Bearish Candlestick Patterns

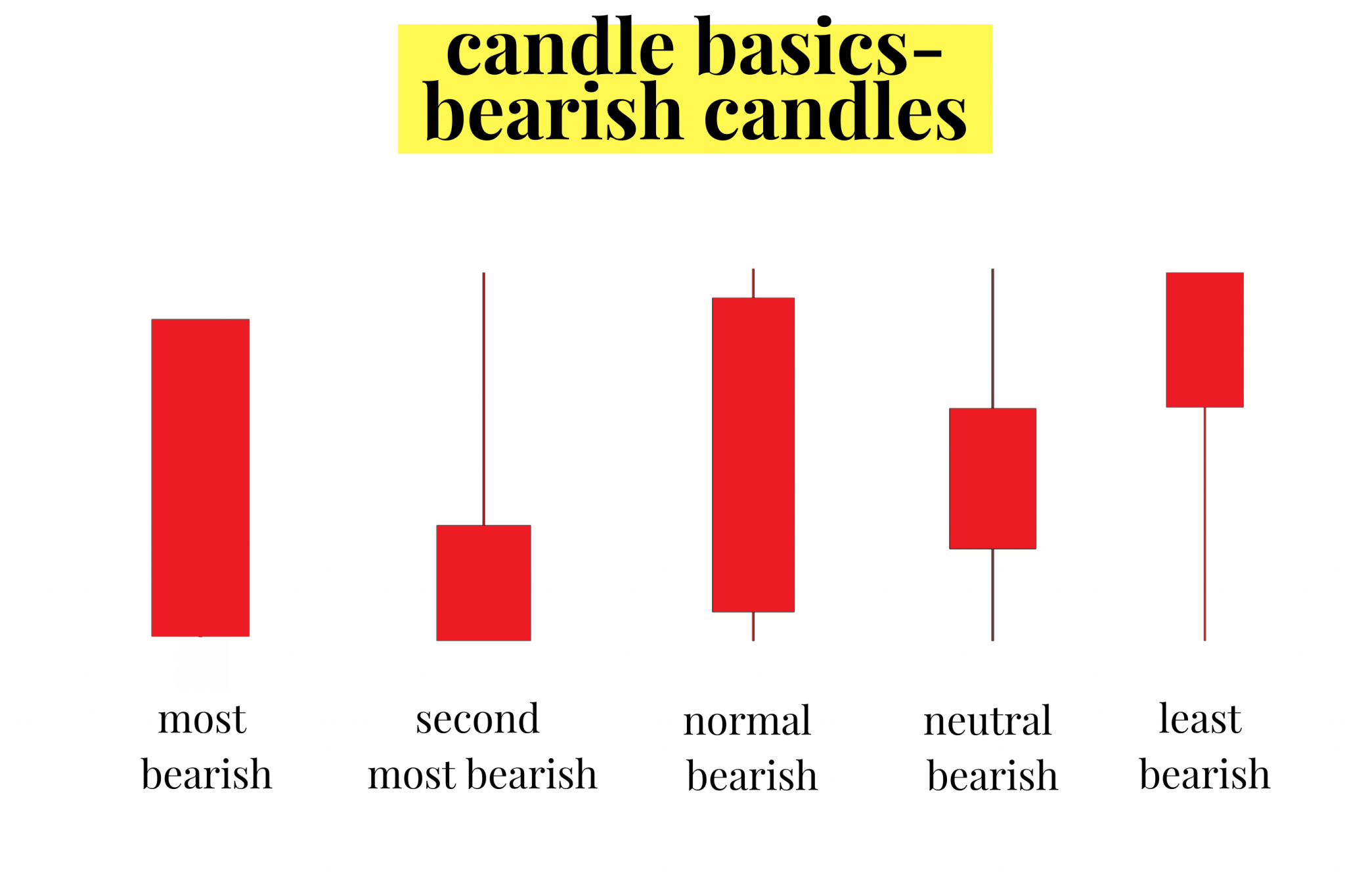

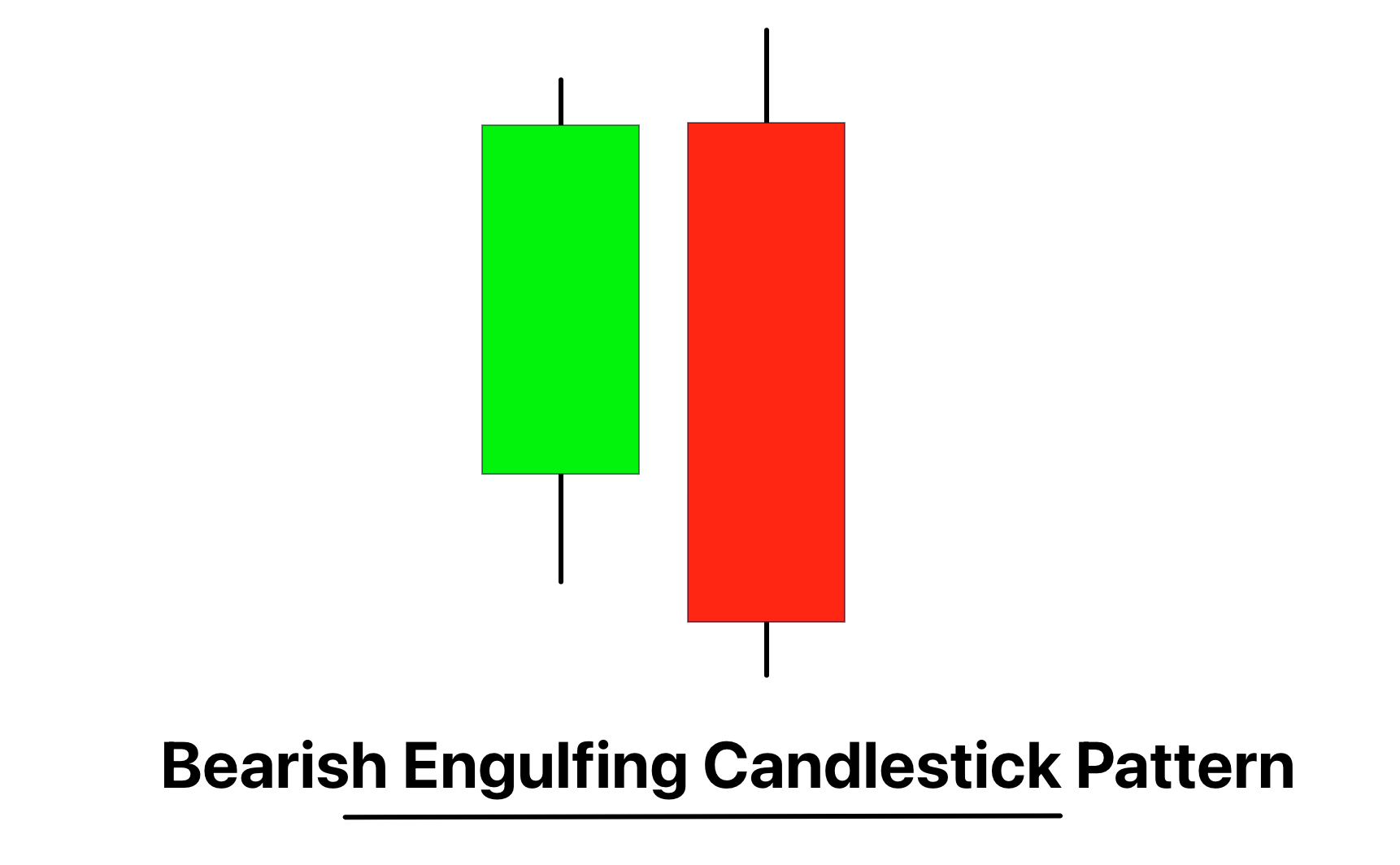

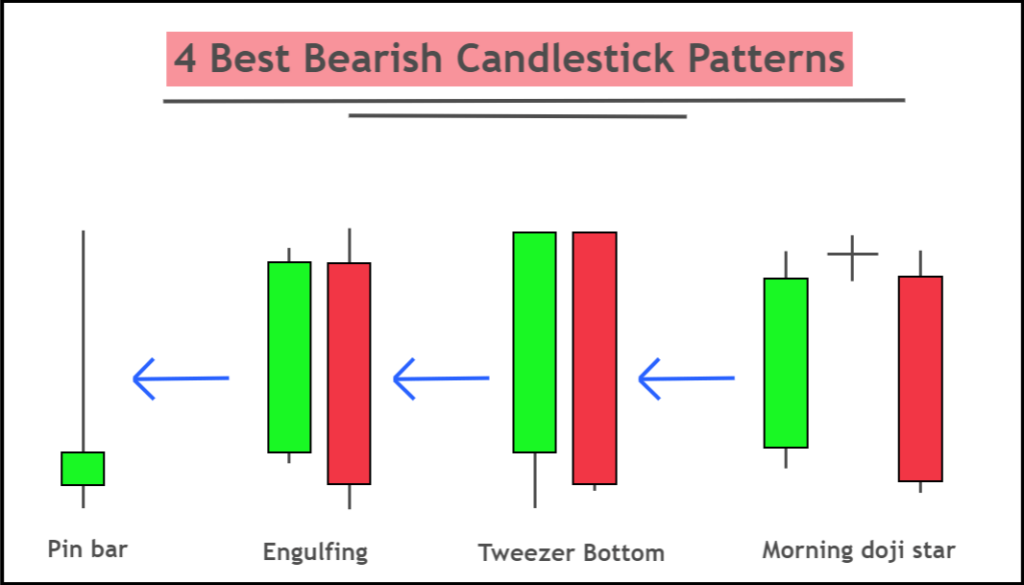

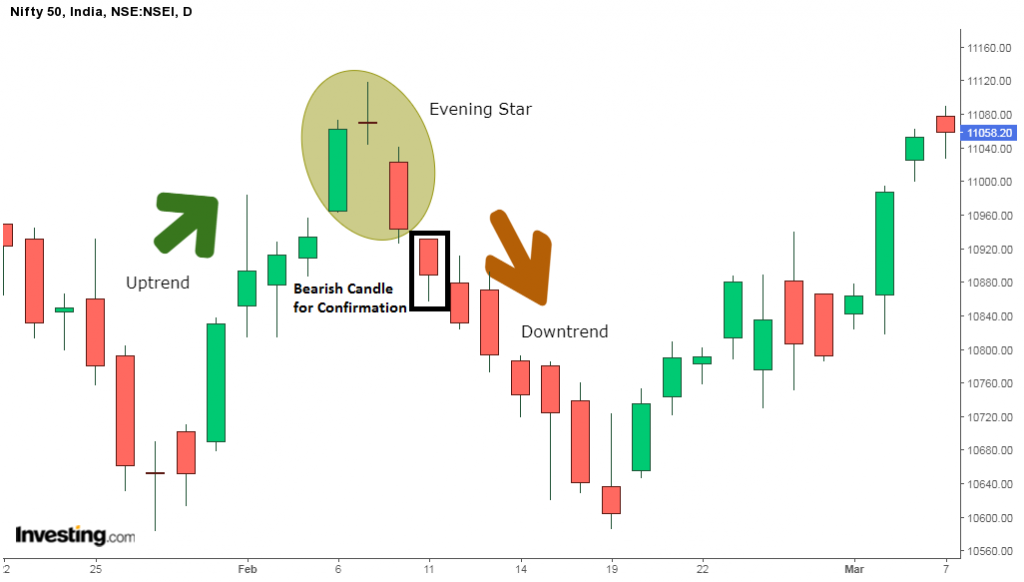

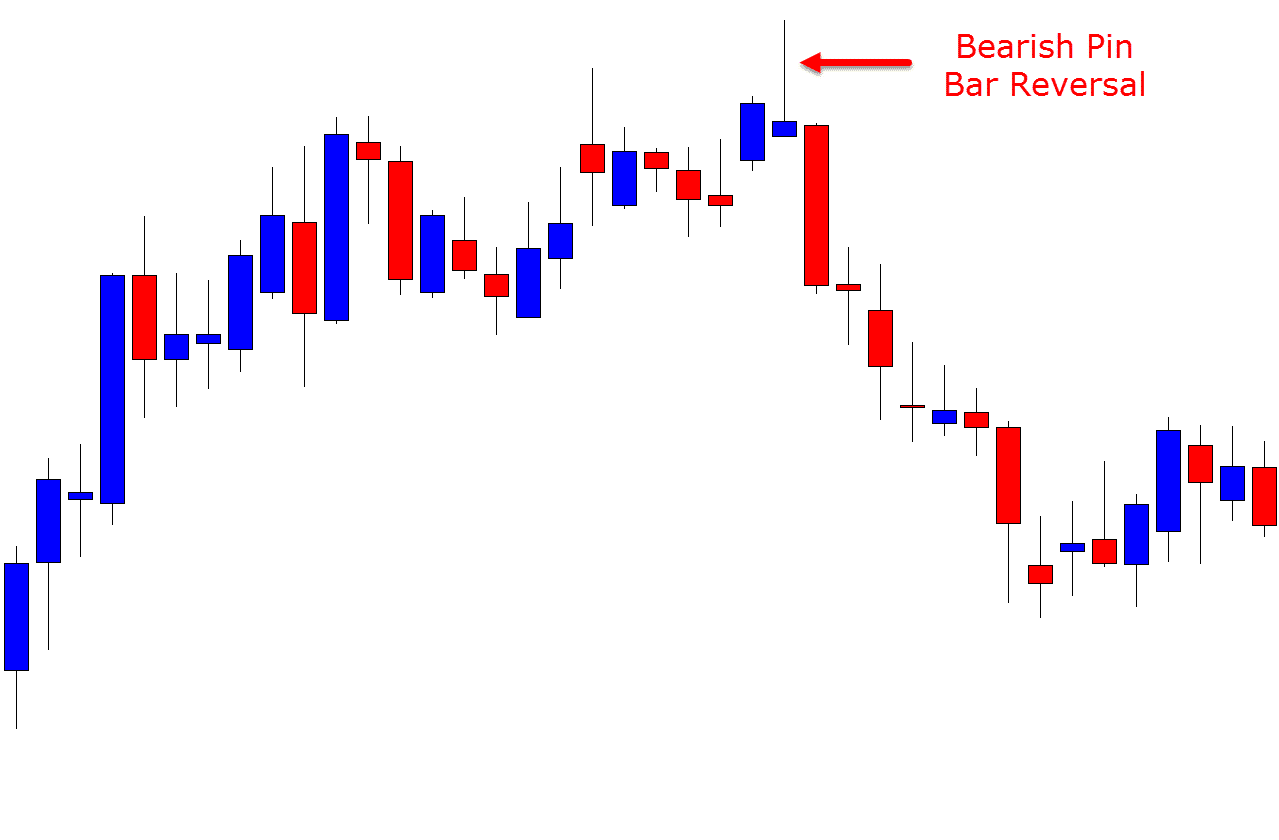

Bearish Candlestick Patterns - Candlestick charts show the day's opening, high, low, and closing. There are also bullish candlesticks. Without further ado, let’s dive into the 8 bearish candlestick patterns you need to know for day trading! Web some of the key bearish reversal patterns include: Web in candlestick charting, bearish candlestick patterns are specific formations of one or more candlesticks on a price chart that suggest a higher likelihood of a downward price movement. Many of these are reversal patterns. They are typically red or black on stock charts. Many of these are reversal patterns. Fact checked by lucien bechard. Appearing at the end of the uptrend, this bearish candlestick pattern indicates weakness in the ongoing price movement and shows that the bulls have pushed the prices up but they are not able to push further. Web 8 min read. Hanging man is a bearish reversal candlestick pattern having a long lower shadow with a small real body. Bearish candles show that the price of a stock is going down. Web some of the key bearish reversal patterns include: Candlestick charts show the day's opening, high, low, and closing. Web some of the key bearish reversal patterns include: Hanging man is a bearish reversal candlestick pattern having a long lower shadow with a small real body. Or reversal of an uptrend. They are typically red or black on stock charts. Many of these are reversal patterns. Web a bearish candlestick pattern is a visual representation of price movement on a trading chart that suggests a potential downward trend or price decline in an asset. Comprising two consecutive candles, the pattern features a smaller. Bearish candles show that the price of a stock is going down. They typically tell us an exhaustion story — where bulls are. Web bearish candlestick patterns are either a single or combination of candlesticks that usually point to lower price movements in a stock. Many of these are reversal patterns. Web some of the key bearish reversal patterns include: Appearing at the end of the uptrend, this bearish candlestick pattern indicates weakness in the ongoing price movement and shows that the bulls. There are also bullish candlesticks. Many of these are reversal patterns. Appearing at the end of the uptrend, this bearish candlestick pattern indicates weakness in the ongoing price movement and shows that the bulls have pushed the prices up but they are not able to push further. Comprising two consecutive candles, the pattern features a smaller. Check out or cheat. Web in candlestick charting, bearish candlestick patterns are specific formations of one or more candlesticks on a price chart that suggest a higher likelihood of a downward price movement. Web importance of bearish candlestick patterns. Web 8 min read. As implied by the bearish reversal definition, the bearish candlestick chart informs you about a potential change in the price of. Web in technical analysis, the bearish engulfing pattern is a chart pattern that can signal a reversal in an upward price trend. Appearing at the end of the uptrend, this bearish candlestick pattern indicates weakness in the ongoing price movement and shows that the bulls have pushed the prices up but they are not able to push further. Web some. Without further ado, let’s dive into the 8 bearish candlestick patterns you need to know for day trading! Web some of the key bearish reversal patterns include: Hanging man is a bearish reversal candlestick pattern having a long lower shadow with a small real body. Web a bearish candlestick pattern is a visual representation of price movement on a trading. Or reversal of an uptrend. Bearish abandoned baby (3 candlesticks), engulfing bearish (2 candlesticks), harami bearish (2 candlesticks), dark cloud cover (2 candlesticks), evening star (3 candlesticks), and shooting star (1. Check out or cheat sheet below and feel free to use it for your training! Web 8 min read. There are also bullish candlesticks. Web in technical analysis, the bearish engulfing pattern is a chart pattern that can signal a reversal in an upward price trend. These patterns are recognized by traders as potential indicators of: Or reversal of an uptrend. Web some of the key bearish reversal patterns include: Bearish abandoned baby (3 candlesticks), engulfing bearish (2 candlesticks), harami bearish (2 candlesticks), dark. Web three black crows is a phrase used to describe a bearish candlestick pattern that may predict the reversal of an uptrend. Hanging man is a bearish reversal candlestick pattern having a long lower shadow with a small real body. These patterns are recognized by traders as potential indicators of: As implied by the bearish reversal definition, the bearish candlestick chart informs you about a potential change in the price of your assets based on historical data. It's formed by the arrangement of the candle's open, close, high, and low prices, creating a specific pattern that indicates selling pressure and a possible shift in market. Bearish abandoned baby (3 candlesticks), engulfing bearish (2 candlesticks), harami bearish (2 candlesticks), dark cloud cover (2 candlesticks), evening star (3 candlesticks), and shooting star (1. Check out or cheat sheet below and feel free to use it for your training! Web in candlestick charting, bearish candlestick patterns are specific formations of one or more candlesticks on a price chart that suggest a higher likelihood of a downward price movement. Web a bearish candlestick pattern is a visual representation of price movement on a trading chart that suggests a potential downward trend or price decline in an asset. Web bearish candlestick patterns are either a single or combination of candlesticks that usually point to lower price movements in a stock. Web 8 min read. Web in technical analysis, the bearish engulfing pattern is a chart pattern that can signal a reversal in an upward price trend. There are also bullish candlesticks. Appearing at the end of the uptrend, this bearish candlestick pattern indicates weakness in the ongoing price movement and shows that the bulls have pushed the prices up but they are not able to push further. Many of these are reversal patterns. Web importance of bearish candlestick patterns.

Candlestick Patterns Explained New Trader U

Bearish Reversal Candlestick Patterns The Forex Geek

Candlestick Patterns The Definitive Guide (2021)

Bearish Engulfing Candlestick Pattern PDF Guide

Bearish Candlestick Patterns Blogs By CA Rachana Ranade

Bearish candlestick cheat sheet. Don’t to SAVE Candlesticks

4 Best Bearish Candlestick Patterns ForexBee

Bearish Candlestick Patterns PDF Guide Free Download

5 Powerful Bearish Candlestick Patterns

What are Bearish Candlestick Patterns

They Typically Tell Us An Exhaustion Story — Where Bulls Are Giving Up And Bears Are Taking Over.

Bearish Candlesticks Come In Many Different Forms On Candlestick Charts.

Bearish Candles Show That The Price Of A Stock Is Going Down.

Fact Checked By Lucien Bechard.

Related Post: