Brokers With No Pattern Day Trader Rule

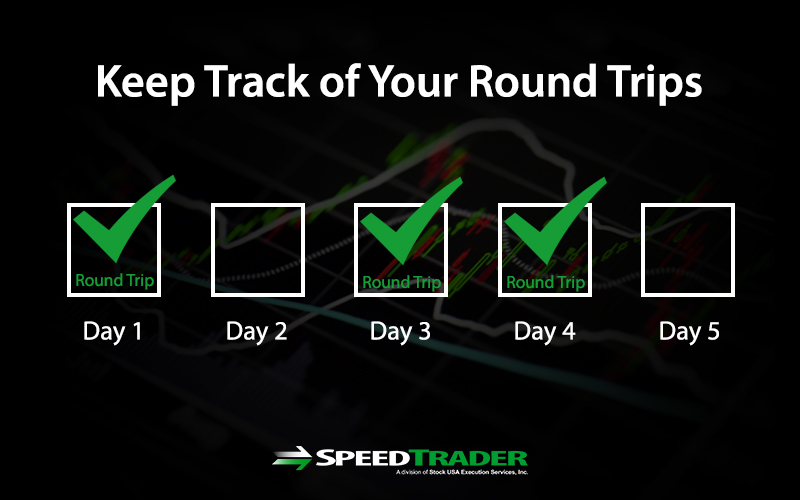

Brokers With No Pattern Day Trader Rule - The financial industry regulatory authority (finra) in the u.s. A day trade involves purchasing and selling the same security on the. If you break the pdt rule you might receive a warning from your broker the first time, but the second violation could result in the broker freezing your account for 90 days or until you can fund it above the needed $25k. Web rule 4210 defines a pattern day trader as anyone who meets the following criteria: Web under the pdt rules, you must maintain minimum equity of $25,000 in your margin account prior to day trading on any given day. Ib smartrouting sm helps support best execution by searching for the best available prices for stocks, options and combinations across exchanges and dark pools. Web schwab may increase its house maintenance margin requirements at any time and is not required to provide you with advance written notice. Under the pdt rule, the sec classifies you as a pattern day trader if you take more than 3 day trades within five business days. Web your broker will know, based on your trading activity. This means avoiding the following infractions: This rule only applies to margin accounts and ira limited margin accounts. If you want to be a day trader, then the $25,000 minimum balance requirement will apply to your account at all times. A regulatory designation for any traders that execute four or more “ day trades ” within five business days, provided that the number of day trades. If the account falls below the $25,000.01 requirement, the pattern day trader will not be permitted to place. Web your account will be flagged for pattern day trading if you make 4 or more day trades within 5 trading days, and the number of day trades represents more than 6% of your total trades in that same 5 trading day. Under the pdt rule, the sec classifies you as a pattern day trader if you take more than 3 day trades within five business days. Web your broker will know, based on your trading activity. Social media 1 twitter 2 facebook 2 instagram 3 rss 4 youtube Web there are two methods of counting day trades. If you break the. This sounds tricky, but it just means that if you want to day trade today, you had to have an account value of more than $25,000 at the end of yesterday. While most brokers follow the rule, there are some brokers that don't like cmeg. You are not entitled to an extension of time on a margin call. To help. Find below the strengths of the best brokers for day trading the united states, updated for 2024: Web day trading at schwab. Under the pdt rule, the sec classifies you as a pattern day trader if you take more than 3 day trades within five business days. Ib smartrouting sm helps support best execution by searching for the best available. A regulatory designation for any traders that execute four or more “ day trades ” within five business days, provided that the number of day trades (buys and sells. This includes folks who are actually day traders, meaning their brokerage is aware that they intend to day trade and they meet the requirement of a $25,000 minimum. If you break. It primarily affects traders who are trading u.s. Ib smartrouting sm helps support best execution by searching for the best available prices for stocks, options and combinations across exchanges and dark pools. Web schwab may increase its house maintenance margin requirements at any time and is not required to provide you with advance written notice. A day trade involves purchasing. These are people who day traded in violation of the rules without meeting the sufficient capital. Having day trades that exceed 6% of the account’s trading. While most brokers follow the rule, there are some brokers that don't like cmeg. This includes folks who are actually day traders, meaning their brokerage is aware that they intend to day trade and. A day trade involves purchasing and selling the same security on the. Web schwab may increase its house maintenance margin requirements at any time and is not required to provide you with advance written notice. Web your broker will know, based on your trading activity. Web there are two methods of counting day trades. Web the pdt rule also known. This means avoiding the following infractions: Web pattern day trader: Web under the rules, a pattern day trader must maintain an equity balance above $25,000 on any day that the customer day trades. Ibkr lite clients have access to $0 commissions on us listed stocks and etfs and the lowest commissions on other products. Read ally invest's full day trading. This rule only applies to margin accounts and ira limited margin accounts. Web pattern day trader: If you want to be a day trader, then the $25,000 minimum balance requirement will apply to your account at all times. For more information about margin, please visit margin loans at schwab. Please contact your brokerage firm for more details on how they count trades to determine if you’re a pattern day trader. This includes folks who are actually day traders, meaning their brokerage is aware that they intend to day trade and they meet the requirement of a $25,000 minimum. Social media 1 twitter 2 facebook 2 instagram 3 rss 4 youtube Read ally invest's full day trading disclosure. These are people who day traded in violation of the rules without meeting the sufficient capital. Web under the rules, a pattern day trader must maintain an equity balance above $25,000 on any day that the customer day trades. Web your account will be flagged for pattern day trading if you make 4 or more day trades within 5 trading days, and the number of day trades represents more than 6% of your total trades in that same 5 trading day period. A day trade involves purchasing and selling the same security on the. Web schwab may increase its house maintenance margin requirements at any time and is not required to provide you with advance written notice. Thus, the pdt rule has a global impact. Web the pattern day trader rule is a regulation specific to the united states and is enforced by the financial industry regulatory authority (finra). Ibkr lite clients have access to $0 commissions on us listed stocks and etfs and the lowest commissions on other products.

How To Avoid Pattern Day Trader Netwhile Spmsoalan

16 Day Trading Rules to Live By in 2021 Bulls on Wall Street

Trading for Daily No Pattern Day Trading Rule YouTube

How To Avoid Pattern Day Trader Netwhile Spmsoalan

No Pattern Day Trading Rules TradeZero Day trading, Day trading

Day Trading Options Definition No Pattern Day Trading Restrictions

Trading Academy 101 Avoid the Pattern Day Trader Rule

No such thing as a Pattern Day Trading Rule YouTube

How To Trade With The Pattern Day Trader (PDT) Rule Pure Power Picks

What is Pattern Day Trader Rule + Tips for Traders

Like Most Other Brokers, Stock And Etf Trades Are Commission Free, And.

Watch To Learn About The Pattern Day Trading Rule, What.

The Financial Industry Regulatory Authority (Finra) In The U.s.

Web The Pattern Day Trader Rule Requires Day Traders Of Stocks And Stock Options To Maintain A Minimum Of $25,000 In Their Margin Accounts.

Related Post: