941 Reconciliation Template Excel

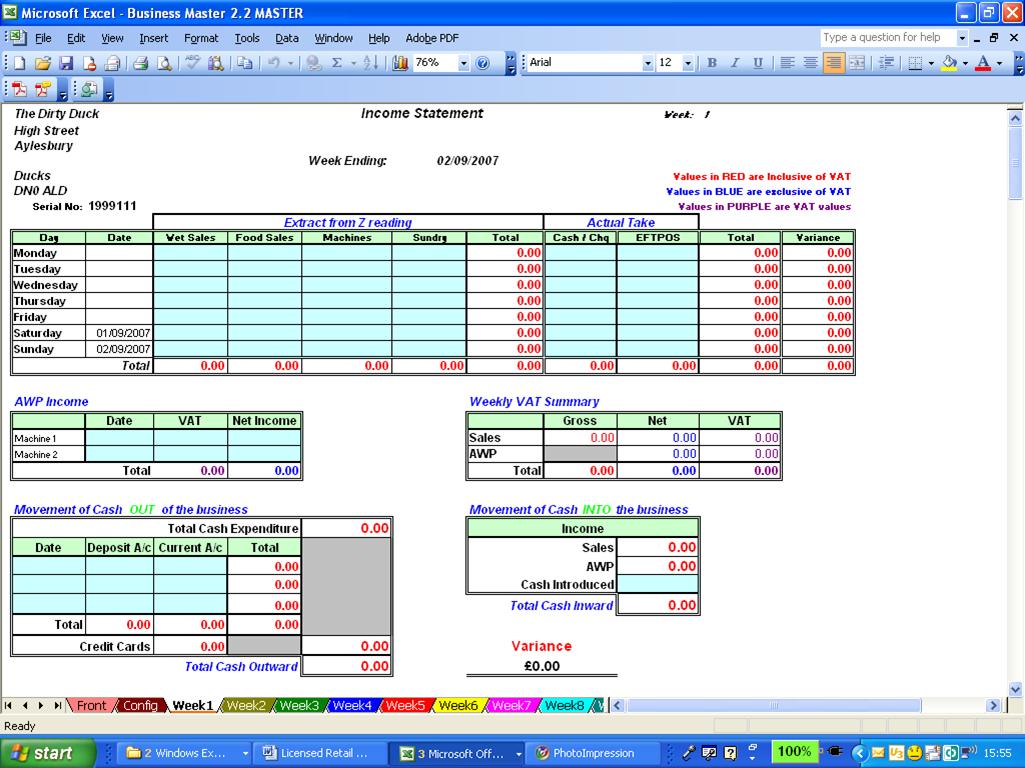

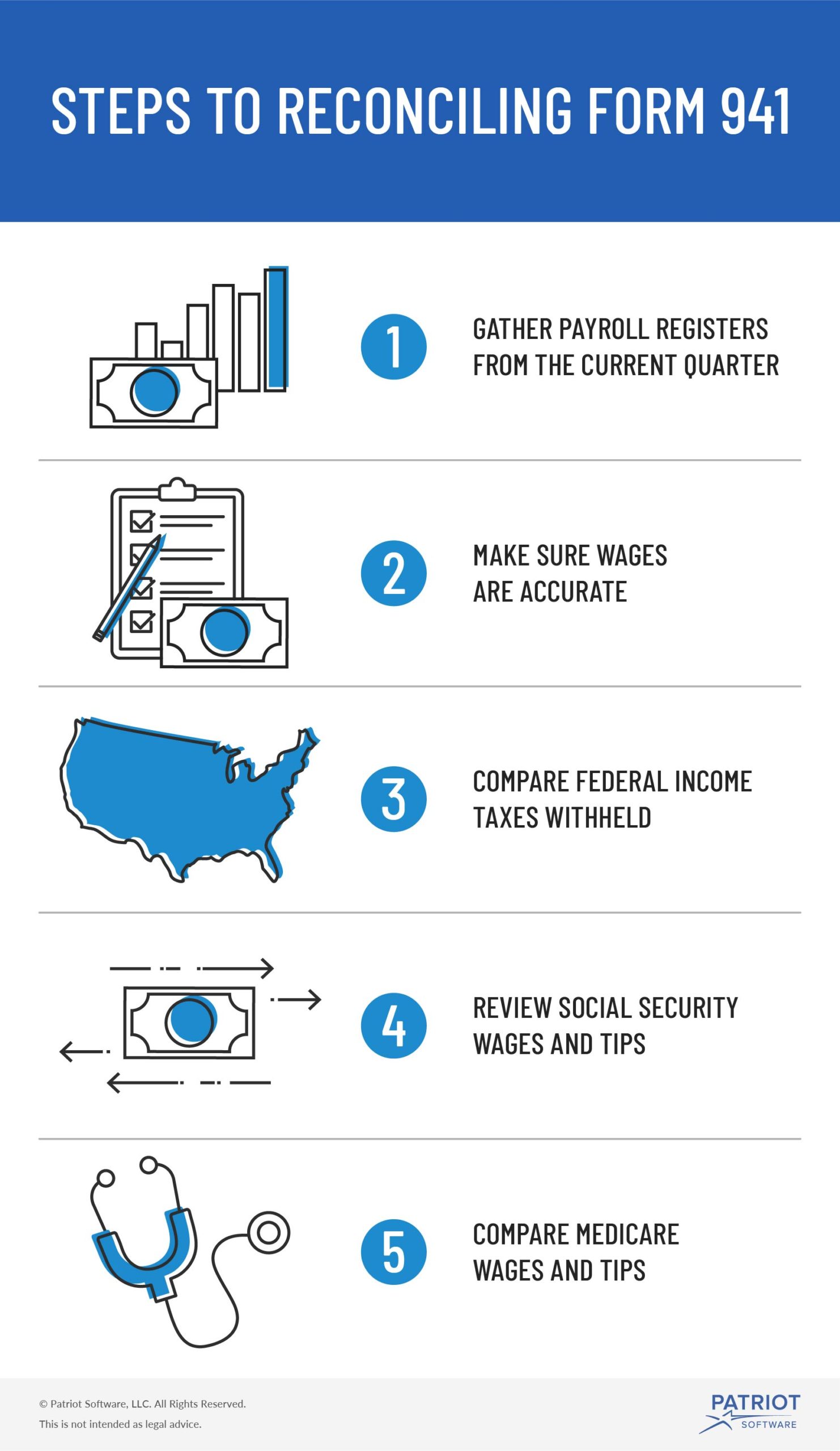

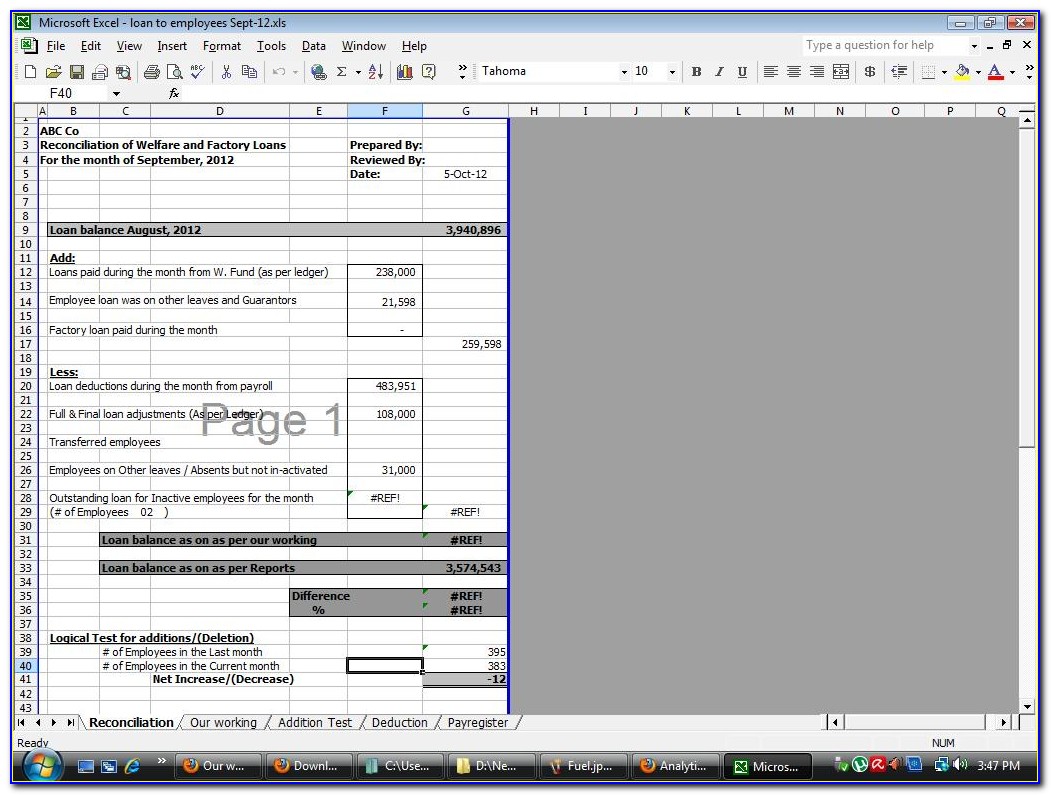

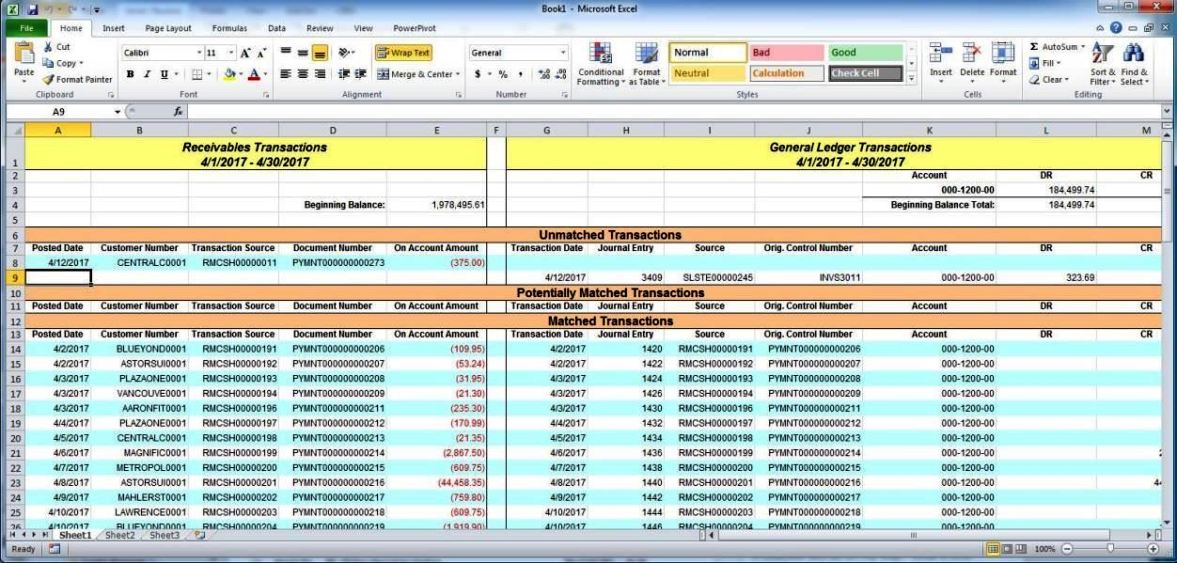

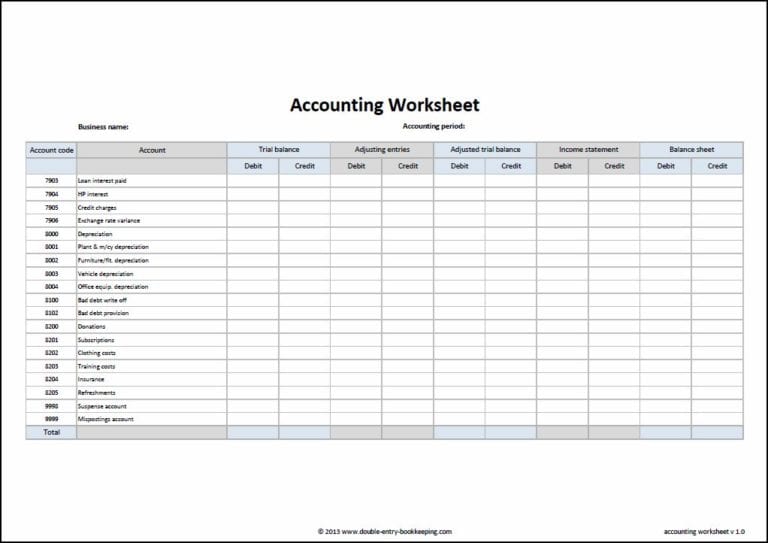

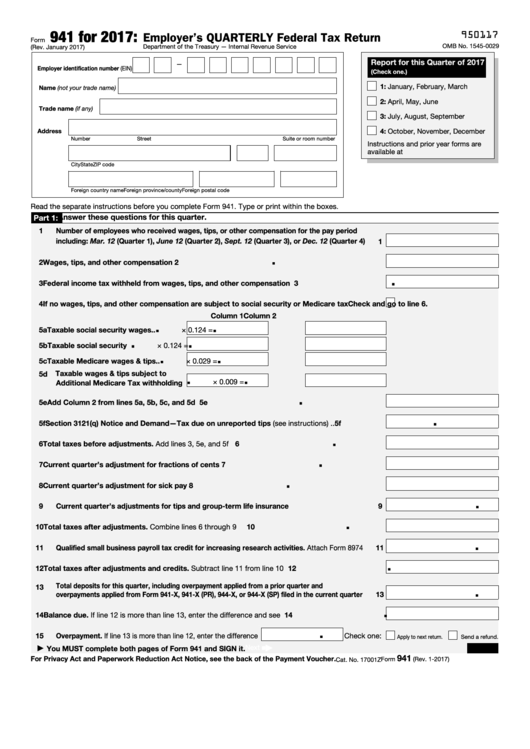

941 Reconciliation Template Excel - Oct 23, 2020 michael whitmire. Run a report that shows annual payroll amounts. Gather payroll registers from the current quarter. Enter your name and address as shown on form 941. Paperless solutionsbbb a+ rated businessfree trial3m+ satisfied customers Every pay period before you cut employee checks—ideally, at least two days before your payday; Web form 941 is used by employers to report payroll taxes to the irs. Web ðï ࡱ á> þÿ 1. Compare those figures with the totals reported on all four 941s for the year. Web follow these five simple steps to reconcile form 941. Web box 4—name and address. Paperless solutionsbbb a+ rated businessfree trial3m+ satisfied customers In this article, we will demonstrate how to create an excel checkbook register with reconciliation. Bankers typically employ reconciliation in their. Compare those figures with the totals reported on all four 941s for the year. Run a report that shows annual payroll amounts. Fill in the empty fields; Web this simple bank reconciliation template is designed for personal or business use, and you can download it as an excel file or google sheets template. Download the required 941 excel template. Compare those figures with the totals reported on all four 941s for the year. Web the three way reconciliation in excel is useful to compare transaction records from 3 different sources and match them to find any error in calculation. Web follow these five simple steps to reconcile form 941. Download the required 941 excel template. The report must be filed at the end of each quarter. Web use the march 2023 revision of. Several years ago we created a bank reconciliation template, which has been the most downloaded template since we’ve. Web web refer to sample excel reconciliation template. The irs has made changes to form 941 for the 2nd quarter of. Web use the march 2023 revision of form 941 to report taxes for the first quarter of 2023; Web make reconciliation. Oct 23, 2020 michael whitmire. The form 941 preparation report in microsoft dynamics ax. This example only lists the accounts common to most firms, many firms will have 1st qtr., 2006 2nd qtr., 2006 3rd. Paperless solutionsbbb a+ rated businessfree trial3m+ satisfied customers Sign in to your taxbandits account and select the 941 form from. Compare those figures with the totals reported on all four 941s for the year. Web make reconciliation documents with template.net's free reconciliation templates excel. Web this simple bank reconciliation template is designed for personal or business use, and you can download it as an excel file or google sheets template. Web use the march 2023 revision of form 941 to. Paperless solutionsbbb a+ rated businessfree trial3m+ satisfied customers Use on any account, petty cash, ledger, or other purposes. Whether you track payroll taxes and wages in a spreadsheet or. Run a report that shows annual payroll amounts. Compare those figures with the totals reported on all four 941s for the year. Worksheet 1 was updated to incorporate a new payroll tax credit and a revised. Web this simple bank reconciliation template is designed for personal or business use, and you can download it as an excel file or google sheets template. Fill in the empty fields; The form 941 preparation report in microsoft dynamics ax. Gather payroll registers from the current. Whether you track payroll taxes and wages in a spreadsheet or. Download the required 941 excel template. Fill in the empty fields; Make sure the amounts reported on. Enclose your check or money order made payable to “united states treasury.”. Run a report that shows annual payroll amounts. Compare those figures with the totals reported on all four 941s for the year. Calculate your tax credits automatically. Web download 41.84 kb 16490 downloads. Web make reconciliation easier with free accounting reconciliation templates. Reconciliation is one of the most important processes in. The report must be filed at the end of each quarter. Compare those figures with the totals reported on all four 941s for the year. Compare those figures with the totals reported on all four 941s for the year. Web web refer to sample excel reconciliation template. Enclose your check or money order made payable to “united states treasury.”. Fill in the empty fields; Paperless solutionsbbb a+ rated businessfree trial3m+ satisfied customers Web download 41.84 kb 16490 downloads. Make sure the amounts reported on. Enter your name and address as shown on form 941. The irs has made changes to form 941 for the 2nd quarter of. Every pay period before you cut employee checks—ideally, at least two days before your payday; Run a report that shows annual payroll amounts. Fill in the required information. Web ðï ࡱ á> þÿ 1.

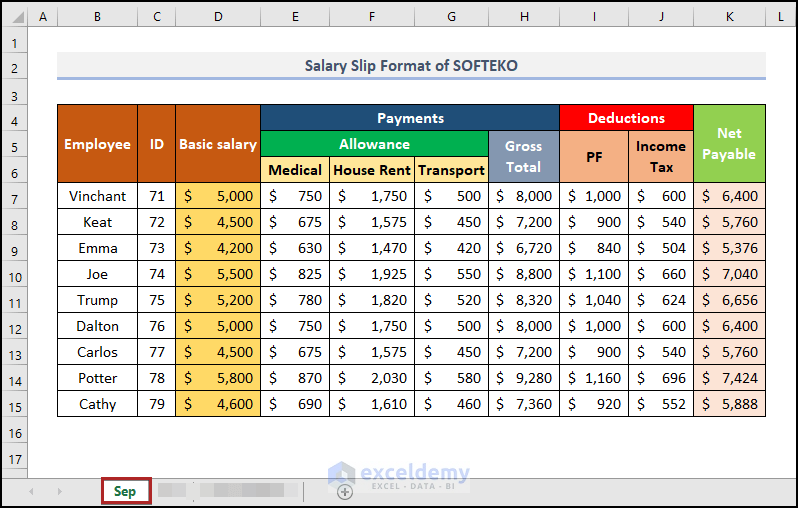

Payroll Reconciliation Excel Template

941 Reconciliation Template Excel

941 Reconciliation Template Excel

941 Reconciliation Template Excel

941 Reconciliation Template Excel

941 Reconciliation Template Excel

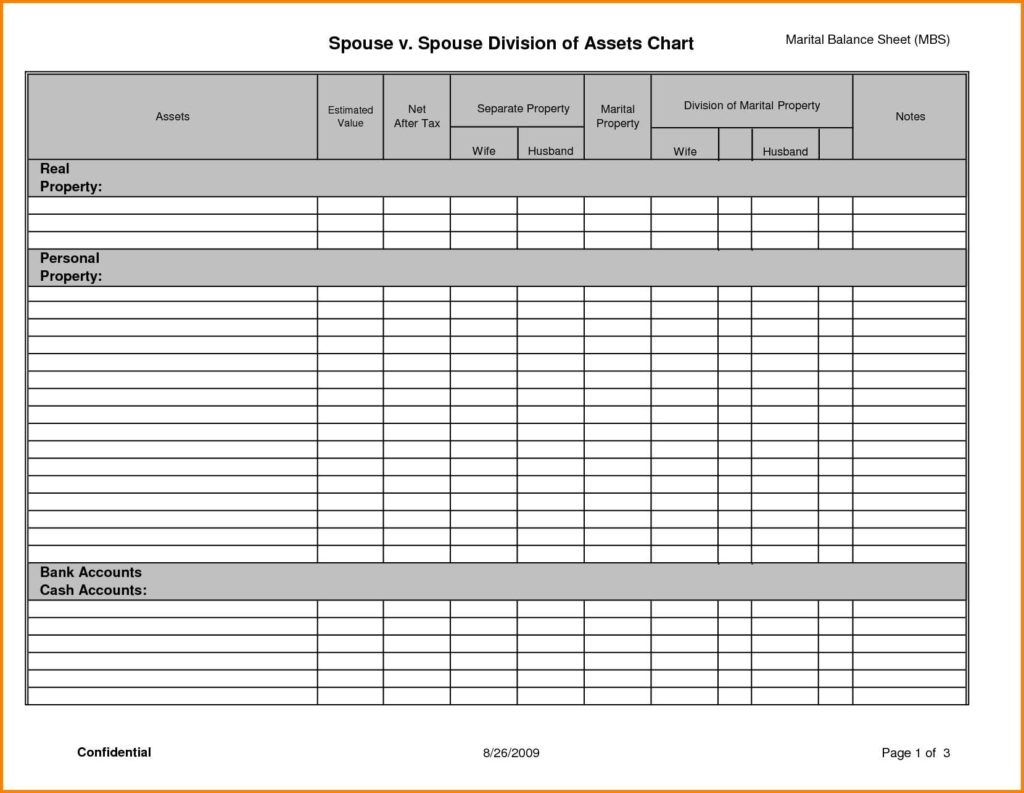

Account Reconciliation Template Excel SampleTemplatess SampleTemplatess

941 Reconciliation Template Excel

941 Reconciliation Template Excel

106 Form 941 Templates free to download in PDF, Word and Excel

Calculate Your Tax Credits Automatically.

Use On Any Account, Petty Cash, Ledger, Or Other Purposes.

Web Make Reconciliation Documents With Template.net's Free Reconciliation Templates Excel.

Web Form 941 Tax Credit Worksheet Updated For 2021 (1) Jazlyn Williams.

Related Post: