Bearish Harmonic Pattern

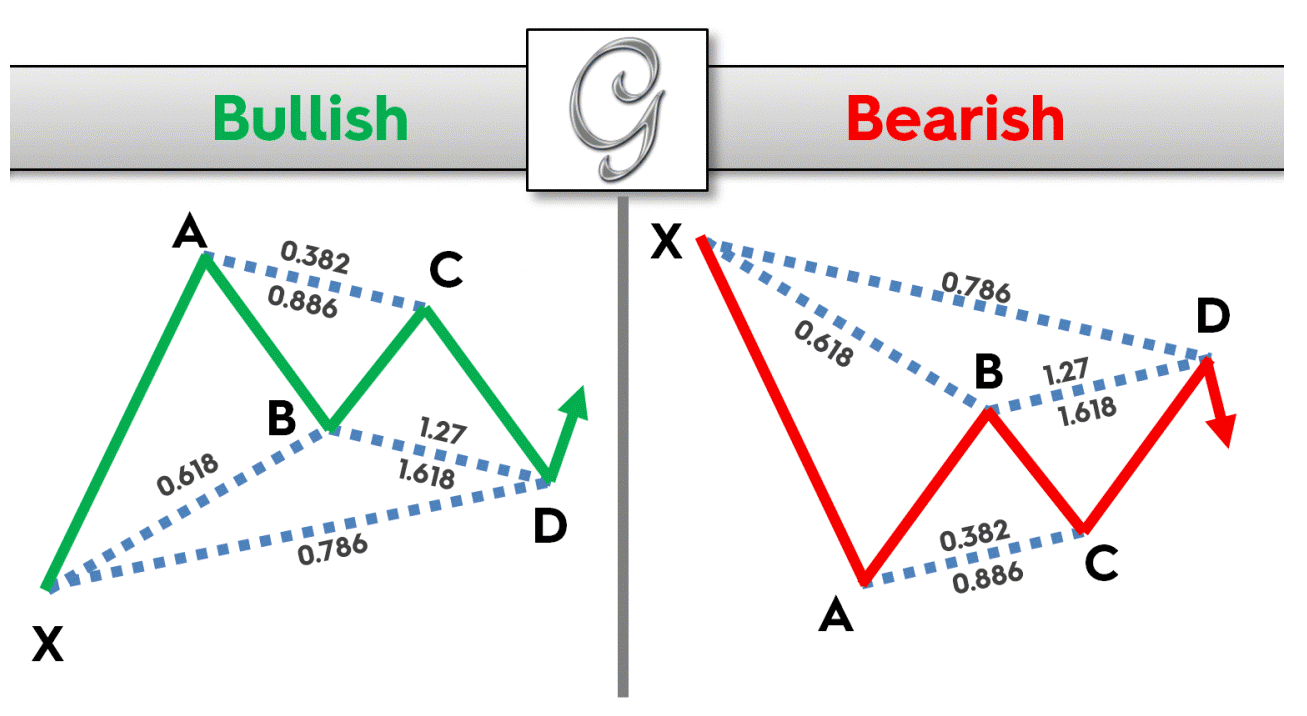

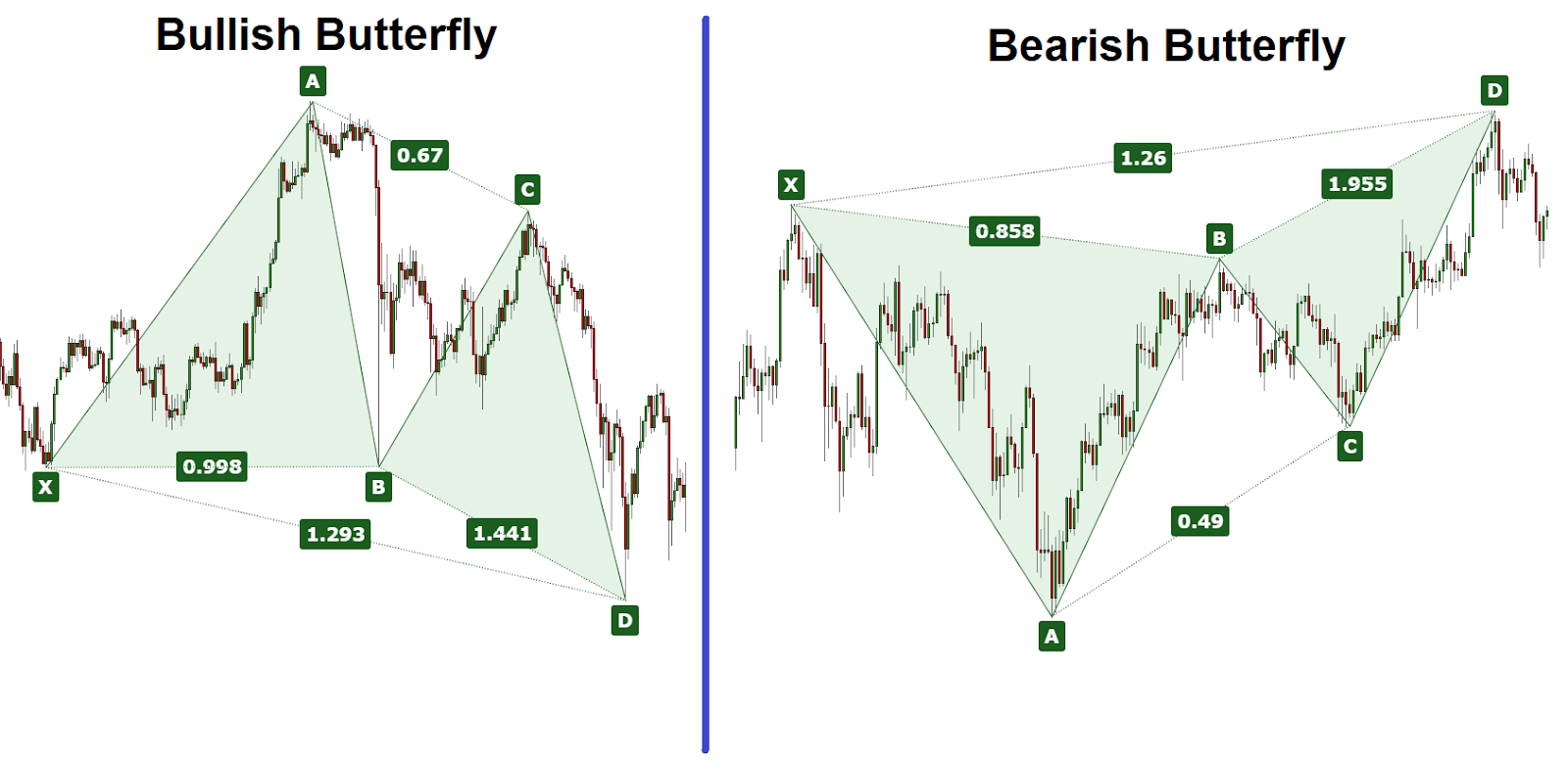

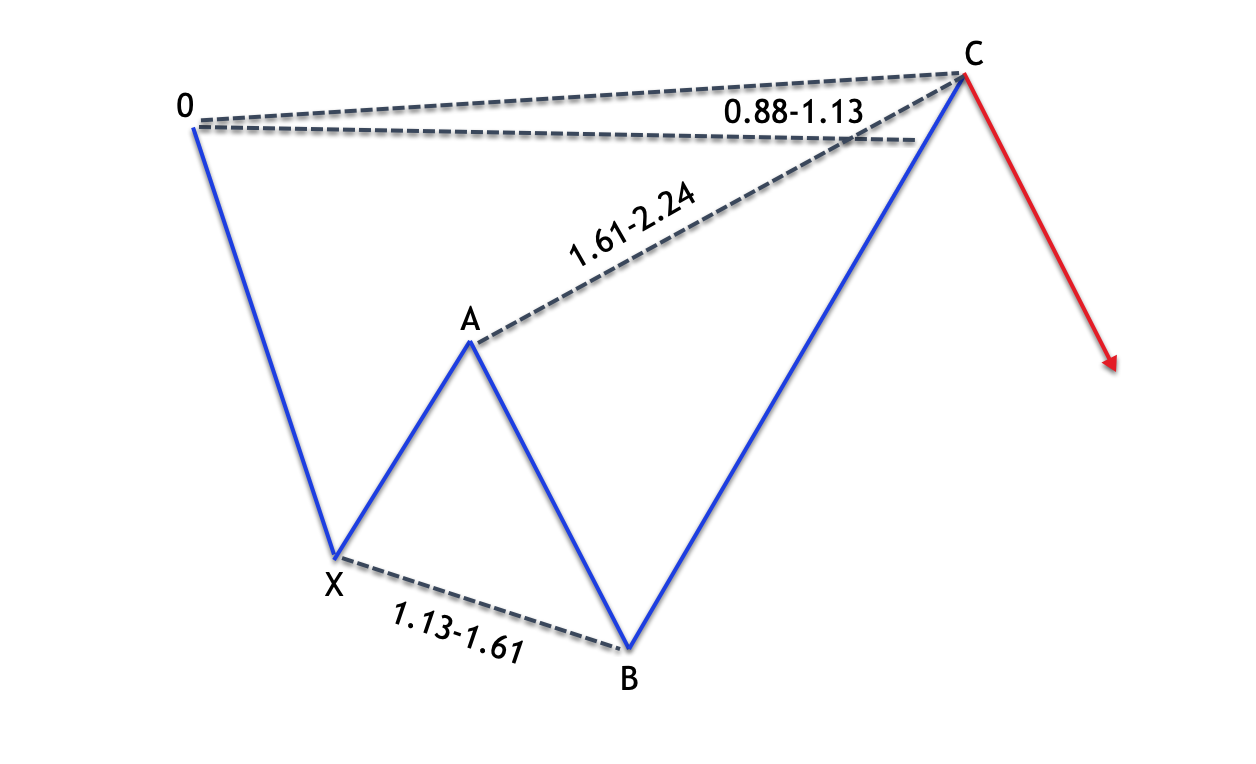

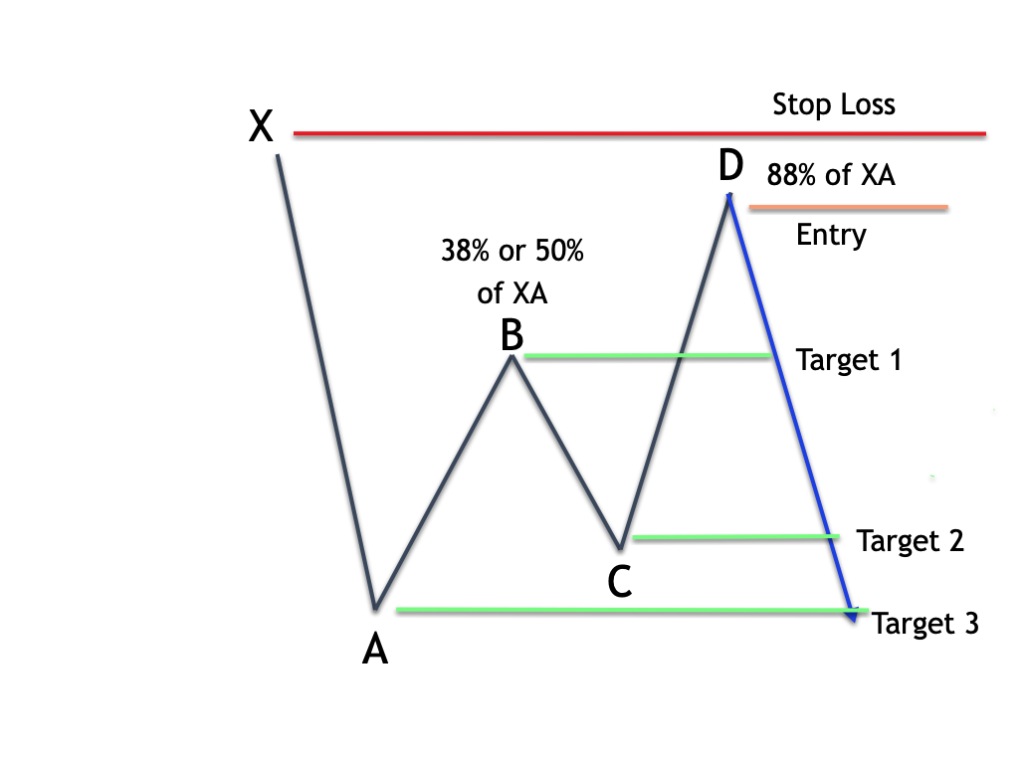

Bearish Harmonic Pattern - Ab represents a motion upward, bc represents a move downward, and cd represents a wave upward. Web harmonic patterns are used by traders to help predict future market movements. The pattern incorporates the 0.886xa retracement, as the defining element in the potential reversal zone (prz). Web harmonic patterns make use of fibonacci and geometric ratios and do have some awkward geometric shapes that tend to determine where the price might reverse. Point d represents where traders will watch for a decline in price, which explains why it is a bearish pattern. Bearish harmonic patterns indicate a possible downturn in the market. The ab leg should end between 38.2% and 50%, signaling a strong initial trend. The simple cypher pattern trading method is using its points as profit targets, meaning the b, a, and c levels. The shark pattern can be bullish or bearish, depending on the direction the pattern is facing, and it may indicate a potential complete trend reversal or a pullback. Identified by scott carney in 2001, the bat pattern is made up of precise elements that identify przs. Besides being a bullish pattern, the triple bottom is combined. A bearish pattern follows a price decline from point x to point a. You can trade using harmonic patterns by opening a trading account with us. Web the bat pattern™, is a precise harmonic pattern™ discovered by scott carney in 2001. Web the exploration of bearish harmonic pattern in trading. As a rule, the last wave is the longest, so the fibonacci extension is built on it. At the root of the methodology is the primary ratio, or. The pattern shows trade entry, stop and target levels from “d” levels using the “xa” leg. A bearish harami is a trend indicated by a large candlestick followed by a much smaller. Web example of a bearish harmonic pattern. Millions of americans were able to see the magical glow of the northern lights on friday night when a powerful geomagnetic storm reached earth. The pattern shows trade entry, stop and target levels from “d” levels using the “xa” leg. So, in general, a breakdown from it is the most likely scenario. Web. Web the descending triangle in which shib trades is a bearish pattern. Web the bat pattern™, is a precise harmonic pattern™ discovered by scott carney in 2001. Differently put, the c point is always lower than the a point. The cypher harmonic pattern is a technical analysis indicator used by traders to identify valuable support and resistance levels based on. Bearish harmonic patterns indicate a possible downturn in the market. These patterns, infused with the mathematical precision of fibonacci numbers, offer a framework for anticipating and strategizing around potential market. 1) wait for 0 leg to a leg (bearish trend) then 2) wait for a leg to b leg (bullish pullback back upwards, but not above a price) then 3). Bearish harmonic patterns indicate a possible downturn in the market. Bullish harmonic patterns indicate a possible upturn in the market. The bat utilizes a minimum 1.618bc projection. One of the major ways to differentiate it from a cypher pattern is the b point which, if it doesn’t go above the 50. May 11, 2024 / 8:24 pm edt / cbs. Point d illustrates where traders would look for a price decrease, explaining why it is a. The harmonic patterns scanner is designed to. Each has a bullish and bearish variant, meaning when the formation is upside down, it may imply a rise or decline in price. One of the major ways to differentiate it from a cypher pattern is the. Point d illustrates where traders would look for a price decrease, explaining why it is a. The bat harmonic pattern follows different fibonacci ratios. The cypher harmonic pattern is a technical analysis indicator used by traders to identify valuable support and resistance levels based on the fibonacci sequence of numbers and detect trend reversals. Web harmonic patterns make use of. Traders can take a bearish or a bullish approach. Web the shark pattern can be either bullish or bearish. In this way, bullish and bearish patterns may. However, there are signs pointing to the contrary. The bat utilizes a minimum 1.618bc projection. In this way, bullish and bearish patterns may. Harmonic formations may suggest reversals or the end of a pullback in price. There are many different harmonic patterns, but some are more popular. Web harmonic patterns are used by traders to help predict future market movements. The ratios are the same, except the pattern starts with a price decline from x. The below example is taken from our auto. May 11, 2024 / 8:24 pm edt / cbs news. Point d represents where traders will watch for a decline in price, which explains why it is a bearish pattern. One of the major ways to differentiate it from a cypher pattern is the b point which, if it doesn’t go above the 50. Web a bearish harmonic pattern is present during an uptrend. Besides being a bullish pattern, the triple bottom is combined. The shark pattern can be bullish or bearish, depending on the direction the pattern is facing, and it may indicate a potential complete trend reversal or a pullback. Bullish harmonic patterns indicate a possible upturn in the market. The red section on the chart highlights the bearish harmonic pattern. At the root of the methodology is the primary ratio, or. A great example of a bearish harmonic pattern is the butterfly pattern which forms when the price drops from x to a. Point d illustrates where traders would look for a price decrease, explaining why it is a. You can trade using harmonic patterns by opening a trading account with us. Web example of a bearish harmonic pattern. The targets for the shark are chosen by analogy with. The b point retracement must be less than a 0.618, preferably a 0.50 or 0.382 of the xa leg.

Bearish Harmonic Pattern GBPJPY (Daily) for FXGBPJPY by safri

The Forex Harmonic Patterns Guide ForexBoat Trading Academy

Bearish shark trading harmonic patterns Vector Image

Harmonic Patterns An Introduction to Harmonic Trading Investar Blog

How to Identify & Trade Harmonic Butterfly Pattern for Profits Bybit

Bearish Harmonic Pattern Trading Strategy Step By Step Guide YouTube

How To Trade The Harmonic Shark Pattern Forex Training Group

Bearish abcd trading harmonic patterns Vector Image

Tips For Trading The Harmonic Bat Pattern Forex Training Group

How to Trade Bearish Cypher Harmonic PatternsCypher Pattern Best Forex

Set A Take Profit Target.

Tradingview Has A Smart Drawing Tool That Allows Users To Visually Identify This Price Pattern On A Chart.

Lastly, You Need To Locate Profit Targets.

Web Top Harmonic Patterns.

Related Post: