Bearish Megaphone Pattern

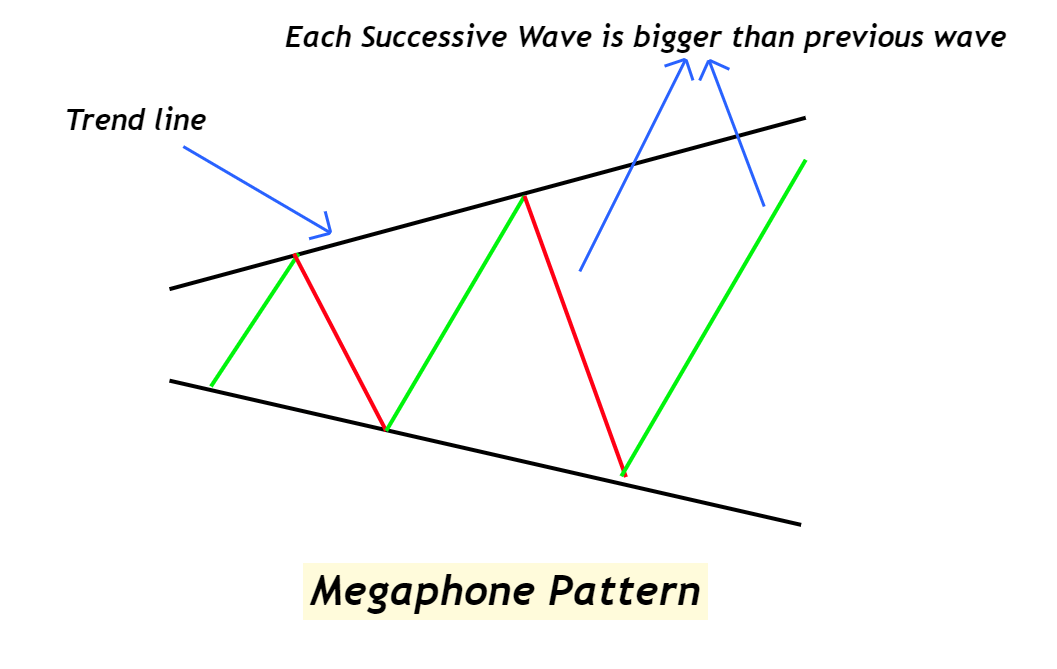

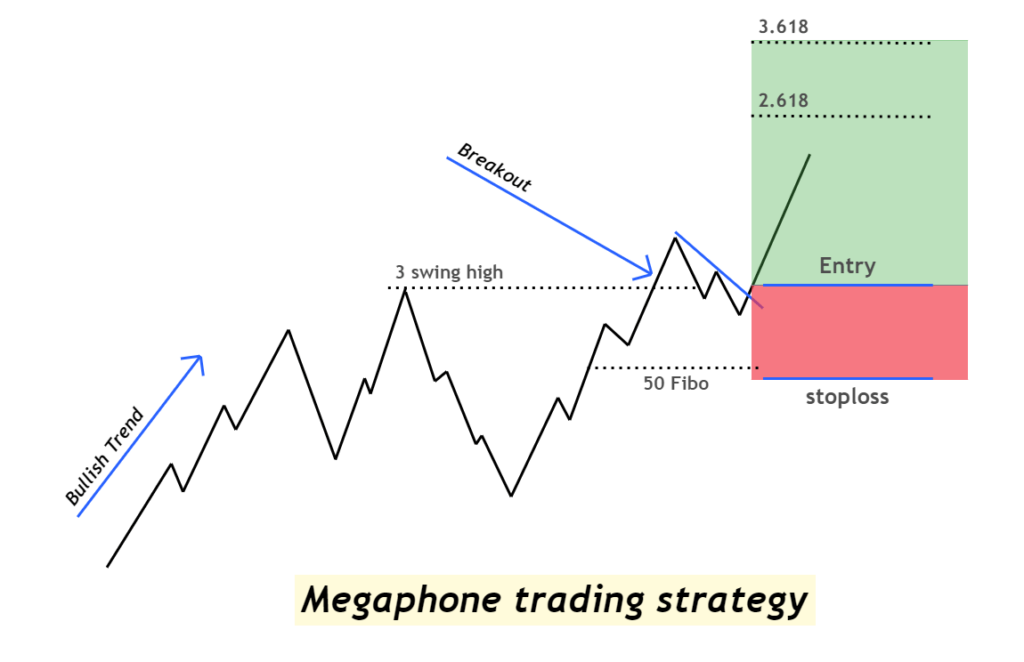

Bearish Megaphone Pattern - Web a broadening top is a unique chart pattern resembling a reverse triangle or megaphone that signals significant volatility and disagreement between bullish and bearish investors. Web learn how to identify and trade bearish chart patterns, such as the inverted cup and handle, rectangle top, head and shoulders, and more. The pattern can signal potential trend reversals or continuations, depending on the direction of the breakout or breakdown. Web a technical chart pattern recognized by analysts, known as a broadening formation or megaphone pattern, is characterized by expanding price fluctuation. Thus, it verifies the persistence of the current bullish momentum. Web a technical chart pattern recognized by analysts, known as a broadening formation or megaphone pattern, is characterized by expanding price fluctuation. Web megaphone pattern in technical analysis chart trading bullish and bearish explanation with guide!👉get my technical analysis course here: Web the megaphone pattern is a technical chart pattern commonly observed in the forex market. If the stock experiences a bearish trend (downward movement) when the megaphone chart pattern begins, it is called a bearish megaphone pattern or megaphone top. It is represented by two lines, one ascending and one descending, that diverge from each other. If the stock experiences a bearish trend (downward movement) when the megaphone chart pattern begins, it is called a bearish megaphone pattern or megaphone top. Web this pattern usually results in a breakout upwards, above the upper trend line. The pattern is considered complete when the price breaks the trendline drawn through the troughs of. Megaphone pattern is a pattern. Bullish pattern is confirmed when prices break above the upper trendline. Web megaphone pattern in technical analysis chart trading bullish and bearish explanation with guide!👉get my technical analysis course here: Web this pattern usually results in a breakout upwards, above the upper trend line. Like a triangle, but its apex slants downwards at an angle. Web a technical chart pattern. There are two types of megaphones; The price may reflect the random. Web learn how to identify and trade bearish chart patterns, such as the inverted cup and handle, rectangle top, head and shoulders, and more. Web in a bullish trend, a megaphone becomes bearish and indicates a potential reversal to the downside, while in a bearish trend, the pattern. Megaphone pattern is known to give multiple trading opportunities to the trader. Thus, it verifies the persistence of the current bullish momentum. Web learn how to identify and trade bearish chart patterns, such as the inverted cup and handle, rectangle top, head and shoulders, and more. The pattern can signal potential trend reversals or continuations, depending on the direction of. Web megaphone pattern is a pattern which consists of minimum two higher highs and two lower lows. Web the megaphone pattern is a technical chart pattern commonly observed in the forex market. Web learn what a megaphone pattern is, how to identify it, and how to trade it in a volatile market. Web learn how to identify and trade the. With a wider mouth than its top, the pattern symbolizes the unpredictable market movements and increased volatility about to. Once the price breaks the upper level, you can take the trade at the fifth swing. Bullish pattern is confirmed when prices break above the upper trendline. It is represented by two lines, one ascending and one descending, that diverge from. A megaphone pattern is a broadening formation that can be bullish or bearish, depending on the direction of the trend lines. Bullish pattern is confirmed when prices break above the upper trendline. Megaphone pattern is a pattern that consists of minimum of higher highs and two lower lows. Though often seen as bearish due to its volatility and uncertainty, its. Megaphone patterns can be observed on various timeframes, from intraday charts to weekly or even monthly ones. Web a technical chart pattern recognized by analysts, known as a broadening formation or megaphone pattern, is characterized by expanding price fluctuation. See the success rates, average price moves, and examples of each pattern in a bull market. Web megaphone pattern is a. With a wider mouth than its top, the pattern symbolizes the unpredictable market movements and increased volatility about to. The pattern is generally formed when the market is highly volatile in nature and traders are not confident about the market direction. Once the price breaks the upper level, you can take the trade at the fifth swing. Web a megaphone. It is represented by two lines, one ascending and one descending, that diverge from each other. The pattern can signal potential trend reversals or continuations, depending on the direction of the breakout or breakdown. Web when connecting these highs and lows, the trend lines form a widening pattern that looks like a megaphone or reverse symmetrical triangle. There are two. Web learn how to identify and trade the megaphone pattern, a chart formation that occurs in volatile markets. The pattern can signal potential trend reversals or continuations, depending on the direction of the breakout or breakdown. Web a technical chart pattern recognized by analysts, known as a broadening formation or megaphone pattern, is characterized by expanding price fluctuation. The price may reflect the random. Like a triangle, but its apex slants downwards at an angle. The pattern is considered complete when the price breaks the trendline drawn through the troughs of. It is also known as broadening wedge. See the success rates, average price moves, and examples of each pattern in a bull market. Generally, a megaphone top consists of three higher highs and two lower lows. The bearish megaphone occurs when the price goes below the channel. If the stock experiences a bearish trend (downward movement) when the megaphone chart pattern begins, it is called a bearish megaphone pattern or megaphone top. Web learn how to identify and trade bearish chart patterns, such as the inverted cup and handle, rectangle top, head and shoulders, and more. Megaphone pattern is a pattern that consists of minimum of higher highs and two lower lows. A megaphone pattern is a broadening formation that can be bullish or bearish, depending on the direction of the trend lines. This pattern typically occurs during times of high market volatility when traders are uncertain about the market’s direction. Web megaphone pattern is a pattern which consists of minimum two higher highs and two lower lows.

Bearish and Bullish Megaphone pattern A Complete Guide ForexBee

Bullish Megaphone & Bearish Megaphone Chart Pattern Stock Market

Bearish and Bullish Megaphone pattern A Complete Guide ForexBee

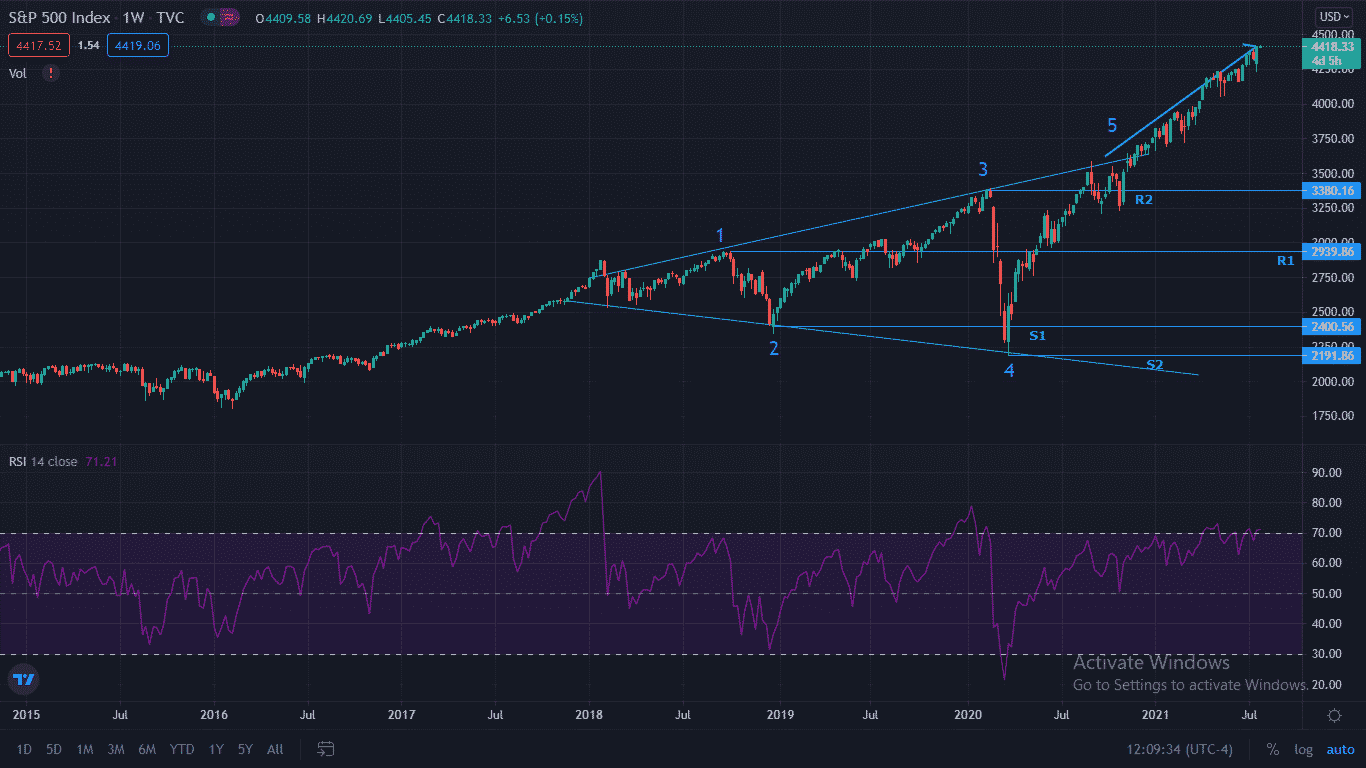

SPY A bearish Megaphone pattern may be "in play" for AMEXSPY by

Bearish Megaphone Pattern on S&P for FXSPX500 by JamesBrown — TradingView

NASDAQ Bearish Megaphone Pattern??? for by Dr

What is the Megaphone Pattern? How To Trade It.

Bearish and Bullish Megaphone pattern A Complete Guide ForexBee

Bearish Megaphone Pattern in the S&P 500? YouTube

Megaphone Pattern The Art of Trading like a Professional

Web Learn What A Megaphone Pattern Is, How To Identify It, And How To Trade It In A Volatile Market.

Normally This Pattern Is Visible When The Market Is At Its Top Or Bottom.

Web A Megaphone Top Is A Bearish Megaphone Pattern That Indicates A Possible Reversal From An Uptrend To A Downtrend Or A Continuation Of A Downtrend.

It Is Characterized By A Series Of At Least Two Higher Highs And Two Lower Lows.

Related Post: