Bearish Hammer Candlestick Pattern

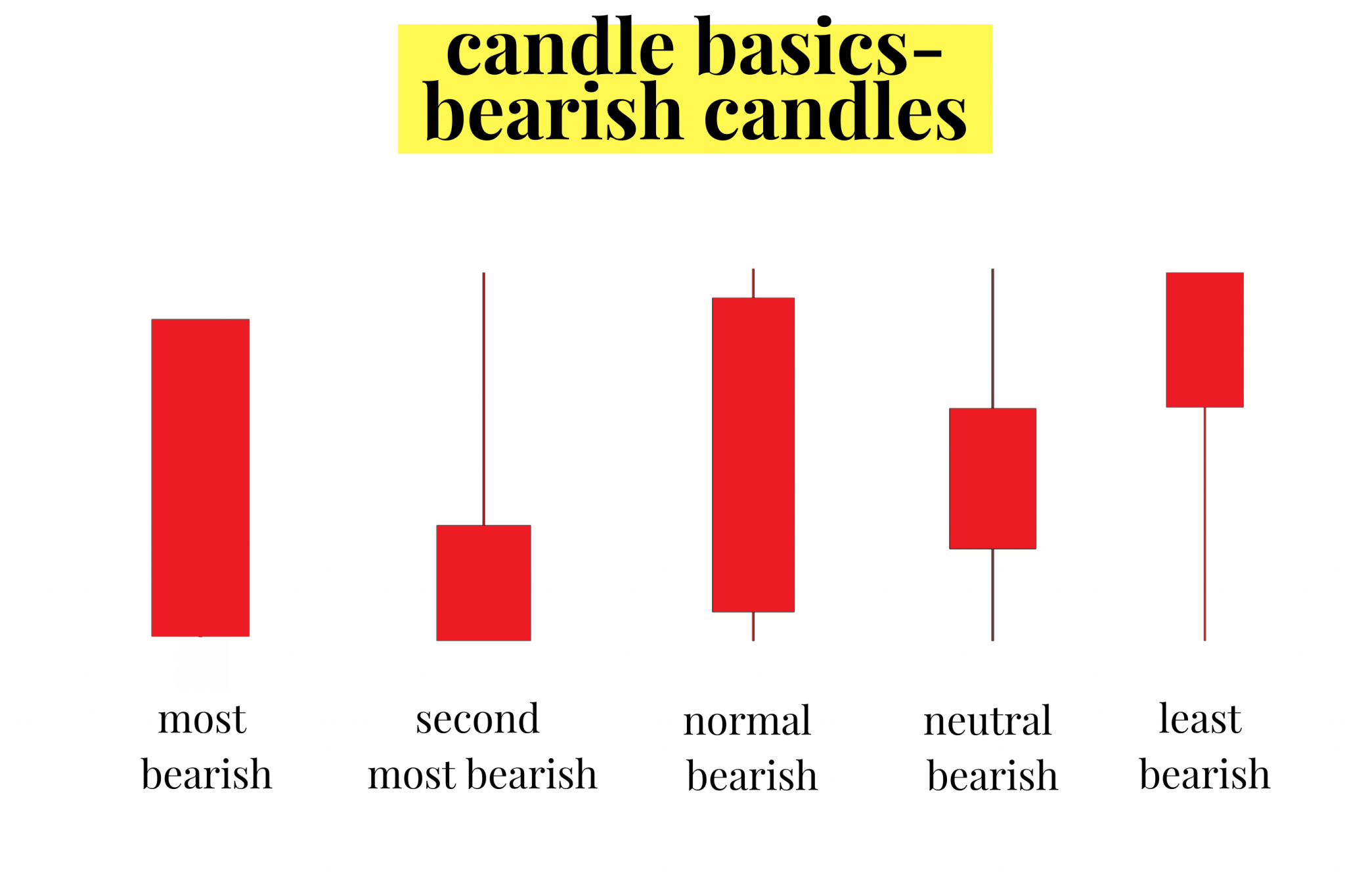

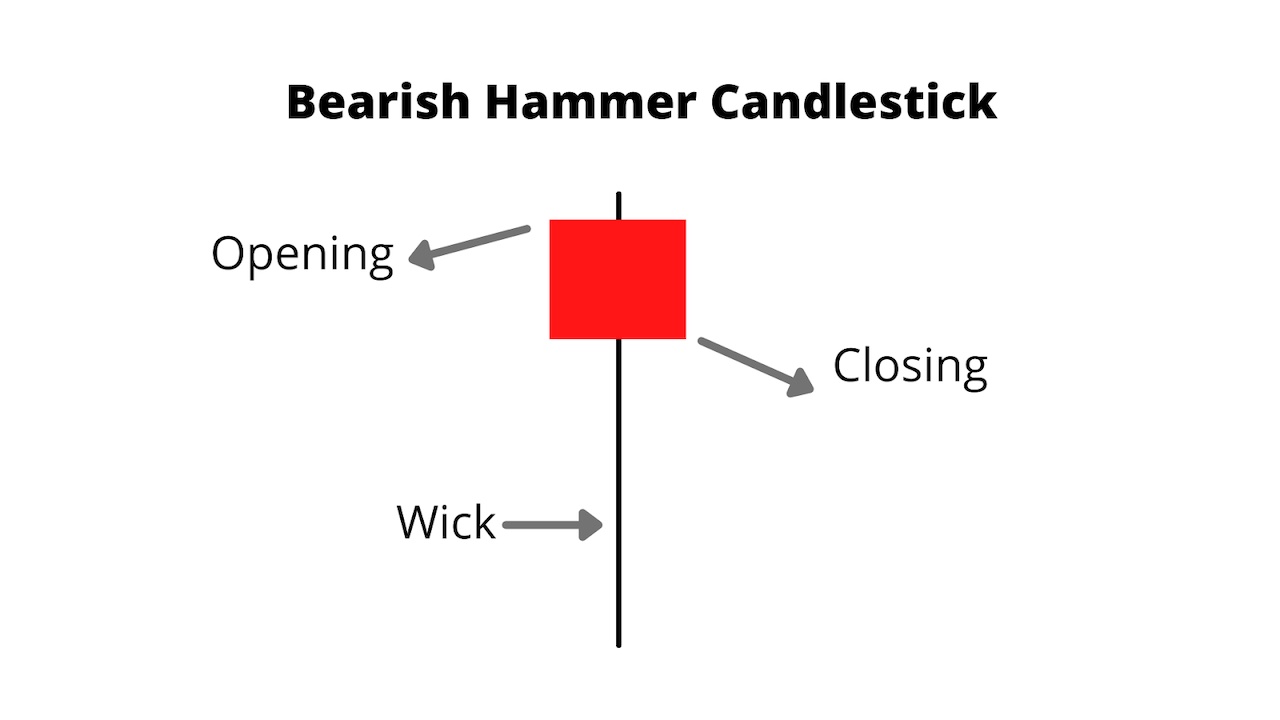

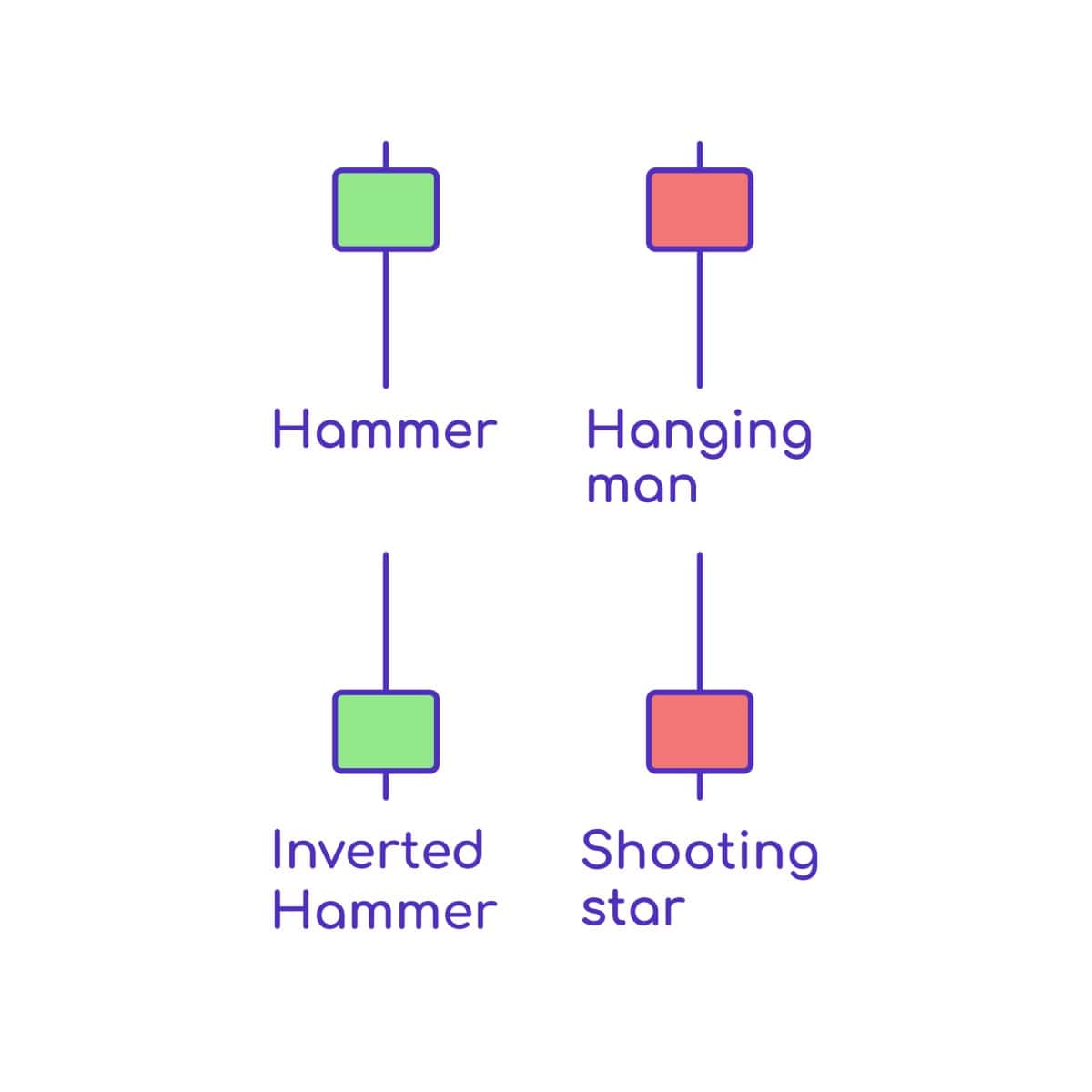

Bearish Hammer Candlestick Pattern - Important bullish reversal candlestick patterns to know. What is a hammer candlestick pattern? Web what is a bearish reversal candlestick pattern? It’s crucial that traders understand that there is more to the. There are also bullish candlesticks. It's a hint that the market's sentiment might be shifting from selling to buying. It has a small real body positioned at the top of the candlestick range and a long lower shadow that is at least twice the height of the real body. Important bearish reversal candlestick patterns to know. Bearish candlesticks come in many different forms on candlestick charts. What does the inverted hammer look like? A bearish reversal candlestick pattern is a sequence of price actions or a pattern, that signals a potential change from uptrend to downtrend. They are typically red or black on stock charts. It's a hint that the market's sentiment might be shifting from selling to buying. Web a bullish hammer pattern (green candle) supports the outlook for long positions while. Web the bearish hammer, also known as a hanging man, is a single candlestick pattern that forms after an advance in price. Not only in crypto but also in stocks, indices, bonds, and forex trading. Web the hammer candlestick formation is viewed as a bullish reversal candlestick pattern that mainly occurs at the bottom of downtrends. The hammer helps traders. Web a hammer candle or candlestick is a widely recognized chart pattern that can be used by forex traders to identify potential bullish or bearish trend reversals. Web a bullish hammer pattern (green candle) supports the outlook for long positions while a bearish hammer pattern (red candle) supports the outlook for short positions. Important bullish reversal candlestick patterns to know.. There are also bullish candlesticks. Web bearish candlestick patterns are either a single or combination of candlesticks that usually point to lower price movements in a stock. Fact checked by lucien bechard. Web what is the hammer candlestick pattern? It manifests as a single candlestick pattern appearing at the bottom of a downtrend and signals a potential bullish reversal. Web a hammer candle or candlestick is a widely recognized chart pattern that can be used by forex traders to identify potential bullish or bearish trend reversals. Web the inverted hammer candlestick formation occurs mainly at the bottom of downtrends and can act as a warning of a potential bullish reversal pattern. The hammer helps traders visualize where support and. As an alternative variation on these themes, the structure of the hammer pattern can also be turned upside down to form an inverted hammer. They typically tell us an exhaustion story — where bulls are giving up and bears are taking over. Many of these are reversal patterns. Understand the significance of each pattern in market analysis. It's a hint. A hammer shows that although there were selling pressures during the day, ultimately a strong buying pressure drove the price back up. Web bearish candlestick patterns are either a single or combination of candlesticks that usually point to lower price movements in a stock. They typically tell us an exhaustion story — where bulls are giving up and bears are. This article will focus on the famous hammer candlestick pattern. Stay updated with the latest trends and insights in the finance world. Web the hammer candlestick is a significant pattern in the realm of technical analysis , vital for predicting potential price reversals in markets. Learn to identify over 50 candlestick chart patterns. Web the hammer candlestick formation is viewed. It’s a bullish reversal candlestick pattern, which indicates the end of a downtrend and the start of a new uptrend. There are dozens of bullish reversal candlestick patterns. The hammer candle is another japanese candlestick pattern among these 35 powerful candlestick patterns. It's a hint that the market sentiment may be shifting from buying to selling. Web there are 42. What happens on the next day after the inverted hammer pattern is what gives traders an idea as to whether or not prices will go higher or lower. A hammer shows that although there were selling pressures during the day, ultimately a strong buying pressure drove the price back up. Web what is the hammer candlestick pattern? It’s crucial that. It manifests as a single candlestick pattern appearing at the bottom of a downtrend and signals a potential bullish reversal. Learn to identify over 50 candlestick chart patterns. A hammer shows that although there were selling pressures during the day, ultimately a strong buying pressure drove the price back up. This article will focus on the famous hammer candlestick pattern. Not only in crypto but also in stocks, indices, bonds, and forex trading. It's a hint that the market's sentiment might be shifting from selling to buying. Web the bearish hammer, also known as a hanging man, is a single candlestick pattern that forms after an advance in price. Web what is a bearish reversal candlestick pattern? It’s crucial that traders understand that there is more to the. Below you can find the schemes and explanations of the most common reversal candlestick patterns. Web a hammer is a price pattern in candlestick charting that occurs when a security trades significantly lower than its opening, but rallies within the period to close near the opening price. Web bearish candlestick patterns are either a single or combination of candlesticks that usually point to lower price movements in a stock. What does the inverted hammer look like? The hammer candle is another japanese candlestick pattern among these 35 powerful candlestick patterns. Web there are 42 recognized patterns that can be split into simple and complex patterns. Important bullish reversal candlestick patterns to know.

What is a Hammer Candlestick Pattern? (2023)

Candlestick Patterns Explained New Trader U

What is a Hammer Candlestick Chart Pattern? NinjaTrader

Is A Hammer Bullish Or Bearish Candle Stick Trading Pattern

What Is Hammer Candlestick? 2 Ways To Trade With This Pattern

What is a Hammer Candlestick Chart Pattern? NinjaTrader

Hammer Candlestick Example & How To Use 2023

Mastering the Hammer Candlestick Pattern A StepbyStep Guide to

15 Candlestick Patterns Every Trader Should Know Entri Blog

The Hammer Candlestick Pattern Identifying Price Reversals

Fact Checked By Lucien Bechard.

They Are Typically Red Or Black On Stock Charts.

The Pattern Gets Its Name Due To Its Very Close Resemblance To A Hammer That Has Been Inverted.

Web A Bullish Hammer Pattern (Green Candle) Supports The Outlook For Long Positions While A Bearish Hammer Pattern (Red Candle) Supports The Outlook For Short Positions.

Related Post: