Best Time Frame For Candlestick Patterns For Intraday

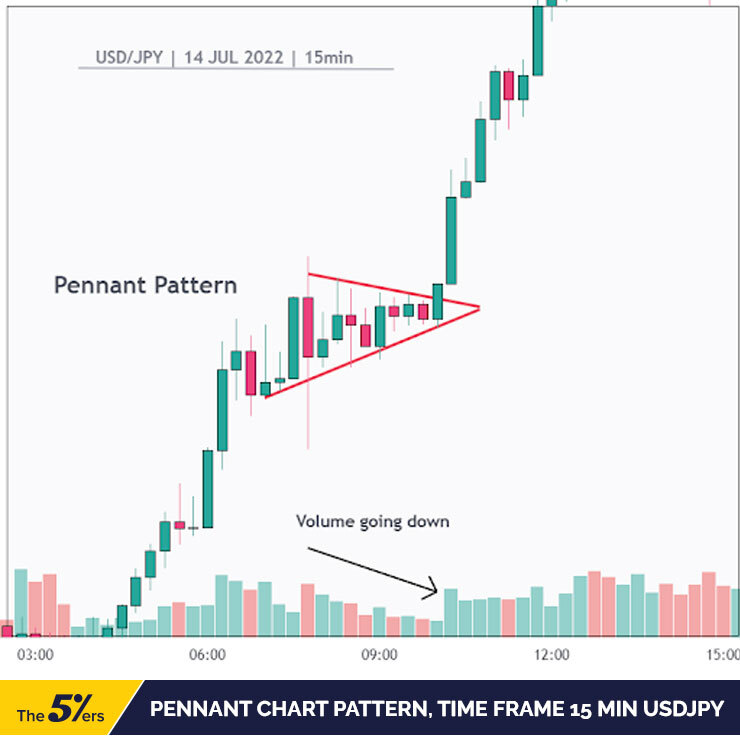

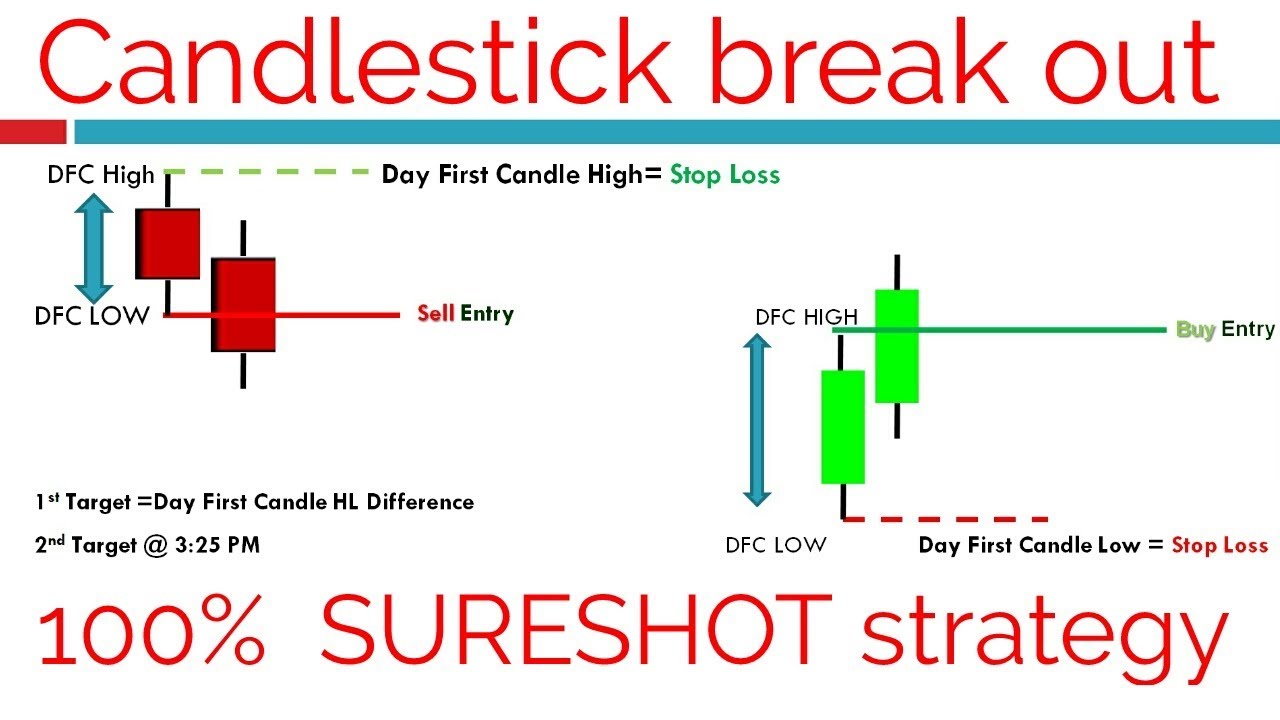

Best Time Frame For Candlestick Patterns For Intraday - As a beginner, finding the best time frame for intraday trading; Web use candlestick charts for the most visual representation of price action. Web single candlestick patterns. So initially, finding the best time frame for intraday trading is necessary. Web chart patterns for day trading can develop over time frames of 5 minutes, 15 minutes, or 30 minutes. Combining chart patterns with japanese candlestick patterns. Candlestick patterns like dojis, hammers, and bullish and bearish engulfing patterns. Can save us a lot of money and help us to walk steadily on the right path in trading. This is a candle with a short body and a long lower wick. This is because by 10.00 a.m. 3.1 how are candlestick patterns used in day trading?. Hammers often appear at potential reversal points, signaling a shift from bearish to. Web a candlestick chart essentially consolidates data within specific time frames, ideally into single bars. Web intraday traders can trade within the stock market exchange durations, i.e., from 9:15 am to 3:30 pm. Web use candlestick charts for. To 10.15 a.m., morning stock volatility. Web a candlestick chart essentially consolidates data within specific time frames, ideally into single bars. However, it also increased the time. Low cost providersplan for your retirement$0 acct minimum providers As a beginner, finding the best time frame for intraday trading; Day traders may want to see this information separated by each minute of trading. Longer timeframes (such as daily or weekly) are suitable for. To 10.15 a.m., morning stock volatility. During this session, only specific time frames are most. Candlestick patterns like dojis, hammers, and bullish and bearish engulfing patterns. However, it also increased the time. This is because by 10.00 a.m. Hammers often appear at potential reversal points, signaling a shift from bearish to. Longer timeframes (such as daily or weekly) are suitable for. Combining chart patterns with japanese candlestick patterns. Web both patterns are essential for candlestick chart analysis. Web single candlestick patterns. Hammers often appear at potential reversal points, signaling a shift from bearish to. 58k views 1 year ago. Intraday candlestick patterns are straightforward and relatively easy to. Web why hammer is best candlestick pattern for intraday trading: Longer timeframes (such as daily or weekly) are suitable for. This is a candle with a short body and a long lower wick. Day traders may want to see this information separated by each minute of trading. Three line strike, two black gapping, three black crows, evening star, and abandoned. 58k views 1 year ago. This is a candle with a short body and a long lower wick. On a candle stick chart, you will find red. Day traders may want to see this information separated by each minute of trading. Web a candlestick chart essentially consolidates data within specific time frames, ideally into single bars. Three line strike, two black gapping, three black crows, evening star, and abandoned. In this free video course, we teach you how to identify trading chart patterns in the real trading market scenario. Combining chart patterns with japanese candlestick patterns. Web intraday trading with candlestick patterns, especially on shorter time frames like 15 minutes, showed potential for profitability. So initially,. Web a candlestick chart essentially consolidates data within specific time frames, ideally into single bars. Can save us a lot of money and help us to walk steadily on the right path in trading. Web explore the most powerful candlestick patterns for intraday trading: Hammers often appear at potential reversal points, signaling a shift from bearish to. As a beginner,. This is a candle with a short body and a long lower wick. Web a candlestick chart essentially consolidates data within specific time frames, ideally into single bars. Low cost providersplan for your retirement$0 acct minimum providers Can save us a lot of money and help us to walk steadily on the right path in trading. Web intraday traders can. Candlestick patterns like dojis, hammers, and bullish and bearish engulfing patterns. Can save us a lot of money and help us to walk steadily on the right path in trading. During this session, only specific time frames are most. Intraday candlestick patterns are straightforward and relatively easy to. Day traders may want to see this information separated by each minute of trading. Combining chart patterns with japanese candlestick patterns. To 10.15 a.m., morning stock volatility. Web intraday traders can trade within the stock market exchange durations, i.e., from 9:15 am to 3:30 pm. Low cost providersplan for your retirement$0 acct minimum providers However, it also increased the time. This is because by 10.00 a.m. Web remember, candlesticks can be used for any time frame. 58k views 1 year ago. Longer timeframes (such as daily or weekly) are suitable for. Web the ideal time for intraday trading, according to stock market analysts, is between 10.15 a.m. Web chart patterns for day trading can develop over time frames of 5 minutes, 15 minutes, or 30 minutes.

BEST Candlestick Patterns for Intraday Trading (Scalping & Day Trading

Best Candlestick Patterns For Intraday Trading UnBrick.ID

5 Popular Intraday Chart Patterns Forex Traders Love to Use

Most Powerful Candle Pattern For Intraday Trading And Swing Trading

What Is The Best Time Frame For Candlesticks? Quantified Strategies

Candlestick patterns in trading intraday strategy YouTube

Price action Forex Trading tutorial Best time frame for candlestick

3 BEST Time Frames for Intraday Trading Strategies you should know

What Is The Best Time Frame For Candlesticks? Quantified Strategies

Best Time Frame for Trading Intraday, Swing and Positional

As A Beginner, Finding The Best Time Frame For Intraday Trading;

Web Why Hammer Is Best Candlestick Pattern For Intraday Trading:

Hammers Often Appear At Potential Reversal Points, Signaling A Shift From Bearish To.

As A Beginner, 9.30 Am To 11.30 Am Is The Best.

Related Post: