Bank Reconciliation Statement Template

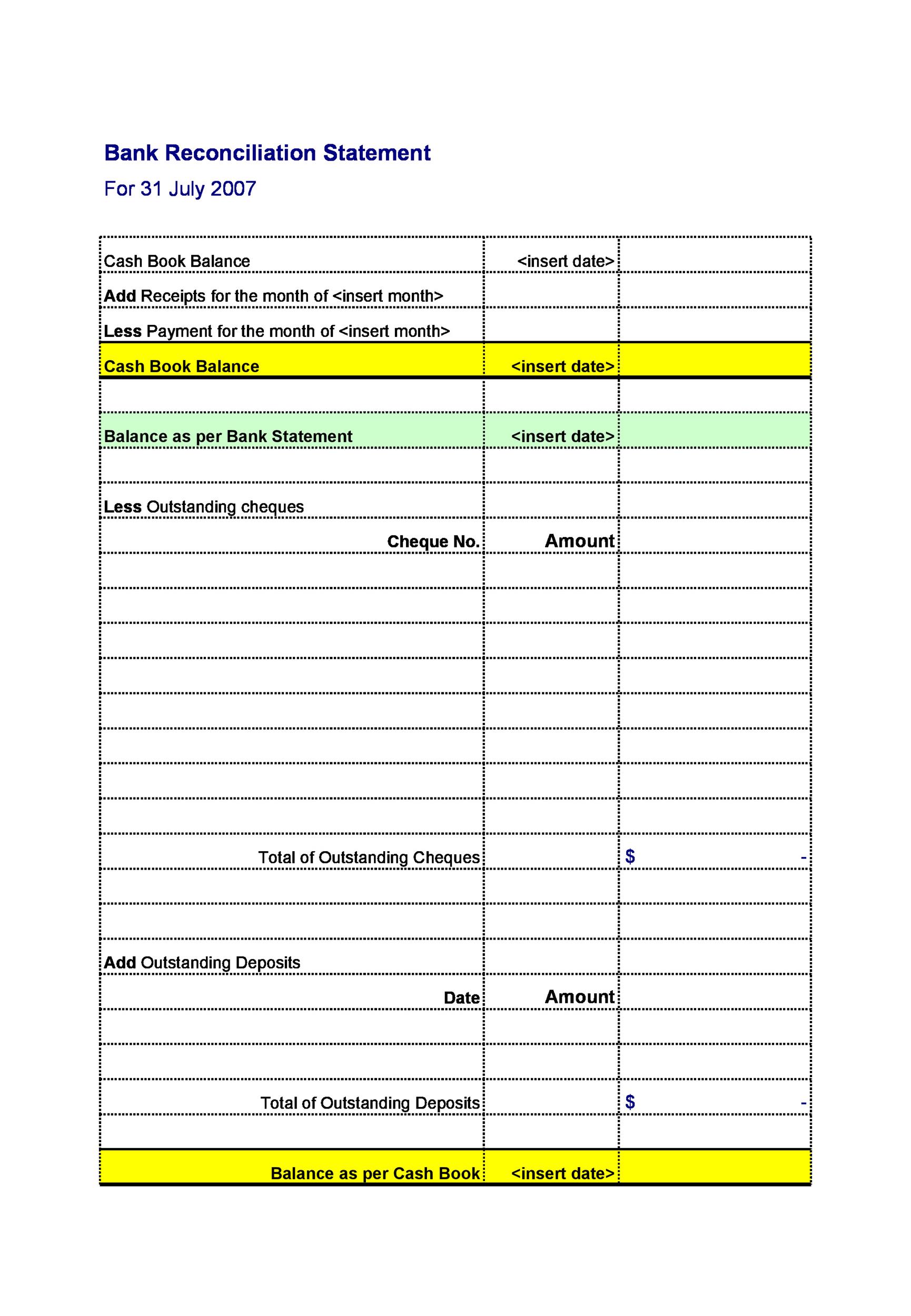

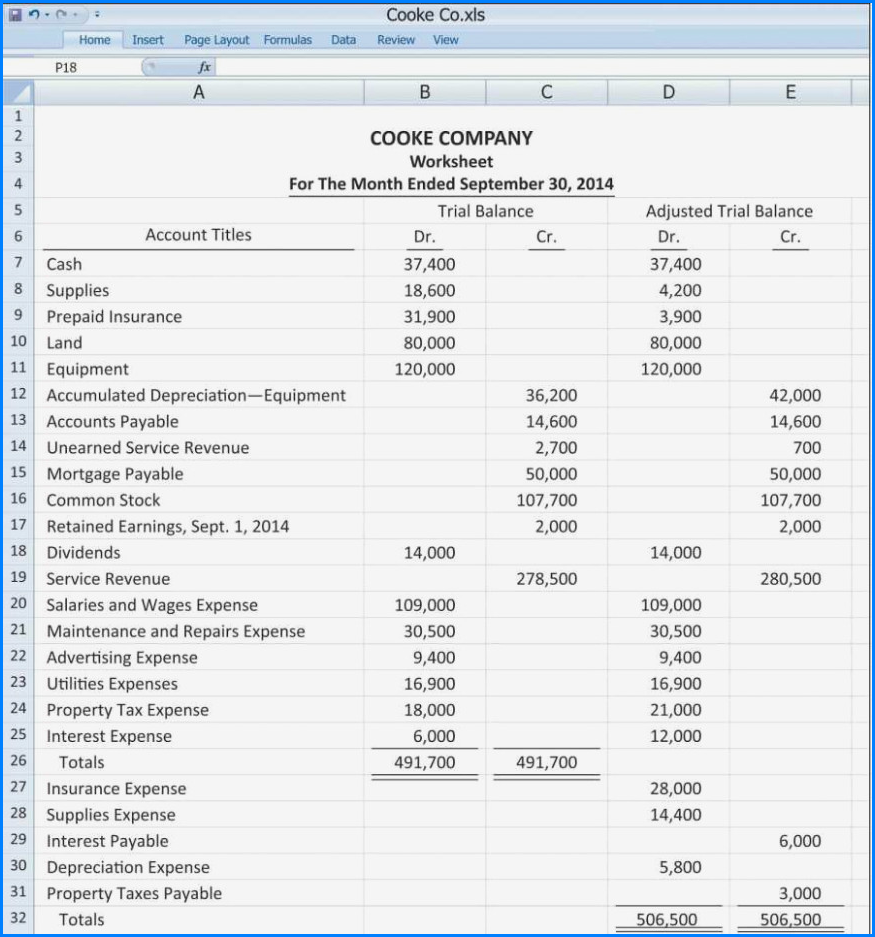

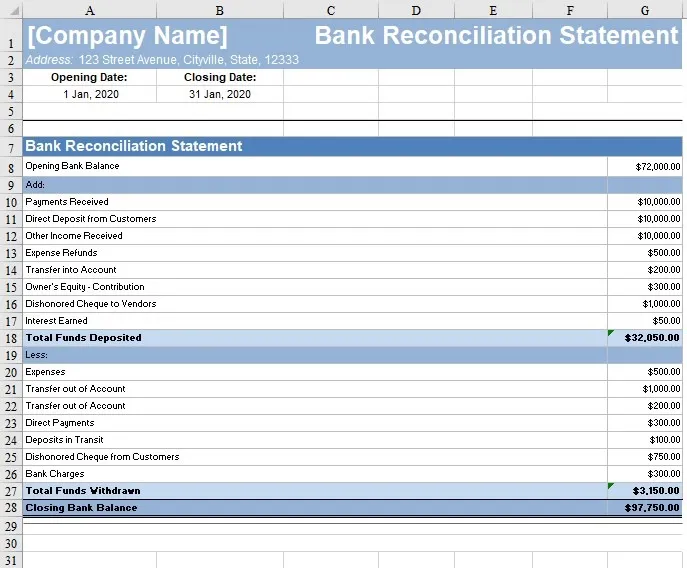

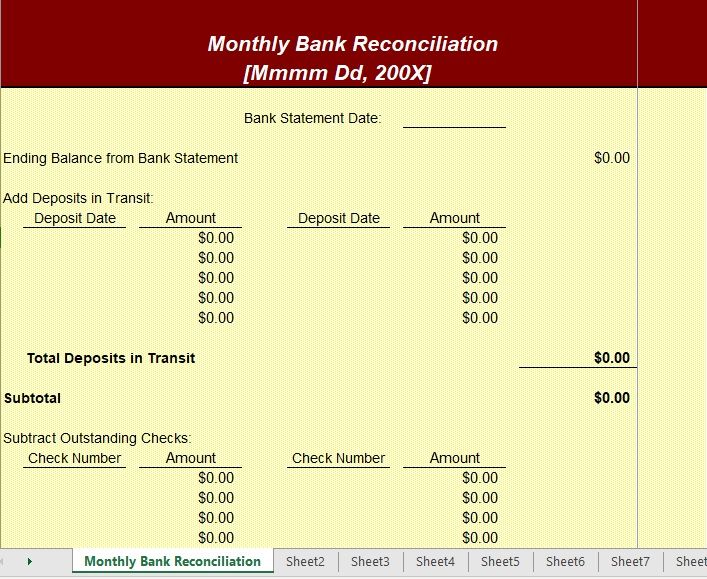

Bank Reconciliation Statement Template - The entries in the statement stop being the cause of discrepancies after a few days. 6.1 for detection of fraudulent activity; Reconciling the two accounts helps identify whether accounting changes are needed. Refer to managing discrepancies in this topic. Refer to monitoring the status in this. Let’s say the opening balance is $10,000 and the closing balance is $11,970. While they help automate the bank. Buy now and get 90% off for 6 months see plans & pricing. Over 1.8 million professionals use cfi to learn accounting, financial analysis, modeling and more. For example, if a businessman issues a check for $2,500 to a supplier on 28 may, it is quite possible that the check may not be presented by the supplier to his bank until, say, 5. Web a bank reconciliation template is a document that serves as a framework for comparing an individual’s or organization’s financial records with the corresponding bank statement. It organizes your bank statement transactions, internal records transactions, and reconciliation adjustments in a clear and systematic manner, making it easier to. You need to enter the date of the issue for the bank. Reconciling the two accounts helps identify whether accounting changes are needed. 2 journal entry to corrent the book balance. We would expect the opening balance to match since they are also the closing balance from last month when we did our last monthly bank reconciliation. It lists the items that make up the differences between the bank statement balance and. Required information to create a bank reconciliation statement. Bank reconciliation template helps you automate matching records in your bank statement with your cash book. Refer to monitoring the status in this. Select cell h5 and insert the following formula. Web a bank reconciliation statement is a document that compares the cash balance on a company’s balance sheet to the corresponding. Ascertain that if the company has a credit card account, you have access to the statement for. Reconciling the two accounts helps identify whether accounting changes are needed. Web monthly bank reconciliation template. It organizes your bank statement transactions, internal records transactions, and reconciliation adjustments in a clear and systematic manner, making it easier to. Refer to managing discrepancies in. Also, cash book is the worksheet name that contains the cash book. Web load a bank statement. Mark the items appearing in both the records. Insert the date on which the statement was printed. Web a bank reconciliation statement is a summary that shows the process of reconciling an organization’s bank account records with the bank statement. Insert the date on which the statement was printed. Select cell h5 and insert the following formula. The next step is to access the bank records to get a list of bank transactions. Web a bank reconciliation template is a document that serves as a framework for comparing an individual’s or organization’s financial records with the corresponding bank statement. The. 6.3 for identifying errors made by the bank; Ascertain that if the company has a credit card account, you have access to the statement for. =match(c5,'cash book'!c13:c20,0) in this case, cells h5 and c5 are the first cell of the column match and transaction id. This integration facilitates the setup of banks, branches, and bank accounts, and the reconciliation of. Insert the date on which the statement was printed. Web a bank reconciliation statement is a document that compares the cash balance on a company’s balance sheet to the corresponding amount on its bank statement. Load a bank statement that includes the payments for the payroll period you want to reconcile. Web a bank reconciliation statement is prepared at the. Select cell h5 and insert the following formula. This integration facilitates the setup of banks, branches, and bank accounts, and the reconciliation of bank statements with payment transactions. The next step is to access the bank records to get a list of bank transactions. Insert the date on which the statement was printed. Their bank balance closes at $1,000 on. It organizes your bank statement transactions, internal records transactions, and reconciliation adjustments in a clear and systematic manner, making it easier to. Web here are some key reasons why you should consider using a bank reconciliation template: We would expect the opening balance to match since they are also the closing balance from last month when we did our last. We have produced a free printable excel bank reconciliation statement worksheet that you can download and use for any small business. Web open the reconciliation template and follow 5 steps mentioned below: Web in this task, you need to prepare a draft bank reconciliation statement. Web a bank reconciliation statement is a document prepared by a company that shows its recorded bank account balance matches the balance the bank lists. Ascertain that if the company has a credit card account, you have access to the statement for. A bank reconciliation template provides a structured format. Web a guide to financial statements with templates. This statement includes all transactions, such. Then, get to work plugging in your numbers. The bank reconciliation statement summarizes the adjustments made to the cash book and the bank statement to bring them into agreement. 8 steps and tips in preparing bank reconciliation or a bank reconciliation form Web 5 bank reconciliation templates; Select cell h5 and insert the following formula. Compare your personal transaction records to your most recent bank statement. Web a bank reconciliation template is a document that serves as a framework for comparing an individual’s or organization’s financial records with the corresponding bank statement. Reconcile payments automatically or manually.![50+ Bank Reconciliation Examples & Templates [100 Free]](https://templatelab.com/wp-content/uploads/2017/04/Bank-Reconciliation-Template-32.jpg)

50+ Bank Reconciliation Examples & Templates [100 Free]

55 Useful Bank Reconciliation Template RedlineSP

![50+ Bank Reconciliation Examples & Templates [100 Free]](http://templatelab.com/wp-content/uploads/2017/04/Bank-Reconciliation-Template-05.jpg?w=320)

50+ Bank Reconciliation Examples & Templates [100 Free]

Bank Reconciliation Definition & Example of Bank Reconciliation

√ Free Printable Bank Reconciliation Template

Bank Reconciliation Template Free Download FreshBooks

![50+ Bank Reconciliation Examples & Templates [100 Free]](http://templatelab.com/wp-content/uploads/2017/04/Bank-Reconciliation-Template-03.jpg)

50+ Bank Reconciliation Examples & Templates [100 Free]

25+ Free Bank Reconciliation Templates & Examples (Excel / Word)

20+ Free Bank Reconciliation Sheet Templates Printable Samples

FREE 10+ Sample Bank Reconciliation in MS Word MS Excel Pages

In Order To Prepare A Bank Reconciliation Statement, You Need To Obtain The Current As Well As.

First, Make Sure That All Of The Deposits Listed On Your Bank Statement Are Recorded In Your.

For Example, If A Businessman Issues A Check For $2,500 To A Supplier On 28 May, It Is Quite Possible That The Check May Not Be Presented By The Supplier To His Bank Until, Say, 5.

Web Bank Reconciliation Statement Template.

Related Post: