Bearish Engulfing Pattern

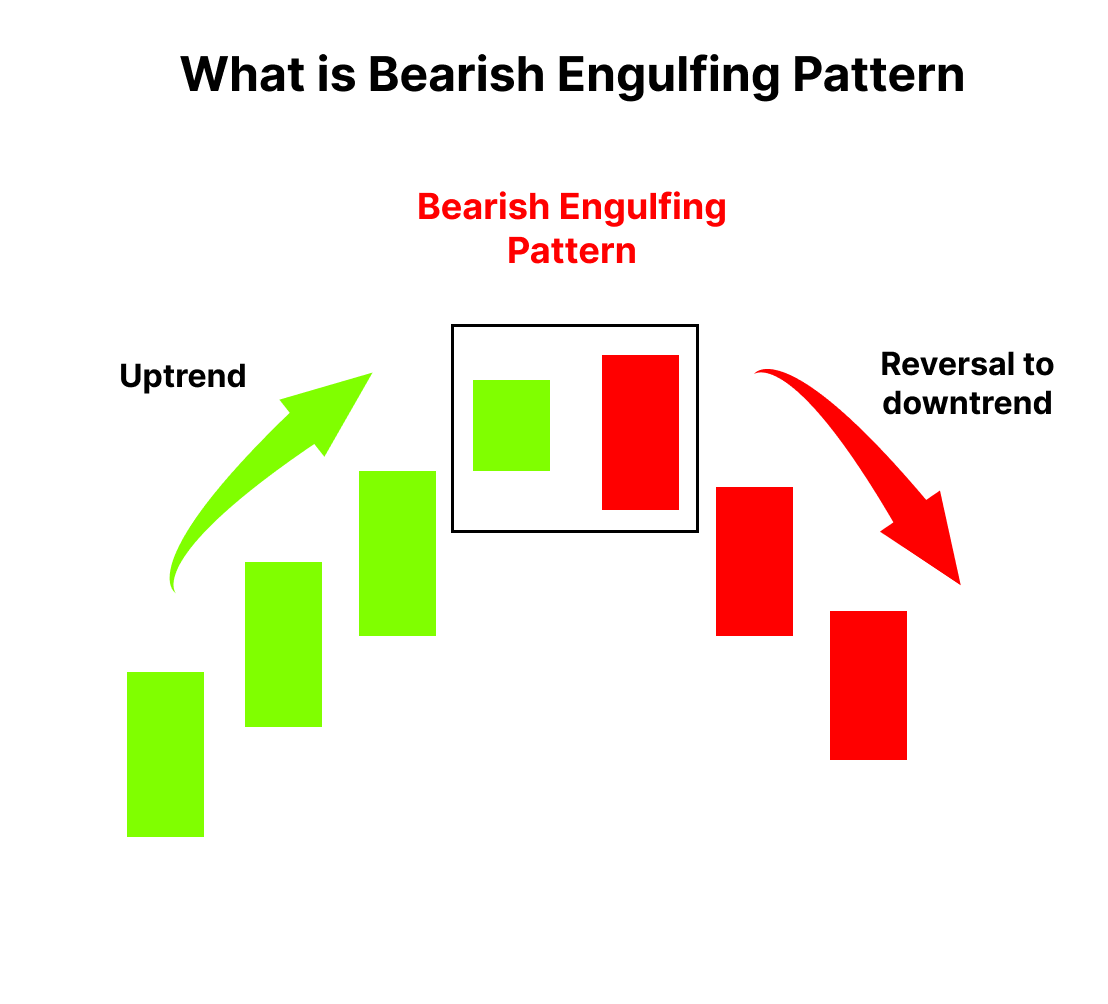

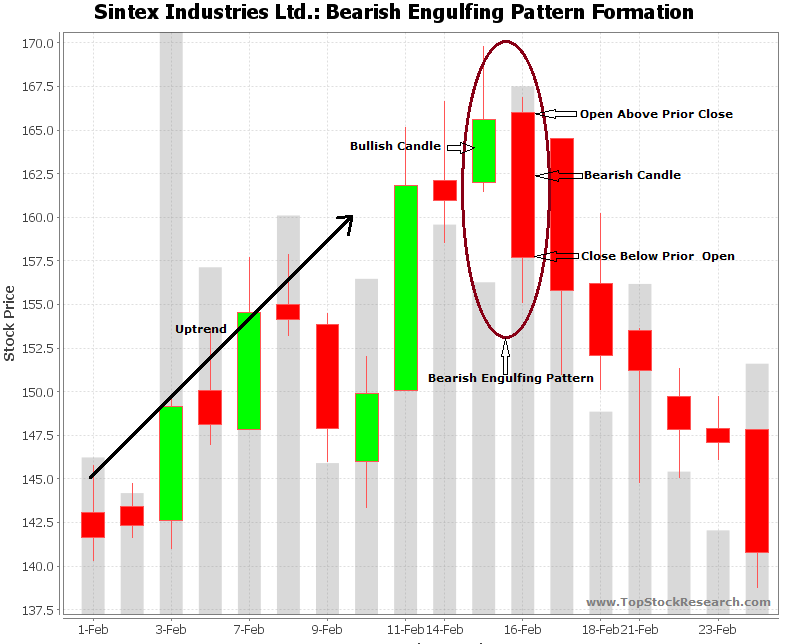

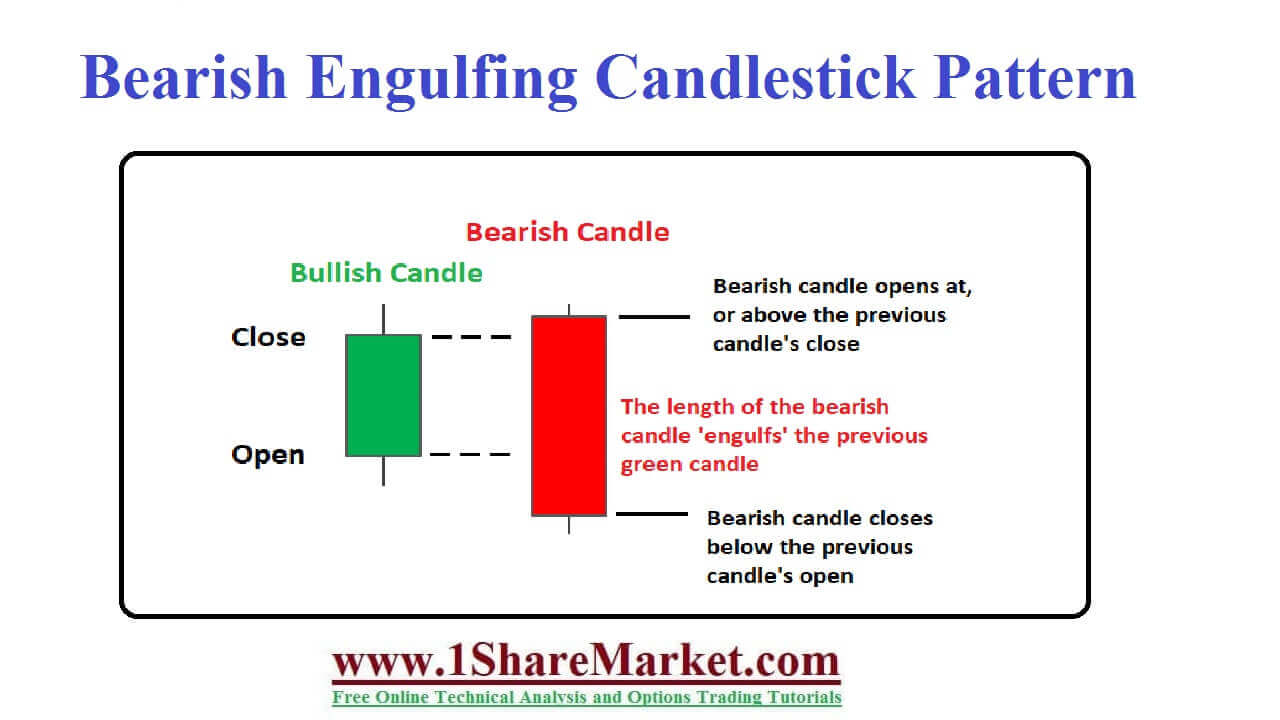

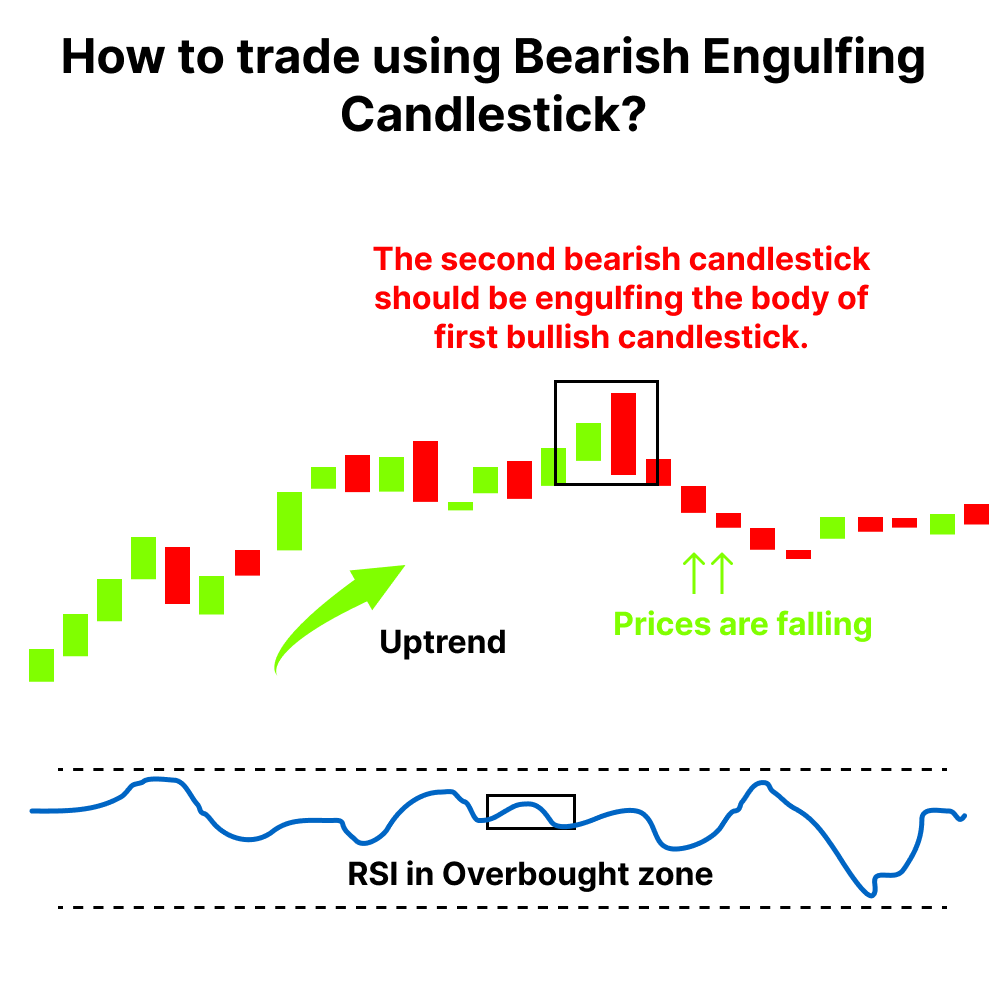

Bearish Engulfing Pattern - Web the bearish engulfing pattern consists of two candles. A smaller bullish candle followed by a larger bearish one, signifying a potential shift in market sentiment from buying to selling. A bearish candle engulfs the body of the previous bullish candle: Most patterns require further bearish confirmation. The first bearish engulfing candle has a bullish close. Web a bearish engulfing pattern is the opposite of a bullish engulfing pattern and occurs when a small bullish candle is followed by a larger bearish candle that completely engulfs the previous candle. The pattern consists of two candlesticks: Consequently, the stock may experience a downward, or bearish, movement in the near future. Web by leo smigel. The bearish engulfing pattern is a crucial technical analysis tool used in predicting a forthcoming reversal of a bullish trend in the market. Most patterns require further bearish confirmation. Bearish reversal patterns should form within an uptrend. Engulfing bearish pattern is a reversal pattern usually found at the end of a given uptrend and consists of two candles. Web by leo smigel. First one is a small upward candle followed by large bearish candle. The body of the second candle completely “covers” the body first candle (without taking into consideration the shadow) Web this technical pattern, characterized by a red candlestick engulfing the preceding bullish candlestick, is widely regarded as one of the most bearish signals in the market, indicating a potential. Web the bearish engulfing pattern consists of two candles. During the first. Web the bearish engulfing pattern is formed when the market trades higher than the previous day’s high, only for prices to reverse and close below the previous day's low. Web the bearish engulfing pattern consists of two candles. Smaller bullish candle (day 1) The pattern is characterized by the bearish candle that fully engulfs the body of the preceding bearish. A bearish engulfing pattern occurs after a price moves higher and indicates. The bearish engulfing pattern indicates a potential reversal of investor sentiment and is suggestive of a stock having reached the upper limits of its value. History shows traditional bearish engulfing methods have a negative edge in all markets tested. During the first day, this candlestick pattern uses a. Greater than equal to 1 day ago. Web why does a bearish engulfing pattern matter? Web the bearish engulfing candlestick is a technical analysis tool used by traders to identify potential trend reversals from an uptrend to a downtrend. #bearishengulfing#chartpattern#trading#chartpattern#nse#bse#stockmarket bearish engulfing candlestick pattern. Web in order to deem a pattern as bearish engulfing, the following points must hold: Web by leo smigel. A bearish engulfing pattern occurs after a price moves higher and indicates. To find all bearish engulfing for mc 500 cr. Web the bearish engulfing pattern is formed when the market trades higher than the previous day’s high, only for prices to reverse and close below the previous day's low. Web a bearish engulfing pattern consists. This pattern is often seen as a signal that a bearish trend is likely to continue as the sellers have gained control and are pushing the price lower. A bullish engulfing candlestick pattern occurs at the end of a downtrend. The appearance of a bearish engulfing pattern after an uptrend. The pattern consists of two candlesticks: Web why does a. A bearish candle engulfs the body of the previous bullish candle: Web engulfing, bearish (2) harami, bearish (2) dark cloud cover (2) evening star (3) shooting star (1) it is important to remember the following guidelines relating to bearish reversal patterns: First one is a small upward candle followed by large bearish candle. Web in order to deem a pattern. Web what is a bearish engulfing pattern? First one is a small upward candle followed by large bearish candle. A bearish candle engulfs the body of the previous bullish candle: Web this technical pattern, characterized by a red candlestick engulfing the preceding bullish candlestick, is widely regarded as one of the most bearish signals in the market, indicating a potential.. Web why does a bearish engulfing pattern matter? Bearish reversal patterns should form within an uptrend. Here’s the pattern deconstructed into its key elements: The appearance of a bearish engulfing pattern after an uptrend. Web by leo smigel. #bearishengulfing#chartpattern#trading#chartpattern#nse#bse#stockmarket bearish engulfing candlestick pattern. Greater than equal to 1 day ago. Web screen tutorial flipcharts download. The first candle of the pattern should be bullish, affirming buyers in control. Web a bearish engulfing pattern consists of two candlesticks that form near resistance levels where the second bearish candle engulfs the smaller first bullish candle. Web a bearish engulfing pattern is the opposite of a bullish engulfing pattern and occurs when a small bullish candle is followed by a larger bearish candle that completely engulfs the previous candle. Here’s the pattern deconstructed into its key elements: The pattern consists of two candlesticks: Engulfing bearish pattern is a reversal pattern usually found at the end of a given uptrend and consists of two candles. Engulfing patterns are made up of multiple candles, and are aptly named as one candle engulfs the previous candles. A bearish engulfing pattern occurs after a price moves higher and indicates. Less than equal to 1 day ago. A smaller bullish candle followed by a larger bearish one, signifying a potential shift in market sentiment from buying to selling. The bearish candle must absorbs completely the previous one formed during the uptrend. Web bullish and bearish engulfing candlestick patterns are powerful reversal formations that generate a signal of a potential reversal. This pattern is often seen as a signal that a bearish trend is likely to continue as the sellers have gained control and are pushing the price lower.

Bearish Engulfing Pattern Meaning, Example & Limitations Finschool

How to trade the engulfing candlestick pattern Pro Trading School

What Is Bearish Engulfing Candle Pattern? Meaning And Trading Strategy

Bearish Engulfing Candlestick Pattern Example 9

Bearish engulfing candlestick pattern with Advantages and limitation

How To Trade Forex With The Bearish Engulfing Candlestick Pattern

How to Use Bearish Engulfing Candlestick Pattern Olymp Trade Wiki

Bearish Engulfing Candlestick Pattern PDF Guide

How To Trade The Bearish Engulfing Candle

Bearish Engulfing Pattern Meaning, Example & Limitations Finschool

History Shows Traditional Bearish Engulfing Methods Have A Negative Edge In All Markets Tested.

The First Bearish Engulfing Candle Has A Bullish Close.

The First Line Can Be Any White Basic Candle, Appearing Both As A Long Or A Short Line.

To Find All Bearish Engulfing For Mc 500 Cr.

Related Post: