Bearish Triangle Pattern

Bearish Triangle Pattern - This provides clues on the likely breakout direction. In the realm of financial markets, the ability to forecast potential price reversals or continuations is pivotal. Traders must wait for the price to. Web the descending triangle is recognized primarily in downtrends and is often thought of as a bearish signal. According to testing, an ascending triangle breaks out upward 64% of the time and downward 36%. Chart patterns, with their ability to visually represent market sentiment, play a key role in this predictive process. Two or more comparable lows form a horizontal line at the bottom. They can also assist a trader in spotting a market reversal. The picture below depicts all three. Studied mostly in technical analysis, bearish stock patterns often show a downfall or impending decline in the price of an asset, indices, or security. Web a descending triangle is a chart pattern used in technical analysis created by drawing one trend line connecting a series of lower highs and a second horizontal trend line connecting a series. Web the descending triangle is recognized primarily in downtrends and is often thought of as a bearish signal. The signal boasts the upcoming selling pressure and a. Chart patterns, with their ability to visually represent market sentiment, play a key role in this predictive process. This provides clues on the likely breakout direction. Web what is bearish chart patterns. Symmetrical (price is contained by 2 converging trend lines with a similar slope), ascending (price is contained by a horizontal trend line acting as resistance and an ascending. In the realm of financial markets, the ability to forecast potential price reversals or continuations is pivotal. The signal boasts the upcoming selling pressure and a series of lower lows and lower highs in the price action. Web there are basically 3 types of triangles and they all point to price being in consolidation: Rising triangle chart pattern signal bullish. Traders must wait for the price to. Chart patterns, with their ability to visually represent market sentiment, play a key role in this predictive process. Symmetrical (price is contained by 2 converging trend lines with a similar slope), ascending (price is contained by a horizontal trend line acting as resistance and an ascending trend line acting as support) and descending. Web regardless of where they form, descending triangles are bearish patterns that indicate distribution. Chart patterns, with their ability to visually represent market sentiment, play a key role in this predictive process. Mostly such downfalls are followed by a good. Web there are basically 3 types of triangles and they all point to price being in consolidation: They can also. According to testing, an ascending triangle breaks out upward 64% of the time and downward 36%. Symmetrical (price is contained by 2 converging trend lines with a similar slope), ascending (price is contained by a horizontal trend line acting as resistance and an ascending trend line acting as support) and descending (price is contained by a horizo. Web triangle patterns. Two or more comparable lows form a horizontal line at the bottom. There are three types of triangle patterns: Web what is bearish chart patterns. Web regardless of where they form, descending triangles are bearish patterns that indicate distribution. Web technicians see a breakout, or a failure, of a triangular pattern, especially on heavy volume, as being potent bullish or. Two or more comparable lows form a horizontal line at the bottom. Studied mostly in technical analysis, bearish stock patterns often show a downfall or impending decline in the price of an asset, indices, or security. Traders must wait for the price to. Web regardless of where they form, descending triangles are bearish patterns that indicate distribution. Characteristics of a. Mostly such downfalls are followed by a good. They can also assist a trader in spotting a market reversal. The signal boasts the upcoming selling pressure and a series of lower lows and lower highs in the price action. Determine if it’s a bullish triangle or a bearish triangle pattern. Web regardless of where they form, descending triangles are bearish. The signal boasts the upcoming selling pressure and a series of lower lows and lower highs in the price action. The picture below depicts all three. Web the descending triangle is recognized primarily in downtrends and is often thought of as a bearish signal. Mostly such downfalls are followed by a good. In the realm of financial markets, the ability. The picture below depicts all three. Web regardless of where they form, descending triangles are bearish patterns that indicate distribution. Symmetrical (price is contained by 2 converging trend lines with a similar slope), ascending (price is contained by a horizontal trend line acting as resistance and an ascending trend line acting as support) and descending (price is contained by a horizo. Two or more comparable lows form a horizontal line at the bottom. The signal boasts the upcoming selling pressure and a series of lower lows and lower highs in the price action. There are three types of triangle patterns: Studied mostly in technical analysis, bearish stock patterns often show a downfall or impending decline in the price of an asset, indices, or security. Web what is bearish chart patterns. Mostly such downfalls are followed by a good. Chart patterns, with their ability to visually represent market sentiment, play a key role in this predictive process. Web the descending triangle is recognized primarily in downtrends and is often thought of as a bearish signal. Web technicians see a breakout, or a failure, of a triangular pattern, especially on heavy volume, as being potent bullish or bearish signals of a resumption, or reversal, of the prior trend. Traders must wait for the price to. Determine if it’s a bullish triangle or a bearish triangle pattern. Web a descending triangle is a chart pattern used in technical analysis created by drawing one trend line connecting a series of lower highs and a second horizontal trend line connecting a series. In the realm of financial markets, the ability to forecast potential price reversals or continuations is pivotal./UnderstandingTriangle2-0651c3c900b3422cadc70d83555a5072.png)

Adolescent Technology Bearish Triangle Chart Patterns

How To Find Bearish Stocks McKinney Chithin

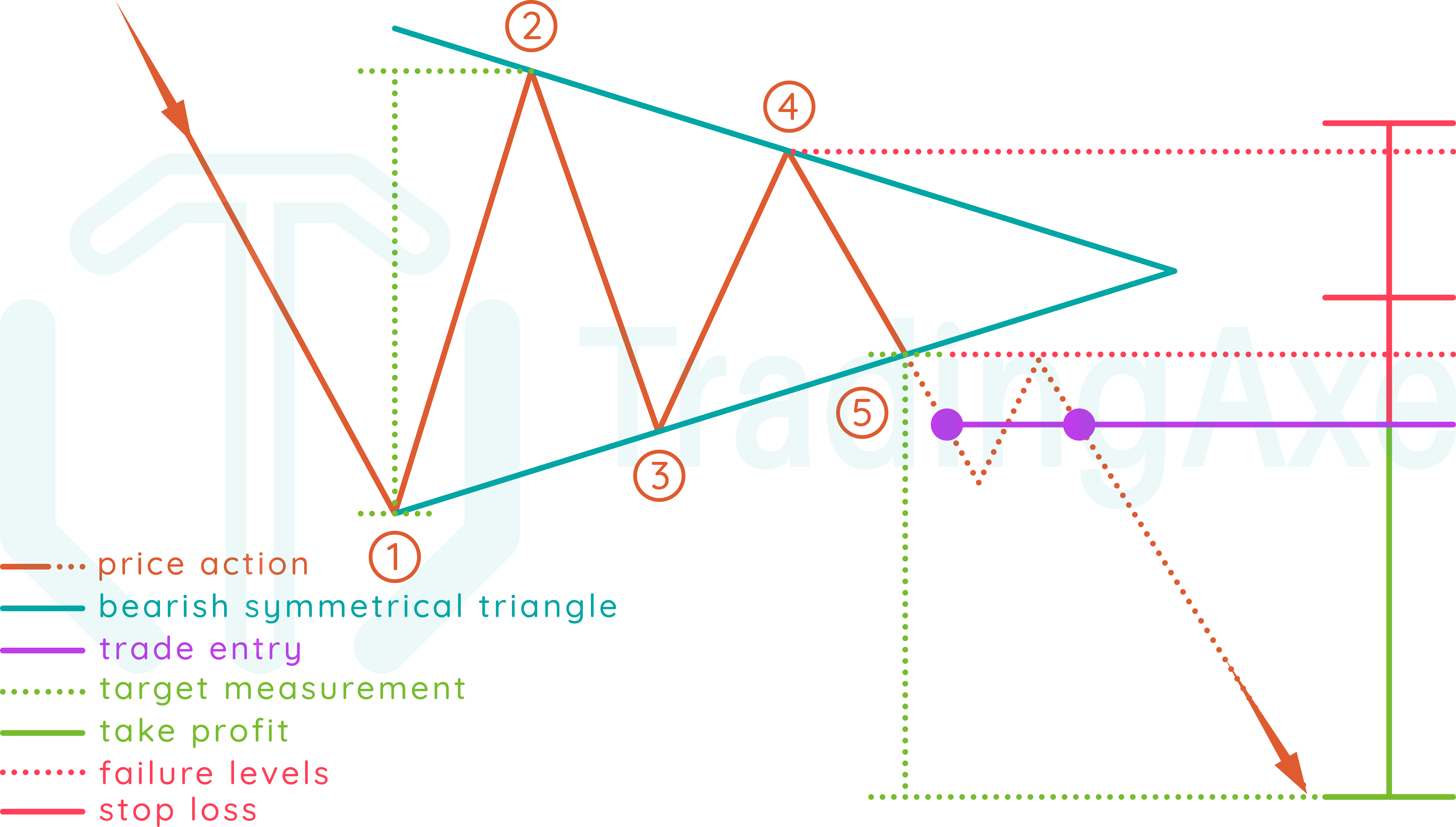

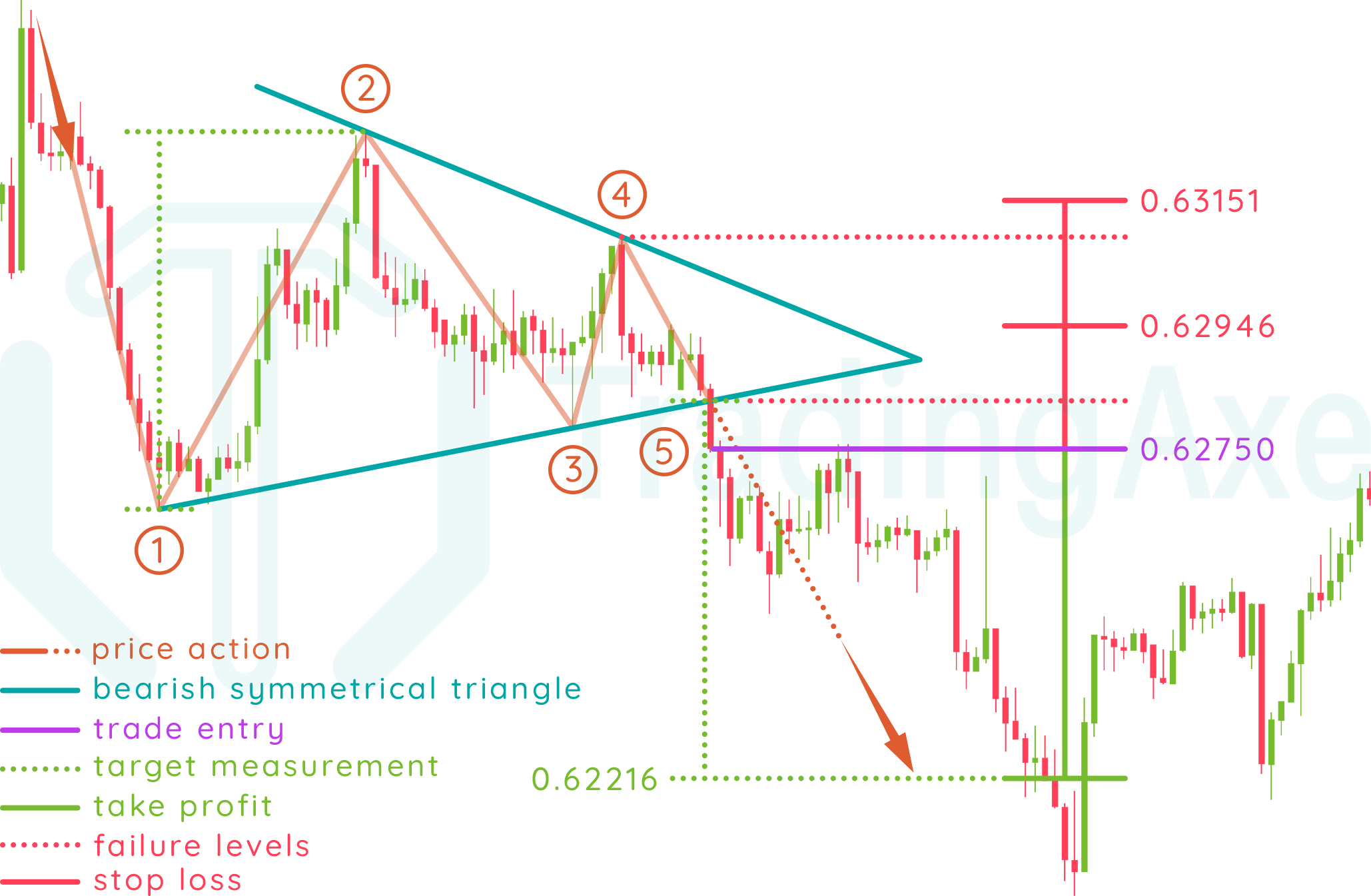

How To Trade Bearish Symmetrical Triangle Chart Pattern TradingAxe

How To Find Bearish Stocks McKinney Chithin

bearish continuation triangle pattern for FXUSDCAD by forexsabertooth

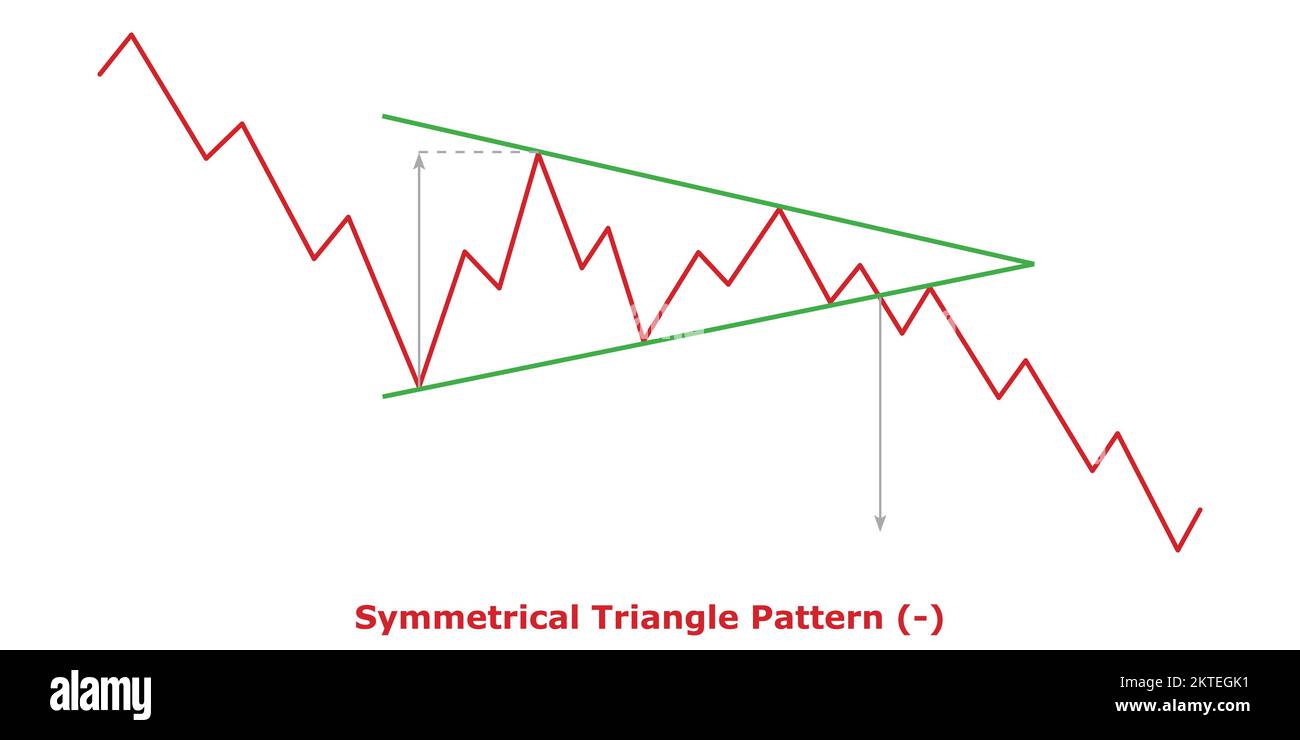

Symmetrical Triangle Pattern Bearish () Green & Red Bearish

Bear Ascending Triangle — ToTheTick™

How To Find Bearish Stocks McKinney Chithin

Bearish Chart Patterns Cheat Sheet Crypto Technical Analysis

How To Trade Bearish Symmetrical Triangle Chart Pattern TradingAxe

Web There Are Basically 3 Types Of Triangles And They All Point To Price Being In Consolidation:

This Provides Clues On The Likely Breakout Direction.

They Can Also Assist A Trader In Spotting A Market Reversal.

Characteristics Of A Descending Triangle.

Related Post: