Bearish Candlestick Pattern

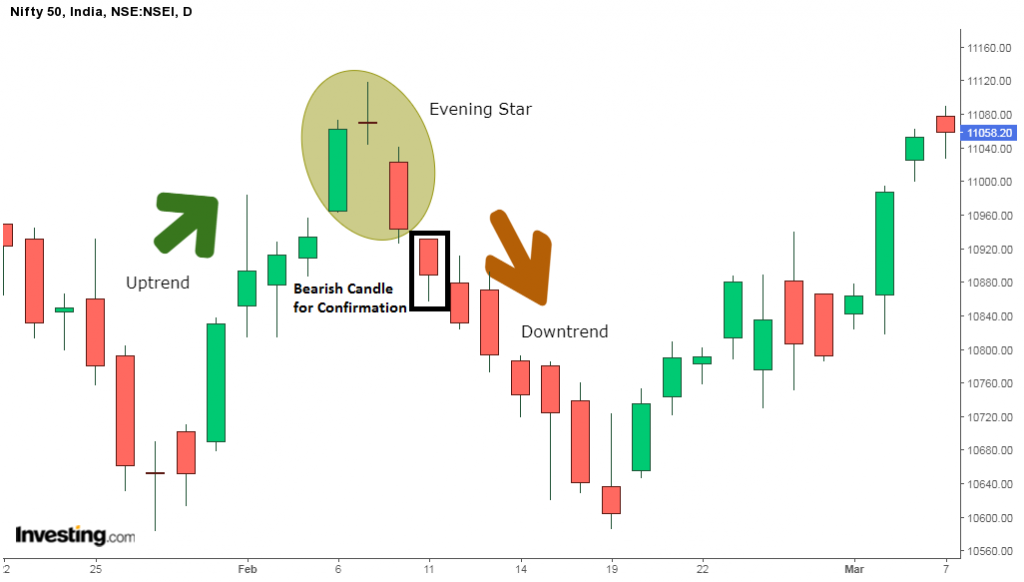

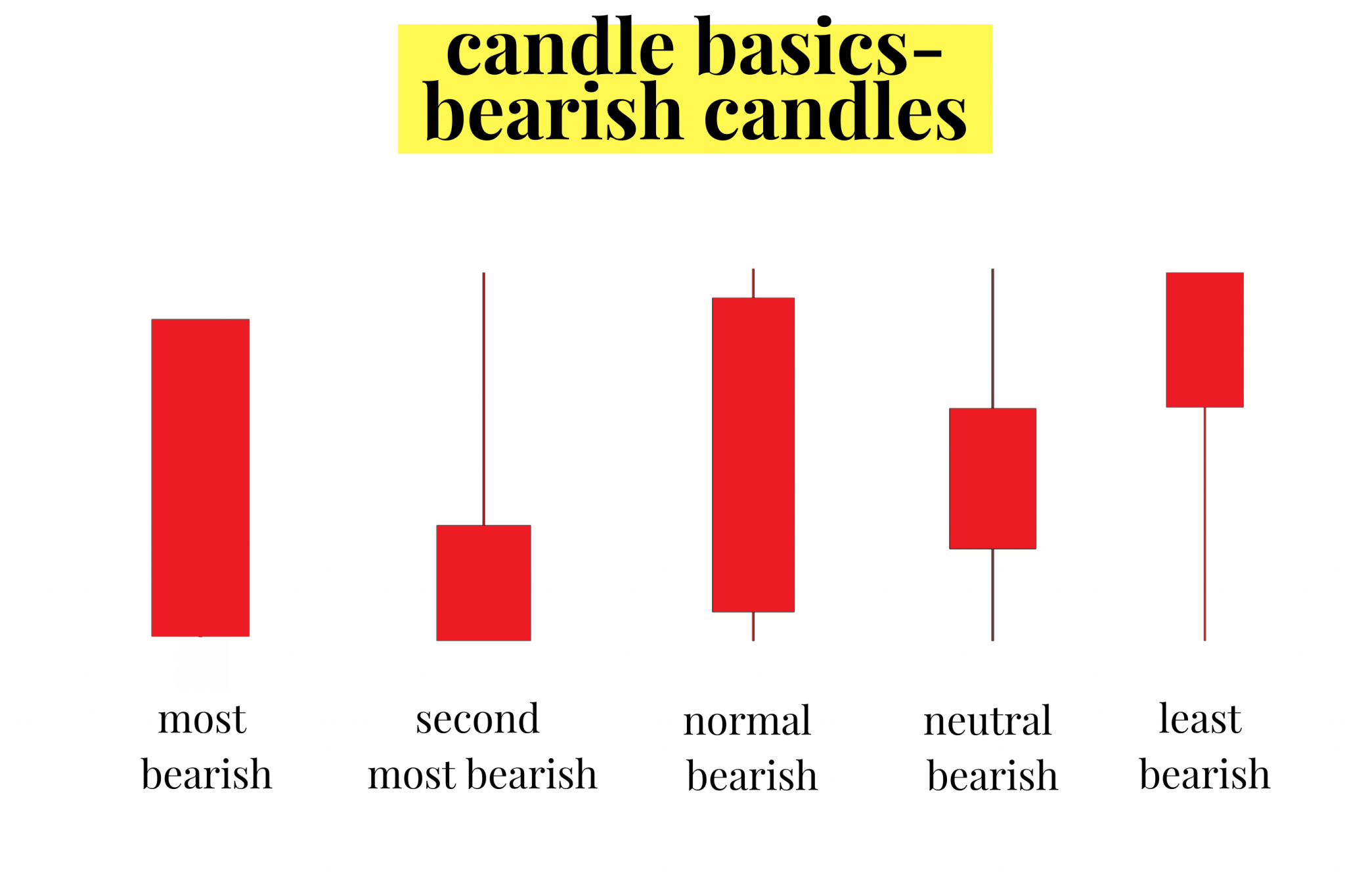

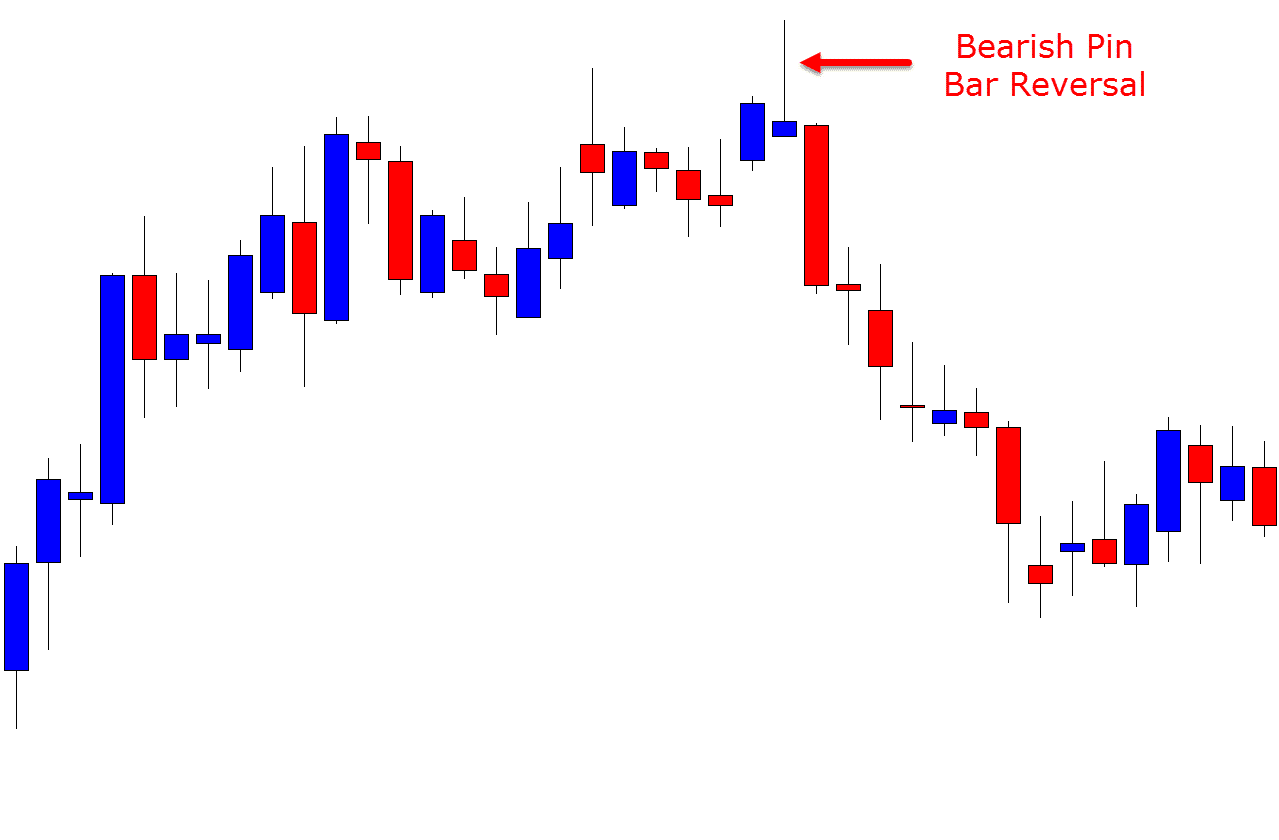

Bearish Candlestick Pattern - Glance into the complicated looking charts for the first time, and you may deem them difficult to understand. Fact checked by lucien bechard. Candlestick technical analysis doji pressure inverted hammer support and resistance. They typically tell us an exhaustion story — where bulls are giving up and bears are taking over. Web in candlestick charting, bearish candlestick patterns are specific formations of one or more candlesticks on a price chart that suggest a higher likelihood of a downward price movement. Web a hanging man is a bearish candlestick pattern that forms at the end of an uptrend and warns of lower prices to come. The candlestick shows you four data points at once: Web silver peaked at a high of 28.77 last friday before ending the day in the red with a bearish candlestick pattern. Bearish candles show that the price of a stock is going down. The piercing pattern is a bullish reversal pattern. Web 8 min read. What is the 3 candle rule in trading? → bearish candlestick patterns signal potential downtrends and reversals in the market. 📚 a gravestone doji is a bearish pattern that suggests a reversal followed by a downtrend in the price action. If you’re starting from the very beginning, watch our video on candlestick charts. A bearish candlestick pattern is a visual representation of price movement on a trading chart that suggests a potential downward trend or price decline in an asset. Occurs during a clear uptrend. Web just like many bullish candlestick patterns, bearish candlestick patterns can also be categorised into patterns indicating reversal and continuation. A long white (or green) candle, indicating strong. A gravestone doji is a bearish reversal candlestick pattern that is formed when the open, low, and closing prices are all near each other with a long upper shadow. Many of these are reversal patterns. Web a hanging man is a bearish candlestick pattern that forms at the end of an uptrend and warns of lower prices to come. The. Bearish candles show that the price of a stock is going down. They typically tell us an exhaustion story — where bulls are giving up and bears are taking over. Web list of bearish candlestick patterns with links to pattern pages. → understanding these patterns helps traders make informed decisions about when to sell or short a security. How can. Web bearish candlestick patterns are either a single or combination of candlesticks that usually point to lower price movements in a stock. → understanding these patterns helps traders make informed decisions about when to sell or short a security. A long white (or green) candle, indicating strong buying. These patterns are recognized by traders as potential indicators of: In this. Web the future bitcoin trend is still unclear, since mixed signs support both a bullish and a bearish possibility. A gravestone doji is a bearish reversal candlestick pattern that is formed when the open, low, and closing prices are all near each other with a long upper shadow. The candlestick shows you four data points at once: These patterns typically. If you’re starting from the very beginning, watch our video on candlestick charts. Web in technical analysis, the bearish engulfing pattern is a chart pattern that can signal a reversal in an upward price trend. Occurs during a clear uptrend. What is the 3 candle rule in trading? Bullish patterns indicate that the price is likely to rise, while bearish. Web importance of bearish candlestick patterns. In addition to the conditions of bullish3, it checks if the close of the candle three periods ago is higher than its open and if the close of the current candle is higher than the previous three candle's high. The piercing pattern consists of two candles. They typically tell us an exhaustion story —. Candlestick technical analysis doji pressure inverted hammer support and resistance. Three line strike is a trend continuation candlestick pattern consisting of four candles. → understanding these patterns helps traders make informed decisions about when to sell or short a security. → bearish candlestick patterns signal potential downtrends and reversals in the market. In this article, we are introducing some examples. A gravestone doji is a bearish reversal candlestick pattern that is formed when the open, low, and closing prices are all near each other with a long upper shadow. Many of these are reversal patterns. The fourth candle's close price is higher than the open price of the first. Or reversal of an uptrend. Glance into the complicated looking charts. → understanding these patterns helps traders make informed decisions about when to sell or short a security. These patterns are recognized by traders as potential indicators of: In addition to the conditions of bullish3, it checks if the close of the candle three periods ago is higher than its open and if the close of the current candle is higher than the previous three candle's high. In this article, we are introducing some examples of bearish candlestick patterns. Web candlestick patterns are used to predict the future direction of price movement. Web silver peaked at a high of 28.77 last friday before ending the day in the red with a bearish candlestick pattern. How can you tell if a candle is bearish? Web the first is a bearish candle, the second is doji, and the third is a bullish candle representing the buyers’ power. Web just like many bullish candlestick patterns, bearish candlestick patterns can also be categorised into patterns indicating reversal and continuation. Occurs during a clear uptrend. This pattern is a standard bearish engulfing. Many of these are reversal patterns. Bearish candlesticks come in many different forms on candlestick charts. Sellers again dominated today, monday, as the price of silver fell below friday. The candle is formed by a long lower shadow coupled with a small real body. Comprising two consecutive candles, the pattern features a smaller.

How to read candlestick patterns What every investor needs to know

5 Powerful Bearish Candlestick Patterns

Bearish Candlestick Patterns Blogs By CA Rachana Ranade

Candlestick Patterns Explained New Trader U

Bearish Reversal Candlestick Patterns The Forex Geek

Bearish Candlestick Patterns PDF Guide Free Download

"Bearish Candlestick Patterns for traders Ultimate Graphics" Poster

What are Bearish Candlestick Patterns

![Candlestick Patterns The Definitive Guide [UPDATED 2022]](https://www.alphaexcapital.com/wp-content/uploads/2020/04/Bearish-Engulfing-Candlestick-Patterns-Example-by-Alphaex-Capital-1030x1030.png)

Candlestick Patterns The Definitive Guide [UPDATED 2022]

Candlestick Patterns The Definitive Guide (2021)

These Patterns Typically Consist Of A Combination Of Candles With Specific Formations, Each Indicating A Shift In Market Dynamics From Buying To Selling Pressure.

Bullish Patterns Indicate That The Price Is Likely To Rise, While Bearish Patterns Indicate That The Price Is Likely To Fall.

The First Candle Is Bearish, And The Next Opens The Gap.

Web In Technical Analysis, The Bearish Engulfing Pattern Is A Chart Pattern That Can Signal A Reversal In An Upward Price Trend.

Related Post: