Bearish Variation Pattern

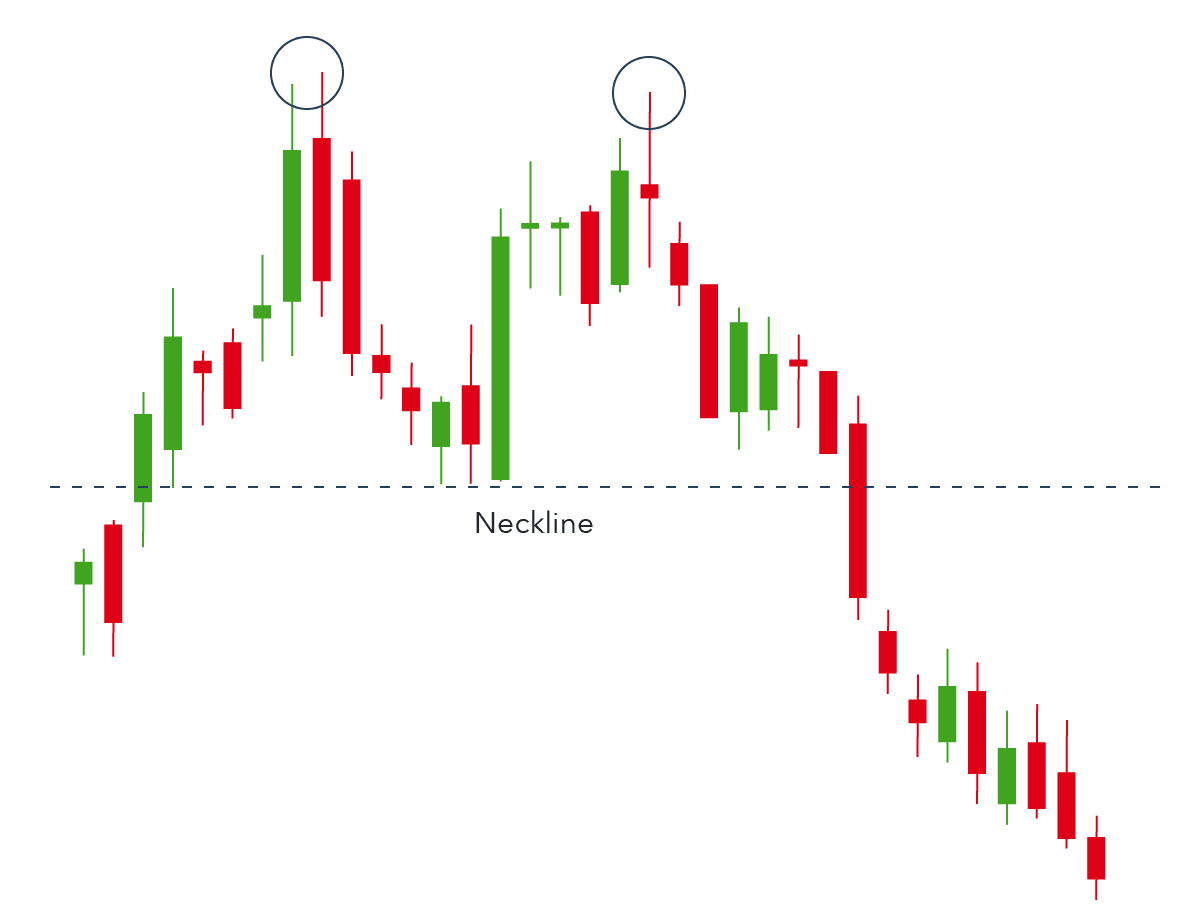

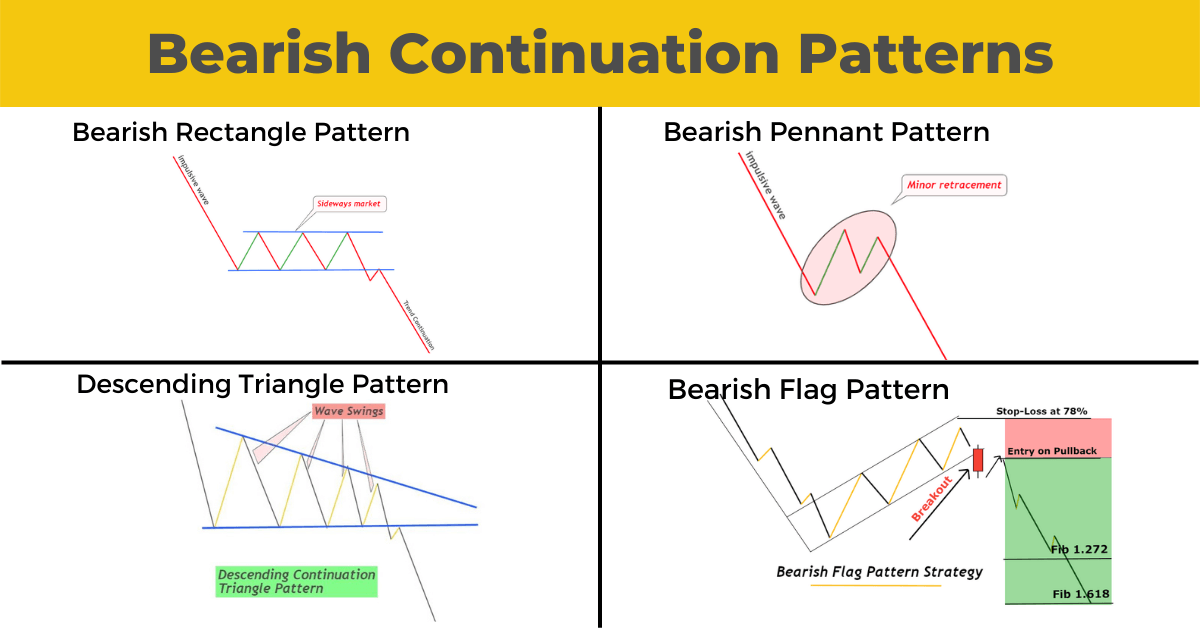

Bearish Variation Pattern - In this post, we answer some questions about the bullish. Web stocks can tumble for all sorts of reasons—an earnings miss, souring investor sentiment, world events—and these moves can play out over mere days or. A bearish candlestick pattern is a visual representation of price movement on a trading chart that suggests a potential. A bullish candle forms the first component of an. Web a bearish harami is a two bar japanese candlestick pattern that suggests prices may soon reverse to the downside. Web bearish candlestick patterns. It's a hint that the market sentiment may be shifting from buying to selling. Web as the name indicates, it is a bullish reversal pattern that signals a potential beginning of an upward swing. Web the diamond chart pattern, also known as a diamond top or a diamond bottom, is a technical analysis formation that occurs when the price of an asset consolidates within a. Web both bearish and bullish engulfing candlestick patterns exist. In the bear trap pattern, the double bottom sell pattern is immediately followed by the. In this post, we answer some questions about the bullish. Our research shows bearish harami and bearish harami cross are profitable patterns. Web the bearish three drives pattern is another variation of the three drives pattern, signaling a potential reversal to the downside in the. In this post, we answer some questions about the bullish. Web the bearish flag pattern, a continuation pattern, indicates that an existing downtrend will persist after a brief consolidation. It's a hint that the market sentiment may be shifting from buying to selling. “bearish prices” is a decrease in prices relative to the market's upper point by approximately 20%. Studied. A bearish candlestick pattern is a visual representation of price movement on a trading chart that suggests a potential. These patterns typically consist of a. Web the evening star pattern is generally the bearish variation of the morning star pattern. Web the diamond chart pattern, also known as a diamond top or a diamond bottom, is a technical analysis formation. Web the diamond chart pattern, also known as a diamond top or a diamond bottom, is a technical analysis formation that occurs when the price of an asset consolidates within a. Web what is a bearish pattern? Web both bearish and bullish engulfing candlestick patterns exist. This is the bearish reversal. Web the bearish flag pattern, a continuation pattern, indicates. These patterns typically consist of a. The pattern consists of a long white candle. Web what is a bearish pattern? “bearish prices” is a decrease in prices relative to the market's upper point by approximately 20%. It's a hint that the market sentiment may be shifting from buying to selling. Web let's dive into this candlestick crash course! Web what is bearish chart patterns. The pattern consists of a long white candle. Web a bearish abandoned baby is a specialized candlestick pattern consisting of three candles, one with rising prices, a second with holding prices, and a third with falling. Web what is a bearish candlestick pattern? A bullish candle forms the first component of an. Web the evening star pattern is generally the bearish variation of the morning star pattern. Web bearish candlestick patterns. In this post, we answer some questions about the bullish. Web the diamond chart pattern, also known as a diamond top or a diamond bottom, is a technical analysis formation that occurs. It’s marked by a sharp price descent (flagpole) followed. Web let's dive into this candlestick crash course! Web a bearish harami is a two bar japanese candlestick pattern that suggests prices may soon reverse to the downside. Web a bearish abandoned baby is a specialized candlestick pattern consisting of three candles, one with rising prices, a second with holding prices,. In this post, we answer some questions about the bullish. It’s marked by a sharp price descent (flagpole) followed. Understanding these candlestick bearish reversal patterns helps spot potential tops, reversals, and down moves early. “bearish prices” is a decrease in prices relative to the market's upper point by approximately 20%. Web what is bearish chart patterns. Web the diamond chart pattern, also known as a diamond top or a diamond bottom, is a technical analysis formation that occurs when the price of an asset consolidates within a. Web bear trap variation pattern is a bear trap pattern that appears in 6 columns instead of 4. Web a bearish reversal candlestick pattern is a sequence of price. It’s marked by a sharp price descent (flagpole) followed. This is the bearish reversal. These patterns typically consist of a. It's a hint that the market sentiment may be shifting from buying to selling. Web what is a bearish candlestick pattern? Web what is a bearish pattern? A bullish candle forms the first component of an. Web let's dive into this candlestick crash course! Web the bearish three drives pattern is another variation of the three drives pattern, signaling a potential reversal to the downside in the market. Web bear trap variation pattern is a bear trap pattern that appears in 6 columns instead of 4. Web the bearish flag pattern, a continuation pattern, indicates that an existing downtrend will persist after a brief consolidation. Understanding these candlestick bearish reversal patterns helps spot potential tops, reversals, and down moves early. Web a bearish abandoned baby is a specialized candlestick pattern consisting of three candles, one with rising prices, a second with holding prices, and a third with falling. Bearish candlestick patterns indicate when the market is dominated by participants with selling sentiments. In this post, we answer some questions about the bullish. Web a bearish reversal candlestick pattern is a sequence of price actions or a pattern, that signals a potential change from uptrend to downtrend.

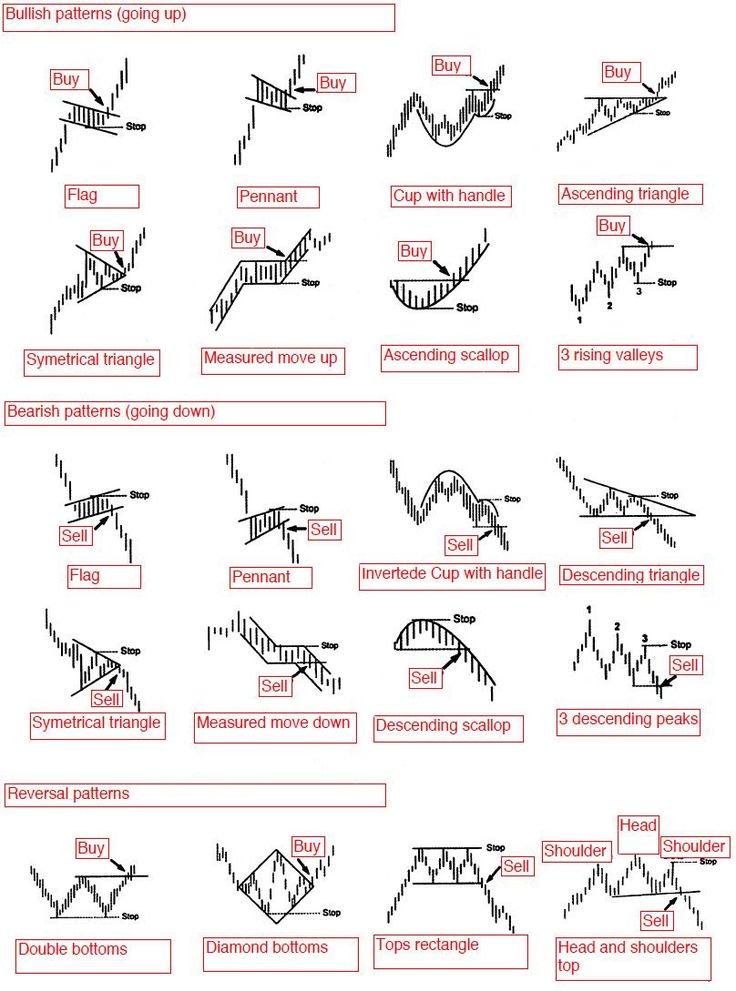

Bullish & Bearish Patterns in Technical Analysis Crypto Radio

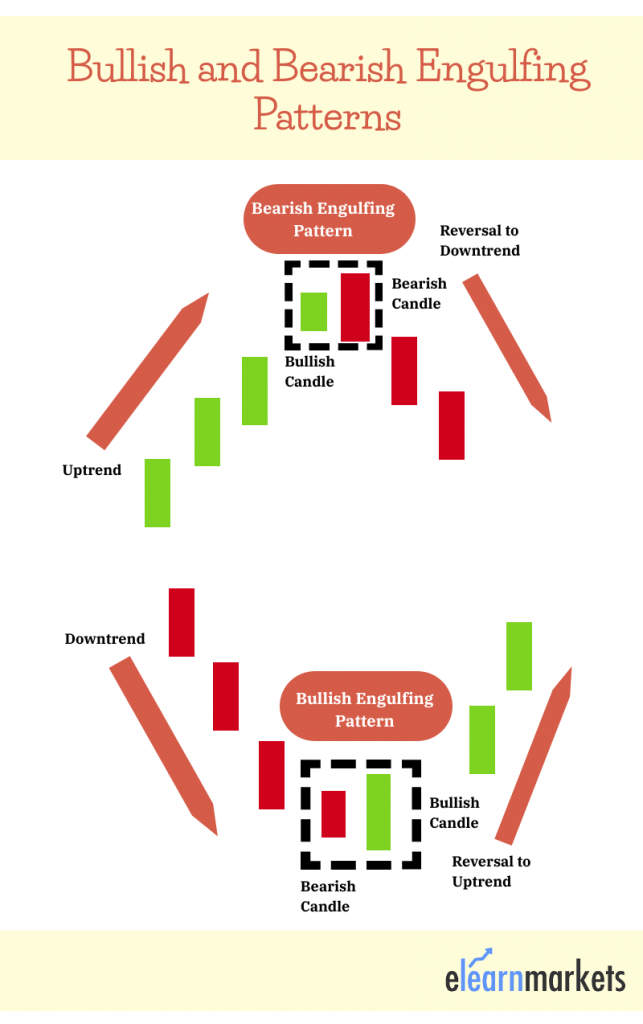

How to Trade with Bullish and Bearish Engulfing Patternsok NIKWOLF

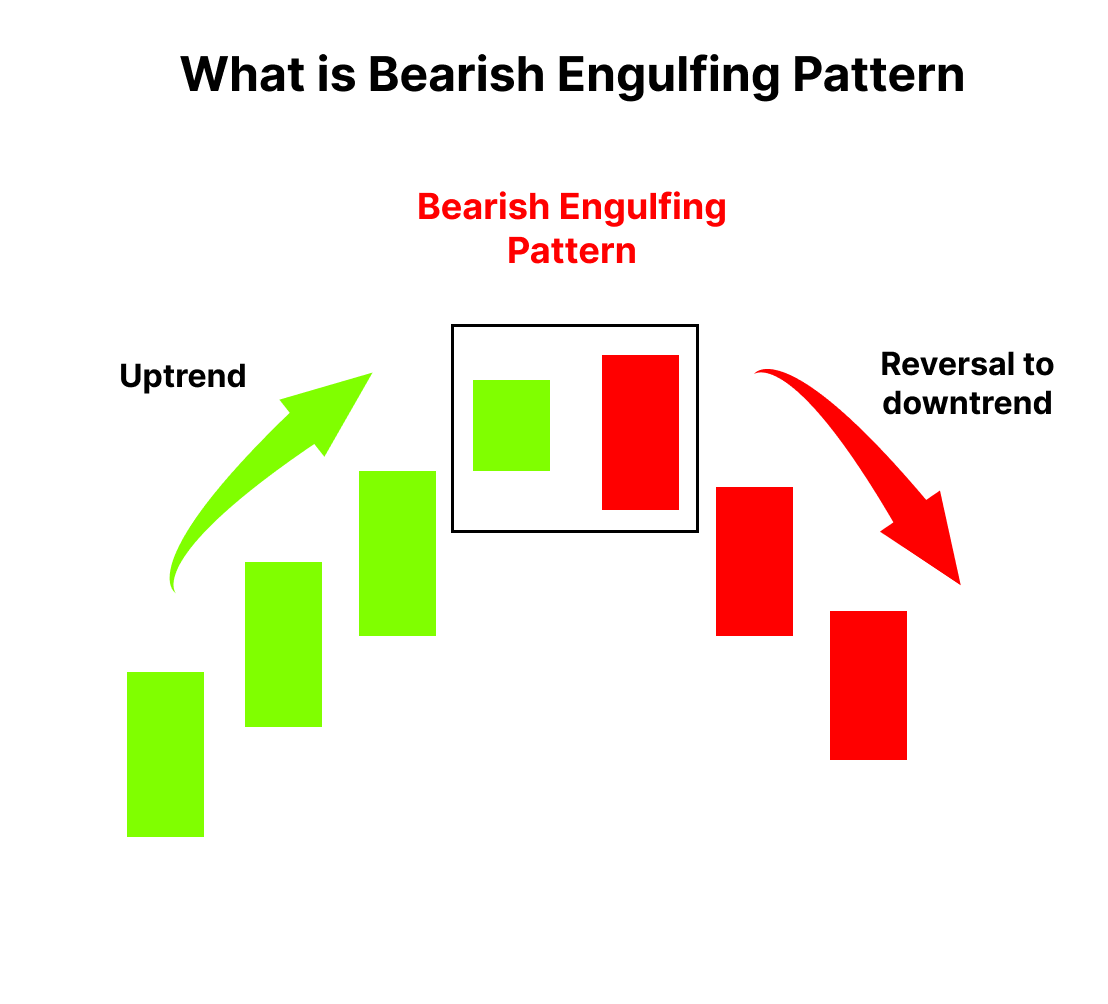

Bearish Engulfing Pattern Meaning, Example & Limitations Finschool

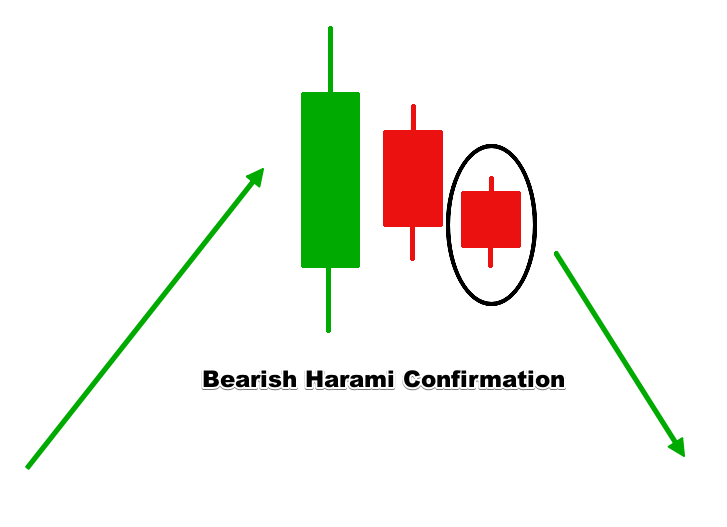

Bullish & Bearish Harami Patterns Forex Training Group

Bearish Chart Patterns Cheat Sheet Crypto Technical Analysis

What Is Bearish Engulfing Candle Pattern? Meaning And Trading Strategy

What Is Bearish Harami Pattern? How To Identify And Use It In Trading

What is Bullish and Bearish Engulfing Candlestick Pattern? Samco

How To Find Bearish Stocks McKinney Chithin

Bearish Continuation Patterns Full Guide ForexBee

Studied Mostly In Technical Analysis, Bearish Stock Patterns Often Show A Downfall Or Impending Decline In The Price Of An Asset,.

Web Stocks Can Tumble For All Sorts Of Reasons—An Earnings Miss, Souring Investor Sentiment, World Events—And These Moves Can Play Out Over Mere Days Or.

In The Bear Trap Pattern, The Double Bottom Sell Pattern Is Immediately Followed By The.

Web The Diamond Chart Pattern, Also Known As A Diamond Top Or A Diamond Bottom, Is A Technical Analysis Formation That Occurs When The Price Of An Asset Consolidates Within A.

Related Post: