A B C D Pattern

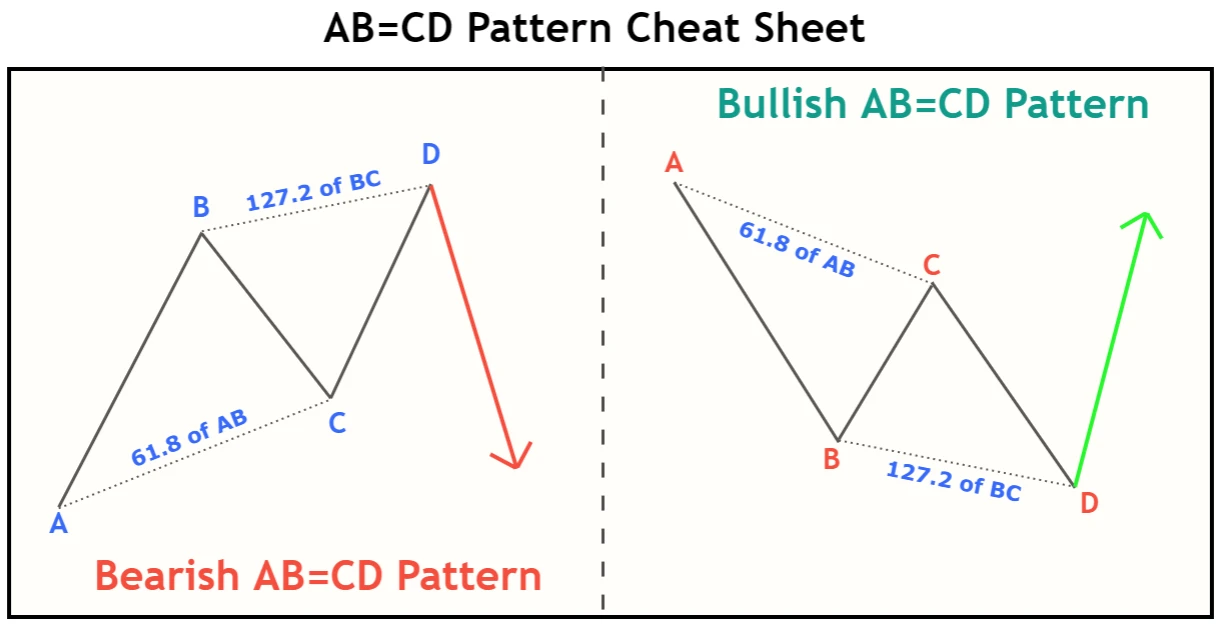

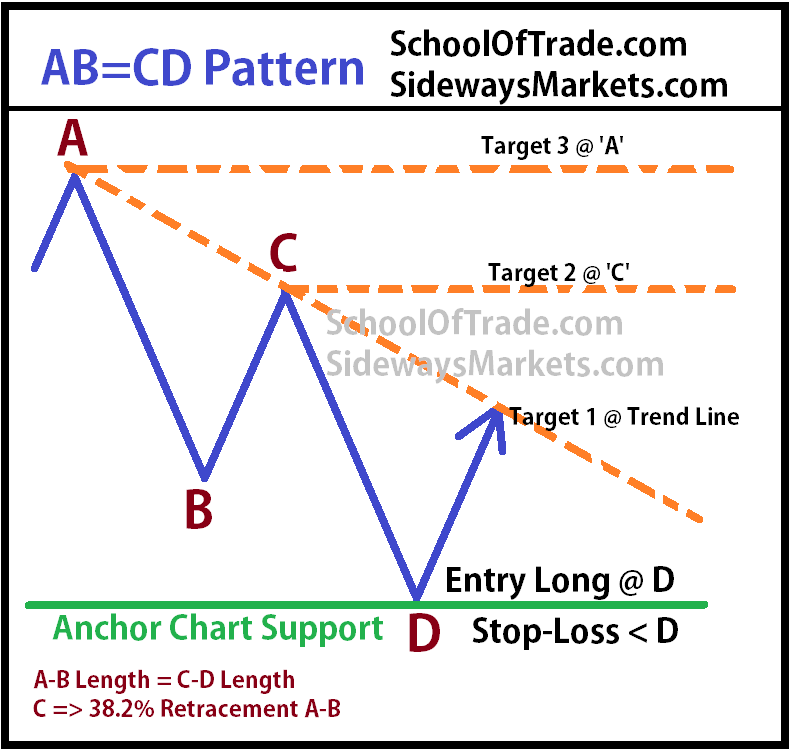

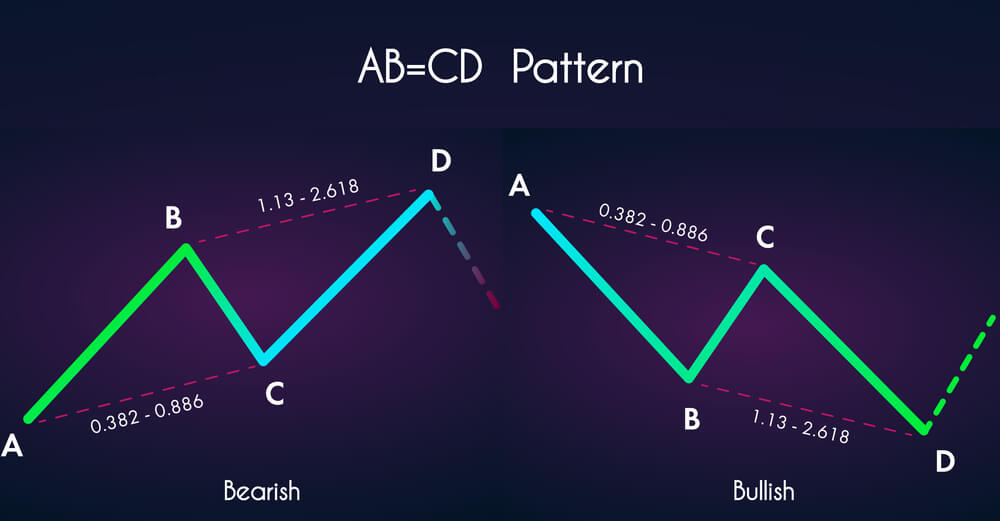

A B C D Pattern - Depending on the context, it can be bullish or bearish. You could say it’s an equal. Web the abcd pattern is a common technical analysis pattern used by traders to identify potential trading opportunities in the financial markets. Suri is the author of trade chart patterns like the pros.you’ll. Web the ab=cd harmonic is reversal pattern. As the disease progresses, however, individuals tend to. It’s when a stock spikes big, pulls back, then grinds ups and breaks out to a new high of the day. Meaning the retracement of ab can not exceed 1.00. It should follow specific fibonacci ratios : Midday pullback and consolidation 3. Bc is the 61.8 percent fibonacci. Midday pullback and consolidation 3. It looks like a diagonal lightning bolt and can indicate an upcoming trading. Web learn how to trade the abcd pattern, a classic chart pattern that shows harmony between price and time. Web the a b c d pattern is a popular harmonic pattern that forms frequently in technical. It’s when a stock spikes big, pulls back, then grinds ups and breaks out to a new high of the day. Web.the abcd pattern employs simplicity to its advantage, built upon the interplay of four crucial protagonists: C can not exceed a. This pattern is formed in a position prior to the final wave in an. You could say it’s. Bc is the 61.8 percent fibonacci. C can not exceed a. Web the abcd pattern is a visual, geometric chart pattern comprised of three consecutive price swings. C:higher low and grind up breaks through the. Web the a b c d pattern is a popular harmonic pattern that forms frequently in technical analysis and it consists of two equal price. C can be a 1.00 retracement of the ab leg, this is a rare pattern and a double top or bottom, but it is. This pattern is formed in a position prior to the final wave in an. Web what is the abcd pattern? Web.the abcd pattern employs simplicity to its advantage, built upon the interplay of four crucial protagonists:. Web.the abcd pattern employs simplicity to its advantage, built upon the interplay of four crucial protagonists: Users can manually draw and maneuver the four. Web the main recognizable feature of an abcd pattern is that the a to b leg (ab leg) matches the c to d leg (cd leg) — in other words, ab ≈ cd. Web learn how. Web the main recognizable feature of an abcd pattern is that the a to b leg (ab leg) matches the c to d leg (cd leg) — in other words, ab ≈ cd. Web the abcd pattern is a visual, geometric chart pattern comprised of three consecutive price swings. Daniels received $130,000 from mr. Here we are using capital letters.. Trump’s personal lawyer, michael d. It is the easiest pattern to create. Web what is the abcd pattern? You could say it’s an equal. It should follow specific fibonacci ratios : The pattern is a measured move where the second leg is “equal” to the first leg. Web the main recognizable feature of an abcd pattern is that the a to b leg (ab leg) matches the c to d leg (cd leg) — in other words, ab ≈ cd. Web the abcd pattern is a visual, geometric chart pattern comprised. It is the easiest pattern to create. The square alphabet pattern is a square shape created using alphabets. The abcd pattern drawing tool allows analysts to highlight various four point chart patterns. Depending on the context, it can be bullish or bearish. The pattern is a measured move where the second leg is “equal” to the first leg. You could say it’s an equal. Web what is the abcd pattern? Trump’s personal lawyer, michael d. Find out the three types of abcd patterns, the rules, the variations and. Depending on the context, it can be bullish or bearish. The b to c leg (bc leg). Web what is the abcd pattern? This pattern is formed by four. Web learn how to trade the abcd pattern, a classic chart pattern that shows harmony between price and time. Depending on the context, it can be bullish or bearish. The ab=cd pattern is found in all markets and on all time frames. C:higher low and grind up breaks through the. Web the abcd pattern is a visual, geometric chart pattern comprised of three consecutive price swings. C can not exceed a. The square alphabet pattern is a square shape created using alphabets. Web the ab=cd harmonic is reversal pattern. The abcd pattern drawing tool allows analysts to highlight various four point chart patterns. As you might have deduced from the name, the pattern. The pattern is a measured move where the second leg is “equal” to the first leg. It should follow specific fibonacci ratios : Web the ab=cd harmonic pattern is a popular chart formation in technical analysis, known for its simple and symmetrical structure, used to predict potential price.

AB = CD Pattern and ‘Reversal Zone' are easy ways to profit

AB=CD Pattern Rules Top 3 ABCD Pattern Trading Tricks & Tips

Harmonic Patterns AB=CD FXTM

Harmonic Patterns The Alternate AB=CD Pattern by Scott Carney YouTube

AB=CD Pattern An Advance Harmonic Trader's Guide ForexBee

Trading The Symmetrical ABCD Pattern;

abcdpatterntradingstrategy2 Forex Training Group

Using the Harmonic AB=CD Pattern to Pinpoint Price Swings Forex

Trading The ‘AB=CD’ Harmonic Pattern Using Fibonacci Ratios Forex Academy

ABCD Pattern ABCD Harmonic Pattern Trading Strategy ABCD Harmonic

Of All The Various Price Patterns That Exist, The Abcd Pattern Is Among The Easiest To Identify.

Meaning The Retracement Of Ab Can Not Exceed 1.00.

The Abcd Pattern Is An Intraday Chart Pattern.

C Can Be A 1.00 Retracement Of The Ab Leg, This Is A Rare Pattern And A Double Top Or Bottom, But It Is.

Related Post: