profit from any upward trajectory. Much. Web using bullish candlestick patterns in trading involves identifying these patterns on the price chart and then using them to make such trading decisions that help maximise the returns. Here are the steps to use bullish candlestick pattern in trading: Web bullish engulfing candlestick. We already learnt how to identify the. But as the saying goes, context is everything. Here are the steps to use bullish candlestick pattern in trading: Web bullish engulfing candlestick. The hammer candlestick pattern is formed of a short body with a long lower wick, and is found at the. But as the saying goes, context is everything. The context is a steady or oversold downtrend. This shows the presence of sellers in the market. The hammer or the inverted hammer. Web bullish engulfing candlestick. It begins with one short red candle. Identify the bullish candlestick pattern. It begins with one short red candle. Web this candlestick closes above the middle of the first long black body and indicates buyer intention to push prices higher. Here are the steps to use bullish candlestick pattern in trading: Followed by a larger green candle that completely engulfs the body of the first candle, showing buyers have overwhelmed sellers. This. Much like the hanging man, the hammer is a bullish candlestick reversal candle. Bullish patterns may form after a market downtrend, and signal a reversal of price movement. The hammer or the inverted hammer. The hammer is a bullish reversal pattern, which signals that a. We already learnt how to identify the. Web this candlestick closes above the middle of the first long black body and indicates buyer intention to push prices higher. Web bullish engulfing candlestick. The context is a steady or oversold downtrend. The hammer candlestick pattern is formed of a short body with a long lower wick, and is found at the. Here are the steps to use bullish candlestick pattern in trading: Web six bullish candlestick patterns. It begins with one short red candle. Web we will focus on five bullish candlestick patterns that give the strongest reversal signal. They are an indicator for traders to consider opening a long position to profit from any upward trajectory. This shows the presence of sellers in the market. But as the saying goes, context is everything.

"Bullish Candlestick Patterns" Poster for Sale by qwotsterpro Bullish

Bullish Candlestick Patterns PDF Guide Free Download

:max_bytes(150000):strip_icc()/UsingBullishCandlestickPatternsToBuyStocks1-ac08e48665894dbfa263e247e53ba04e.png)

Using Bullish Candlestick Patterns To Buy Stocks

Candlestick Patterns The Definitive Guide (2021)

6 Reliable Bullish Candlestick Pattern TradingSim

Candlestick Patterns The Definitive Guide (2021)

Bullish Candlestick Patterns Free PDF Download Advanced Forex

Bullish candlestick patterns📚 . Technical analysis Don’t to

Bullish Candlestick Chart Patterns

What are Bullish Candlestick Patterns?

If You Are Familiar With The Bearish “Hanging Man”, You’ll Notice That The Hammer Looks Very Similar.

Followed By A Larger Green Candle That Completely Engulfs The Body Of The First Candle, Showing Buyers Have Overwhelmed Sellers.

Identify The Bullish Candlestick Pattern.

Web Using Bullish Candlestick Patterns In Trading Involves Identifying These Patterns On The Price Chart And Then Using Them To Make Such Trading Decisions That Help Maximise The Returns.

Related Post: