50 30 20 Budget Spreadsheet Template

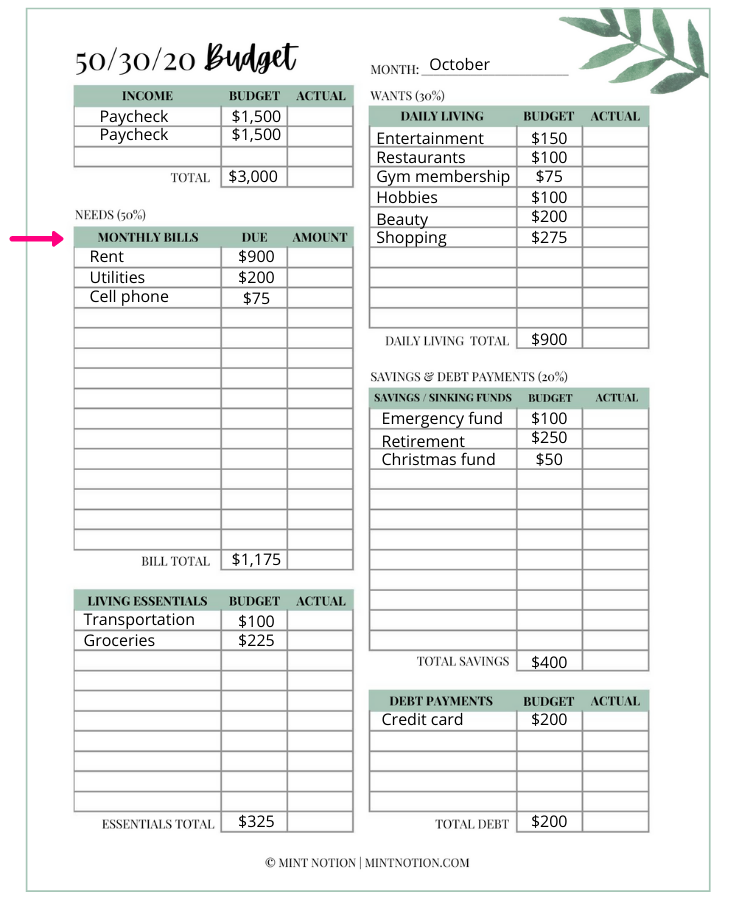

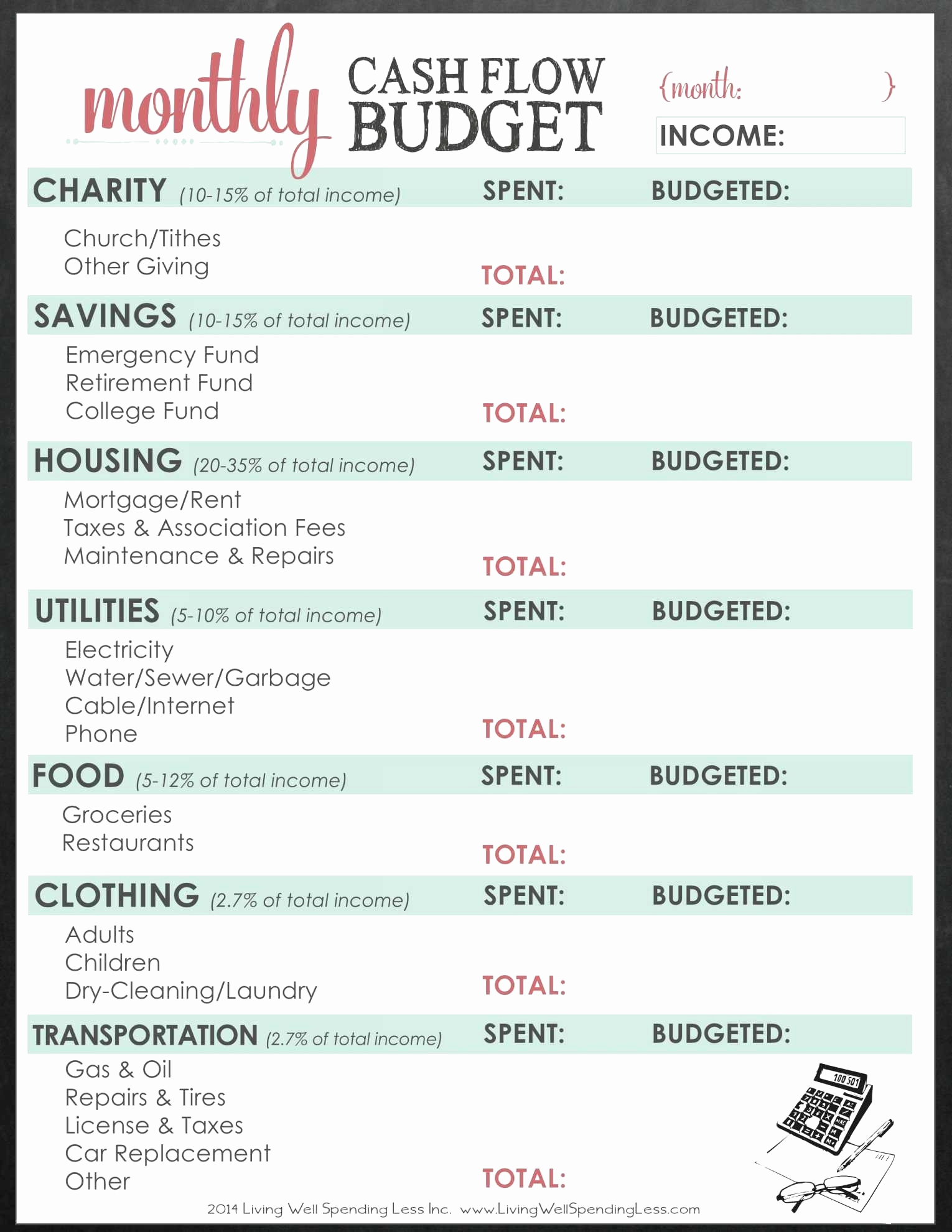

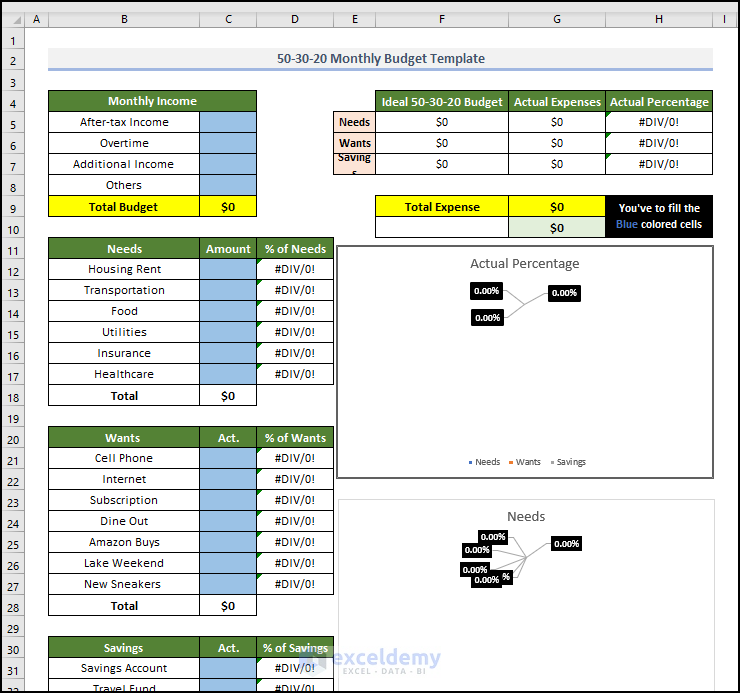

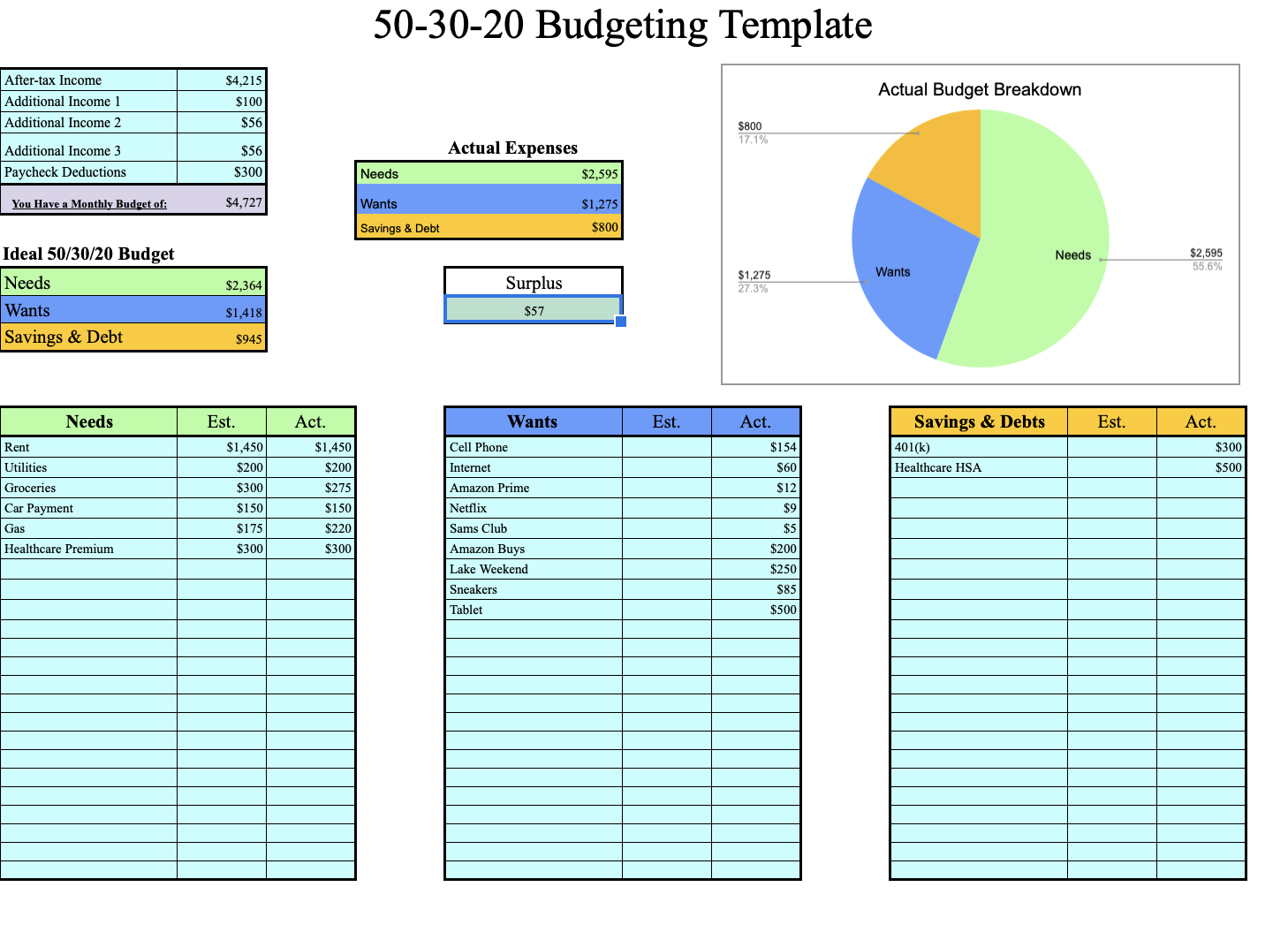

50 30 20 Budget Spreadsheet Template - How to divide your income? Web written by shahriar abrar rafid. If you don’t normally keep track of your spending, using a budgeting tool like mint.com for a month might be helpful. Results on how to spread your income: Web simple monthly budget template. 50% of net pay for needs, 30% for wants and 20% for savings and debt repayment. How you prefer to budget will affect what you want in a spreadsheet template. It helps you see exactly what your income is going toward and shows you if you’re under or over budget as you track your spending. Figure out your total monthly income. 4 steps to preparing any budget. All 15 are 100% free! Free 50/30/20 budget sheet download for google sheets. Web with that information, the worksheet shows how your finances compare with the 50/30/20 budget breakdown, which recommends that 50% of your income goes toward needs, 30% toward wants and. You can also share it with family and friends to encourage them to join you on your. Web if you want to save your budget plan in the excel file, you can skip to the 50 30 20 budget excel template. Using a 50/30/20 budget calculator can make your budgeting efforts easier and save you tons of time. They also provide a very rough estimate of your net worth. 50% of net pay for needs, 30% for. It helps you see exactly what your income is going toward and shows you if you’re under or over budget as you track your spending. Web click the image to download the budget template diy 50 30 20 budget spreadsheet. Enter everything you saved each month (savings 20% accounts, education fund, retirement), updating throughout the month and tracking against your. Free 50/30/20 budget sheet download for google sheets. Home business 50 30 20 budget template. Results on how to spread your income: It is useful to keep track of various revenue sources and spending categories. Web 50/30/20 monthly budget template. Then, divide the money into 50% for needs, 30% for wants, and 20% for savings. 50% of net pay for needs, 30% for wants and 20% for savings and debt repayment. How to divide your income? Spreadsheets (google sheets or excel spreadsheet) bullet journals. When managing your finances, having a budget is important for ensuring you are not spending too. If you don’t normally keep track of your spending, using a budgeting tool like mint.com for a month might be helpful. Web if you want to save your budget plan in the excel file, you can skip to the 50 30 20 budget excel template. 4 steps to preparing any budget. Brittney gets paid $2,000 every 2 weeks. Web the. If you don’t normally keep track of your spending, using a budgeting tool like mint.com for a month might be helpful. Web to use the 50/30/20 budget rule, start by calculating your net income. Results on how to spread your income: To help make it even easier to start your new monthly budget, we’ve created a budget worksheet to help. Updated on november 3, 2022. Her total monthly income that she will budget based on is $4,000. Web with that information, the worksheet shows how your finances compare with the 50/30/20 budget breakdown, which recommends that 50% of your income goes toward needs, 30% toward wants and. Web nerdwallet recommends the 50/30/20 budget, which suggests that 50% of your income. All 15 are 100% free! It helps you see exactly what your income is going toward and shows you if you’re under or over budget as you track your spending. Web the following spreadsheet templates use simple formulas to calculate your custom 50/30/20 budget snapshot. How to divide your income? Keep track of your finances. Figure out how you walk through these basic budgeting steps to know what you want. Results on how to spread your income: Web simple monthly budget template. Free 50/30/20 budget sheet download for google sheets. Web by andre flowers. Web by andre flowers. How to divide your income? Web the 50/30/20 budgeting rule divides your budget into 3 main categories: They also provide a very rough estimate of your net worth. 50% of net pay for needs, 30% for wants and 20% for savings and debt repayment. Figure out your total monthly income. Spreadsheets (google sheets or excel spreadsheet) bullet journals. All 15 are 100% free! Another option is to set up your own 50 30 20 budget spreadsheet. Keep track of your finances. Web if you want to save your budget plan in the excel file, you can skip to the 50 30 20 budget excel template. Web 1 digital download of the 50/30/20 personal budgeting template. Web click the image to download the budget template diy 50 30 20 budget spreadsheet. Determine how you are going to track your budget and finances. Track and visualize your income and spending for an average month to see how it compares to an ideal budget. Write down your total take home income.

50/30/20 Budget Overview Template Printable Monthly Budget Etsy New

What is the 50/30/20 Budget Rule and How it Works Mint Notion

50 30 20 Budget Spreadsheet Template —

50/30/20 Budget Template Instant Download Printable

Printable 50/30/20 Budget Template

How to Create a 503020 Budget Spreadsheet in Excel

50/30/20 Budget Template Printable, Monthly Budget Planner 50/30/20

Free Printable 50/30/20 Budget Spreadsheet Template

50 30 20 Rule (Free Excel Budgeting Template) I Try FI

The 50/30/20 rule to budgeting and saving Locke Digital

Her Total Monthly Income That She Will Budget Based On Is $4,000.

How You Prefer To Budget Will Affect What You Want In A Spreadsheet Template.

Enter Everything You Saved Each Month (Savings 20% Accounts, Education Fund, Retirement), Updating Throughout The Month And Tracking Against Your 20% Goal.

Figure Out How You Walk Through These Basic Budgeting Steps To Know What You Want.

Related Post: