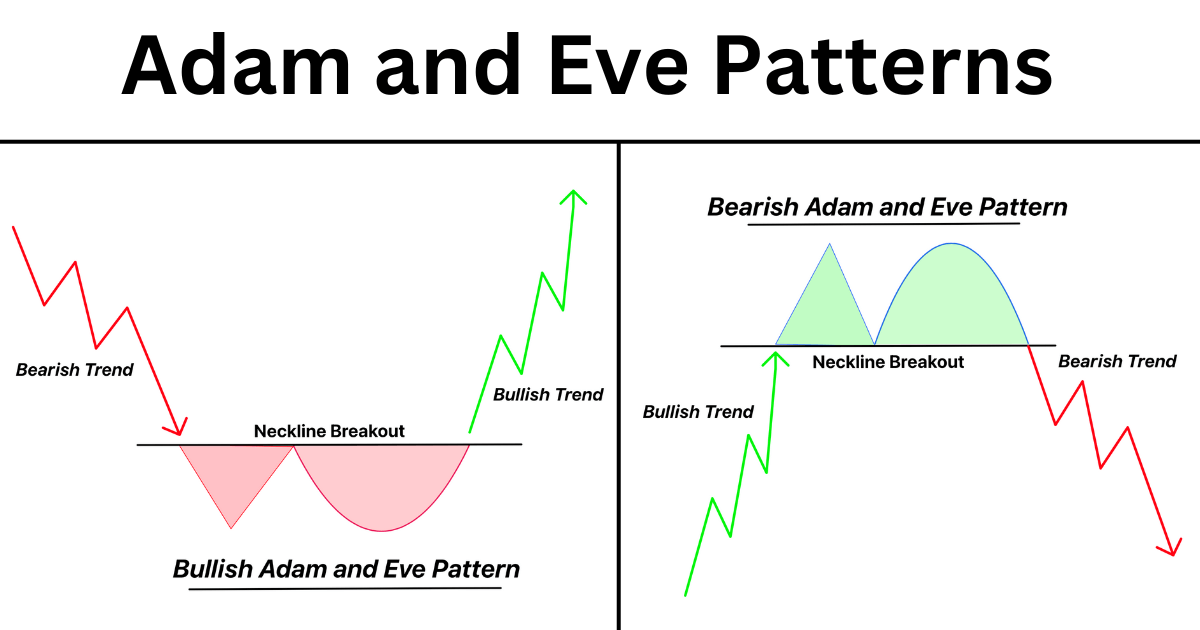

Adam And Eve Chart Pattern

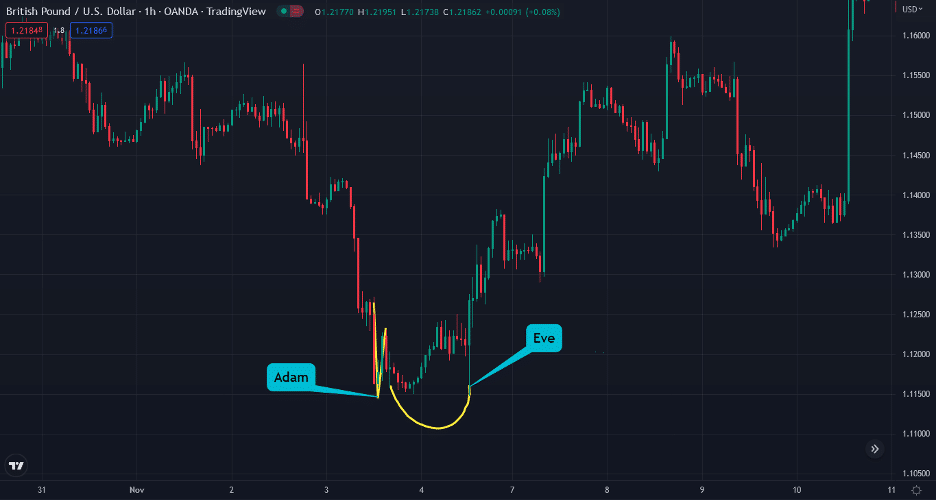

Adam And Eve Chart Pattern - Score your chart pattern for performance. The pattern was first mentioned in the book encyclopedia of chart patterns by thomas. Trading pullbacks in double tops and predicting big declines. The pattern was first mentioned in the book encyclopedia of chart patterns by thomas bulkowski, and until these days, it is a relatively unfamiliar classical chart patternto many traders worldwide. An eve low typically follows an adam low and is. Web that is one of the key ways of telling an adam bottom or top from an eve. This pattern is named after. Double bottoms, eve & eve. Double tops, eve & adam; Double bottoms, adam & eve. Adam and eve is a rare bullish/bearish reversal double bottom/top chart pattern that is a combination of v and u shape price. Double bottom trading setup has won 80% of. Web the adam and eve chart pattern is a technical analysis pattern that is used to identify potential reversals in the price of an asset. This is the first ‘adam’. Web the eve bottom distinguishes itself from its predecessor with a rounded trough, indicating price congestion over a wider range. Double tops, eve & adam; Double bottom trading setup has won 80% of. Web trading pattern pairs: Web the adam and eve chart pattern is a rare but accurate formation in the trading world. Web the adam and eve chart pattern is a technical analysis pattern that is used to identify potential reversals in the price of an asset. Web according to thomas bulkowski's encyclopedia of chart patterns, the adam and eve formation is characterized by a sharp and deep first bottom on high volume (adam). Article explains the four varieties. The adam and. Web trading pattern pairs: Then the price bounces back. Article explains the four varieties. Web the adam and eve chart pattern is a rare but accurate formation in the trading world. Web the eve bottom distinguishes itself from its predecessor with a rounded trough, indicating price congestion over a wider range. Web the adam and eve top pattern is a bearish chart pattern that is essentially the reverse of the adam and eve bottom pattern. The adam and eve pattern is a variation of double top and double bottom patterns. According to thomas bulkowski's encyclopedia of chart patterns, the adam and eve formation is characterized by a sharp and deep first. The pattern was first mentioned in the book encyclopedia of chart patterns by thomas bulkowski, and until these days, it is a relatively unfamiliar classical chart patternto many traders worldwide. Web on august 28, 2023. Trading pullbacks in double tops and predicting big declines. An eve low typically follows an adam low and is. Score your chart pattern for performance. Double bottom trading setup has won 80% of. Web the adam and eve chart pattern is a rare but accurate formation in the trading world. Web the adam and eve bottom bottom pattern is a bullish chart pattern that can provide traders with valuable insights into the market’s psychology. Double bottoms, adam & eve. Score your chart pattern for performance. Score your chart pattern for performance. Web the adam and eve pattern is a bullish and bearish reversal chart pattern. Web trading pattern pairs: Slightly different from traditional double bottoms/tops. Web the eve bottom distinguishes itself from its predecessor with a rounded trough, indicating price congestion over a wider range. An eve low typically follows an adam low and is. Double bottoms, eve & eve. Then the price bounces back. Web the adam and eve bottom bottom pattern is a bullish chart pattern that can provide traders with valuable insights into the market’s psychology. According to thomas bulkowski's encyclopedia of chart patterns, the adam and eve formation is characterized by. Then the price bounces back. An eve low typically follows an adam low and is. Web trading pattern pairs: The adam and eve pattern is a variation of double top and double bottom patterns. The adam and eve pattern is a concept that appears in technical analysis of stock market trends. Adam and eve is a bullish and bearish reversal chart pattern that appears in a downtrend or uptrend. Web that is one of the key ways of telling an adam bottom or top from an eve. Slightly different from traditional double bottoms/tops. Article explains the 4 varieties. Web the eve & adam double bottom chart pattern confirms when price closes above the high between the two bottoms, shown here as the breakout point. Web the adam and eve pattern is a bullish and bearish reversal chart pattern. Double bottoms, eve & eve. The pattern was first mentioned in the book encyclopedia of chart patterns by thomas. Article explains the four varieties. Double tops, adam & eve. Web on august 28, 2023. Double tops, eve & adam; Adam and eve is a rare bullish/bearish reversal double bottom/top chart pattern that is a combination of v and u shape price. Web the eve bottom distinguishes itself from its predecessor with a rounded trough, indicating price congestion over a wider range. Web the adam and eve chart pattern is a rare but accurate formation in the trading world. Score your chart pattern for performance.

Mastering The Adam And Eve Chart Pattern Your Path To Profitable Trading

Adam and Eve Double Bottom Chart Pattern Market Pulse

What Is A Double Top Pattern? How To Trade Effectively With It

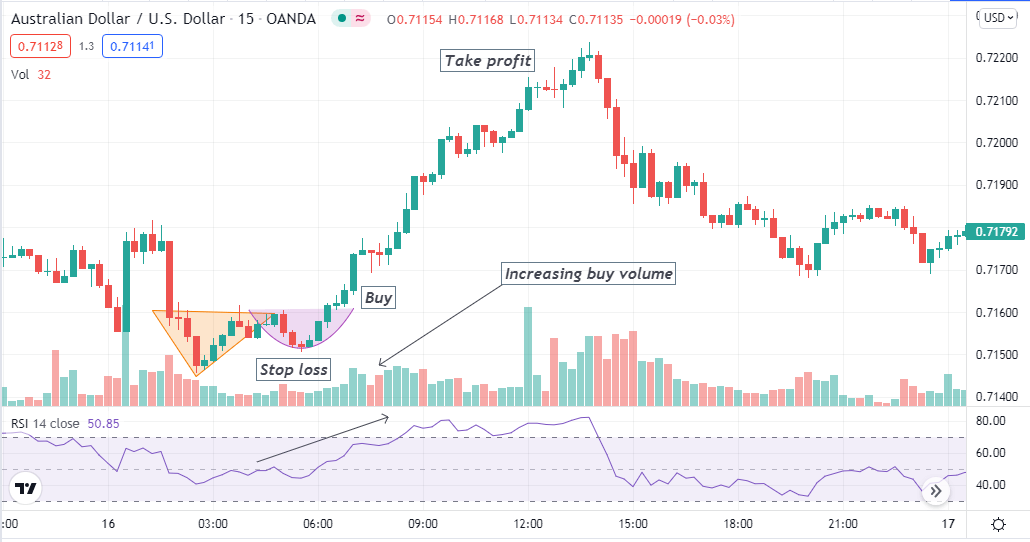

Adam and Eve Pattern Forex Trading Strategy • FX Tech Lab

What Is A Double Bottom Pattern? How To Use It Effectively How To

Mastering the Adam and Eve Chart Pattern Your Path to Profitable Trading

Adam And Eve Chart

What Is A Double Bottom Pattern? How To Use It Effectively How To

How to identify the Adam and Eve Pattern? ForexBee

How To Trade The Adam and Eve Pattern (Double Tops and Bottoms)

Web According To Thomas Bulkowski's Encyclopedia Of Chart Patterns, The Adam And Eve Formation Is Characterized By A Sharp And Deep First Bottom On High Volume (Adam).

This Pattern Is Named After.

The Adam And Eve Pattern Is A Concept That Appears In Technical Analysis Of Stock Market Trends.

The Adam And Eve Pattern Is A Variation Of Double Top And Double Bottom Patterns.

Related Post: