Ascending Triangle Pattern

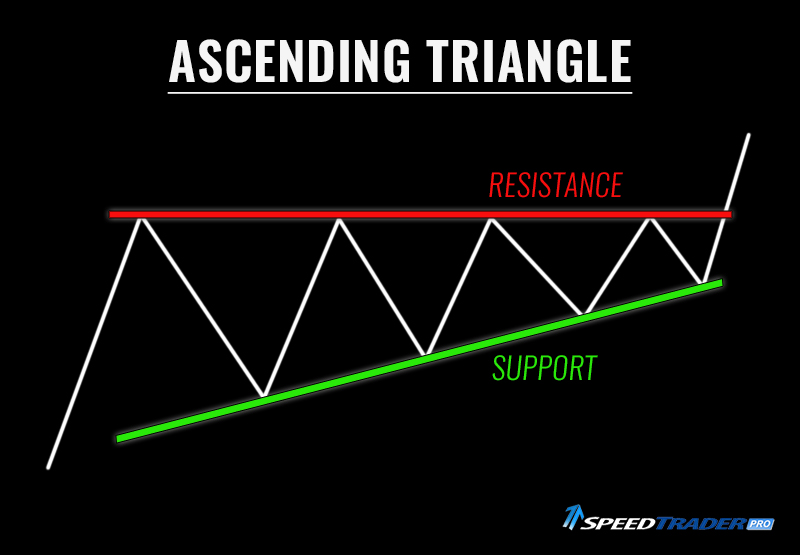

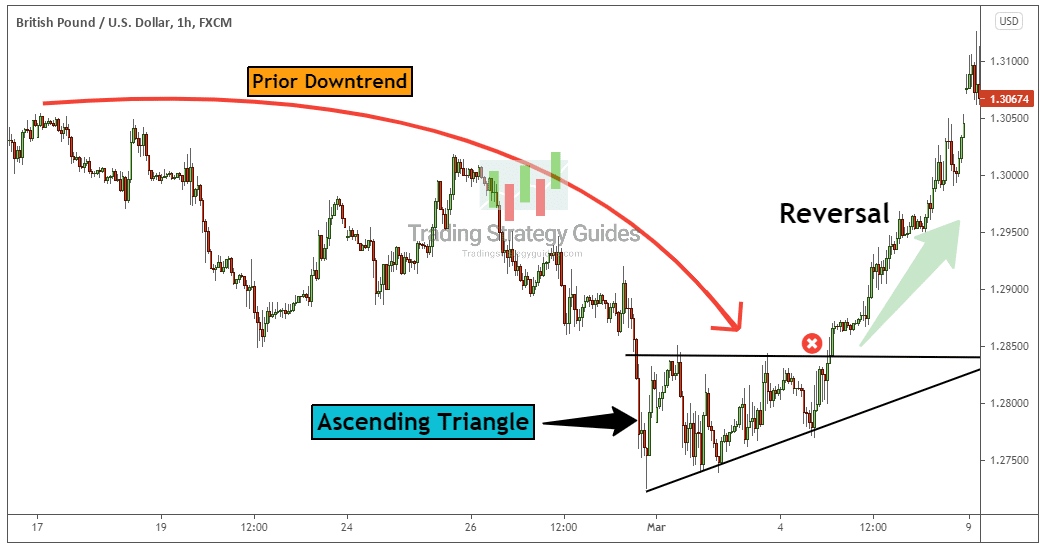

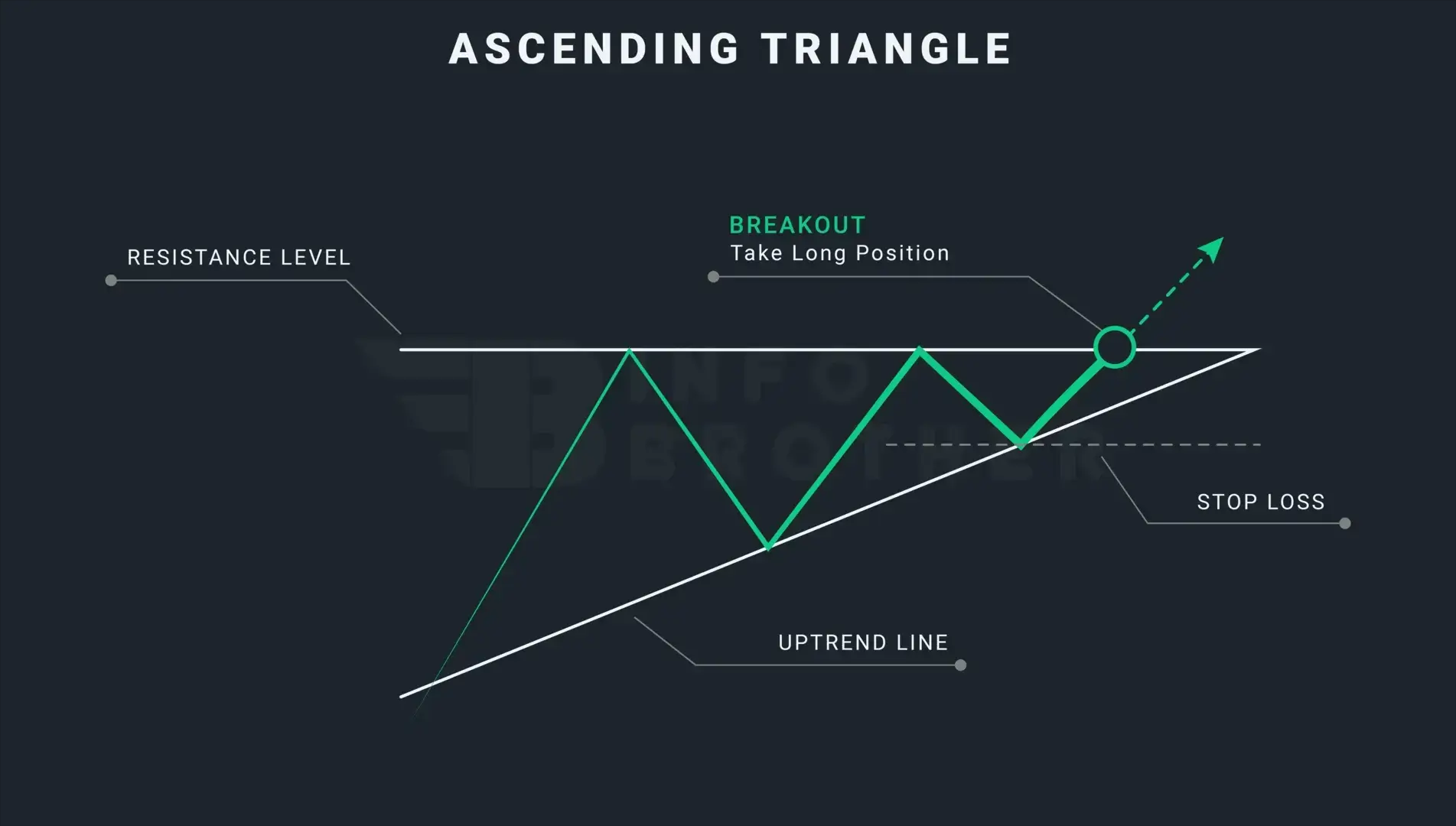

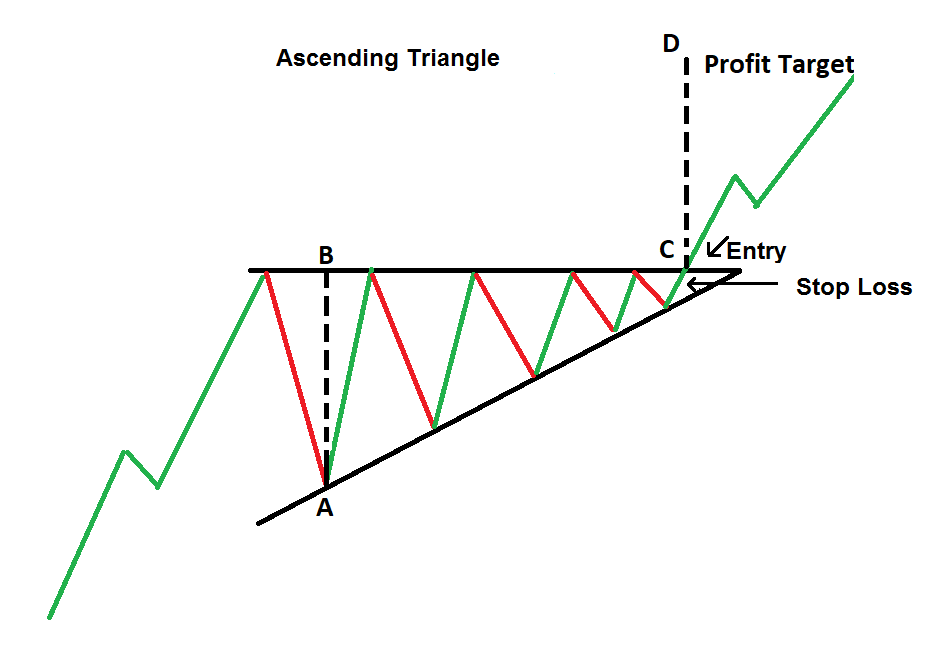

Ascending Triangle Pattern - A triangle is a technical analysis pattern created by drawing trendlines along a price range that gets narrower over time because of lower tops and higher bottoms. Web an ascending triangle is perhaps one of the most commonly recognised technical analysis patterns, also known as the bullish triangle, whereby the range of prices between high and low prices gradually narrows to form a triangle pattern awaiting breakout. Web the ascending triangle is an incredibly helpful pattern when assessing potential trend continuations. The price action temporarily pauses the uptrend as buyers are consolidating. Web the ascending triangle is a bullish chart pattern formed during an uptrend and signals the continuation of the existing trend. Features that help to identify the ascending triangle: By understanding the characteristics of this pattern and combining it with other technical analysis tools, traders can make informed decisions and improve their chances of success in the market. Web roughly scans ascending triangle pattern technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap, dividend yield etc. The ascending triangle is considered to be a continuation pattern. With continuation patterns, the best strategy is to buy straight away with the breakout. With continuation patterns, the best strategy is to buy straight away with the breakout. You have resistance across the top and uptrending price. They will aim for a breakout to the topside as the wedge narrows down. Features that help to identify the ascending triangle: Web see the ascending triangle chart below: Three forms of the triangle continuation patterns exist including the symmetrical, ascending. Learn how to identify ascending triangle patterns and the information these patterns can provide. The last step is to define our entry trigger point and measure our profit targets. What it is, how to trade it an ascending triangle is a chart pattern used in technical analysis created. The price action temporarily pauses the uptrend as buyers are consolidating. Web the ascending triangle is a bullish chart pattern formed during an uptrend and signals the continuation of the existing trend. A triangle is a technical analysis pattern created by drawing trendlines along a price range that gets narrower over time because of lower tops and higher bottoms. By. Three forms of the triangle continuation patterns exist including the symmetrical, ascending. By understanding the characteristics of this pattern and combining it with other technical analysis tools, traders can make informed decisions and improve their chances of success in the market. The highs around the resistance price form a horizontal line, while the consecutively higher lows form an ascending line.. It is literally the opposite setup of the descending triangle. It does, however, have its shortcomings and traders ought to be aware of both. However, they are gradually starting to push the price up as evidenced by the higher lows. Web sg formed a daily ascending triangle breakout pattern. You have resistance across the top and uptrending price. The ascending triangle is considered to be a continuation pattern. Web the ascending triangle pattern is a valuable tool for technical traders to identify potential bullish breakouts. Learn how to identify ascending triangle patterns and the information these patterns can provide. The ascending trendline commenced at $18.44 on may 2, 2024. A triangle is a technical analysis pattern created by. It is a bullish continuation pattern, signaling price breakout in an upward direction. Web the ascending triangle pattern is a popular and reliable trading strategy for traders. Three forms of the triangle continuation patterns exist including the symmetrical, ascending. With continuation patterns, the best strategy is to buy straight away with the breakout. It does, however, have its shortcomings and. In technical analysis, triangles are the shape of continuation patterns on charts, and ascending triangles represent one pattern formation. The highs around the resistance price form a horizontal line, while the consecutively higher lows form an ascending line. Web sg formed a daily ascending triangle breakout pattern. What happens during this time is that there is a certain level that. It is considered a continuation chart pattern, which means that when it forms. In technical analysis, triangles are the shape of continuation patterns on charts, and ascending triangles represent one pattern formation. The last step is to define our entry trigger point and measure our profit targets. It does, however, have its shortcomings and traders ought to be aware of. It is a bullish continuation pattern, signaling price breakout in an upward direction. The pattern is identified by drawing two. Web see the ascending triangle chart below: They will aim for a breakout to the topside as the wedge narrows down. The price action needs to connect with resistance and the trendline at least twice. Web the ascending triangle pattern is a popular and reliable trading strategy for traders. Web an ascending triangle is just that, a triangle that’s on the rise. It’s a triangle that’s going up on a stock chart. With continuation patterns, the best strategy is to buy straight away with the breakout. The last step is to define our entry trigger point and measure our profit targets. Web sg formed a daily ascending triangle breakout pattern. They will aim for a breakout to the topside as the wedge narrows down. The price action temporarily pauses the uptrend as buyers are consolidating. This triangle chart pattern is fairly easy to recognize and assists traders to find entry and exit levels during an ongoing trend. The breakout triggered the earning gap to $30. Web the ascending triangle pattern formed during a uptrend is significant and produces the best trading results. It is literally the opposite setup of the descending triangle. Web the ascending triangle is a bullish formation that usually forms during an uptrend as a continuation pattern. It is created by price moves that allow for an upper horizontal line to be drawn along the swing highs, and a lower rising trendline to be drawn along the swing lows. An ascending triangle is a type of triangle chart pattern that occurs when there is a resistance level and a slope of higher lows. Three forms of the triangle continuation patterns exist including the symmetrical, ascending.

The Ascending Triangle What is it & How to Trade it?

Ascending Triangle Chart Pattern Explained + Examples

Triangle Pattern Characteristics And How To Trade Effectively How To

Ascending Triangle Chart Patterns A Complete Guide

Ascending Triangle Chart Pattern What iIt Is and How to Use it

Ascending Triangle Pattern Bullish Breakout In 4Steps

:max_bytes(150000):strip_icc()/Triangles_AShortStudyinContinuationPatterns1-bba0f7388b284f96b90ead2b090bf9a8.png)

The Ascending Triangle Pattern What It Is, How To Trade It

How to Trade the Ascending Triangle Pattern 2023 Rich Tv

Ascending Triangle Chart Pattern What iIt Is and How to Use it

Ascending and Descending Triangle Patterns Investar Blog

Web The Ascending Triangle Is A Bullish Chart Pattern Formed During An Uptrend And Signals The Continuation Of The Existing Trend.

Web The Ascending Triangle Pattern:

The Ascending Trendline Commenced At $18.44 On May 2, 2024.

Symmetrical (Price Is Contained By 2 Converging Trend Lines With A Similar Slope), Ascending (Price Is Contained By A Horizontal Trend Line Acting.

Related Post: