Bear Flag Pattern

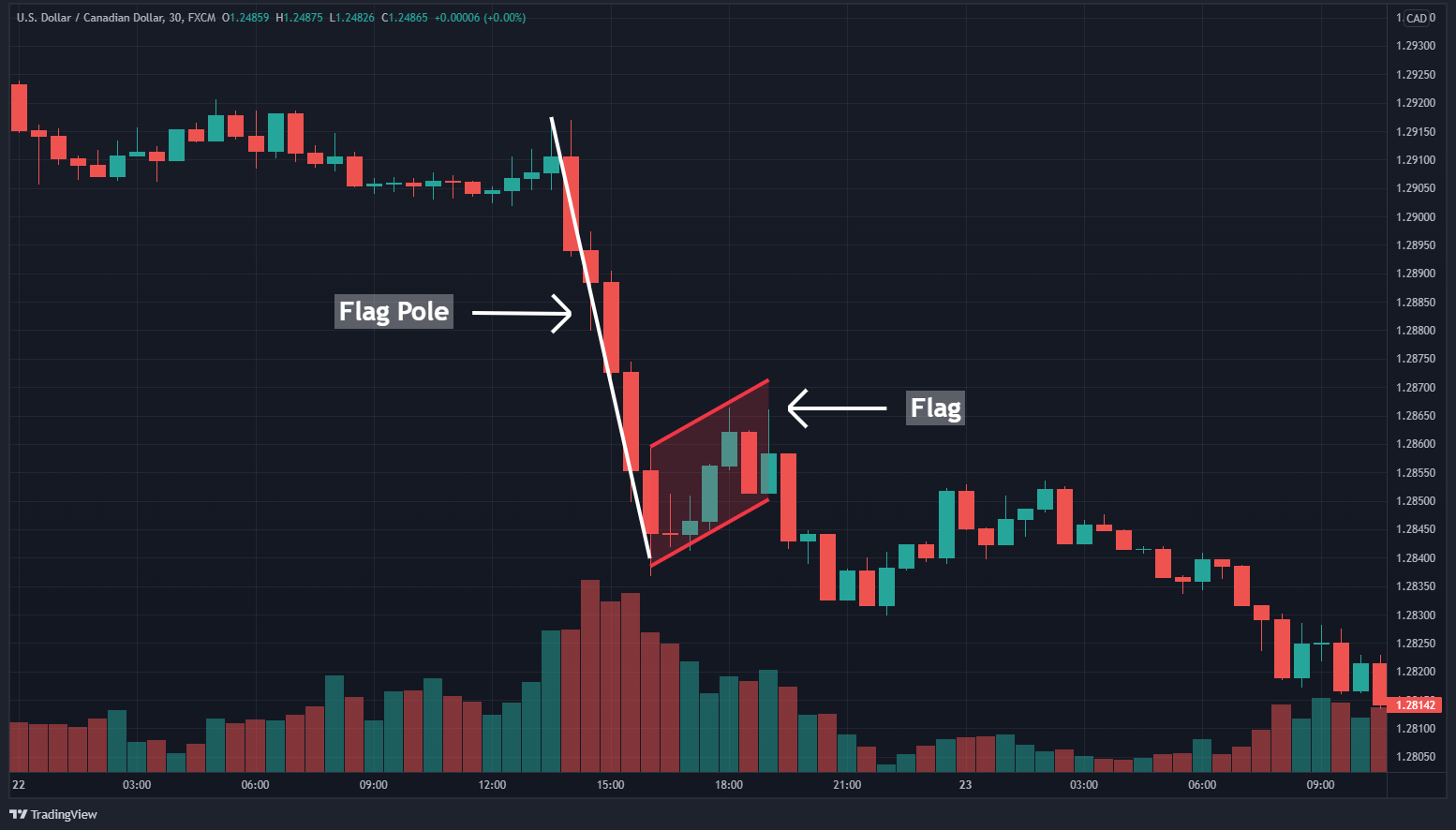

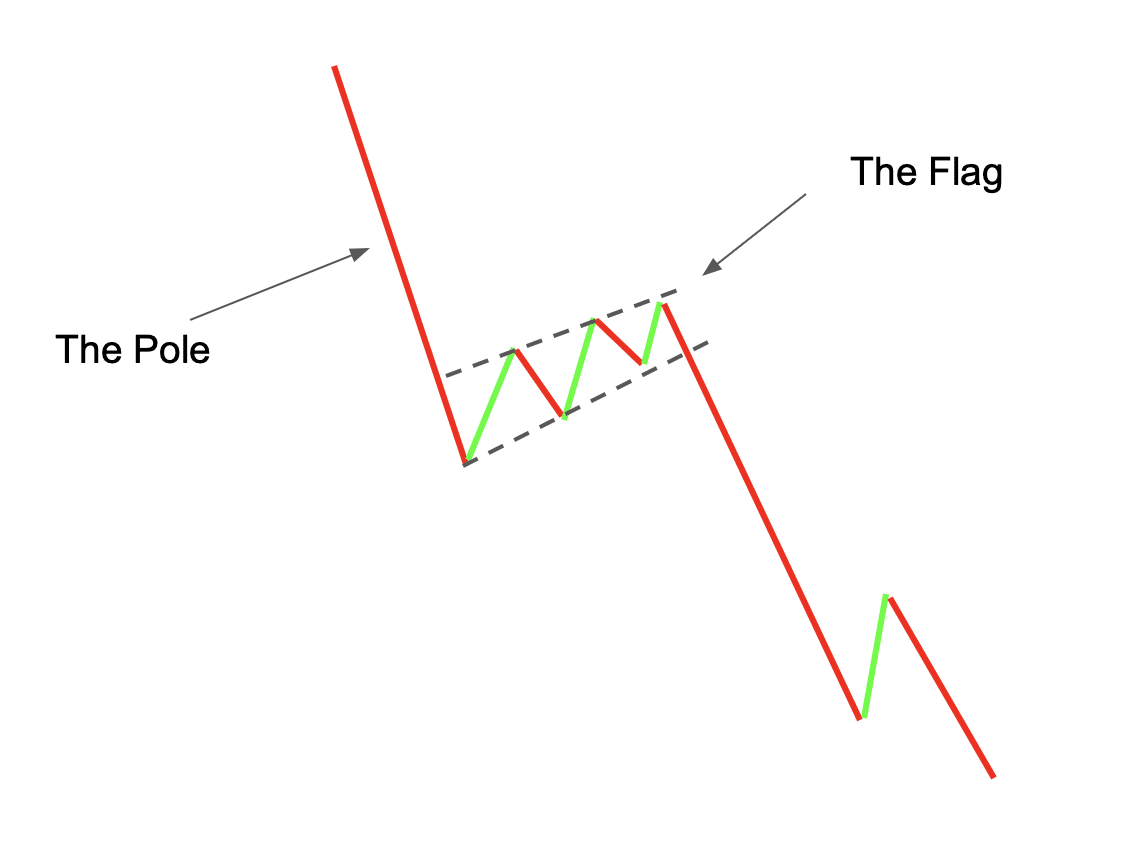

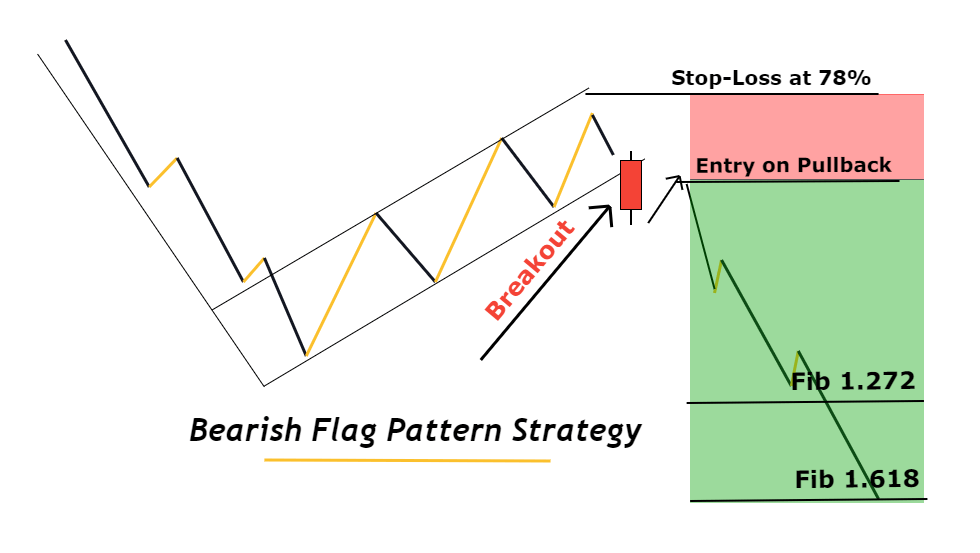

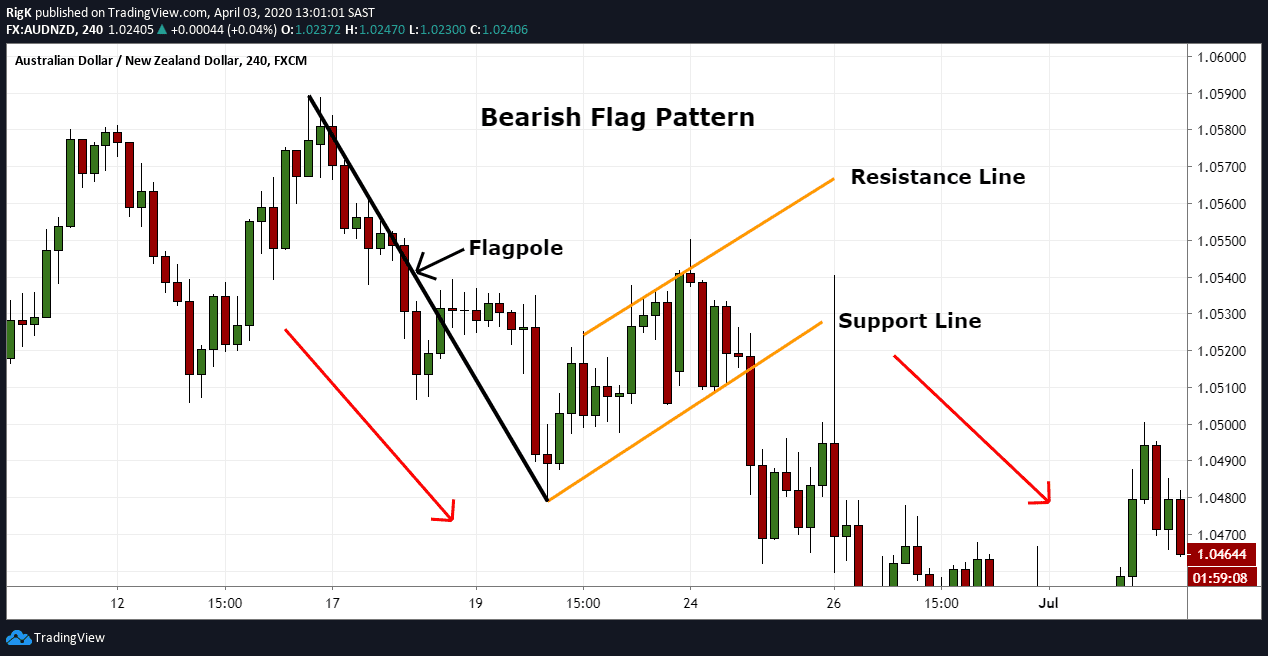

Bear Flag Pattern - As a continuation pattern, the bear flag helps sellers to push the price action further lower. Sometimes, traders often call it the inverted flag pattern as opposed to the bull flag. Web powerful solar storm sparks stunning display of northern lights across the globe 02:04. In the technical analysis of financial markets, a flag is a classic pattern appearing on a chart that shows a tight consolidation in the price or. The flag and the flag pole. Web what is a bear flag pattern? Millions of americans were able to see the magical glow of the northern lights on friday night when a. It is considered a continuation pattern, indicating that the prevailing trend is likely to continue after a brief consolidation or pause. It is formed when the price of an asset experiences a sharp decline, called the pole, followed by a period of consolidation, which is. What is a bear flag pattern? Web every bull flag and bear flag pattern is characterized by six primary traits: It is considered a continuation pattern, indicating that the prevailing trend is likely to continue after a brief consolidation or pause. Web a flag pattern is a technical analysis chart pattern that can be observed in the price charts of financial assets, such as stocks, currencies,. Overview | how to trade | examples | failure | benefits | limitations | psychology | faq. Web every bull flag and bear flag pattern is characterized by six primary traits: It is formed when the price of an asset experiences a sharp decline, called the pole, followed by a period of consolidation, which is. Web a flag pattern is. Web bull and bear flags are popular price patterns recognised in technical analysis, which traders often use to identify trend continuations. Read on to learn more about the bear flag and how to integrate it into your trading strategy. Web a bear flag is a small price consolidation pattern that forms after a rapid price move in a downtrend. It. Followed by at least three or more smaller consolidation candles, forming the flag. Web a flag pattern is a technical analysis chart pattern that can be observed in the price charts of financial assets, such as stocks, currencies, or commodities. Web a bear flag is a technical analysis pattern that can indicate a potential price reversal in a financial market.. These patterns are considered continuation patterns in technical analysis terms, as they have a habit of occurring before the trend which preceded their formation is continued. Shaun murison | senior market analyst, johannesburg. Bull and bear flag formations are price patterns which occur frequently across varying time frames in financial markets. Web a bear flag is a small price consolidation. In the context of technical analysis, a flag is a price. Web the bear flag pattern is a significant instrument in technical analysis that uses a chart pattern to signify the continuation of an ongoing downward price trend. Web a bear flag is a technical analysis charting pattern used to predict the continuation of a bearish trend. Sometimes, traders often. A bear flag pattern is a bearish pattern that signals a continuation of an existing downtrend, indicating further price decreases. Web the bear flag pattern is a significant instrument in technical analysis that uses a chart pattern to signify the continuation of an ongoing downward price trend. Web the bearish flag pattern is a powerful technical analysis tool used by. Millions of americans were able to see the magical glow of the northern lights on friday night when a. Web the bearish flag is a candlestick chart pattern that signals the extension of the downtrend once the temporary pause is finished. As a continuation pattern, the bear flag helps sellers to push the price action further lower. In this article. Web bull and bear flags are popular price patterns recognised in technical analysis, which traders often use to identify trend continuations. The pattern is composed of two parts: Sometimes, traders often call it the inverted flag pattern as opposed to the bull flag. Fact checked by kirsten rohrs schmitt. It has the same structure as the bull flag but inverted. Followed by at least three or more smaller consolidation candles, forming the flag. As a continuation pattern, the bear flag helps sellers to push the price action further lower. Usually, these candles are moving up or down, just a little bit in a tight range after the “flag pole.” Web the bearish flag is a candlestick chart pattern that signals. Followed by at least three or more smaller consolidation candles, forming the flag. Web the bear flag pattern is a popular price pattern used by technical traders within the financial markets to determine trend continuations. Overview | how to trade | examples | failure | benefits | limitations | psychology | faq. Web the bear flag is an upside down version of the bull flat. What are bull and bear flag patterns? This article will explore bear flag trading. Web the bearish flag is a candlestick chart pattern that signals the extension of the downtrend once the temporary pause is finished. As a continuation pattern, the bear flag helps sellers to push the price action further lower. Fact checked by kirsten rohrs schmitt. As a continuation pattern, the bear flag helps sellers to push the price action further lower. Usually, these candles are moving up or down, just a little bit in a tight range after the “flag pole.” Web every bull flag and bear flag pattern is characterized by six primary traits: Web a bear flag is a bearish chart pattern that signals the market is likely to head lower (and the opposite is called a bull flag ). A strong momentum move lower with large range candles. In the technical analysis of financial markets, a flag is a classic pattern appearing on a chart that shows a tight consolidation in the price or. Web the bear flag pattern is a continuation pattern.Explained What Is a Bear Flag Pattern & How to Trade It? Bybit Learn

Forex Bear Flag Pattern System Forex Trading Strategies

How To Trade The Bear Flag Pattern

Bearish Flag Strategy Quick Profits In 5 Simple Steps

What Is A Bear Flag Pattern? Satoshi Alerts

Bearish Flag Pattern Explained with Powerful Trading Plan ForexBee

Bear Flag Chart Pattern Meaning, Benefits & Reliability Finschool

What is a Bear Flag? Learn How To Trade This Pattern.

Flag Pattern Full Trading Guide with Examples

Bear Flag Pattern Explained New Trader U

Gain Valuable Insights Into Spotting Potential Market Reversals And Optimizing Your Trading Strategies With The Bear Flag Pattern.

Web A Bear Flag Is A Small Price Consolidation Pattern That Forms After A Rapid Price Move In A Downtrend.

Web A Bear Flag Pattern Is Constructed By A Descending Trend Or Bearish Trend, Followed By A Pause In The Trend Line Or Consolidation Zone.

A Bear Flag Pattern Is A Bearish Pattern That Signals A Continuation Of An Existing Downtrend, Indicating Further Price Decreases.

Related Post: