Bearish Wedge Pattern

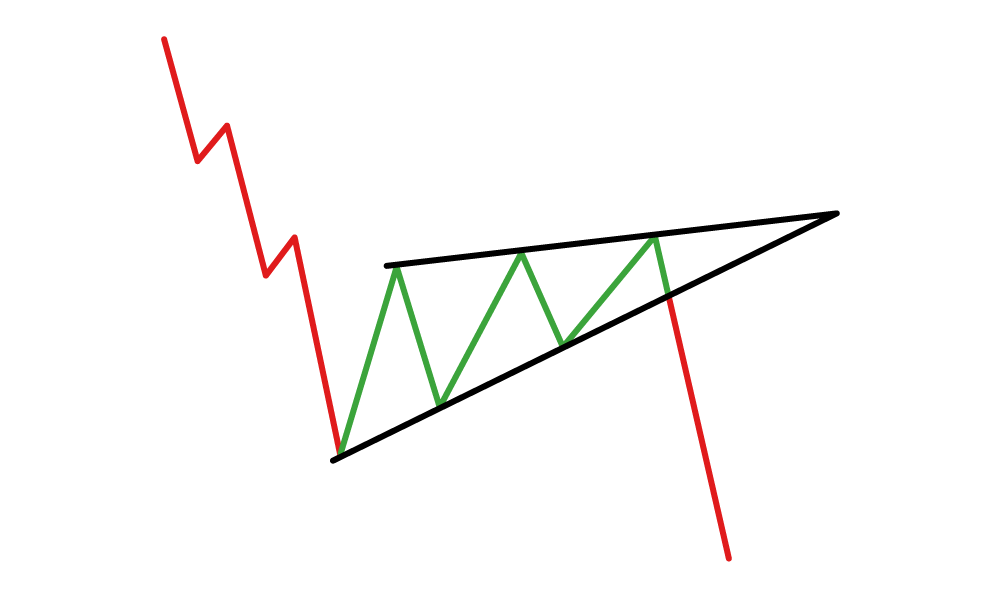

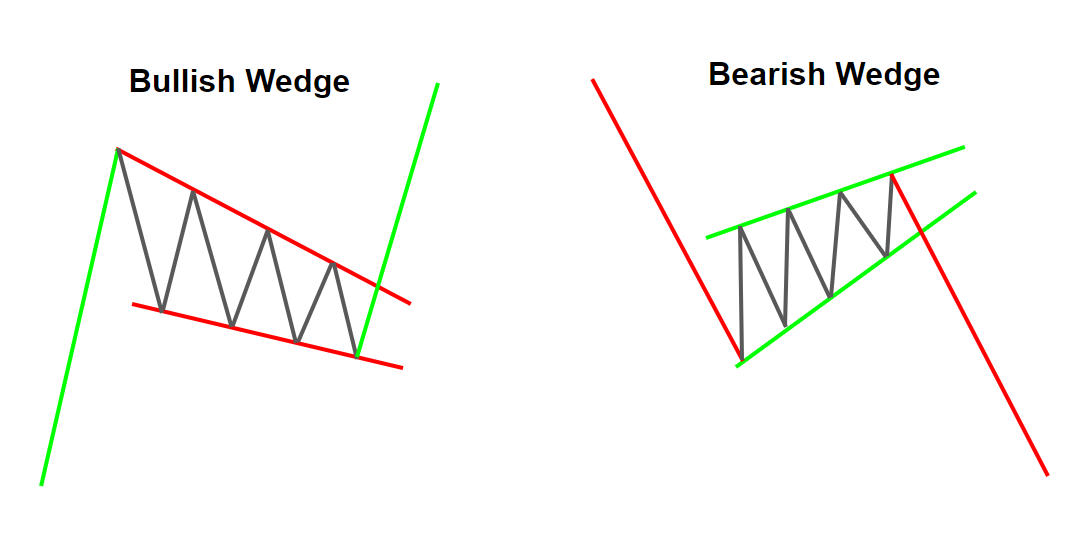

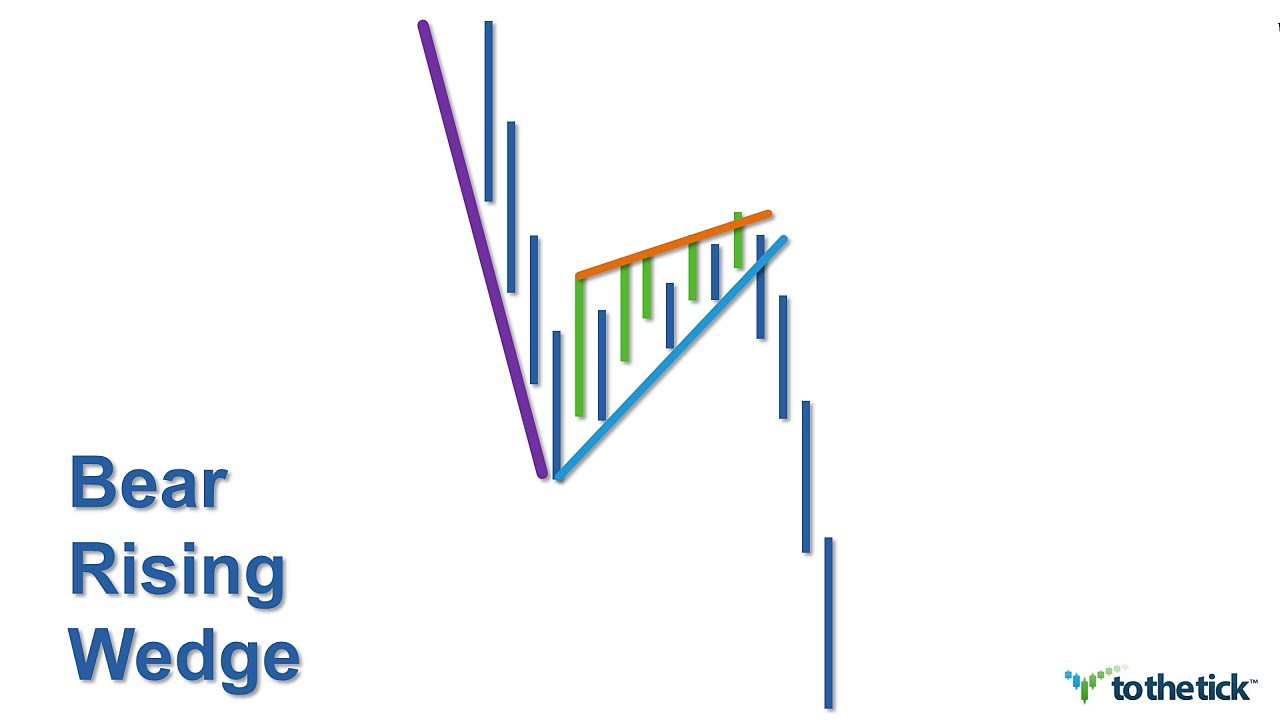

Bearish Wedge Pattern - Web the rising wedge is a bearish pattern that begins wide at the bottom and contracts as prices move higher and the trading range narrows. First, the converging trend lines; In essence, both continuation and reversal scenarios are inherently bullish. The slope closes at the end just to take sharpe reverse in the movement and direction. They typically tell us an exhaustion story — where bulls are giving up and bears are taking over. This is how to distinguish the two: Web the rising wedge formation is bearish, the falling wedge formation is bullish. With the rising wedge, there is a short signal as soon as the price breaks through the lower ascending trend line. Web the falling wedge is a bullish pattern that begins wide at the top and contracts as prices move lower. Web the rising (ascending) wedge pattern is a bearish chart pattern that signals a highly probable breakout to the downside. Web the rising wedge formation is bearish, the falling wedge formation is bullish. Web rising and falling wedges explained. Web the falling wedge pattern is a technical formation that signals the end of the consolidation phase that facilitated a pull back lower. While it can break out in either direction, it is primarily seen as a bearish pattern. It’s the. They typically tell us an exhaustion story — where bulls are giving up and bears are taking over. It features upward sloping support and resistance lines, with higher lows forming faster than higher highs. Web a rising wedge is often considered a bearish chart pattern that indicates a potential breakout to the downside. Web bearish candlestick patterns are either a. Web the arm share price has traded within a narrow rising wedge since mid april—a chart pattern technical analysts typically interpret as having a bearish bias because it indicates an easing of. Therefore, the outlook for the stock is extremely bearish, which can see it drop to $56, its lowest level on. It features upward sloping support and resistance lines,. The chart setups based on fibonacci ratios are very popular as well: Web a rising wedge is a bearish chart pattern that forms at the end of an uptrend. If you appreciate our charts, give us a quick 💜💜 today, we'll explore two important ones: In contrast to symmetrical triangles, which have no definitive slope and no bias, falling wedges. Ascending wedges can occur when a market is rising or falling: Web the falling wedge pattern is a technical formation that signals the end of the consolidation phase that facilitated a pull back lower. Web rising and falling wedges explained. Web the rising wedge formation is bearish, the falling wedge formation is bullish. Web the rising (ascending) wedge pattern is. These patterns can signal shifts in market trends. In contrast to symmetrical triangles, which have no definitive slope and no bullish or bearish bias, rising wedges definitely slope up and have a bearish bias. Web the rising wedge is a bearish pattern and the inverse version of the falling wedge. What does a rising wedge pattern signal? Web the rising. Web the rising (ascending) wedge pattern is a bearish chart pattern that signals an imminent breakout to the downside. Welcome to the world of trading patterns. It’s the opposite of the falling (descending) wedge pattern (bullish). A rising wedge can be both a continuation and reversal pattern, although the former is more common and more efficient as it follows the.. These patterns can signal shifts in market trends. Web this wedge pattern forex traders recognize signals a potential bearish reversal pattern. Web the falling wedge pattern is a technical formation that signals the end of the consolidation phase that facilitated a pull back lower. It suggests a potential reversal in the trend. Web a rising wedge is a bearish chart. Here is list of the classic ones: A rising wedge can be both a continuation and reversal pattern, although the former is more common and more efficient as it follows the. Participants are complacent as the immediate up trend continues to grind but they don’t notice the narrowing channel. Both trend lines are sloping up with a narrowing channel up. Here is list of the classic ones: Let's dive in and see how they work. Web in price action analysis, wedges are some of the best reversal patterns in the market. This is how to distinguish the two: What is the difference between a wedge pattern and a triangle pattern? It’s the opposite of the falling (descending) wedge pattern (bullish). Web the arm share price has traded within a narrow rising wedge since mid april—a chart pattern technical analysts typically interpret as having a bearish bias because it indicates an easing of. Here is list of the classic ones: In this, the price goes higher giving an impression of continuous highs contracting in the shape of a symmetrical triangle. Web can a wedge pattern form in both bullish and bearish markets? Wedges can serve as either continuation or reversal patterns. Web in price action analysis, wedges are some of the best reversal patterns in the market. A falling wedge is a temporary interruption of an uptrend, but it is a reversal signal for a downtrend. When a market is in an uptrend, they’re a sign that traders are reconsidering the bull move. Both trend lines are sloping up with a narrowing channel up trend. If you appreciate our charts, give us a quick 💜💜 today, we'll explore two important ones: A rising wedge can be both a continuation and reversal pattern, although the former is more common and more efficient as it follows the. The falling wedge gives a buy signal if the price crosses the upper descending trend line. Whether you’re a seasoned trader or just starting out, this comprehensive guide will equip you with everything you need to know about this powerful chart pattern. In either case, this pattern holds three common characteristics: It’s the opposite of the falling (descending) wedge pattern (bullish), as these two constitute a popular wedge pattern.

Using the Rising Wedge Pattern in Forex Trading

How to Trade the Rising Wedge Pattern Warrior Trading

Bear Rising Wedge ToTheTick™

5 Chart Patterns Every Beginner Trader Should Know Brooksy

Topstep Trading 101 The Wedge Formation Topstep

Topstep Trading 101 The Wedge Formation

The Bearish Rising Wedge Lesson from Virgin America VA Afraid to

Wedge Patterns 101 A Trader's Essential Toolkit

What Is A Wedge Pattern? How To Use The Wedge Pattern Effectively How

TECHNICAL ANALYSIS Bear Rising Wedge YouTube

Welcome To The Ultimate Guide To Understanding And Trading The “Wedge Pattern” In Stock Markets.

While It Can Break Out In Either Direction, It Is Primarily Seen As A Bearish Pattern.

As Outlined Earlier, Falling Wedges Can Be Both A Reversal And Continuation Pattern.

A Rising Wedge Is Formed When The Price Consolidates Between Upward Sloping Support And Resistance Lines.

Related Post: