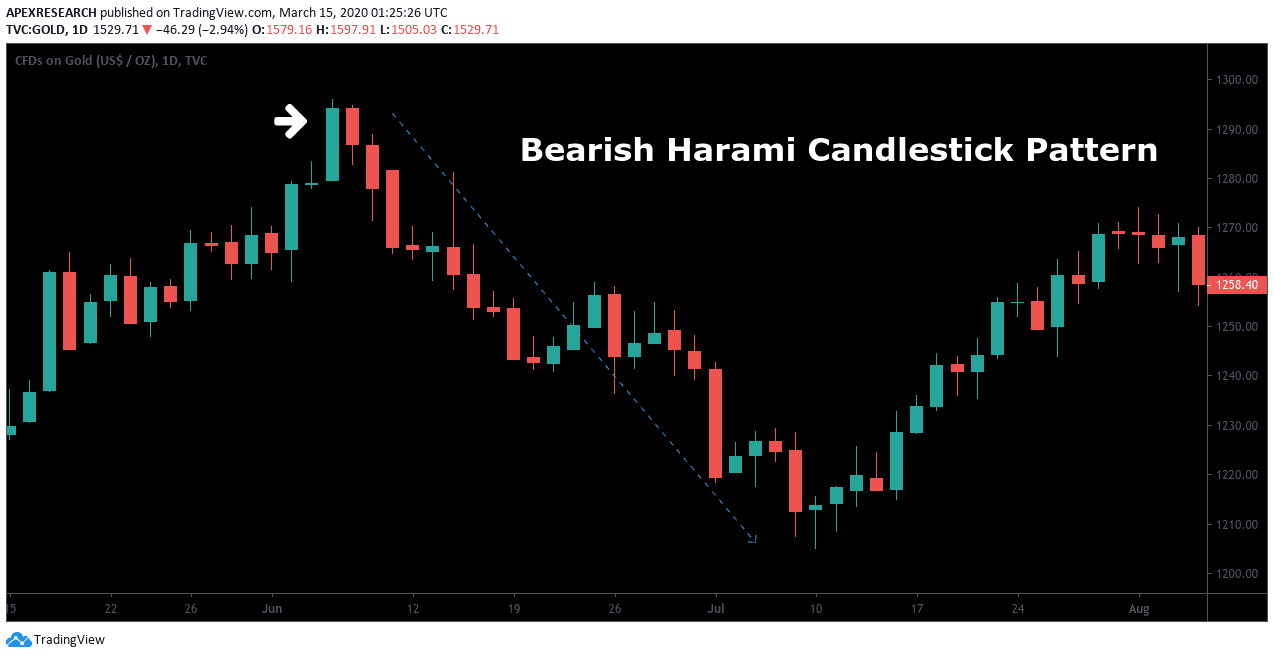

Bearish Harami Candlestick Pattern

Bearish Harami Candlestick Pattern - If the second candle is a doji, this pattern is classified as a harami cross. The real body of the candle on day 2 will be well within the real body of day 1 candle. Learn how to quickly spot the bearish harami on chart and how to trade it. Stay updated with the latest trends and insights in the finance world. Considered a reversal signal when it appears at the top. This pattern is generally formed at the top of the price chart. Web a bullish harami is a basic candlestick chart pattern indicating that a bearish stock market trend may be reversing. Learn to identify over 50 candlestick chart patterns. White candle, long white candle, white marubozu, opening white marubozu, closing white marubozu. Important bearish reversal candlestick patterns to know. It may benefit traders and technical analysts seeking to spot selling opportunities. The second candle must be small and bearish. Stay updated with the latest trends and insights in the finance world. It looks like this on your charts: This pattern consists of a large bullish candlestick (green candle) followed by a doji candlestick. Web the bearish harami candlestick pattern is a bearish reversal candlestick pattern, that converts an uptrend into a downtrend, but all bearish harami candlestick patterns cannot convert. The second candle must be small and bearish. The second candle is inside the body of the first candle. White candle, long white candle, white marubozu, opening white marubozu, closing white marubozu. This. The second candle is inside the body of the first candle. White candle, long white candle, white marubozu, opening white marubozu, closing white marubozu. Web the harami patterns are trend reversal patterns, meaning that their appearance during a prevailing trend may indicate a potential reversal in the direction. Web a bearish harami is a two bar japanese candlestick pattern that. Web the bearish harami candlestick pattern is formed by two candles. Harami candlestick patterns are a type of reversal pattern, where there are bullish and bearish equivalents. Web the bearish harami is a popular forex trend reversal and continuation pattern. A bearish harami usually appears at the end of bullish trends and indicates a possible upcoming reversal. The real body. A bearish harami candlestick is formed when there is a large bullish candle on day 1 and is followed by a smaller bearish candle on day 2. Web a bullish harami is a basic candlestick chart pattern indicating that a bearish stock market trend may be reversing. It may benefit traders and technical analysts seeking to spot selling opportunities. Harami. The real body of the candle on day 2 will be well within the real body of day 1 candle. Stay updated with the latest trends and insights in the finance world. This pattern consists of a large bullish candlestick (green candle) followed by a doji candlestick. Web a bullish harami is a basic candlestick chart pattern indicating that a. Web what is bearish harami pattern? Bearish harami cross a large white body followed by a doji. The anatomy of a bearish harami. Understand the significance of each pattern in market analysis. The second candle must be small and bearish. Web a bearish harami is formed when there is a large bullish candle on day 1 and is followed by a smaller bearish candle on day 2. Web in financial technical analysis, a candlestick pattern is a movement in prices shown graphically on a candlestick chart that some believe can help to identify repeating patterns of a particular market movement.. A bearish harami usually appears at the end of bullish trends and indicates a possible upcoming reversal. White candle, long white candle, white marubozu, opening white marubozu, closing white marubozu. Web the harami candlestick pattern can signal both bullish and bearish indications as seen below: An important aspect of the bearish harami is that prices should gap down on day. Web a bearish harami cross pattern is a bearish reversal candlestick pattern that consists of two candlesticks. Web the bearish harami is a popular forex trend reversal and continuation pattern. The pattern consists of a long white candle followed by a small black. A bearish reversal candlestick pattern is a sequence of price actions or a pattern, that signals a. This pattern is generally formed at the top of the price chart. Web a bearish harami is a two bar japanese candlestick pattern that suggests prices may soon reverse to the downside. It consists of a large red candle and a smaller green body candle fully engulfed by the first. It is formed when the market is trending upwards, but then the bears take control and push the price down. It is characterized by a large bullish candle followed by a small bearish candle, in which the bearish candle is wholly contained within the range of the bullish candle. Learn to identify over 50 candlestick chart patterns. The first candle must be bullish and have a big body. A bearish harami usually appears at the end of bullish trends and indicates a possible upcoming reversal. Understand the significance of each pattern in market analysis. Traders keen on recognizing trend changes often turn to this pattern for valuable insights into market dynamics. The second candle must be small and bearish. The story it tells is one of bullish conviction swiftly fading. Here’s how to identify the bearish harami candlestick pattern: The bearish harami is a bearish reversal pattern in candlestick analysis. Web the bearish harami is a popular forex trend reversal and continuation pattern. A bearish harami candlestick is formed when there is a large bullish candle on day 1 and is followed by a smaller bearish candle on day 2.

Bearish Harami Candle Stick Pattern

Harami Candlestick Patterns A Trader’s Guide

The Bearish Harami candlestick pattern show a strong reversal

How to Use Bullish and Bearish Harami Candles to Find Trend Reversals

The Bearish Harami candlestick pattern show a strong reversal

What Is Bearish Harami Pattern? How To Identify And Use It In Trading

Harami Candlestick Chart Pattern (Bearish and Bullish)

Bearish Harami Candlestick Pattern Technical Analysis Tools by Margex

What Is Bearish Harami Pattern? How To Identify And Use It In Trading

How to Trade with the Bearish Harami

The Bearish Harami Pattern Has The Opposite Setup And Functions Compared To The Bullish Harami.

Web A Bearish Harami Is Formed When There Is A Large Bullish Candle On Day 1 And Is Followed By A Smaller Bearish Candle On Day 2.

It May Benefit Traders And Technical Analysts Seeking To Spot Selling Opportunities.

The Anatomy Of A Bearish Harami.

Related Post: