Bottom Diamond Pattern

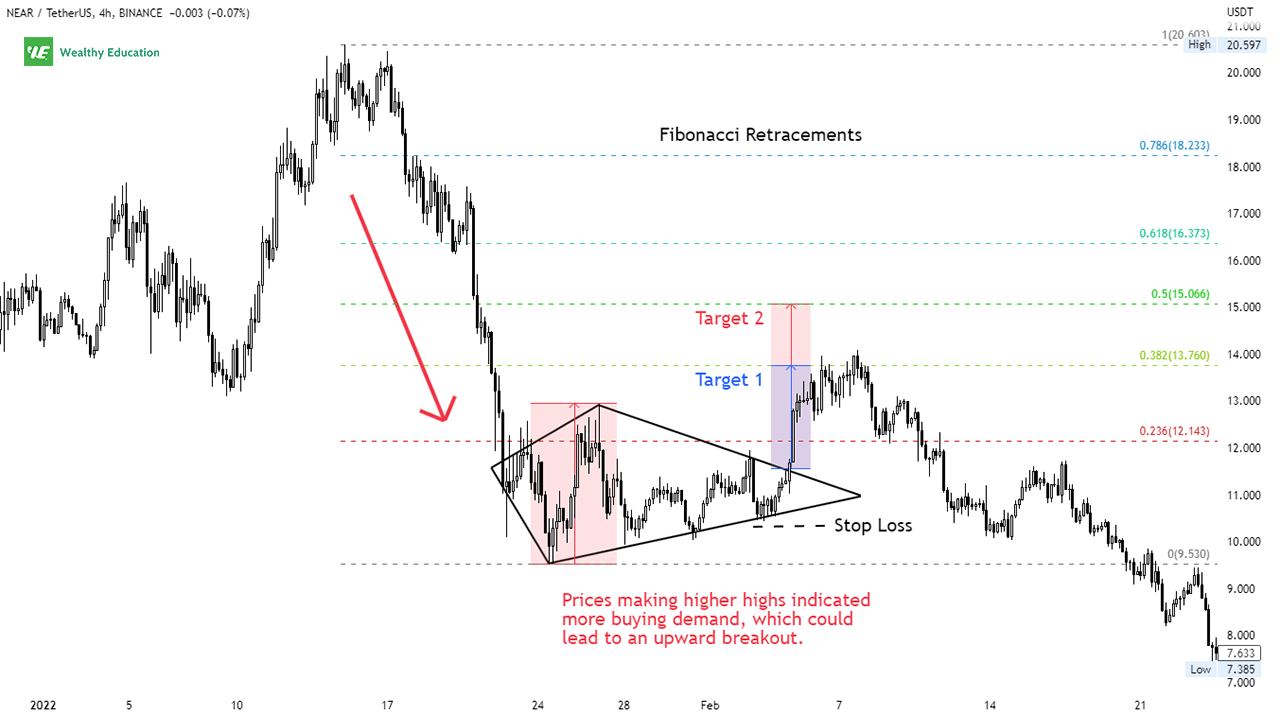

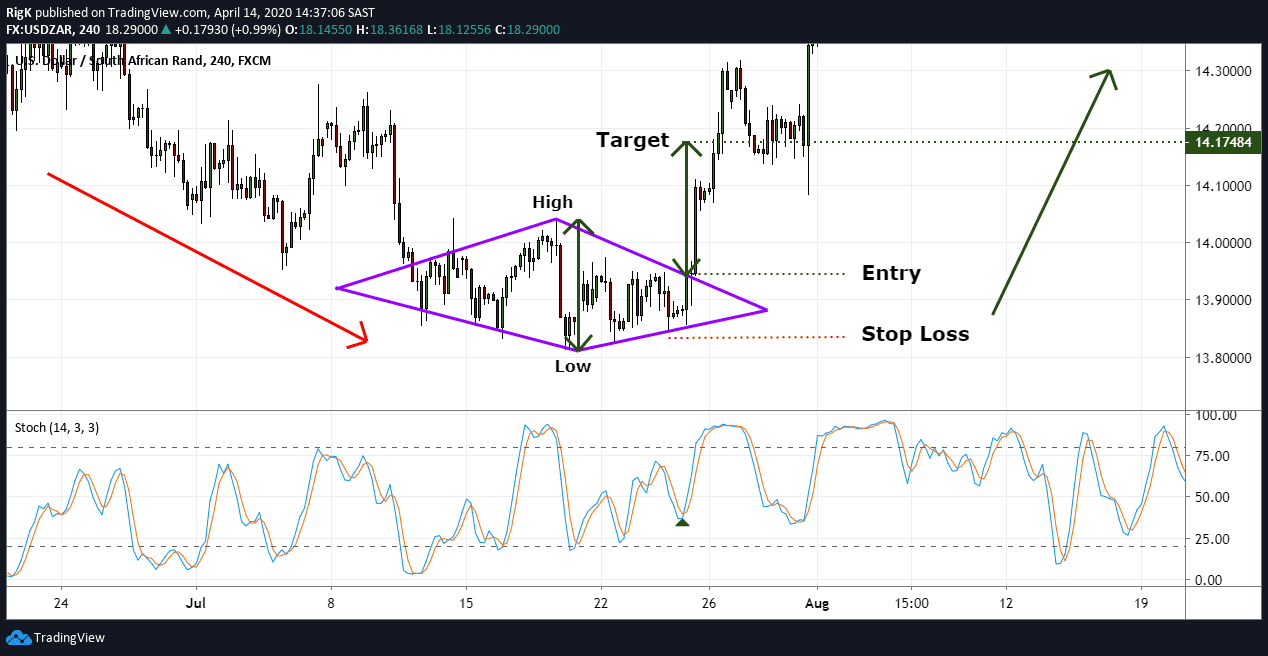

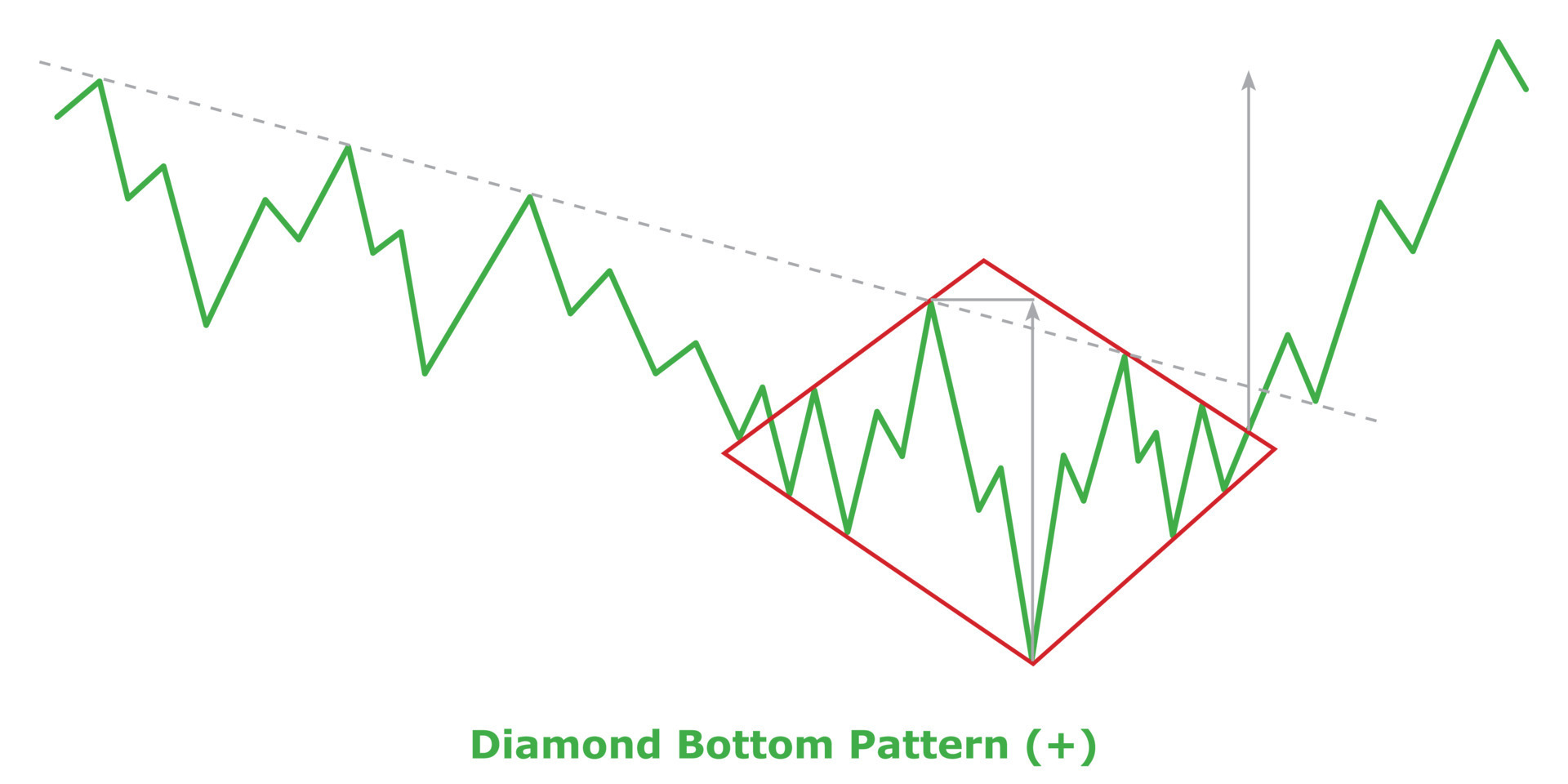

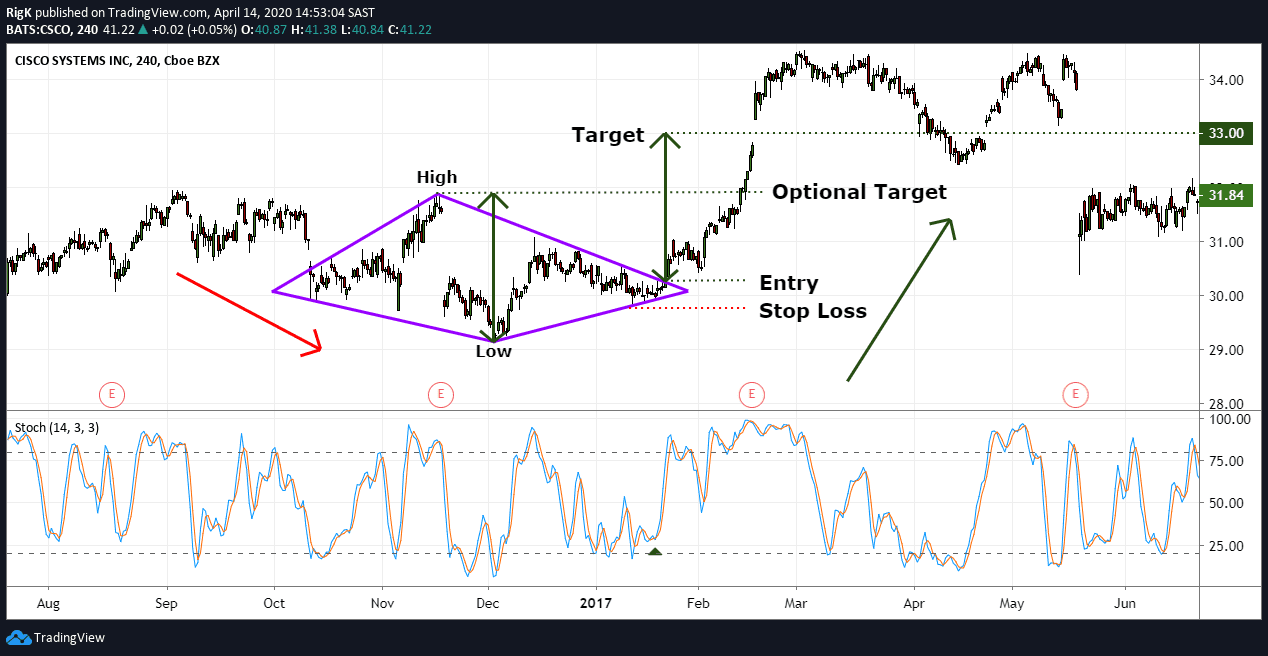

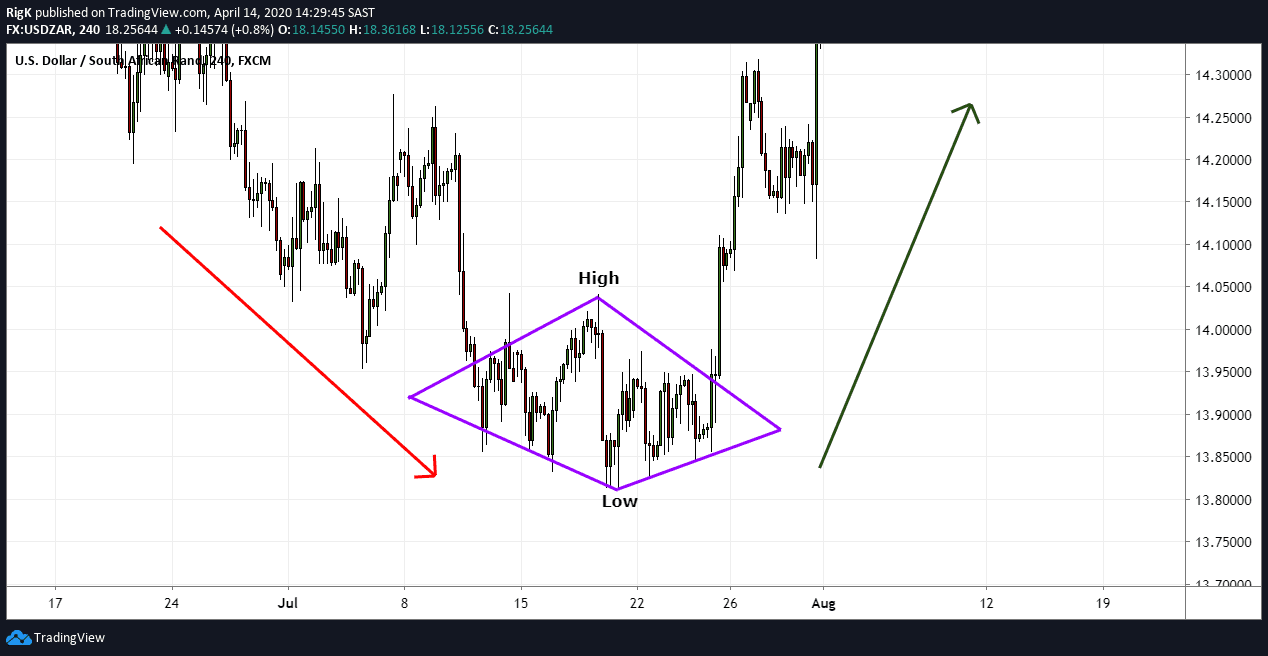

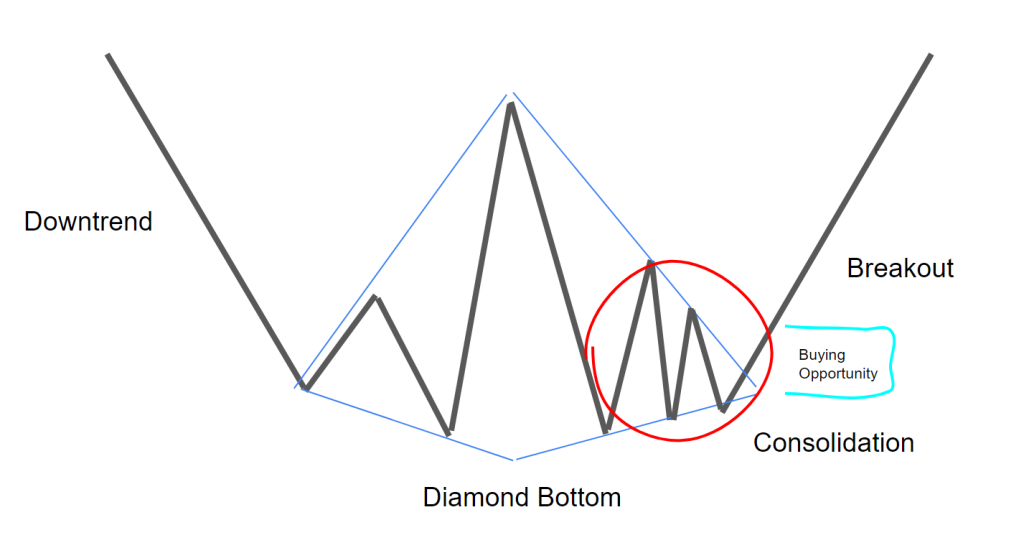

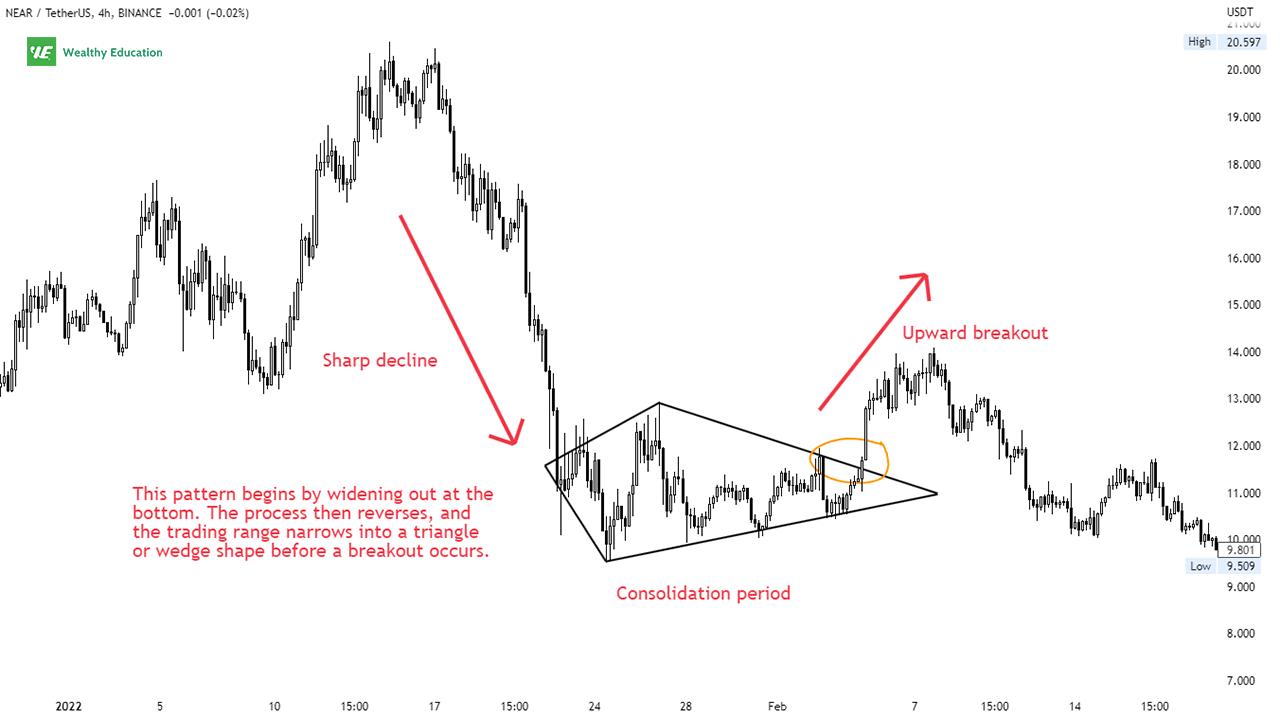

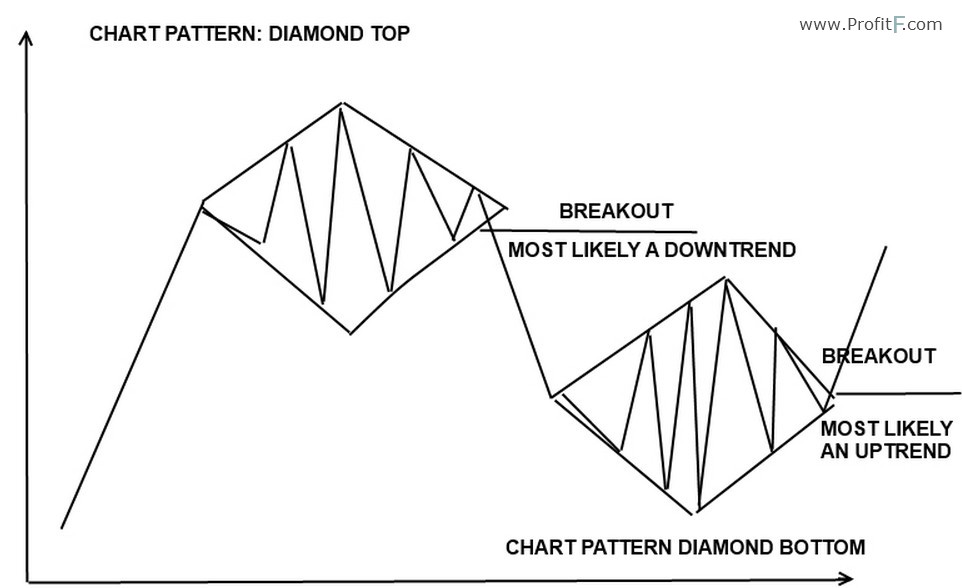

Bottom Diamond Pattern - This pattern marks the exhaustion of the selling current and investor indecision. Web in this way, you can take long or short positions using diamond patterns. Bullish diamond pattern (diamond bottom) bearish diamond pattern (diamond top) in stock trading, the bearish diamonds on the top of bullish trends are more common. The formation builds as the price first drops to carve out a low, then recovers somewhat before making a lower low. Characterized by a unique shape that resembles a diamond, this formation is created by the expansion of price ranges followed by a contraction that precedes a breakout. Similar to the checkerboard pattern, the crisscross pattern also. However bullish diamond pattern or diamond bottom is. Many times the diamond chart pattern is skewed or pushed to one side, making diamonds difficult to spot. Web with a reflective pastel green diamond pattern, this cold cup adds a glamourous flair to any cold beverage. Web the diamond bottom formation, often referred to as a diamond pattern or diamond reversal pattern, is a significant technical analysis pattern observed in financial markets, particularly in stock and commodity trading. Similar to the checkerboard pattern, the crisscross pattern also. Volatility and oscillations increase in the. The first diamond bottom pattern trading step is to identify the diamond bottom in a market. Web the diamond bottom formation, often referred to as a diamond pattern or diamond reversal pattern, is a significant technical analysis pattern observed in financial markets, particularly in stock. The market rallies to a high point, and then retraces lower. This pattern marks the exhaustion of the selling current and investor indecision. Then the market makes a higher high. Web the diamond pattern appears frequently in forex charts, especially for major currency pairs like eur/usd. Second, the price will form what seems like a broadening wedge pattern. This process repeats to create four distinct troughs and peaks which comprise the “diamond”. Web conversely, the pattern is referred to as a diamond bottom or a bullish diamond pattern due to its bullish meaning when a diamond occurs in a bear market. Web diamond top formation: Forex traders look for diamond top or bottom patterns to identify turning points. If the profit target is achieved, then you will achieve a profit of 44 pips. Web the diamond bottom pattern is a relatively rare chart formation that signals a potential reversal of a downtrend in the financial markets. Identify the diamond bottom on a price chart. Notice the strong uptrend preceding the diamond structure. Web conversely, the pattern is referred. Web diamond top formation: On the illustration above we can see what the diamond top formation appears as. Set a stop loss above the pattern, around price 115.73, to protect your position. Web open a sell position below the diamond top pattern, around the price of 115.40. Then the market makes a higher high. Web a diamond bottom is a bullish, trend reversal, chart pattern. Web the diamond pattern appears frequently in forex charts, especially for major currency pairs like eur/usd. Diamond pattern trading is the strategy traders use to trade these rare trend reversal patterns. A stop loss can generally be placed a few. Web open a sell position below the diamond top. Set a profit target around the price of 114.96, with a risk/reward ratio of 1:1. Web the diamond pattern is a reversal pattern that appears at major tops and bottoms. Web the bottom of the diamond top is exactly 0.7250. Bullish diamond pattern (diamond bottom) bearish diamond pattern (diamond top) in stock trading, the bearish diamonds on the top of. Web diamond top formation: This pattern is considered a reversal pattern, indicating a potential change in the prevailing trend. Generally, one locates the stop loss above the upper or below the lower extreme of the diamond pattern. The technical event® occurs when prices break upward out of the diamond formation. Web the diamond pattern has a reversal characteristic: The diamond chart pattern is so rare because it takes quite a while to form. The diamond bottoms are rare. Web with a reflective pastel green diamond pattern, this cold cup adds a glamourous flair to any cold beverage. This relatively uncommon pattern is found by identifying a period in which the price. The technical event® occurs when prices break. Volatility and oscillations increase in the. Web how to trade the diamond bottom. Similar to the checkerboard pattern, the crisscross pattern also. The market rallies to a high point, and then retraces lower. Diamond patterns are chart patterns that are used for detecting reversals in an asset’s trending value, which when traded with properly can lead to great returns. It has four trendlines, consisting of two support lines and two resistance. Web in this way, you can take long or short positions using diamond patterns. The diamond chart pattern is actually two patterns — diamond tops and diamond patterns. Similar to the checkerboard pattern, the crisscross pattern also. Web updated 9/17/2023 20 min read. Web the diamond bottom pattern is a relatively rare chart formation that signals a potential reversal of a downtrend in the financial markets. Web the diamond pattern has a reversal characteristic: Identify the diamond bottom on a price chart. The first diamond bottom pattern trading step is to identify the diamond bottom in a market. Web first, a diamond top pattern happens when the asset price is in a bullish trend. The market rallies to a high point, and then retraces lower. Web how to trade the diamond bottom. These patterns form on a chart at or near the peaks or valleys of a move, their sharp reversals forming the shape of a diamond. First, it should form the support and resistance lines, diverging almost at strong angles to the horizontal lines. To be safe, the trader will set. A diamond bottom has to be preceded by a bearish trend.

Diamond Pattern Trading Explained

Diamond Bottom Pattern (Updated 2022)

Diamond Bottom Pattern Definition & Examples

Diamond Bottom Pattern Green and Red 13001115 Vector Art at Vecteezy

Diamond Chart Pattern Explained Forex Training Group

Diamond Bottom Pattern Definition & Examples

Diamond Bottom Pattern Definition & Examples

How to Trade the Diamond Pattern The Success Academy

Diamond Bottom Pattern (Updated 2022)

Diamond Reversal Chart Pattern in Forex technical analysis

Web The Diamond Pattern Is A Reversal Pattern That Appears At Major Tops And Bottoms.

The Trendline Connects The Lows Of The Left Shoulder To The Head, Which Forms The Bottom Of The Pattern (Points A, B, And C), Forming A V Shape.

Web The Diamond Bottom Formation, Often Referred To As A Diamond Pattern Or Diamond Reversal Pattern, Is A Significant Technical Analysis Pattern Observed In Financial Markets, Particularly In Stock And Commodity Trading.

A Diamond Bottom Is Formed By Two Juxtaposed Symmetrical Triangles, So Forming A Diamond.

Related Post: