Bear Flag Stock Pattern

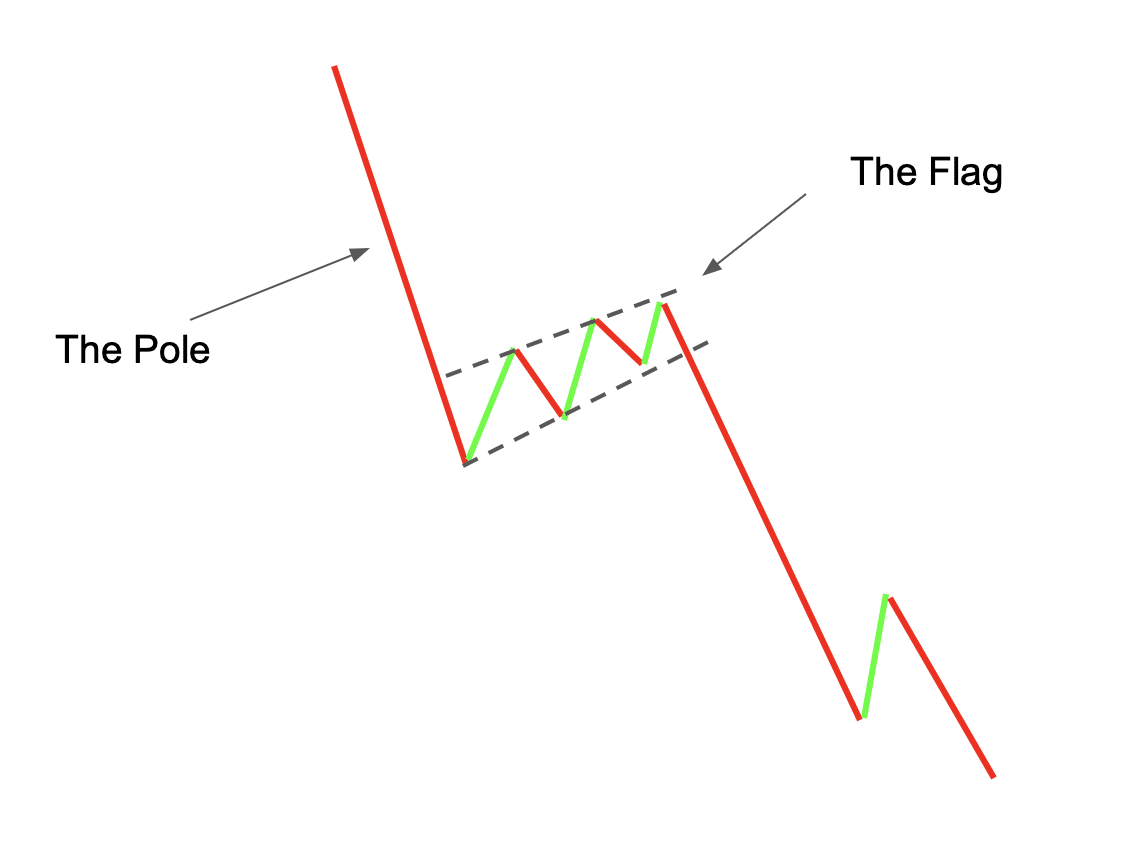

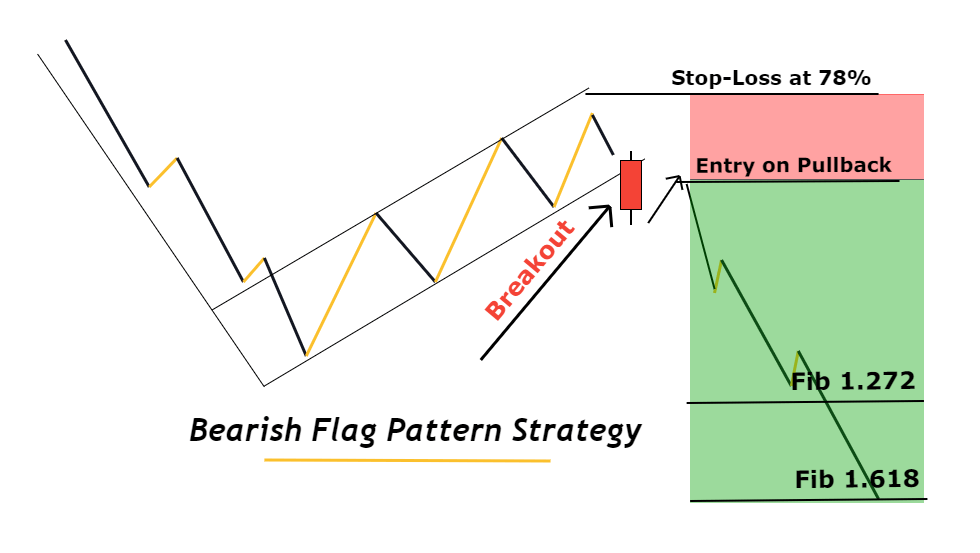

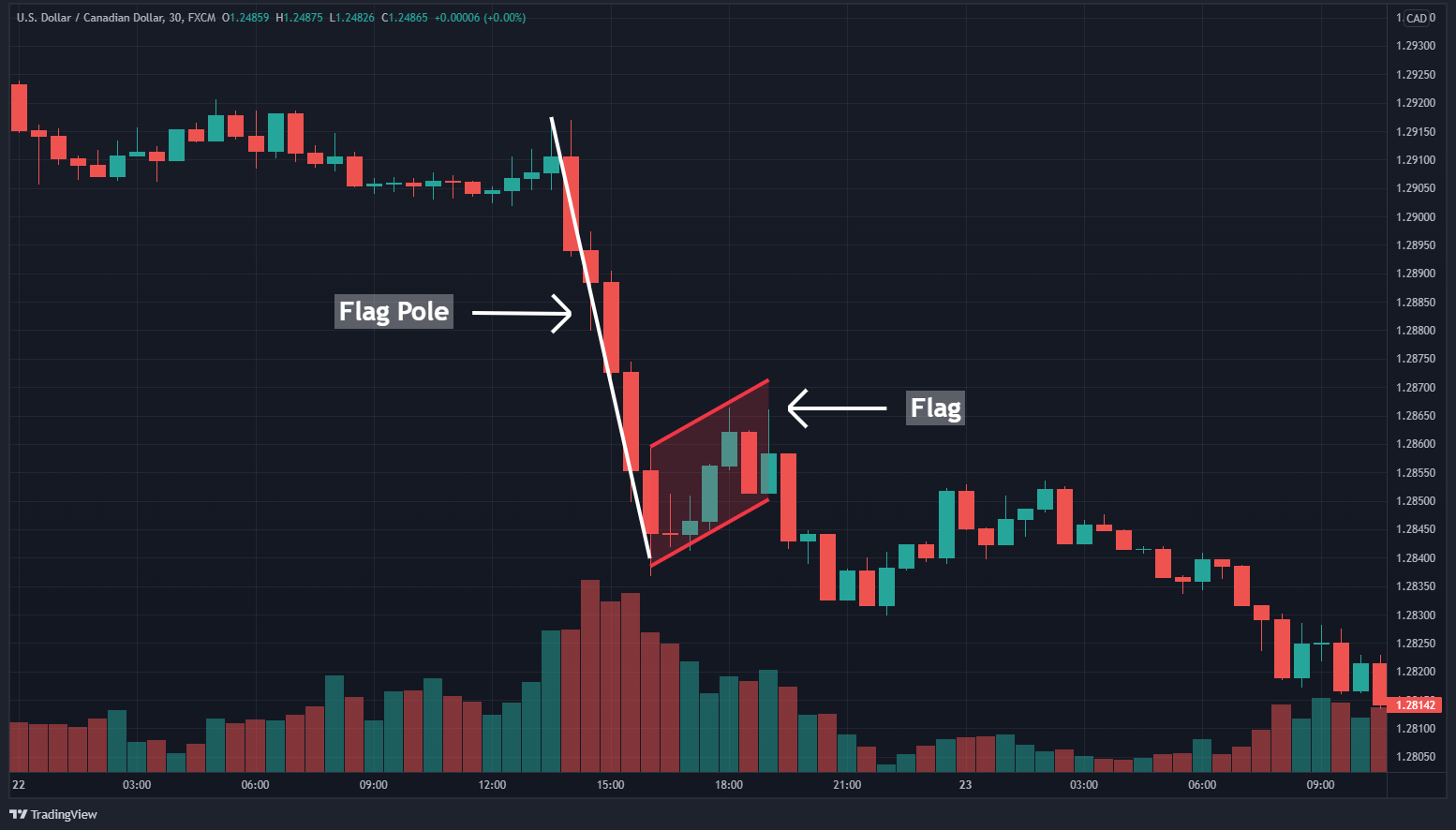

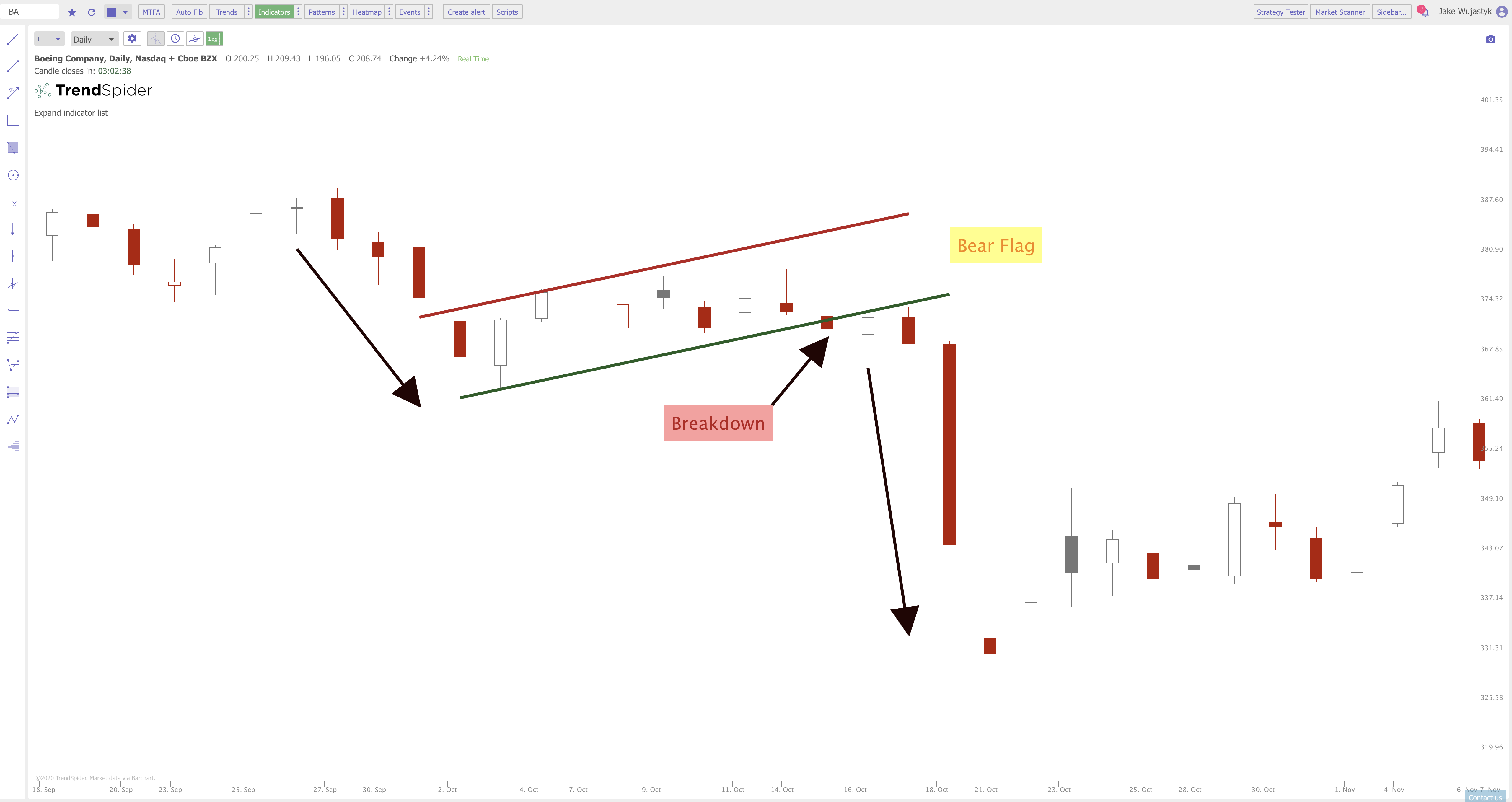

Bear Flag Stock Pattern - Web bear flag patterns are one of the most popular bearish patterns. Web a bear flag is a technical analysis charting pattern used to predict the continuation of a bearish trend. Web the bear flag pattern has long been a popular and reliable trading signal used by technical traders in the markets to identify the likely continuation of a downtrend. It signals the extension of a prevailing downtrend after a temporary pause in price action has been completed. Web the bearish flag is a candlestick chart pattern that signals the extension of the downtrend once the temporary pause is finished. Web the bear flag shows a small rising parallel trend channel. Read on to learn more about the bear flag and how to integrate it into your trading strategy. This article will explore bear flag trading. Learn how to trade bull flag and bear flag chart patterns the right way. The bear flag is a continuation pattern which only slightly retraces the decline preceding it. Web a bear flag pattern is a technical analysis pattern that occurs during a downtrend. It works in the same manner as a bull flag, with the only difference being that it is a bearish pattern looking to push the price action further lower after the period of consolidation. Web the bearish flag pattern is a powerful technical analysis tool. Each boundary line has three touches from price. Learn how to identify, interpret, and leverage these patterns. As a continuation pattern, the bear flag helps sellers to push the price action further lower. Web a bear flag is a bearish trend continuation pattern used in technical analysis by traders to identify new downtrends with traders entering sell trades when the. Web a flag pattern is a technical analysis chart pattern that can be observed in the price charts of financial assets, such as stocks, currencies, or commodities. Each boundary line has three touches from price. Web the bear flag pattern is a significant instrument in technical analysis that uses a chart pattern to signify the continuation of an ongoing downward. Web a bear flag pattern is a technical analysis pattern that occurs during a downtrend. These patterns are considered continuation patterns in technical analysis terms, as they have a habit of occurring before the trend which preceded their formation is continued. Each boundary line has three touches from price. Mostly such downfalls are followed by a good market consolidation or. Web a bear flag is a small price consolidation pattern that forms after a rapid price move in a downtrend. The flag and the flag pole. Each boundary line has three touches from price. This pattern is named for the resemblance of an inverted flag on a pole. As a continuation pattern, the bear flag helps sellers to push the. Web the bear flag pattern is a popular price pattern used by technical traders within the financial markets to determine trend continuations. Web the bear pennant is a bearish chart pattern that aims to extend the downtrend, which is why it is considered to be a continuation pattern. It is a small downward sloping price channel that can be delineated. Web studied mostly in technical analysis, bearish stock patterns often show a downfall or impending decline in the price of an asset, indices, or security. It represents a bearish market sentiment and reflects that the ongoing downtrend will likely persist after a brief consolidation period. Web the bear pennant is a bearish chart pattern that aims to extend the downtrend,. Web a flag pattern is a technical analysis chart pattern that can be observed in the price charts of financial assets, such as stocks, currencies, or commodities. Web a bear flag pattern is a technical analysis pattern that occurs during a downtrend. Published wed, may 1 202411:03 am edt updated wed, may 1 202411:33 am edt. Web a bear flag. There is symmetry represented in the pattern as the channel can be divided in half. This article will explore bear flag trading. Mostly such downfalls are followed by a good market consolidation or sideways when. Web the bear flag shows a small rising parallel trend channel. A strong momentum move lower with large range candles. Web the bear flag pattern is a popular price pattern used by technical traders within the financial markets to determine trend continuations. Web studied mostly in technical analysis, bearish stock patterns often show a downfall or impending decline in the price of an asset, indices, or security. Web the bearish flag is a candlestick chart pattern that signals the extension. Gain valuable insights into spotting potential market reversals and optimizing your trading strategies with the bear flag pattern. It represents a bearish market sentiment and reflects that the ongoing downtrend will likely persist after a brief consolidation period. The flag and the flag pole. It is a small downward sloping price channel that can be delineated with two parallel lines hanging off a rapid. Web bull and bear flag formations are price patterns which occur frequently across varying time frames in financial markets. They consist of either a large bearish candlestick or several smaller bearish candlesticks down, forming the flag pole, followed by several smaller bullish candlesticks pulling back up for consolidation, which forms the flag. Web a bear flag is a bearish chart pattern that signals the market is likely to head lower (and the opposite is called a bull flag ). Web explore the differences between bear flag vs bull flag patterns in trading. Web the bearish flag is a candlestick chart pattern that signals the extension of the downtrend once the temporary pause is finished. There is symmetry represented in the pattern as the channel can be divided in half. Each boundary line has three touches from price. It doesn’t matter if you. In this edition of stockcharts tv's the final bar, dave focuses in on price pattern analysis for the s&p 500, then reflects on the emergence of defensive sectors like consumer staples. As a continuation pattern, the bear flag helps sellers to push the price action further lower. The bear flag is a continuation pattern which only slightly retraces the decline preceding it. Web the bear pennant is a bearish chart pattern that aims to extend the downtrend, which is why it is considered to be a continuation pattern.

What Is A Bear Flag Pattern? Satoshi Alerts

Bearish Flag Pattern Explained with Powerful Trading Plan ForexBee

Forex Bear Flag Pattern System Forex Trading Strategies

Bear Flag Pattern How to Identify it and Trade it Like a PRO [Forex

Bearish Flag Strategy Quick Profits In 5 Simple Steps

How To Trade The Bear Flag Pattern

How to Trade a Bearish Flag Pattern

Bear Flag Chart Pattern

Bear Flag Pattern Explained New Trader U

Bear Flag Pattern Explained New Trader U

Web The Bear Flag Pattern Is A Significant Instrument In Technical Analysis That Uses A Chart Pattern To Signify The Continuation Of An Ongoing Downward Price Trend.

Mostly Such Downfalls Are Followed By A Good Market Consolidation Or Sideways When.

A Strong Momentum Move Lower With Large Range Candles.

Web The Bear Flag Pattern Is Found In A Downtrending Stock.

Related Post: