A Calendar Year-End Reporting Period Is Defined As A

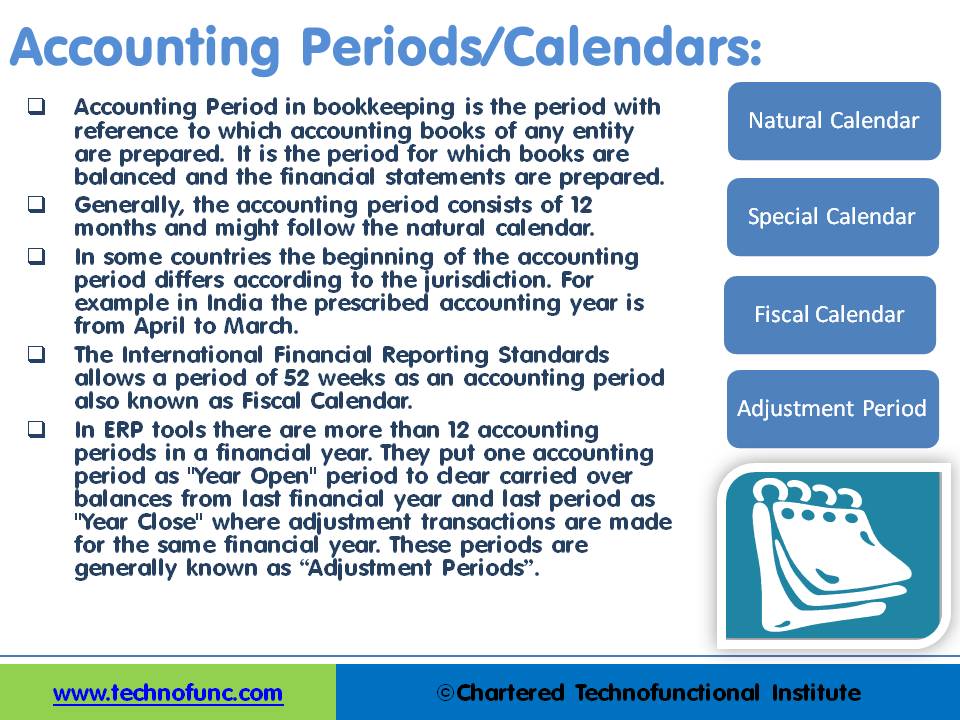

A Calendar Year-End Reporting Period Is Defined As A - 12 december a period consisting of 12 consecutive months or 52 weeks is called a _______ year Businesses can follow the standard. Web for companies with reporting periods ending on or after 24 february, and calendar year end companies reporting in the first quarter of 2022, these events and market. A calender year end reporting period is defined as a 12 month period which ends on december 31st in a year. It is typically either for a month, quarter, or year. Web the calendar year is the most common tax year. 12 december see an expert. Web a fiscal year (fy), also known as a budget year, is a period of time used by the government and businesses for accounting purposes to formulate annual financial. Web a financial year equals 12 consecutive months during which a business tracks its finances for tax and reporting purposes. 12, december see an expert. Other tax years include a fiscal year and a short tax year. There are 2 steps to solve this one. A calender year end reporting period is defined as a 12 month period which ends on december 31st in a year. 12 december see an expert. 12 december a period consisting of 12 consecutive months or 52 weeks is called. Each taxpayer must use a consistent accounting method, which is a set. Web for companies with reporting periods ending on or after 24 february, and calendar year end companies reporting in the first quarter of 2022, these events and market. Businesses can follow the standard. Web the calendar year is the most common tax year. A calender year end reporting. 12, december see an expert. 12 december a period consisting of 12 consecutive months or 52 weeks is called a _______ year Most months in the calendar year have at least 30 days, and february. Web a financial year equals 12 consecutive months during which a business tracks its finances for tax and reporting purposes. A calender year end reporting. Web the calendar year is the most common tax year. 12 december see an expert. 12, december see an expert. Web a financial year equals 12 consecutive months during which a business tracks its finances for tax and reporting purposes. There are 2 steps to solve this one. 12, december see an expert. Web a fiscal year (fy), also known as a budget year, is a period of time used by the government and businesses for accounting purposes to formulate annual financial. There are 2 steps to solve this one. Web a reporting period is the span of time covered by a set of financial statements. It is. 12 december see an expert. Web a financial year equals 12 consecutive months during which a business tracks its finances for tax and reporting purposes. Each taxpayer must use a consistent accounting method, which is a set. Other tax years include a fiscal year and a short tax year. Web for companies with reporting periods ending on or after 24. Other tax years include a fiscal year and a short tax year. Each taxpayer must use a consistent accounting method, which is a set. Web a reporting period is the span of time covered by a set of financial statements. 12, december see an expert. Web for companies with reporting periods ending on or after 24 february, and calendar year. Other tax years include a fiscal year and a short tax year. 12, december see an expert. Web a financial year equals 12 consecutive months during which a business tracks its finances for tax and reporting purposes. 12 december see an expert. It is typically either for a month, quarter, or year. Most months in the calendar year have at least 30 days, and february. Web a financial year equals 12 consecutive months during which a business tracks its finances for tax and reporting purposes. 12, december see an expert. 12 december a period consisting of 12 consecutive months or 52 weeks is called a _______ year Web for companies with reporting. Web a fiscal year (fy), also known as a budget year, is a period of time used by the government and businesses for accounting purposes to formulate annual financial. Businesses can follow the standard. Web the calendar year is the most common tax year. Web a reporting period is the span of time covered by a set of financial statements.. There are 2 steps to solve this one. Businesses can follow the standard. Web for companies with reporting periods ending on or after 24 february, and calendar year end companies reporting in the first quarter of 2022, these events and market. 12 december see an expert. Web a fiscal year (fy), also known as a budget year, is a period of time used by the government and businesses for accounting purposes to formulate annual financial. Web a reporting period is the span of time covered by a set of financial statements. Web a financial year equals 12 consecutive months during which a business tracks its finances for tax and reporting purposes. A calender year end reporting period is defined as a 12 month period which ends on december 31st in a year. 12 december a period consisting of 12 consecutive months or 52 weeks is called a _______ year 12, december see an expert. Each taxpayer must use a consistent accounting method, which is a set. Most months in the calendar year have at least 30 days, and february.TechnoFunc GL Periods and Calendars

Year End Report 9+ Examples, Format, Pdf Examples

Payroll Calendar Definition, How to Create, and More

Calendar Year Reporting Period Month Calendar Printable

Fiscal Year Vs Calendar Year

Calendar Year Reporting Period Month Calendar Printable

how to write a good end of year report

Calendar Year Reporting Period Month Calendar Printable

How to Visualize a Perfect Annual Report for the End of the Year

Calendar Yearend Summary Report Plan PPT Template PowerPoint PPTX

Web The Calendar Year Is The Most Common Tax Year.

Other Tax Years Include A Fiscal Year And A Short Tax Year.

It Is Typically Either For A Month, Quarter, Or Year.

Related Post: