Black Scholes Excel Template

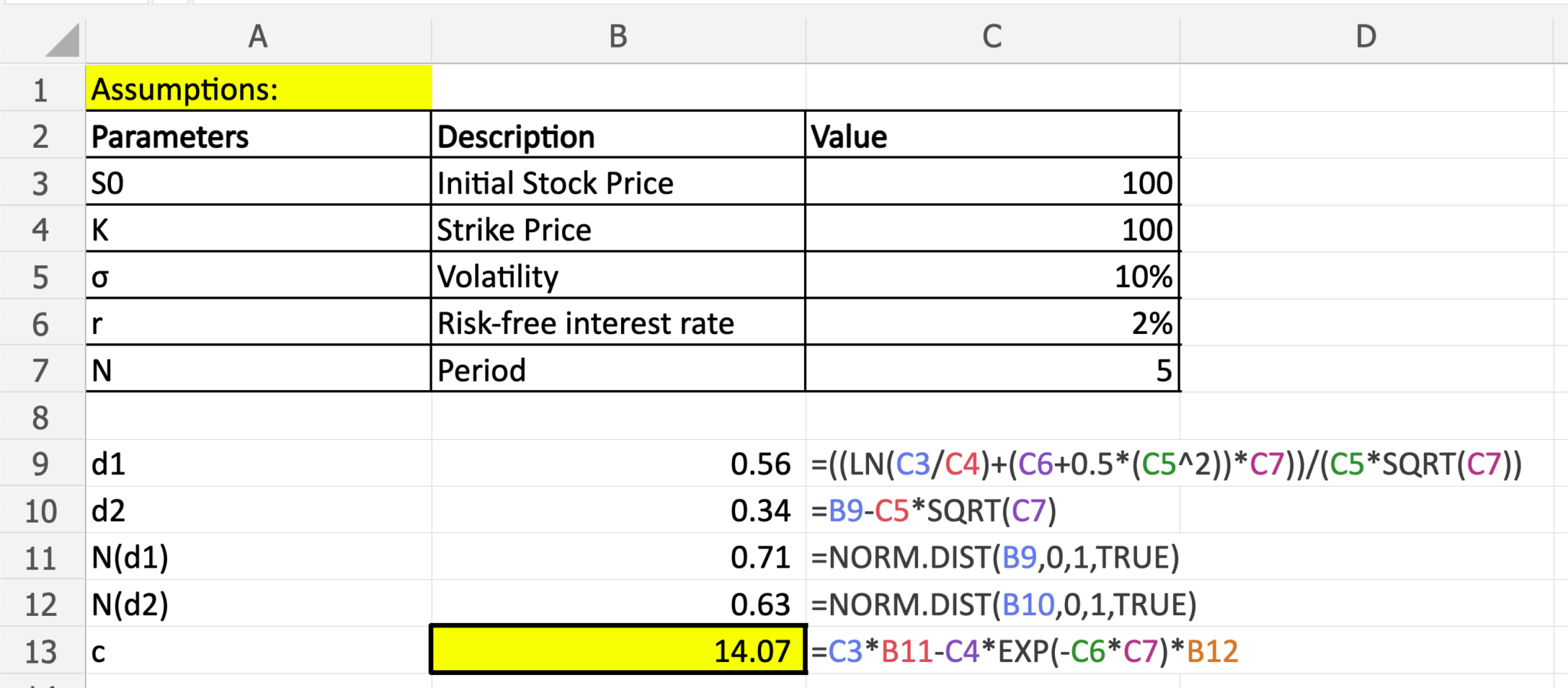

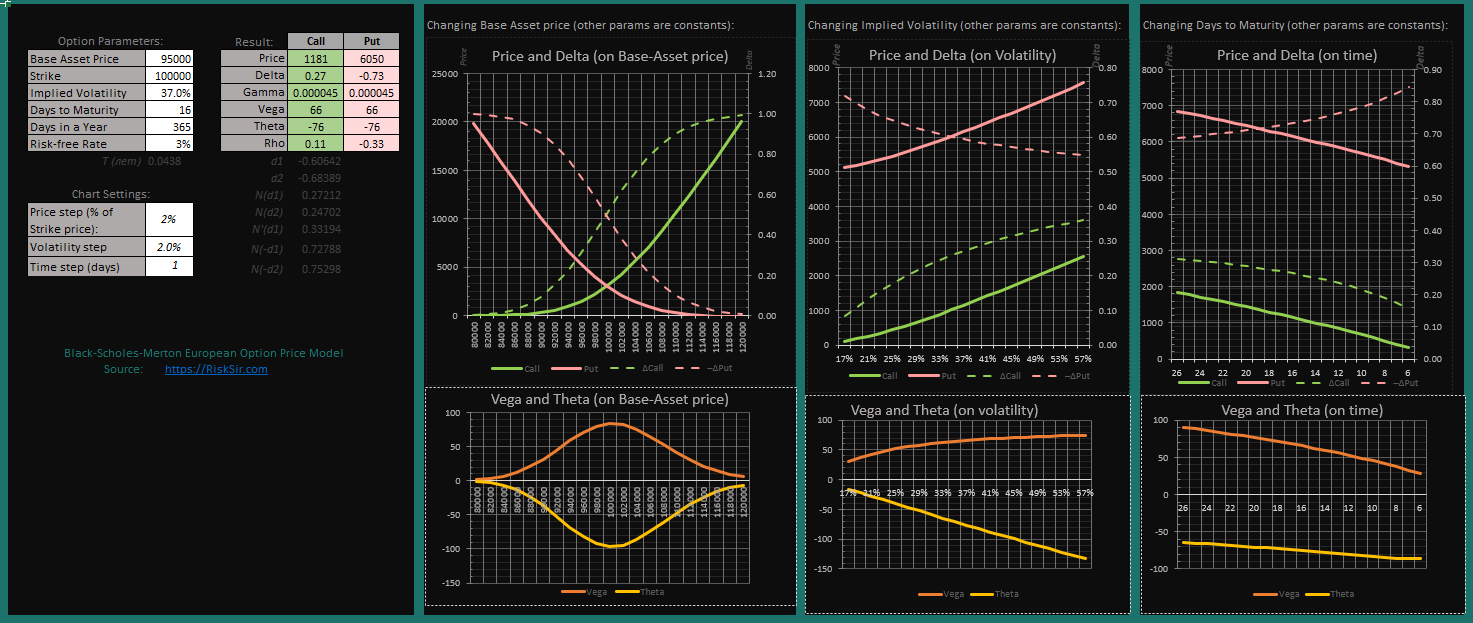

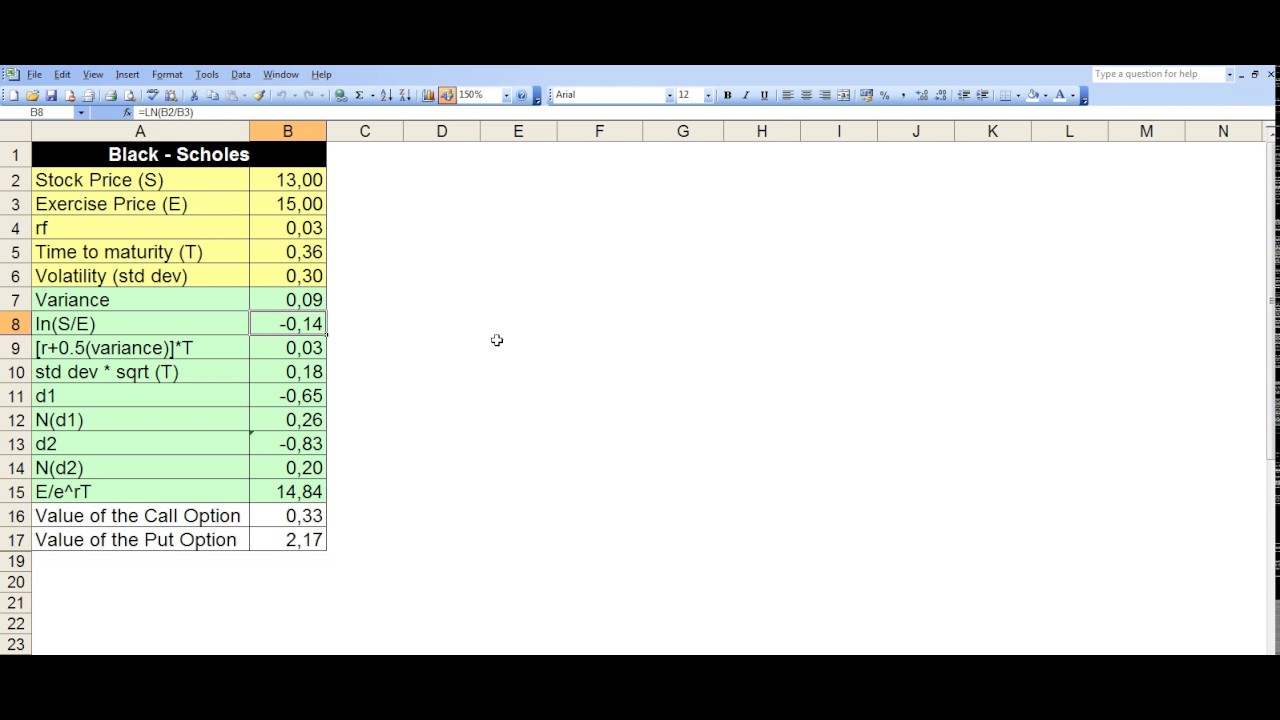

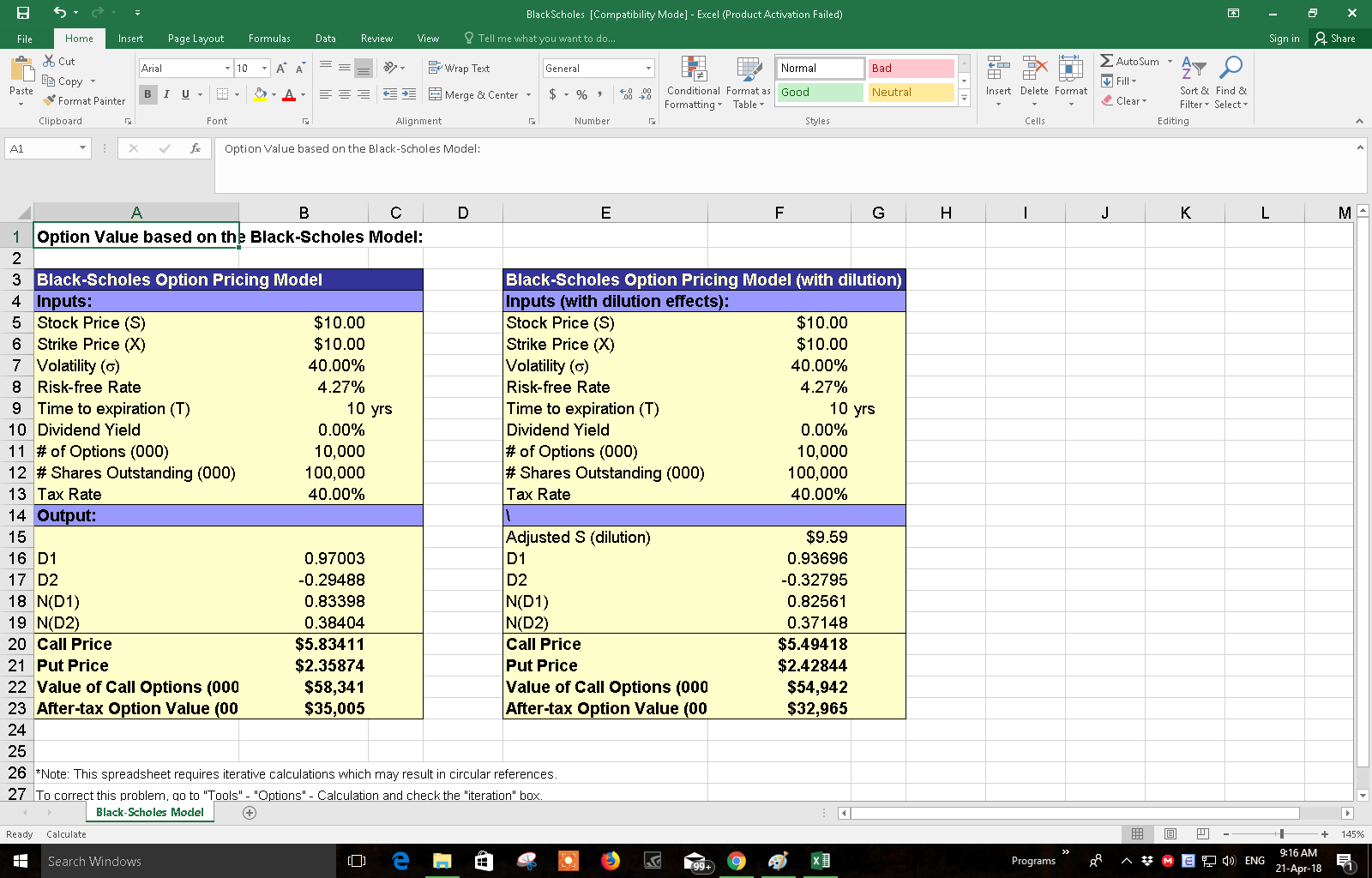

Black Scholes Excel Template - Create a table with columns for each parameter: Built by finance professors and financial modelers. Join | learn about membership. Exhibit 2 , below, presents an excel template that calculates the option’s fair value. Black scholes excel model is the best framework to calculate the underlying value of an option contract. Microsoft excel 2013 pro 64 bit. The put and call versions of the black & scholes equation are shown as separate equations above but the two equations can be merged into a single equation by adding an additional parameter which has the value of 1 for calls and. Web black scholes on the hp10bii+ financial calculator. Web the black scholes model is a mathematical model to determine the theoretical price of the call and put options. Also relevant for option traders. Web need to calculate some puts and calls? 562 views 10 months ago. Web 12 black scholes model in excel, manual calculations (frm) fin analytics research. Setting up the cells in the way shown This course is meant for ca, cma, cfa and mba students. Web 12 black scholes model in excel, manual calculations (frm) fin analytics research. Login to access this resource. Download the excel file for this module: Web need to calculate some puts and calls? 3.7 (13 ratings) 80 students. This course is meant for ca, cma, cfa and mba students. Web the black scholes model is a mathematical model to determine the theoretical price of the call and put options. Web 12 black scholes model in excel, manual calculations (frm) fin analytics research. Is adequate for companies that do not grant many stock options. Additionally, i’m going to use. Black scholes excel model is the best framework to calculate the underlying value of an option contract. Join | learn about membership. Get ready to dive deep into financial modeling with 'black scholes option pricing model explained in excel'. Web individual investors who trade options also employ the model to estimate the price of an option and determine whether it. Now, let’s see the steps. Learn black+scholes model of option pricing from a chartered accountant. Join | learn about membership. 11k views 6 months ago quantitative finance: 12 black scholes model in excel, manual calculations. 12 black scholes model in excel, manual calculations. Web black scholes on the hp10bii+ financial calculator. Web the black scholes model is a mathematical model to determine the theoretical price of the call and put options. Here is a brief preview of cfi’s black scholes calculator. Setting up the cells in the way shown 3.7 (13 ratings) 80 students. 11k views 6 months ago quantitative finance: 562 views 10 months ago. Applying trial and error process for calculating volatility in excel. This content is exclusive to members. Microsoft excel 2013 pro 64 bit. 11k views 6 months ago quantitative finance: Get ready to dive deep into financial modeling with 'black scholes option pricing model explained in excel'. Web an excel implementation. Web black scholes on the hp10bii+ financial calculator. The spreadsheet allows for dividends and also gives you the greeks. Built by finance professors and financial modelers. Download the free black scholes calculator. Web individual investors who trade options also employ the model to estimate the price of an option and determine whether it is overpriced or underpriced. Learn black+scholes model of option pricing from a chartered accountant. Additionally, i’m going to use some excel functions like ln, normdist, and exp. Also relevant for option traders. These are sample parameters and results. Learn black+scholes model of option pricing from a chartered accountant. By gladys from dollar excel. These are sample parameters and results. Robert merton was the first to expand the mathematical understanding of the options. Applying trial and error process for calculating volatility in excel. Label additional columns for calculations, including d1, d2, and the option price. This course is meant for ca, cma, cfa and mba students. Get ready to dive deep into financial modeling with 'black scholes option pricing model explained in excel'. Create a table with columns for each parameter: Microsoft excel 2013 pro 64 bit. Use marketxls with all options data in excel. Exhibit 2 , below, presents an excel template that calculates the option’s fair value. Web an excel implementation. Web black scholes on the hp10bii+ financial calculator. This content is exclusive to members. Bs_nondiv.xlsm [29 kb] download the vba code for this module: 11k views 6 months ago quantitative finance: The put and call versions of the black & scholes equation are shown as separate equations above but the two equations can be merged into a single equation by adding an additional parameter which has the value of 1 for calls and.

BlackScholes Option Pricing (Excel formula) Dollar Excel

10 Black Scholes Excel Template Excel Templates

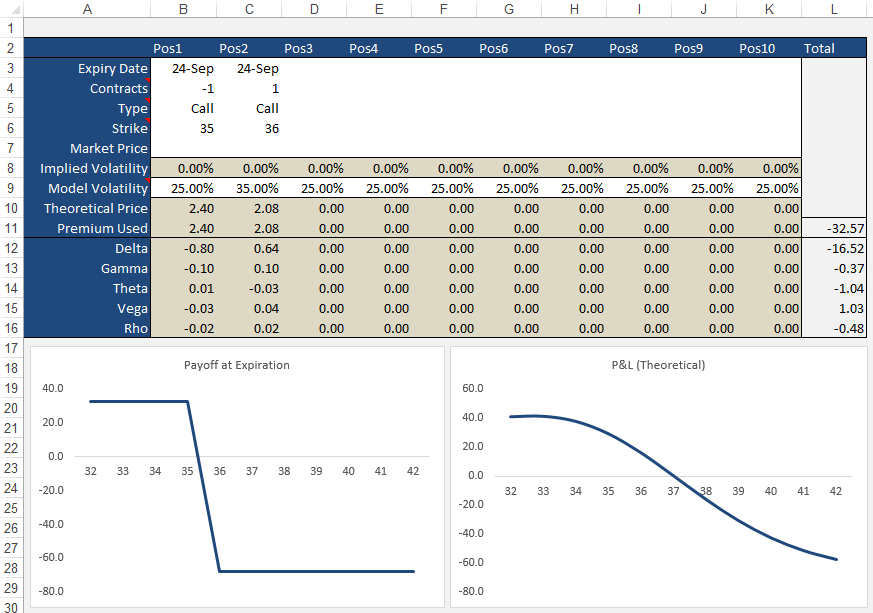

Excel BlackScholesMerton Option Price and Greeks Financial Risk

Black Scholes Excel Template

BlackScholes Excel Pricing Model Eloquens

Black Scholes Option Calculator

Black Scholes Excel Template SampleTemplatess SampleTemplatess

10 Black Scholes Excel Template Excel Templates

Black Scholes Calculator Download Free Excel Template

Blackscholes option pricing model spreadsheet stock market

Join | Learn About Membership.

Web Need To Calculate Some Puts And Calls?

Built By Finance Professors And Financial Modelers.

Now, Let’s See The Steps.

Related Post: