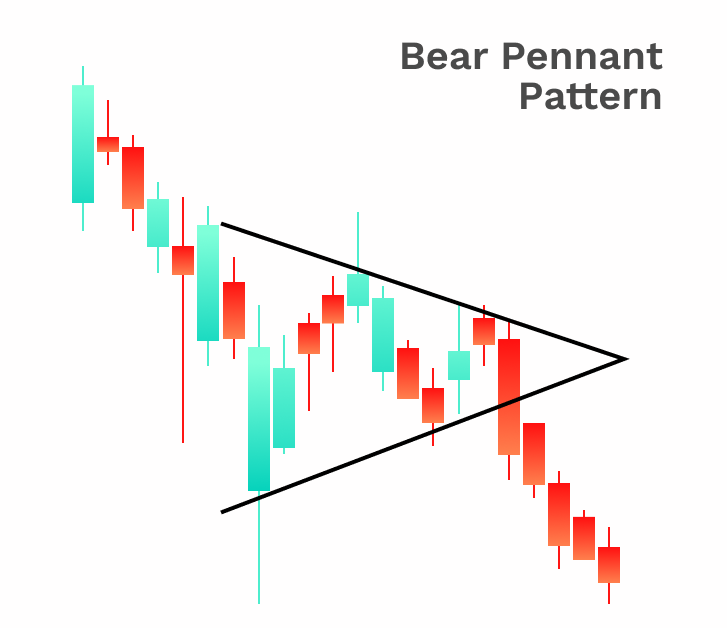

Bear Pennant Pattern

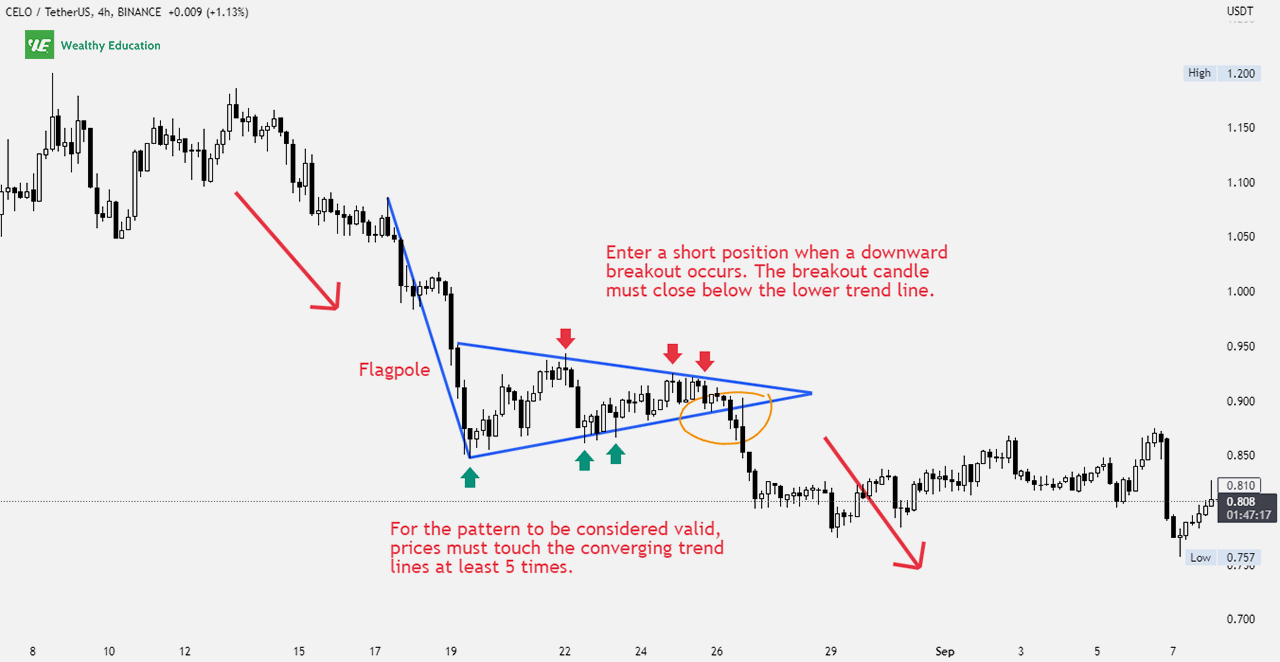

Bear Pennant Pattern - 📈 this analysis explores the implications of this breakout, which aligns with the shibunacci indicator, offering additional confirmation. It provides traders with the opportunity to enter a short position and make financial gains. Individuals can use this pattern to predict a stock’s price movement. Instead of consolidating after a move up, the market pauses on a significant move down. Web a pennant chart pattern generally allows you to make a quick and humongous profit. Contrary to symmetrical triangles, such patterns have a flagpole. It is considered a reliable indicator for traders looking to enter a short position, as it signals that the ongoing bearish trend is likely to persist. The bear pennant is a continuation pattern with narrowing price action following a constant decline. It resembles a small, symmetrical triangle known as a “pennant,” which forms after a significant downward price. Its components and formation, success rate, and useful tips on how to trade a bear pennant. It is considered a reliable indicator for traders looking to enter a short position, as it signals that the ongoing bearish trend is likely to persist. Web in this blog post we look at how the bearish pennant works, its structure, strengths and weaknesses. Web learn about a bearish pennant pattern in trading: 📈 this analysis explores the implications of. (when it’s perfectly traded.) and. This pattern can be there in a price chart for 1 to 3 weeks. Instead of consolidating after a move up, the market pauses on a significant move down. It is a bearish continuation pattern, suggesting that the existing downtrend may persist after a. Web similarly suggestive of imminent change is the bearish pennant pattern. After a sharp decline, the formation of the bearish pennant occurs: It resembles a small, symmetrical triangle known as a “pennant,” which forms after a significant downward price. Web bearish pennants are continuation patterns that occur in strong downtrends. Individuals can also use this chart pattern as a breakout signal to confirm the existing downtrend. We will also share a. Individuals can use this pattern to predict a stock’s price movement. The pattern gets its name from the consolidation, which often looks like a pennant as prices wedge together before breaking down further. They’re essentially the opposite to bullish pennants: After a sharp decline, the formation of the bearish pennant occurs: We will also share a simple strategy to demonstrate. It is a bearish continuation pattern, suggesting that the existing downtrend may persist after a. This formation occurs when there is a downtrend followed by a period of consolidation. Web bear pennants are bearish continuation patterns; Web in this blog post we look at how the bearish pennant works, its structure, strengths and weaknesses. Its three main features are breakout. It occurs during a bearish trend and indicates a possible extension of a downtrend. Web similarly suggestive of imminent change is the bearish pennant pattern in trading circles; Web in this blog post we look at how the bearish pennant works, its structure, strengths and weaknesses. Web a bear pennant pattern is a trading pattern indicating a downward price move’s. It is considered a reliable indicator for traders looking to enter a short position, as it signals that the ongoing bearish trend is likely to persist. After a sharp decline, the formation of the bearish pennant occurs: Contrary to symmetrical triangles, such patterns have a flagpole. Web the bear pennant is a continuation pattern that signals that the ongoing trend. It occurs during a bearish trend and indicates a possible extension of a downtrend. Individuals can also use this chart pattern as a breakout signal to confirm the existing downtrend. Web the bear flag pattern is a technical analysis tool that comprises a chart pattern signaling a potential continuation of a downtrend. It provides traders with the opportunity to enter. This pattern breaks out in the expected direction about 80% of the time. The bear pennant is a continuation pattern with narrowing price action following a constant decline. Web bearish pennants are continuation patterns that occur in strong downtrends. Web the bear flag pattern is a technical analysis tool that comprises a chart pattern signaling a potential continuation of a. The bear pennant is a continuation pattern with narrowing price action following a constant decline. This pattern breaks out in the expected direction about 80% of the time. It is considered a reliable indicator for traders looking to enter a short position, as it signals that the ongoing bearish trend is likely to persist. Web the bear pennant pattern is. They're characterized by a small symmetrical triangle created by converging trendlines. Web the bear pennant pattern is found within a downtrending stock. It resembles a small, symmetrical triangle known as a “pennant,” which forms after a significant downward price. Individuals can use this pattern to predict a stock’s price movement. The pattern gets its name from the consolidation, which often looks like a pennant as prices wedge together before breaking down further. Web bear pennants are bearish continuation patterns; Look for these price movements to show that the price wants to continue to decline. Instead of consolidating after a move up, the market pauses on a significant move down. Web similarly suggestive of imminent change is the bearish pennant pattern in trading circles; It is a bearish continuation pattern, suggesting that the existing downtrend may persist after a. It occurs during a bearish trend and indicates a possible extension of a downtrend. Individuals can also use this chart pattern as a breakout signal to confirm the existing downtrend. Web a pennant chart pattern generally allows you to make a quick and humongous profit. By understanding and identifying this pattern, traders can strategize entry and exit points, by aligning their strategies with the market's bearish signals to effectively manage risk and capitalize on potential. We will also share a simple strategy to demonstrate how to trade a bear pennant pattern and make profits. Web in this blog post we look at how the bearish pennant works, its structure, strengths and weaknesses.

Pennant Patterns Trading Bearish & Bullish Pennants

Bear Pennant Pattern Chart Patterns ThinkMarkets AU

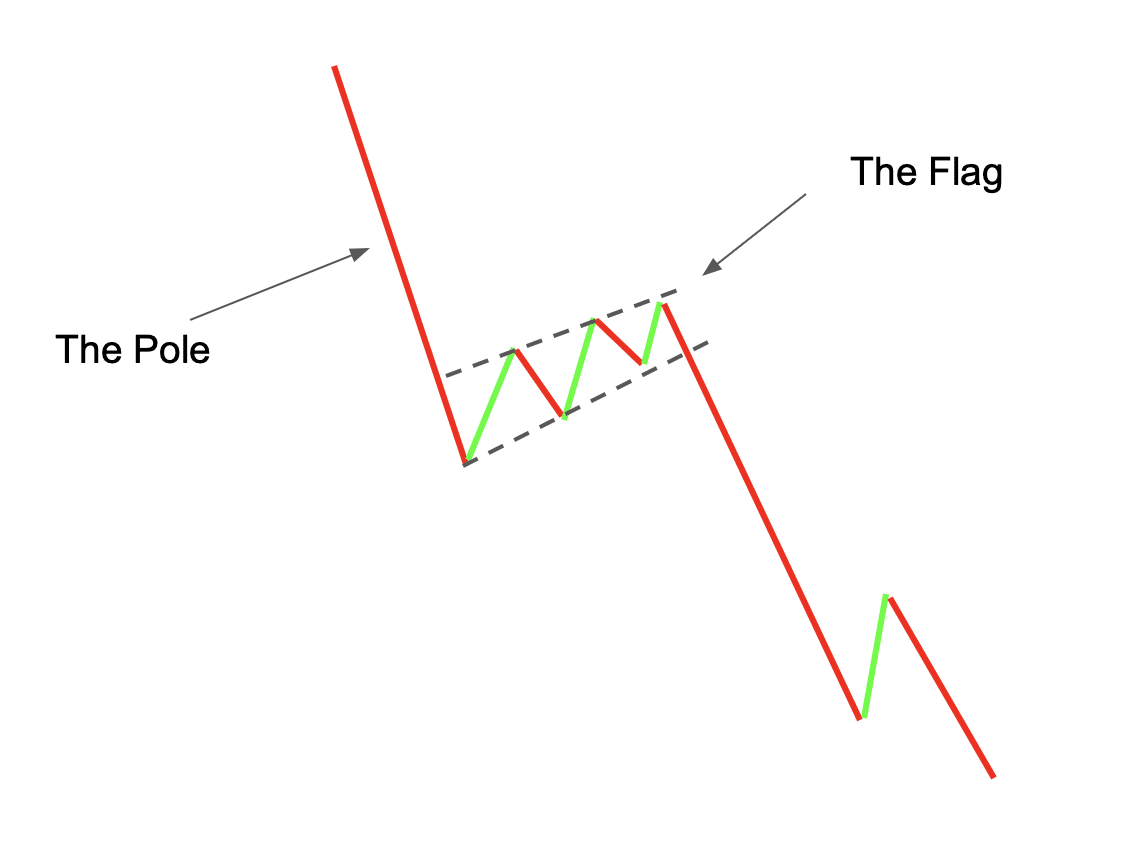

What Is A Bear Flag Pattern?

What Is a Bear Pennant Pattern in Crypto Trading? Freewallet

![How To Trade The Bear Pennant Pattern [Video Included]](https://howtotrade.com/wp-content/uploads/2022/04/Bear-Pennant-chart-pattern-flag-pole-pennant-1170x668.png)

How To Trade The Bear Pennant Pattern [Video Included]

.png)

Bear Pennant How to Trade with a Bearish Chart Pattern Bybit Learn

.png)

Bear Pennant How to Trade with a Bearish Chart Pattern Bybit Learn

.png)

Bear Pennant How to Trade with a Bearish Chart Pattern Bybit Learn

Bear Pennant Pattern (Updated 2023)

What Is A Bear Flag Pattern? Satoshi Alerts

Traders Use This Classical Chart.

Ideally, Look For A Bear Pennant In Strong Or Newly Formed Downtrends, Typically After A Major Bearish Breakdown, Such As On A Daily Head And Shoulders Pattern.

It Acts As A Harbinger, Signaling Impending Alterations To Prevailing Market Conditions.

Web Learn About A Bearish Pennant Pattern In Trading:

Related Post: