Bearish Reversal Candlestick Patterns

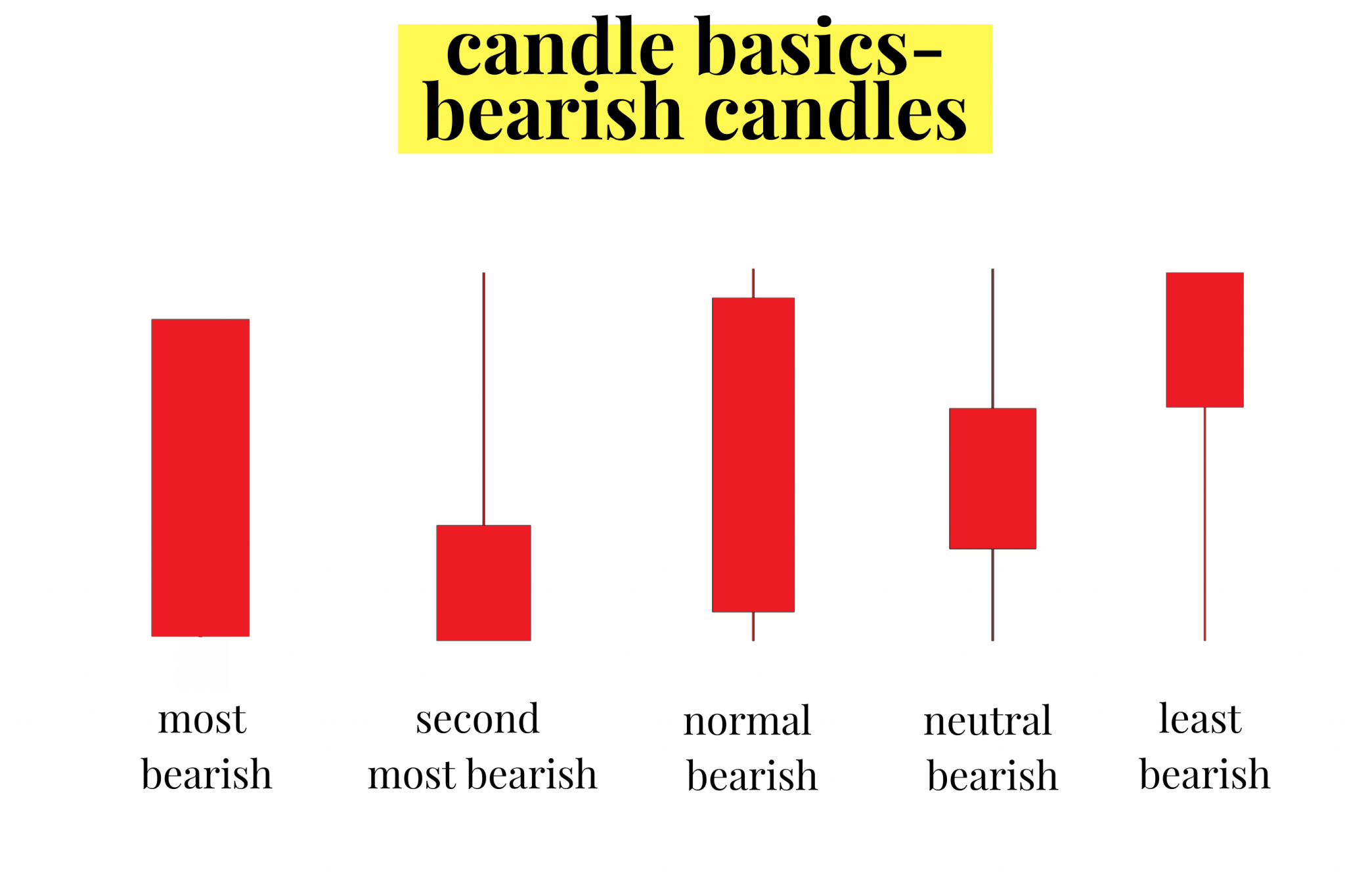

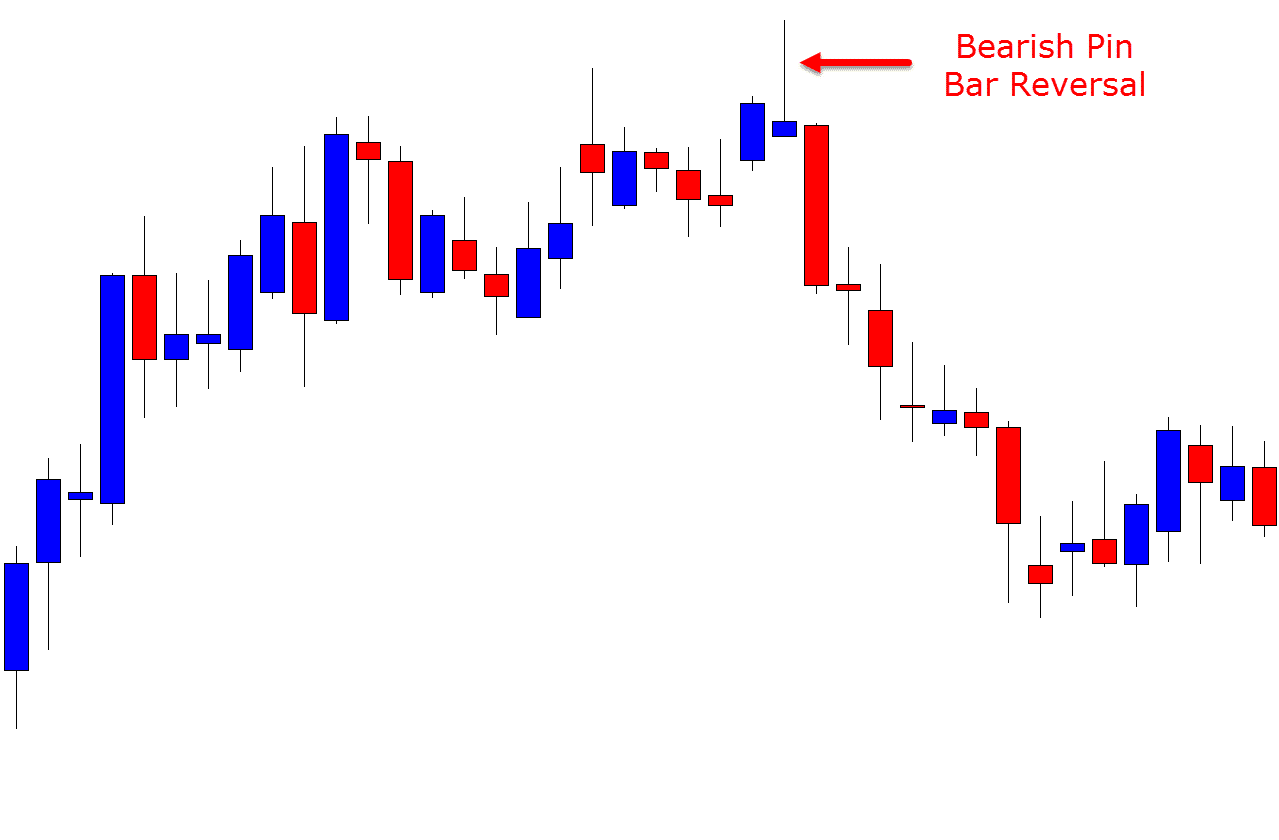

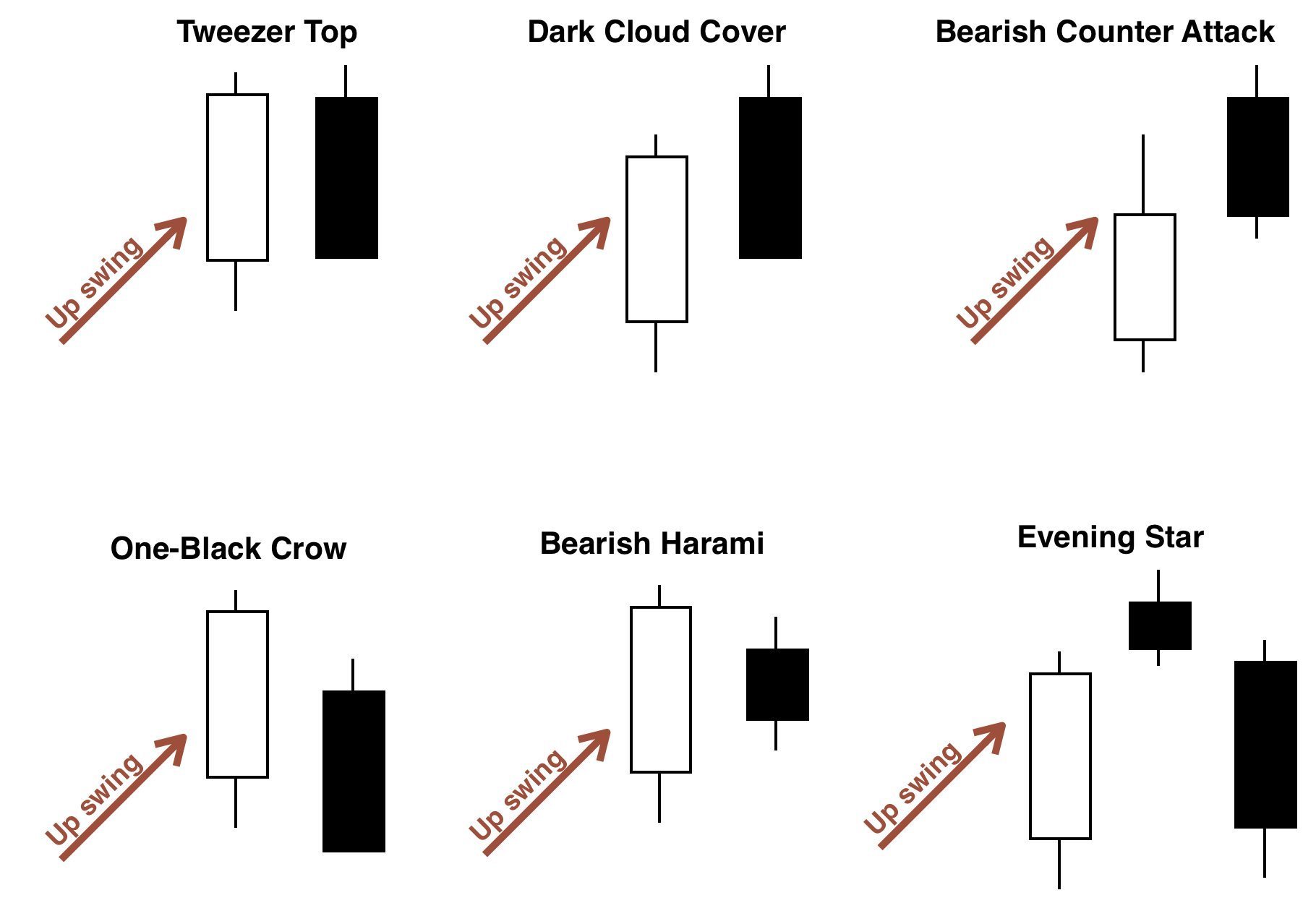

Bearish Reversal Candlestick Patterns - Therefore, traders should be on the lookout for signs of a potential reversal, such as bullish candlestick patterns, a break above key resistance levels, or a shift in trading volume indicating increased buying activity. Understand the significance of each pattern in market analysis. The actual reversal indicates that selling pressure overwhelmed buying pressure for one or more days, but it remains unclear whether or not sustained selling or lack of buyers will. Bearish reversal patterns should form at the end of an uptrend. All the range is classified into reversal and continuous pattern categories, the two types of chart patterns. It signifies a potential reversal. Web bearish reversal candlestick patterns. Bearish abandoned baby (3 candlesticks), engulfing bearish (2 candlesticks), harami bearish (2 candlesticks), dark cloud cover (2 candlesticks), evening star (3 candlesticks), and shooting star (1. This is when momentum begins to shift. As with other reversal patterns, this pattern typically occurs when price approaches a specific area of value. Information is not investment advice. Web besides, some traders use several bearish candlestick patterns to detect the seller’s domination on the market. Web a reversal candlestick pattern is a bullish or bearish reversal pattern formed by one or more candles. Stay updated with the latest trends and insights in the finance world. Bearish candlesticks come in many different forms on. They are typically red or black on stock charts. Web three black crows is a phrase used to describe a bearish candlestick pattern that may predict the reversal of an uptrend. Web updated april 10, 2024. Web a candlestick reversal pattern is a series of one to three candlesticks in a specific order. The shift can be either bullish or. The upper shadow of the candle must be at least twice the length of the candle’s body. Information is not investment advice. Bearish abandoned baby (3 candlesticks), engulfing bearish (2 candlesticks), harami bearish (2 candlesticks), dark cloud cover (2 candlesticks), evening star (3 candlesticks), and shooting star (1. This is when momentum begins to shift. Web these bearish reversal candlestick. They are typically red or black on stock charts. The upper shadow of the candle must be at least twice the length of the candle’s body. Bearish abandoned baby (3 candlesticks), engulfing bearish (2 candlesticks), harami bearish (2 candlesticks), dark cloud cover (2 candlesticks), evening star (3 candlesticks), and shooting star (1. 4.2 candlestick bearish reversal patterns. Stay updated with. They typically tell us an exhaustion story — where bulls are giving up and bears are taking over. Candlestick charts show the day's opening, high, low, and closing. And when you learn to spot them on charts, they can signal a potential change in trend direction. How to find high probability bearish reversal setups. 4.2 candlestick bearish reversal patterns. Web inverted hammer (1) morning star (3) bullish abandoned baby (3) the hammer and inverted hammer were covered in the article introduction to candlesticks. Various candlestick reversal patterns exist, but not all of them are equally strong or reliable. And when you learn to spot them on charts, they can signal a potential change in trend direction. Learn to identify. The actual reversal indicates that selling pressure overwhelmed buying pressure for one or more days, but it remains unclear whether or not sustained selling or lack of buyers will. They typically tell us an exhaustion story — where bulls are giving up and bears are taking over. They are typically red or black on stock charts. Web these bearish reversal. This article will focus on the other six patterns. And when you learn to spot them on charts, they can signal a potential change in trend direction. Web a candlestick reversal pattern is a series of one to three candlesticks in a specific order. Web 📍 bearish reversal candlestick patterns : Web shrinking candles are a bearish reversal candlestick pattern. As with other reversal patterns, this pattern typically occurs when price approaches a specific area of value. This is when momentum begins to shift. Information is not investment advice. Bearish candles show that the price of a stock is going down. And when you learn to spot them on charts, they can signal a potential change in trend direction. Web find out how bullish and bearish reversal candlestick patterns show that the market is reversing. Web updated april 10, 2024. How to find high probability bearish reversal setups. Web three black crows is a phrase used to describe a bearish candlestick pattern that may predict the reversal of an uptrend. Therefore, traders should be on the lookout for signs. Web bearish candlestick patterns are either a single or combination of candlesticks that usually point to lower price movements in a stock. Bearish candles show that the price of a stock is going down. How to understand any candlestick pattern without memorizing a single one. Candlestick pattern strength is described as either strong, reliable, or weak. Web 📍 bearish reversal candlestick patterns : They typically tell us an exhaustion story — where bulls are giving up and bears are taking over. Bearish three candle reversal pattern that forms in an up trend. Therefore, traders should be on the lookout for signs of a potential reversal, such as bullish candlestick patterns, a break above key resistance levels, or a shift in trading volume indicating increased buying activity. Learn to identify over 50 candlestick chart patterns. The shift can be either bullish or bearish. Get a definition, signals of an uptrend, and downtrend on real charts. Web these bearish reversal candlestick patterns can be single or multiple candlestick patterns. How to find high probability trend continuation setups. Bearish candlesticks come in many different forms on candlestick charts. Web shrinking candles are a bearish reversal candlestick pattern that indicates shrinking trading volume or momentum. Web in financial technical analysis, a candlestick pattern is a movement in prices shown graphically on a candlestick chart that some believe can help to identify repeating patterns of a particular market movement.

Bearish Reversal Candlestick Patterns The Forex Geek

:max_bytes(150000):strip_icc()/AdvancedCandlestickPatterns4-fa047e5b2078456998bfc730dd6d7619.png)

Advanced Candlestick Patterns

Bearish Candlestick Reversal Patterns Stock trading strategies

The Bearish Harami candlestick pattern show a strong reversal

Candlestick Patterns Explained New Trader U

What are Bearish Candlestick Patterns

Bearish candlestick cheat sheet. Don’t to SAVE Candlesticks

Bearish Reversal Candlesticks Patterns for BINANCEBTCUSDT by EXCAVO

Candlestick Patterns The Definitive Guide (2021)

Bearish Reversal Candlestick Patterns Technical Analysis

Comprising Two Consecutive Candles, The Pattern Features A Smaller.

Web A Reversal Candlestick Pattern Is A Bullish Or Bearish Reversal Pattern Formed By One Or More Candles.

Web Some Of The Key Bearish Reversal Patterns Include:

Various Candlestick Reversal Patterns Exist, But Not All Of Them Are Equally Strong Or Reliable.

Related Post: