Bearish Stock Patterns

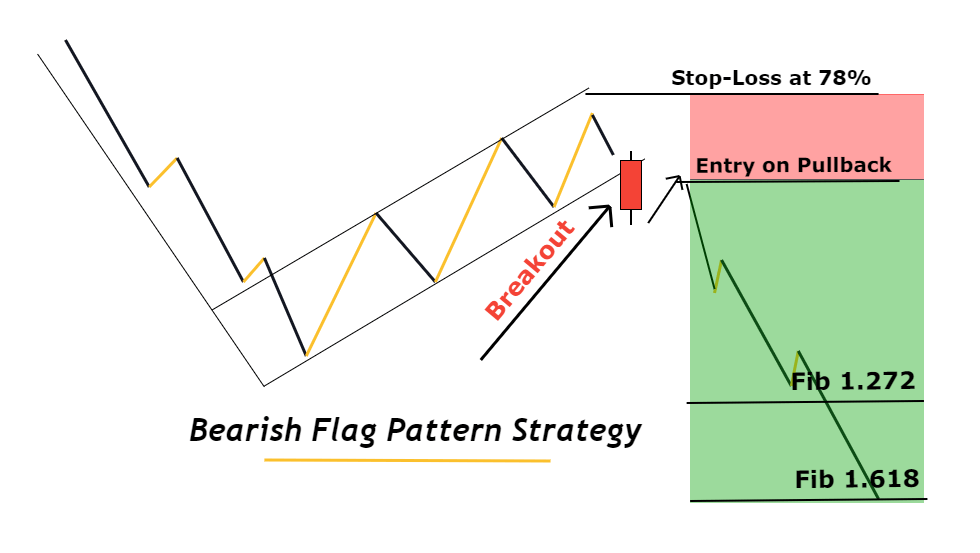

Bearish Stock Patterns - Common bearish chart patterns include flags, wedges, rectangles, and triangles. Appearing at the end of the uptrend, this bearish candlestick pattern indicates weakness in the ongoing price movement and shows that the bulls have pushed the prices up but they are not able to push further. Web there are dozens of popular bearish chart patterns. They typically tell us an exhaustion story — where bulls are giving up and bears are taking over. Bearish candlesticks tell you when selling power is coming in. In a bearish pattern, volume is falling, and a flagpole forms on the right side of the pennant. The chart setups based on fibonacci ratios are very popular as well: Hence, it is bearish and indicates selling pressure. This article will look at the different types of bearish candlestick patterns and how to use them when trading securities. This reversal pattern can mark the end of a lengthy uptrend. The first indication of an island top is a significant gap up, or sharply higher price at the open, following an upward price trend. Many of these are reversal patterns. Web the chipmaker’s gross margin rose 30.2% from the prior year’s quarter to $5.22 billion. This reversal pattern can mark the end of a lengthy uptrend. Bearish abandoned baby (3. Mcdonald’s corp (nyse:mcd) has recently formed a death cross pattern, a bearish technical signal indicating a potential downtrend. Web 📉 4 common bearish patterns. Web bearish chart patterns cheat sheet. Web a bearish pennant is a pattern that indicates a downward trend in prices. Here is list of the classic ones: Many of these are reversal patterns. Per our technical indicators, the current sentiment is bullish while the fear & greed index is showing 39 (fear).zk stock recorded 1/1 (100%) green days with 0.00% price. Web 📉 4 common bearish patterns. Web the bearish flag is a candlestick chart pattern that signals the extension of the downtrend once the temporary pause. Web some of the key bearish reversal patterns include: Bearish candlesticks tell you when selling power is coming in. Web bearish patterns in technical analysis indicate a potential fall in an asset’s value. The chart setups based on fibonacci ratios are very popular as well: It works in the same manner as a bull flag, with the only difference being. In a bearish pattern, volume is falling, and a flagpole forms on the right side of the pennant. Web bearish candlestick patterns are either a single or combination of candlesticks that usually point to lower price movements in a stock. In this edition of stockcharts tv's the final bar, dave focuses in on price pattern analysis for the s&p 500,. They signal the potential for a downtrend by revealing an increase in selling pressure and a series of lower highs and lower lows in the price action. They typically tell us an exhaustion story — where bulls are giving up and bears are taking over. Here is list of the classic ones: He also recaps earnings movers, including dis, shop,. Web there are dozens of popular bearish chart patterns. The chart setups based on fibonacci ratios are very popular as well: Appearing at the end of the uptrend, this bearish candlestick pattern indicates weakness in the ongoing price movement and shows that the bulls have pushed the prices up but they are not able to push further. In trading, a. He also recaps earnings movers, including dis, shop, and more. Web the chipmaker’s gross margin rose 30.2% from the prior year’s quarter to $5.22 billion. Web there are dozens of popular bearish chart patterns. A gravestone doji is a bearish reversal candlestick pattern that is formed when the open, low, and closing prices are all near each other with a. Many of these are reversal patterns. 📚 a gravestone doji is a bearish pattern that suggests a reversal followed by a downtrend in the price action. Web bearish stock patterns are technical analysis patterns that show an impending decline in the price of a stock or security. Many of these are reversal patterns. Web one such candlestick pattern is the. In trading, a bearish pattern is a technical chart pattern that indicates a potential trend reversal from an uptrend to a downtrend. As a continuation pattern, the bear flag helps sellers to push the price action further lower. Web a bearish pennant is a pattern that indicates a downward trend in prices. Here is list of the classic ones: Web. Some days, the bulls win. Web bearish candlesticks are one of two different candlesticks that form on stock charts: Web bearish doji star: Web a black or filled candlestick means the closing price for the period was less than the opening price; Web what are bearish stock patterns? As a continuation pattern, the bear flag helps sellers to push the price action further lower. Neutral chart patterns cheat sheet. This development comes as mcdonald’s. Web a bearish candlestick pattern is a visual representation of price movement on a trading chart that suggests a potential downward trend or price decline in an asset. The markets are a tug of war between the bulls and the bears when stock trading. Web three black crows is a phrase used to describe a bearish candlestick pattern that may predict the reversal of an uptrend. In 2023, this unit reported a hefty operating loss of $7 billion. Web each candlestick is a representation of buyers and sellers and their emotions, regardless of the underlying “value” of the stock. This article will look at the different types of bearish candlestick patterns and how to use them when trading securities. Here is list of the classic ones: Web the bearish flag is a candlestick chart pattern that signals the extension of the downtrend once the temporary pause is finished.

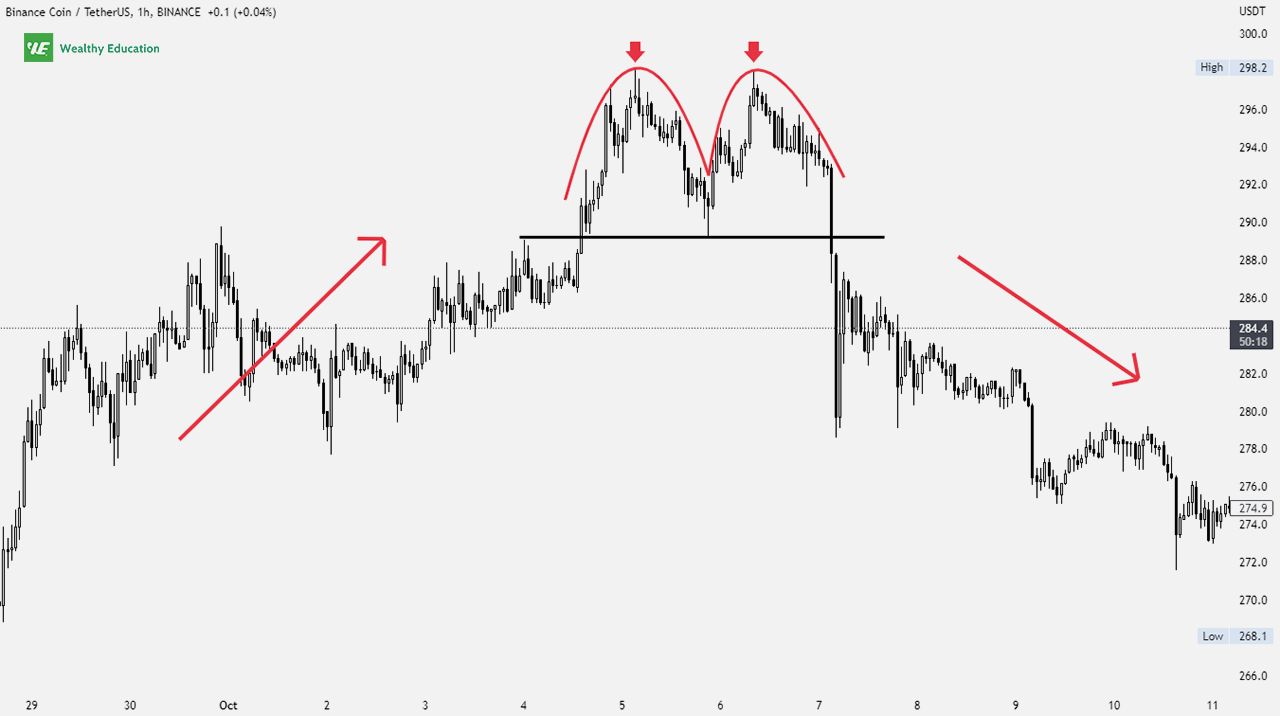

Bearish Trend Patterns Stock trading strategies, Trading charts

Top 3 Bearish Chart Patterns New Traders Should Understand Warrior

The Most Bearish Stock Patterns (2023) Rated By Experts

.png)

Bear Pennant How to Trade with a Bearish Chart Pattern Bybit Learn

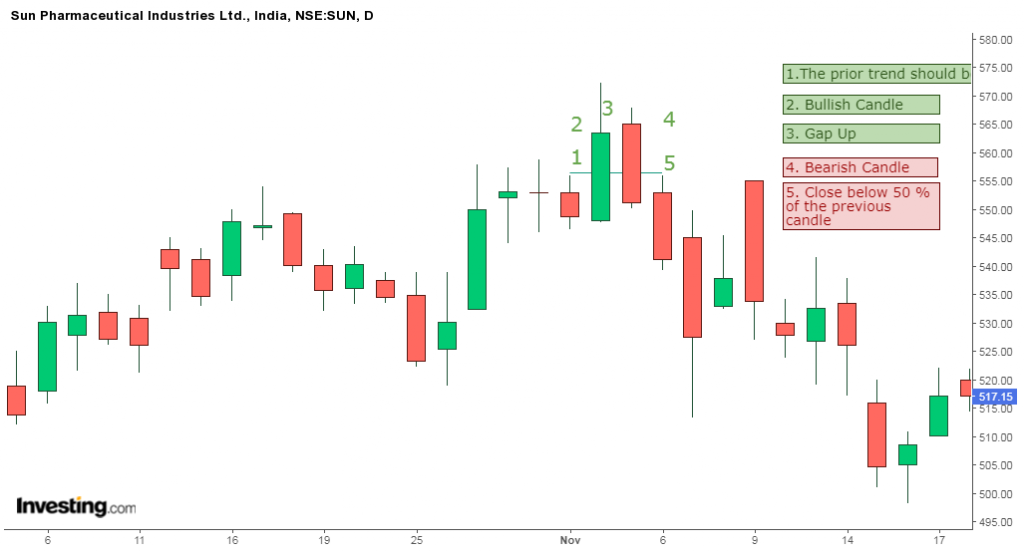

Bearish Candlestick Reversal Patterns Trading charts, Trading quotes

How To Find Bearish Stocks McKinney Chithin

Bearish Chart Patterns

5 Powerful Bearish Candlestick Patterns

Trading Forex With Reversal Candlestick Patterns » Best Forex Brokers

Bearish Flag Pattern Explained with Powerful Trading Plan ForexBee

There Are Dozens Of Popular Bearish Chart Patterns.

Candlestick Charts Show The Day's Opening, High, Low, And Closing.

Being Bearish Means That An Investor Feels That Investment Positions, Or The Market In General, Will Decline.

In This Edition Of Stockcharts Tv's The Final Bar, Dave Focuses In On Price Pattern Analysis For The S&P 500, Then Reflects On The Emergence Of Defensive Sectors Like Consumer Staples.

Related Post: