3 Red Candles Pattern

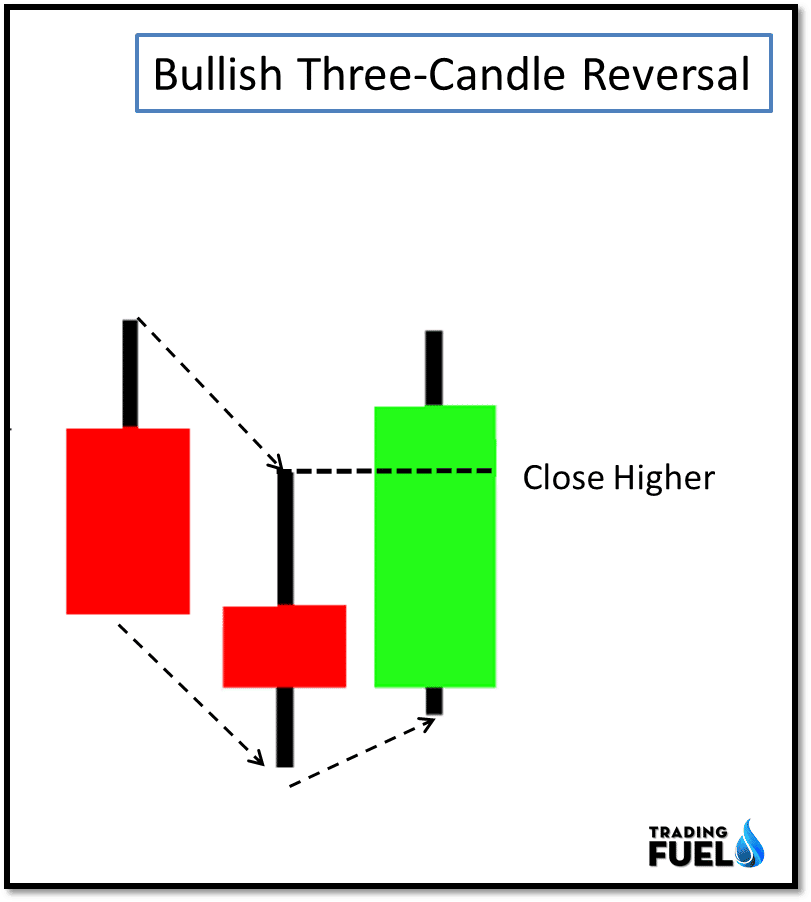

3 Red Candles Pattern - Web there are three consecutive red candles with long bodies on three trading days. And other three candlestick patterns are continuation patterns, which signal a. Web the pattern includes a gap in the direction of the current trend, leaving a candle with a small body (spinning top/or doji) all alone at the top or bottom, just like an island. Triple candlestick patterns are crucial formations on price charts used to indicate potential trend reversals or continuations, with common examples including morning star, evening star, three white soldiers, and three black crows. The setup candle, confirmation candle, and trigger candle. The third candlestick closes above the high of candlestick 1 and 2. The pattern is ended with a long red candle that closes above the high of the pattern, which means the market will go up in. The following candlestick closes below the opening of the first candlestick. Web what is the 3 candlestick rule? The first candlestick is long and bullish, indicating that the market is still in an uptrend. They show current momentum is slowing and the price direction is changing. The second, third, and fourth candles are small and bearish. Web the three white soldiers candlestick pattern is typically observed as a reversal indicator, often appearing after a period of price decline. Web three black crows is a phrase used to describe a bearish candlestick pattern that may. 1 a three soldiers reversal pattern indicating a shift in power from the sellers to the buyers. Web a bearish (red) candlestick. It indicates a bullish reversal, although the price should ultimately move in the. Table of contents [show] what are candlestick charts? The first pattern must be bullish. They are used in technical analysis to predict the direction in which the price of an asset is likely to move. The three crows pattern, also referred to as the “three black crows”, is a reversal pattern found at the end of an uptrend. Web what is the 3 candlestick rule? It typically represents a shift in momentum, with the. Web rising three methods definition & meaning. For a candlestick pattern to become a rising three methods, it must meet the following criteria: Candlestick charts show open, low, close and high prices of a trading day. The following candlestick closes below the opening of the first candlestick. It typically represents a shift in momentum, with the price moving in the. It typically represents a shift in momentum, with the price moving in the opposite direction after a sustained trend. Web the three inside down candlestick pattern is the opposite of the three inside up pattern and indicates a trend reversal found at the end of an uptrend. Web some three candlestick patterns are reversal patterns, which signal the end of. The pattern is ended with a long red candle that closes above the high of the pattern, which means the market will go up in. Web rising three methods definition & meaning. Each session opens at a similar price to the previous day, but selling pressures push the. Web this pattern is formed by three black or red (down) candles. Web the three inside down candlestick pattern is the opposite of the three inside up pattern and indicates a trend reversal found at the end of an uptrend. Candlestick charts are a visual representation of market data, showing the high, low, opening, and closing prices during a given time period. The following candlestick closes below the opening of the first. Web rising three methods definition & meaning. And other three candlestick patterns are continuation patterns, which signal a. Candlestick charts show open, low, close and high prices of a trading day. Each session opens at a similar price to the previous day, but selling pressures push the price lower and lower with each close. This chart pattern suggests a strong. Web what is the 3 candlestick rule? For a candlestick pattern to become a rising three methods, it must meet the following criteria: Ideally you want to find a series of 3 green candlesticks; They are essential tools for technical analysts in identifying potential reversals or the continuation of a trend. And other three candlestick patterns are continuation patterns, which. The setup candle, confirmation candle, and trigger candle. Table of contents [show] what are candlestick charts? Each session opens at a similar price to the previous day, but selling pressures push the. Web a bearish (red) candlestick. Web the pattern includes a gap in the direction of the current trend, leaving a candle with a small body (spinning top/or doji). They show current momentum is slowing and the price direction is changing. For a candlestick pattern to become a rising three methods, it must meet the following criteria: It typically represents a shift in momentum, with the price moving in the opposite direction after a sustained trend. 1 a three soldiers reversal pattern indicating a shift in power from the sellers to the buyers. Web the three white soldiers candlestick pattern is typically observed as a reversal indicator, often appearing after a period of price decline. The first pattern must be bullish. Each session opens at a similar price to the previous day, but selling pressures push the. Web the three candle pattern consists of three specific candlesticks: And other three candlestick patterns are continuation patterns, which signal a. The third candlestick closes above the high of candlestick 1 and 2. The second, third, and fourth candles are small and bearish. Web rising three methods definition & meaning. The setup candle is the first candle in the pattern and sets the stage for a potential reversal. 101k views 3 years ago technical analysis for beginners. Web three black crows is a phrase used to describe a bearish candlestick pattern that may predict the reversal of an uptrend. Web the three inside down candlestick pattern is the opposite of the three inside up pattern and indicates a trend reversal found at the end of an uptrend.

Three red burning candles on white background Vector Image

An Overview of Triple Candlestick Patterns Forex Training Group

10 Price Action Candlestick Patterns Poole Squithrilve

Candlestick Patterns The Definitive Guide (2021)

How To Trade Blog What Is Three Inside Down Candlestick Pattern

Three+ Candle Patterns ChartPatterns Candlestick Stock Market

How to read candlestick patterns What every investor needs to know

How to Read Candlestick Charts for Intraday Trading

Candlestick Patterns The Trader's Guide

Three Candle Patterns Explained Part 1 YouTube

This Chart Pattern Suggests A Strong Change In.

The Following Chart Shows An Example Of A Three Inside Down Pattern:

Table Of Contents [Show] What Are Candlestick Charts?

It Indicates A Bullish Reversal, Although The Price Should Ultimately Move In The.

Related Post: