Abcd Chart Pattern

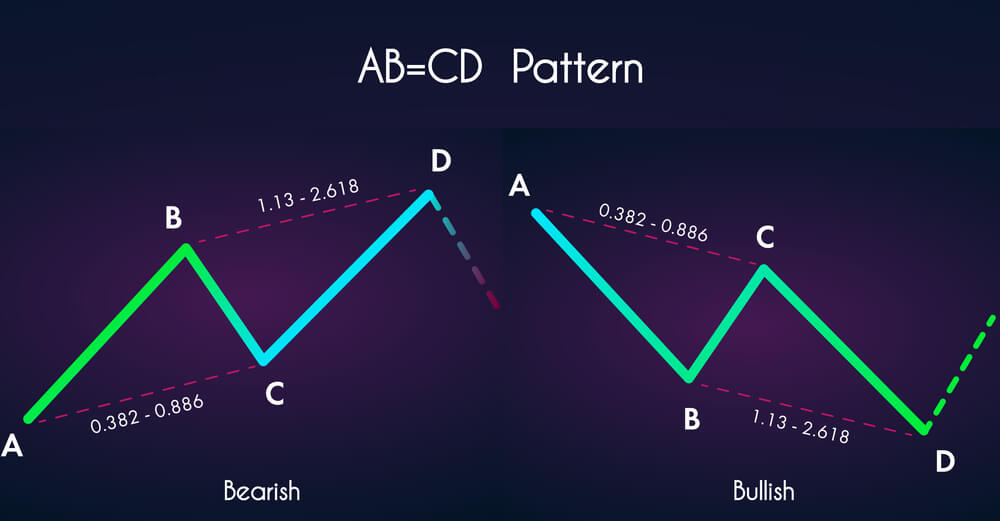

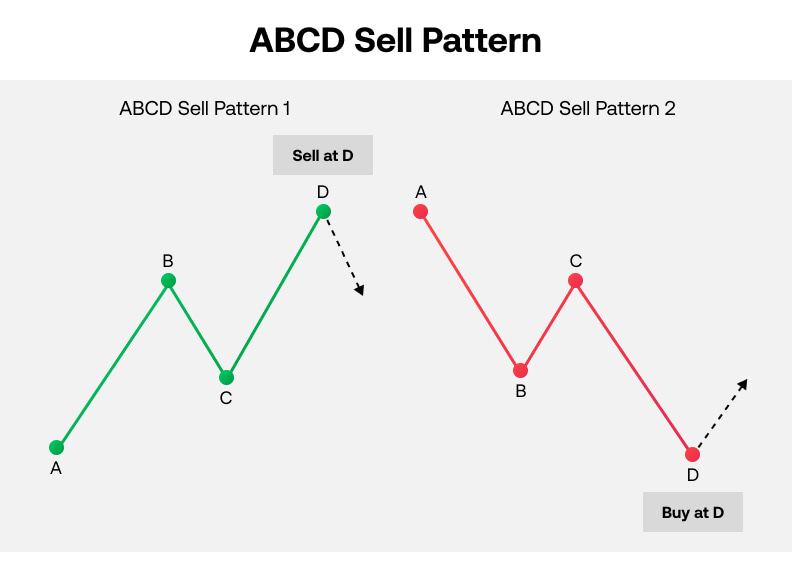

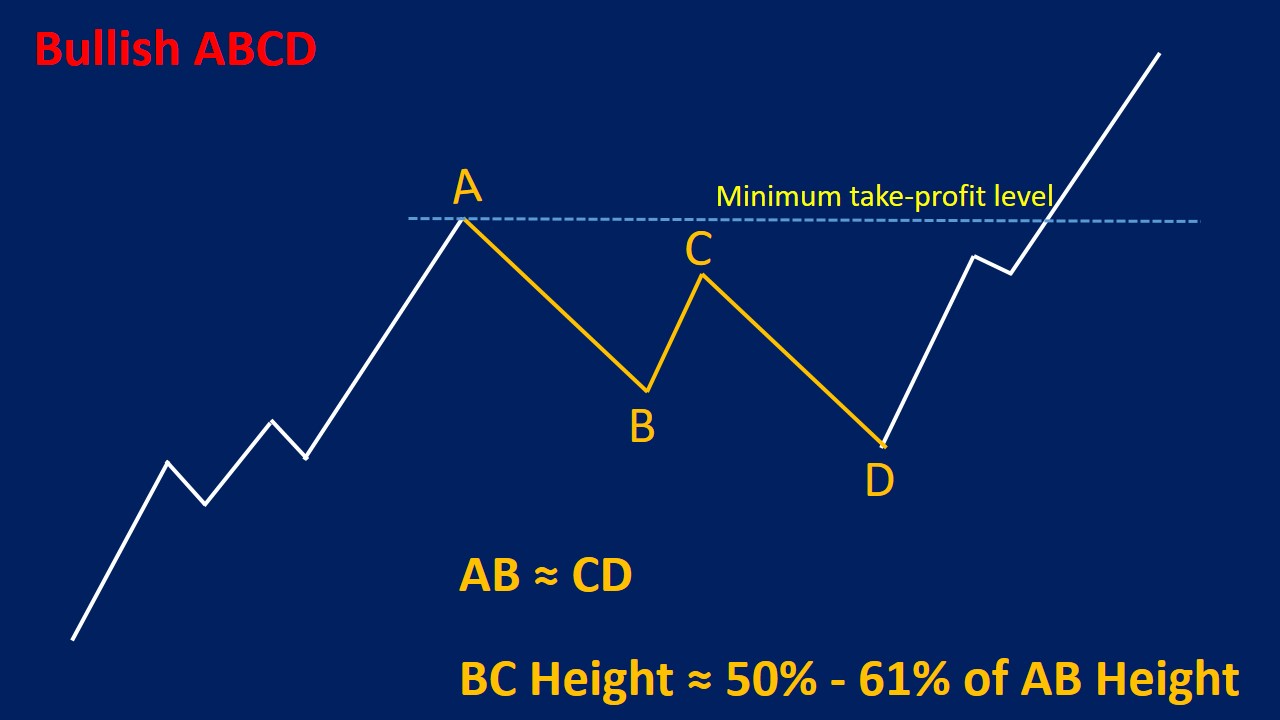

Abcd Chart Pattern - Web bearish ab=cd (abcd) this chart pattern is the same as the bullish ab=cd pattern, but it is upside down. Ebirders filled in data gaps. 36.1 million ebird checklists —a 28% increase in number of checklists. Web when ab is identified, the next step is to plot bc. At the beginning of an uptrend, for example, the equity would make an aggressive move to an extreme pivot point (marked. Web the ict silver bullet strategy offers traders a unique approach to capitalising on market opportunities during specific trading hours. On a bullish one, you might want to buy the market. Cd must be 127.2% or 161.8% of ab or of cd. Whether you're trading futures, forex, bonds or equities, chart patterns may be. Web reflects the standard, rhythmic style in which the market moves; Abcd trading pattern is a trend that stocks take in the market, observable on price charts. 36.1 million ebird checklists —a 28% increase in number of checklists. 374,682 ebirders contributed data—a 20% increase from last year. Web reflects the standard, rhythmic style in which the market moves; At (d), the uptrend should reverse and begin to turn into a downtrend. This article explored this advanced strategy, explaining the role of fair value gaps, liquidity,. Multiday charts generally offer insight into the behaviour of stocks and markets over an extended period of time. The pattern can be bullish or. Web bearish ab=cd (abcd) this chart pattern is the same as the bullish ab=cd pattern, but it is upside down. Web what. Web what is the abcd trading pattern? Chart patterns understand how to read the charts like a pro trader; This article explored this advanced strategy, explaining the role of fair value gaps, liquidity,. It consists of an initial leg up or leg down followed by a short consolidation and then another leg up or down in the direction of the. On a bearish abcd, you might choose to enter a sell position at this point. This article explored this advanced strategy, explaining the role of fair value gaps, liquidity,. On a bullish one, you might want to buy the market. 1) wait for 0 leg to a leg (bearish trend) then 2) wait for a leg to b leg (bullish. The sequence of events follows a. Ebirders filled in data gaps. This article explored this advanced strategy, explaining the role of fair value gaps, liquidity,. Web the abcd pattern is a technical analysis pattern that consists of four price swings, forming a distinctive shape on a price chart. Web the abcd pattern is great for traders to learn because it. The pattern starts with a bullish ab line, which can be. 202 additional species this year. Learn everything in this definitive guide. C usually retraces to 61.8% or 78.6% of ab. On a bearish abcd, you might choose to enter a sell position at this point. Similarly, point b should be the 0.618 retracement of drive 2. Web reflects the standard, rhythmic style in which the market moves; The abcd pattern is an intraday chart pattern. Web in the contemporary marketplace, chart patterns are a favorite tool for legions of participants. 1) wait for 0 leg to a leg (bearish trend) then 2) wait for a. Web what is the abcd trading pattern? It’s when a stock spikes big, pulls back, then grinds ups and breaks out to a new. As usual, you’ll need your hawk eyes, the fibonacci tool, and a smidge of patience on this one. Web a global view —global relative abundance and range maps for 1,009 species; Web what is the abcd. Point d must be a new low below point b. Chart patterns understand how to read the charts like a pro trader; Similarly, point b should be the 0.618 retracement of drive 2. The sequence of events follows a. 374,682 ebirders contributed data—a 20% increase from last year. On a bearish abcd, you might choose to enter a sell position at this point. In strong markets, c can trace only up to 38.2% or up to 50% of ab. Whether you're trading futures, forex, bonds or equities, chart patterns may be. This article explored this advanced strategy, explaining the role of fair value gaps, liquidity,. It looks like. 374,682 ebirders contributed data—a 20% increase from last year. 11 million unique locations— an additional 4 million. Web the abcd pattern is a technical analysis pattern that consists of four price swings, forming a distinctive shape on a price chart. C must be lower than a and must be the intermediate high after the low point at b. Web the abcd pattern is great for traders to learn because it is easy to identify and has defined risk/reward levels. 36.1 million ebird checklists —a 28% increase in number of checklists. Cd must be 127.2% or 161.8% of ab or of cd. Users can manually draw and maneuver the four. At the beginning of an uptrend, for example, the equity would make an aggressive move to an extreme pivot point (marked. Web market analysis keep up to date with the latest market news; An abc pattern a pivot long signal. Web the pattern is essentially the opposite of the bullish pattern, rising where the bull pattern falls and falling where the bull pattern rises. Web discover how you can generate an extra source of income in less than 20 minutes a day—even if you have no trading experience or a small starting capital. It consists of an initial leg up or leg down followed by a short consolidation and then another leg up or down in the direction of the original move. Web what is the abcd trading pattern? C usually retraces to 61.8% or 78.6% of ab.

Trading The ‘AB=CD’ Harmonic Pattern Using Fibonacci Ratios Forex Academy

ABCD Pattern ABCD Harmonic Pattern Trading Strategy ABCD Harmonic

Using the Harmonic AB=CD Pattern to Pinpoint Price Swings Forex

ABCD Pattern Day Trading Guide Everything You Need To Maximize Profits

ABCD Pattern Trading What is ABCD Pattern? US

ABCD Harmonic Pattern in Forex Identify & Trade Free Forex Coach

What Is an ABCD Trading Pattern?

The Day Trading ABCD Pattern Explained TradingSim

ABCD Harmonic Pattern in Forex Identify & Trade Free Forex Coach

ABCD Pattern Trading Strategy and Examples

Web Fans Are Busy Designing Capes To Commemorate This Weekend's Psn Fiasco After Helldivers 2 Boss Johan Pilestedt Noted That The Game's Steam Reviews Resemble An Accidental Cape Design.

Similarly, Point B Should Be The 0.618 Retracement Of Drive 2.

Abcd Trading Pattern Is A Trend That Stocks Take In The Market, Observable On Price Charts.

Indicators Learn How To Read And Trade With Technical Indicators;

Related Post: