Bull Flag Pattern In Chart

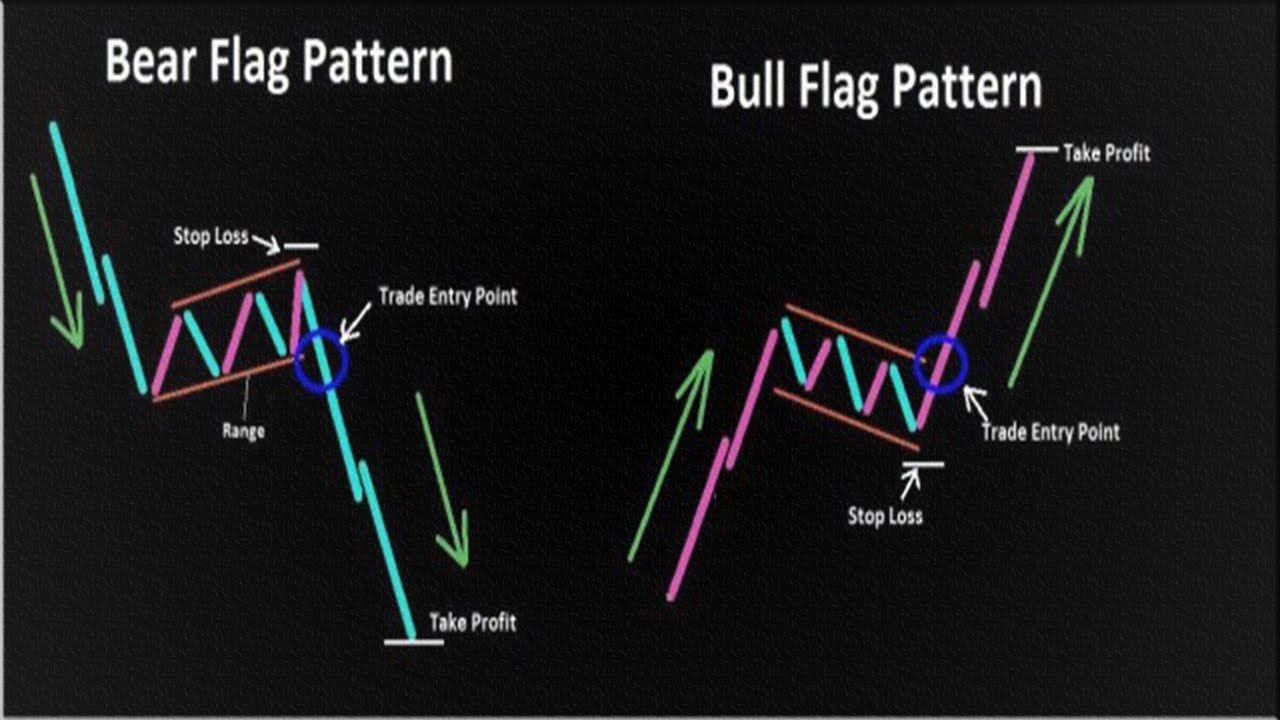

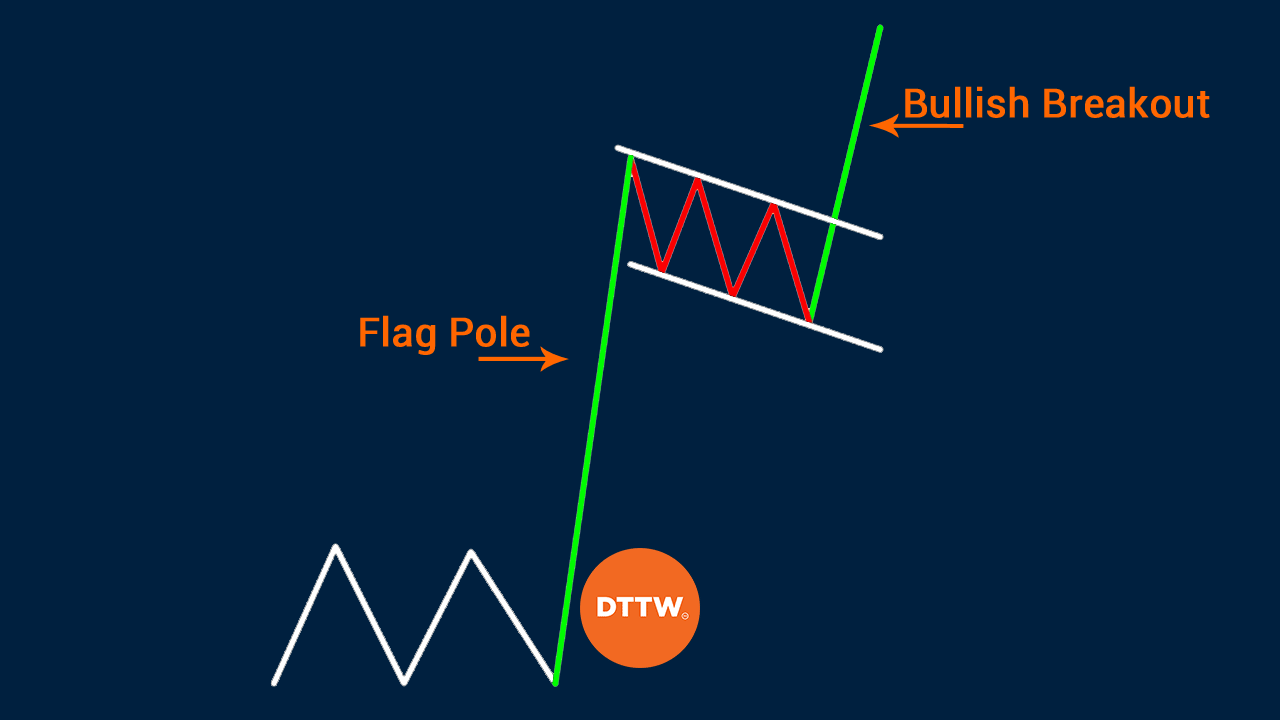

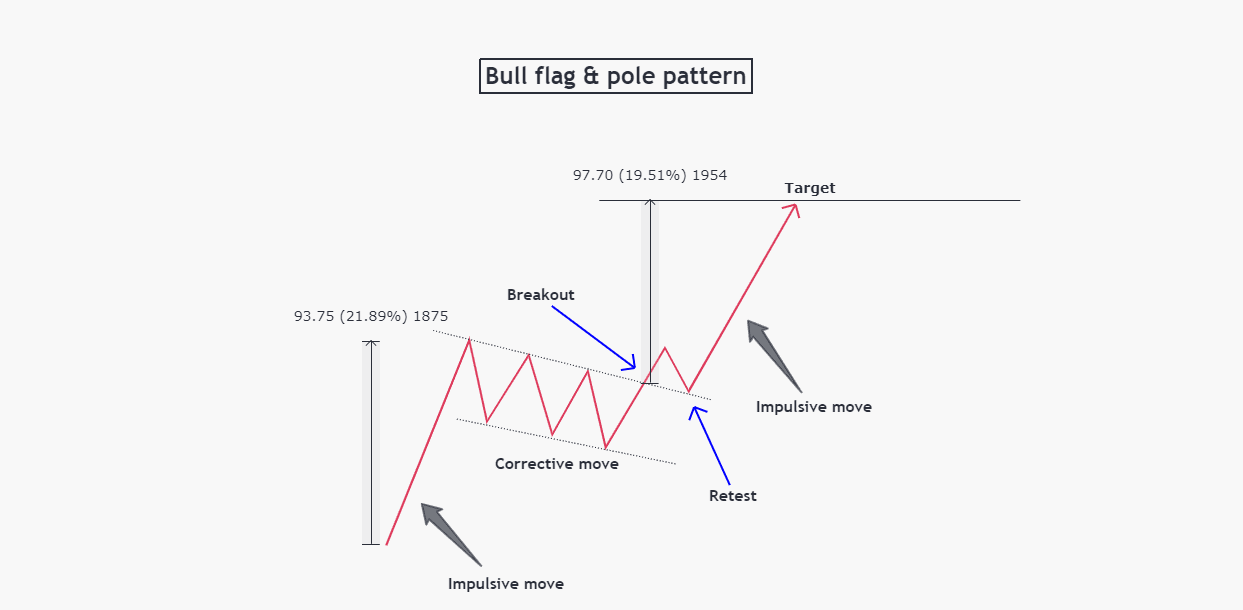

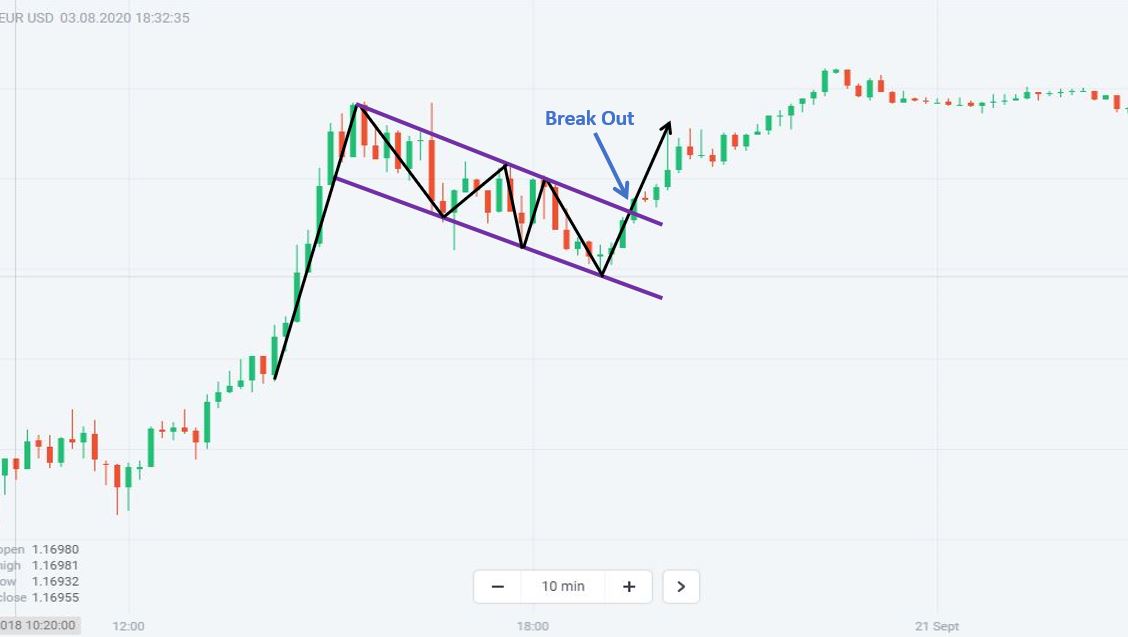

Bull Flag Pattern In Chart - However, most guides out there teach you how to spot them and not how to trade them. Bull flags are known as a bullish continuation pattern. It’s simple, and it’s effective. The flagpole and the flag. Web the bull flag pattern is a popular chart pattern used in technical analysis to identify a potential continuation of a bullish trend. Web spotting the bull flag on the chart. Web bull flag and bear flag chart patterns explained. Web the bull flag has a rectangular shape or a slight downward slope during the consolidation phase, while the bull pennant forms a triangular shape with converging trendlines. This post is written by jet toyco, a trader and trading coach. What does bullish flag tell traders. Web bull flag and bear flag chart patterns explained. This consolidation phase resembles a flag on a flagpole, hence the name “bull flag.” identifying characteristics of a bull flag include. This post is written by jet toyco, a trader and trading coach. Bull flags are the opposite of bear flags, which form amid a concerted downtrend. Both patterns suggest a. What's the importance of a bull flag pattern in technical analysis? Web a bull flag pattern means the market price of a financial market is in a bullish trend and the market chart is indicating further price increases after a price breakout from the flag's resistance line. The bull flag pattern is probably one of the first chart patterns you’ve. The bull flag pattern is one of the most common patterns on charts. Web what is a bull flag chart pattern? Bull and bear flags are popular price patterns recognised in technical analysis, which traders often use to identify trend continuations. What does bullish flag tell traders. Web bull flags are one of the most well known & easily recognized. Candlesticks are a way to gauge the way traders feel about a stock. The bull flag formation is a technical analysis pattern that resembles a flag. Web spotting the bull flag on the chart. Both patterns suggest a temporary pause in the upward movement, but the specific formation distinguishes them from each other. Bull flags are the opposite of bear. In this article we look at how to trade these opportunities. Web the bull flag has a rectangular shape or a slight downward slope during the consolidation phase, while the bull pennant forms a triangular shape with converging trendlines. Web the bull flag chart pattern is a continuation chart pattern that resembles a flag in a pole and emerges when. The flagpole and the flag. The pattern occurs in an uptrend wherein a stock pauses for a time, pulls back to some degree, and then resumes the uptrend. This pattern is easily recognizable by its initial sharp rise in prices, forming the ‘flagpole,’ followed by a more moderate downward or sideways price movement, creating the ‘flag’ itself. Trading the bull. Web a bull flag is a bullish stock chart pattern that resembles a flag, visually. The flagpole and the flag. Web what is a bull flag chart pattern? Bull flags are known as a bullish continuation pattern. The price action consolidates within the two parallel trend lines in the opposite direction of the uptrend, before breaking out and continuing the. There should be a straight run upwards leading up to. Bull flags are the opposite of bear flags, which form amid a concerted downtrend. Web bull flag patterns are a common pattern found in charts. The most important factor in identifying any flag pattern is the clear staff or flagpole; Understand the bull flag pattern. Web the bull flag has a rectangular shape or a slight downward slope during the consolidation phase, while the bull pennant forms a triangular shape with converging trendlines. Candlesticks are a way to gauge the way traders feel about a stock. There should be a straight run upwards leading up to. The bull flag pattern is probably one of the. Web a bull flag is a bullish continuation pattern characterized by a strong upward move in price, followed by a period of consolidation or sideways movement. The bull flag pattern is one of the most common patterns on charts. The bull flag pattern is probably one of the first chart patterns you’ve learned. Understand the bull flag pattern. It is. Web the bull flag pattern is a continuation chart pattern that facilitates an extension of the uptrend. Shaun murison | analyst, johannesburg. Bull and bear flags are popular price patterns recognised in technical analysis, which traders often use to identify trend continuations. Trading this pattern helps professional traders identify price trends with ease, and pick up substantial price swings in a short time. Both patterns suggest a temporary pause in the upward movement, but the specific formation distinguishes them from each other. He also recaps earnings movers, including dis, shop, and more. Trading the bull flag pattern. Web bull flag patterns are a common pattern found in charts. Web the bull flag chart pattern is a continuation chart pattern that resembles a flag in a pole and emerges when a trade experiences a significant price rise. Web the bull flag pattern is a popular chart pattern used in technical analysis to identify a potential continuation of a bullish trend. Web in the bull flag pattern, the flag portion of the chart may exhibit a 'w' pattern within the flag, distinguishing it from a 'm' pattern, which could signal a more negative double top rather than. Web a bull flag pattern means the market price of a financial market is in a bullish trend and the market chart is indicating further price increases after a price breakout from the flag's resistance line. The most important factor in identifying any flag pattern is the clear staff or flagpole; In this article we look at how to trade these opportunities. It signals that the prevailing vertical trend may be in the process of extending its range. A bull flag must have orderly characteristics to be considered a bull flag.

Bull Flag Chart Patterns ThinkMarkets

How to Trade Bearish Flag and the Bullish Flag Chart Patterns Forex

Bull Flag Chart Patterns The Complete Guide for Traders

What is Bull Flag Pattern & How to Identify Points to Enter Trade DTTW™

Bullish flag chart pattern Basic characteristics & 3 examples

Bull Flag Chart Pattern & Trading Strategies Warrior Trading

What Is Flag Pattern? How To Verify And Trade It Efficiently

How to Trade Bullish Flag Patterns

Bull Flag Pattern New Trader U

Bullish Flag Chart Pattern Trading charts, Trading quotes, Stock

The Flag Pole, The Flag, And The Break Of The Price Channel.

Web A Bull Flag Is A Powerful Pattern Seen On Price Charts, Indicative Of A Continuation In An Uptrend Following A Brief Period Of Consolidation.

The Bull Flag Is A Clear Technical Pattern That Has Three Distinct Components:

Web A Bull Flag Is A Bullish Stock Chart Pattern That Resembles A Flag, Visually.

Related Post: