Bearish Candle Pattern

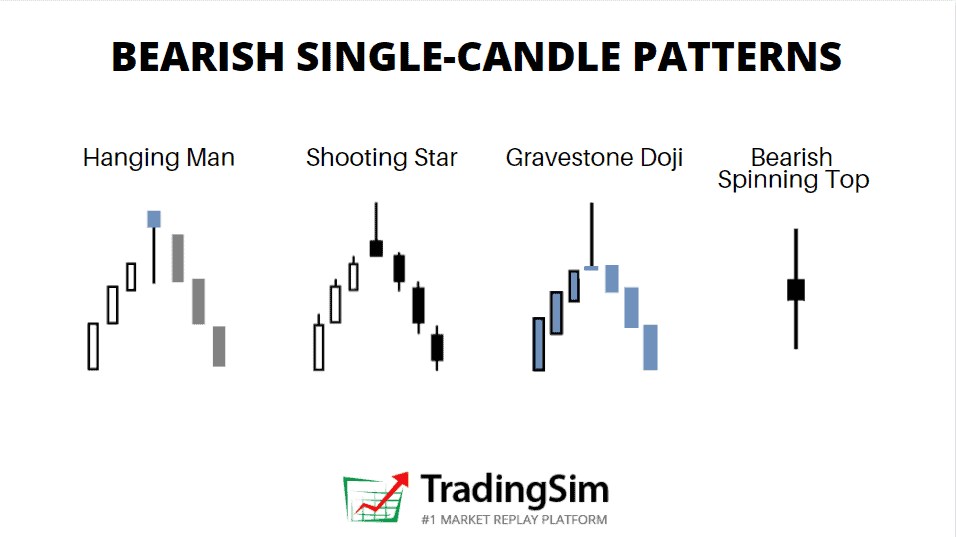

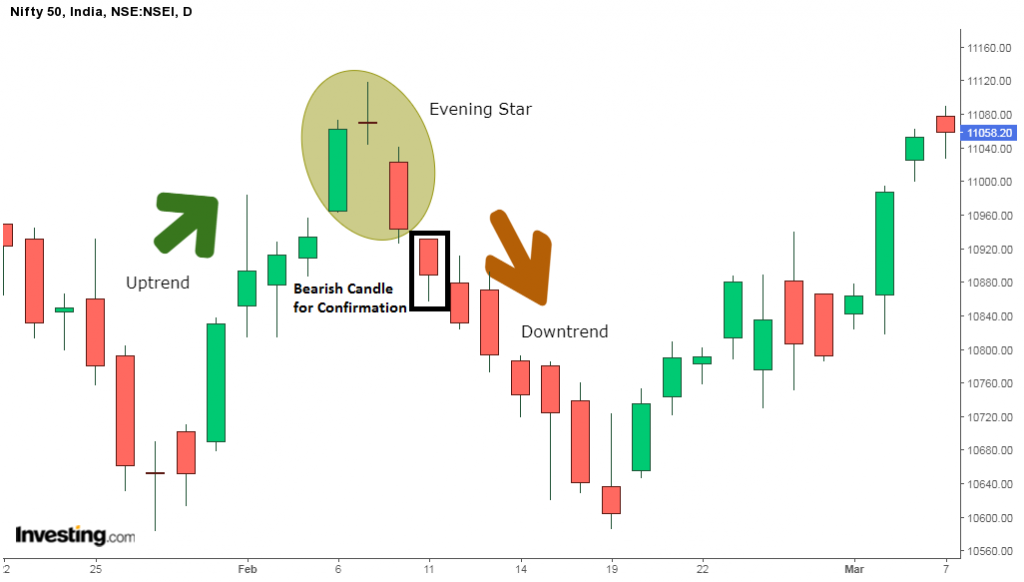

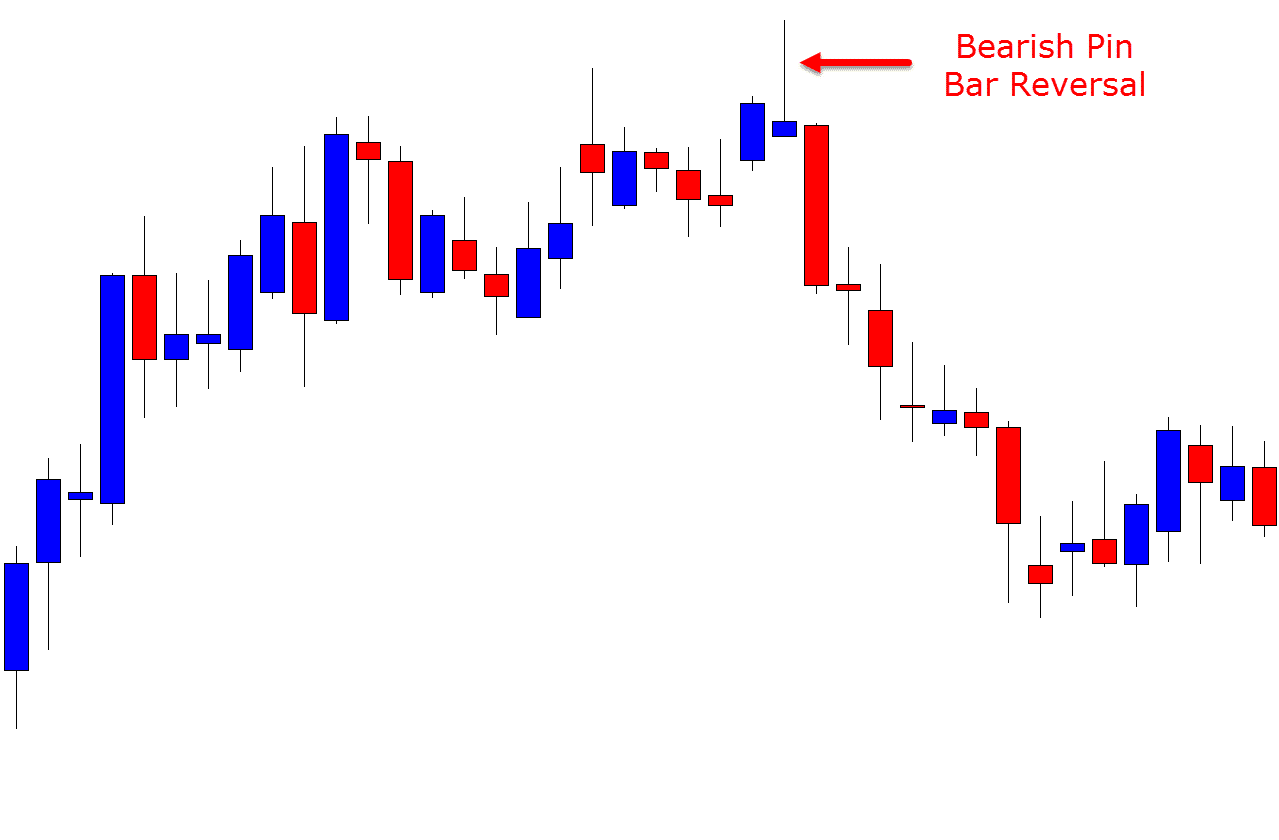

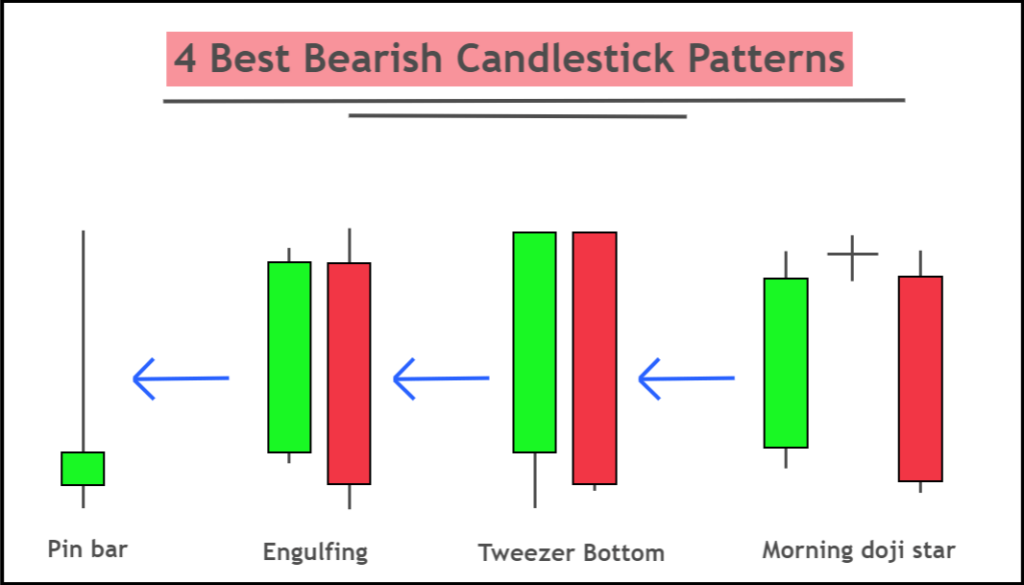

Bearish Candle Pattern - A bullish reversal holds more weight in a downtrend. Glance into the complicated looking charts for the first time, and you may deem them difficult to understand. Web three black crows is a bearish candlestick pattern used to predict the reversal of a current uptrend. Web a hanging man is a bearish reversal candlestick pattern that occurs after a price advance. Illustrated guide to the bullish engulfing candlestick pattern. Web bearish candlestick patterns are chart formations that signal a potential downtrend or reversal in the market. Many of these are reversal patterns. Comprising two consecutive candles, the pattern features a. Web in technical analysis, the bearish engulfing pattern is a chart pattern that can signal a reversal in an upward price trend. Example charts help explain this indicator. Web the shooting star, hanging man pattern, and bearish engulfing are common bearish candles. Web three line strike is a trend continuation candlestick pattern consisting of four candles. Bearish engulfing pattern technical analysis candlesticks charting pattern occurs at tops of uptrends. Web three black crows is a bearish candlestick pattern used to predict the reversal of a current uptrend. Web. The fourth candle's close price is higher than the open price of the first candle. Bearish candlesticks come in many different forms on candlestick charts. A bearish candlestick pattern is a visual representation of price movement on a trading chart that suggests a potential downward trend or price decline in an asset. Web three line strike is a trend continuation. Web a hanging man is a bearish candlestick pattern that forms at the end of an uptrend and warns of lower prices to come. Web 📚 a gravestone doji is a bearish pattern that suggests a reversal followed by a downtrend in the price action. Remember, the trend preceding the reversal dictates its potential: Web bearish chart patterns. Heavy pessimism. This pattern is a standard bearish engulfing. The bearish three line strike continuation is recognized if: Heavy pessimism about the market price often causes traders to close their long positions, and open a short position to take advantage of the falling price. Amid fluctuating market conditions, bitcoin [btc] traded at $61,512 at press time, marking a 1.4% decrease in the. Web 8 min read. Web the future bitcoin trend is still unclear, since mixed signs support both a bullish and a bearish possibility. Web a bearish harami is a two bar japanese candlestick pattern that suggests prices may soon reverse to the downside. Besides, some traders use several bearish candlestick patterns to detect the seller’s domination on the market. The. Web a hanging man is a bearish reversal candlestick pattern that occurs after a price advance. Bearish candlesticks come in many different forms on candlestick charts. Remember, the trend preceding the reversal dictates its potential: Web just like many bullish candlestick patterns, bearish candlestick patterns can also be categorised into patterns indicating reversal and continuation. They typically tell us an. Web just like many bullish candlestick patterns, bearish candlestick patterns can also be categorised into patterns indicating reversal and continuation. Web 📚 a gravestone doji is a bearish pattern that suggests a reversal followed by a downtrend in the price action. Remember, the trend preceding the reversal dictates its potential: There are also bullish candlesticks. Bearish engulfing pattern technical analysis. Web bearish chart patterns. Web just like many bullish candlestick patterns, bearish candlestick patterns can also be categorised into patterns indicating reversal and continuation. Web bearish candlestick patterns usually form after an uptrend, and signal a point of resistance. Web a bearish reversal candlestick pattern is a sequence of price actions or a pattern, that signals a potential change from. Web 📚 a gravestone doji is a bearish pattern that suggests a reversal followed by a downtrend in the price action. They are typically red or black on stock charts. Mastering key bullish and bearish candlestick patterns gives you an edge. Glance into the complicated looking charts for the first time, and you may deem them difficult to understand. Web. Web three black crows is a bearish candlestick pattern used to predict the reversal of a current uptrend. A bearish candlestick pattern is a visual representation of price movement on a trading chart that suggests a potential downward trend or price decline in an asset. The candle is formed by a long lower shadow coupled with a small real. Glance. Web what is a bearish candlestick pattern? And a bearish reversal has higher probability reversing an uptrend. Many of these are reversal patterns. This pattern is a standard bearish engulfing. Heavy pessimism about the market price often causes traders to close their long positions, and open a short position to take advantage of the falling price. Traders use it alongside other technical indicators such as the relative strength index. The candle is formed by a long lower shadow coupled with a small real. They are typically red or black on stock charts. It's a hint that the market sentiment may be shifting from buying to selling. Hanging man is a bearish reversal candlestick pattern having a long lower shadow with a small real body. Web the bearish deliberation candlestick pattern is a technical analysis formation that signals a potential bearish reversal in an uptrending market. These patterns often indicate that sellers are in control, and prices may continue to decline. Web bearish candlestick patterns are chart formations that signal a potential downtrend or reversal in the market. Web bearish candlestick patterns usually form after an uptrend, and signal a point of resistance. Web 5 powerful bearish candlestick patterns. There is an eclectic bearish chart patterns range, used by expert or conventional traders or investors to understand the market and make informed decisions.

Bearish Candlestick Chart

8 Best Bearish Candlestick Patterns for Day Trading TradingSim

Bearish Reversal Candlestick Patterns The Forex Geek

5 Powerful Bearish Candlestick Patterns

Bearish Candlestick Patterns PDF Guide Free Download

What are Bearish Candlestick Patterns

4 Best Bearish Candlestick Patterns ForexBee

Bearish Candlestick Patterns The Forex Geek

Bearish Reversal Candlesticks Patterns for BINANCEBTCUSDT by EXCAVO

Candlestick Patterns The Definitive Guide (2021)

In This Article, We Are Introducing Some Examples Of Bearish Candlestick Patterns.

Web Three Line Strike Is A Trend Continuation Candlestick Pattern Consisting Of Four Candles.

Remember, The Trend Preceding The Reversal Dictates Its Potential:

Depending On Their Heights And Collocation, A Bullish Or A Bearish Trend Continuation Can Be Predicted.

Related Post: