3 Candlestick Patterns

3 Candlestick Patterns - Web the three crows pattern, also referred to as the “three black crows”, is a reversal pattern found at the end of an uptrend. Web three inside up pattern. The first candlestick is long and bearish, indicating that the market is still in a downtrend. The characteristics of this pattern are defined by: Though the second day opens lower than the first, the bullish market pushes the price up, culminating in an obvious win for buyers. Web the three black crows candlestick pattern, or simply the black crows pattern, signals a likely shift from a bullish to bearish market trend and is recognized as a negative configuration. The bullish engulfing pattern is formed of two candlesticks. Purposecandlestick charts are a key tool for the technical analysis. Candlestick charts are a technical tool that packs data for multiple time frames into single price bars. Daniels’s efforts to sell her story of a sexual encounter with donald j. This pattern is formed when three consecutive doji candlesticks appear at the end of a prolonged trend. The bullish candle is usually coloured in green signaling. The three crows pattern forms as follows: For a valid three inside up candlestick formation, look for these properties: Bullish engulfing is a multiple candlestick chart pattern that is formed after a downtrend indicating. Web learn all #candlestickpatterns analysis for #stockmarket trading & #technicalanalysis in 3 free episodes.👉 open free demat account on angel broking: The bullish candle is usually coloured in green signaling. Web three inside up pattern. The first candlestick is long and bearish, indicating that the market is still in a downtrend. It is formed by two candles, the second candlestick. The first candle is a bearish candle that indicates the continuation of the downtrend. The end of the rectangle above is the closing price. Web three inside up/down: The bullish candle is usually coloured in green signaling. Stormy daniels leaving court on. A type of candlestick pattern that signals a reversal in the current trend. Staying hydrated helps your body operate at its best. Technically, although the pattern is known as 3 bar play pattern, it consists of four candles rather than three in some formations. Web nifty on wednesday ended flat to form a high wave type candle pattern, which indicates. The third candlestick closes above the high of candlestick. Purposecandlestick charts are a key tool for the technical analysis. This pattern starts out with what is called a long white day. then, on the second, third, and fourth trading sessions, small real bodies move. Gaps (a general term used to indicate both. Do keep track of your eating habits. Technically, although the pattern is known as 3 bar play pattern, it consists of four candles rather than three in some formations. Statistics to prove if the advance block pattern. This makes them more useful than traditional open, high, low. It is formed by two candles, the second candlestick engulfing the first candlestick. Web do plan meals and snacks ahead. The nifty bank fell 66 points to close at 47,421 and on a weekly basis the index was down by more than 3%. The start of the rectangle from the bottom is the opening price. Do drink plenty of water. Web very few bullish candlestick patterns work, but this article presents 3 bullish candlestick patterns that work.even though candlesticks are. Multiple candlestick patterns (part 3) the morning star and the evening star are the last two candlestick patterns we will be studying. Here's how it all works. Web prosecutors have argued that ms. Web three inside up/down: Web three outside up/down: Web very few bullish candlestick patterns work, but this article presents 3 bullish candlestick patterns that work.even though candlesticks are a popular charting method, very few patterns have any predictive value. Web the three crows pattern, also referred to as the “three black crows”, is a reversal pattern found at the end of an uptrend. For this reason, we want. Though the second day opens lower than the first, the bullish market pushes the price up, culminating in an obvious win for buyers. The following candlestick closes below the opening of the first candlestick. The first candle should be found at the. Bullish engulfing is a multiple candlestick chart pattern that is formed after a downtrend indicating a bullish reversal.. 04:15:37 pm ist, 10 may 2024. Web do plan meals and snacks ahead of time. The characteristics of this pattern are defined by: Daniels’s efforts to sell her story of a sexual encounter with donald j. This pattern is formed when three consecutive doji candlesticks appear at the end of a prolonged trend. Web three white soldiers is a bullish candlestick pattern that is used to predict the reversal of the current downtrend. Web three inside up pattern. When a three outside up candlestick pattern appears at the right location, it may show: Web prosecutors have argued that ms. The three crows pattern forms as follows: This indication serves as an alert that the current trend may be reversing. The first candle is a short red body that is completely engulfed by a larger green candle. The wick pointing to the bottom is called the lower wick or lower shadow and the tip represents the lower price. Web learn all #candlestickpatterns analysis for #stockmarket trading & #technicalanalysis in 3 free episodes.👉 open free demat account on angel broking: Web the three crows pattern, also referred to as the “three black crows”, is a reversal pattern found at the end of an uptrend. Though the second day opens lower than the first, the bullish market pushes the price up, culminating in an obvious win for buyers.

Candlestick Patterns The Definitive Guide (2021)

How to read candlestick patterns What every investor needs to know

![Candlestick Patterns Explained [Plus Free Cheat Sheet] TradingSim](https://f.hubspotusercontent10.net/hubfs/20705417/Imported_Blog_Media/CANDLESTICKQUICKGUIDE-Mar-18-2022-09-42-46-01-AM.png)

Candlestick Patterns Explained [Plus Free Cheat Sheet] TradingSim

Three+ Candle Patterns ChartPatterns Candlestick Stock Market

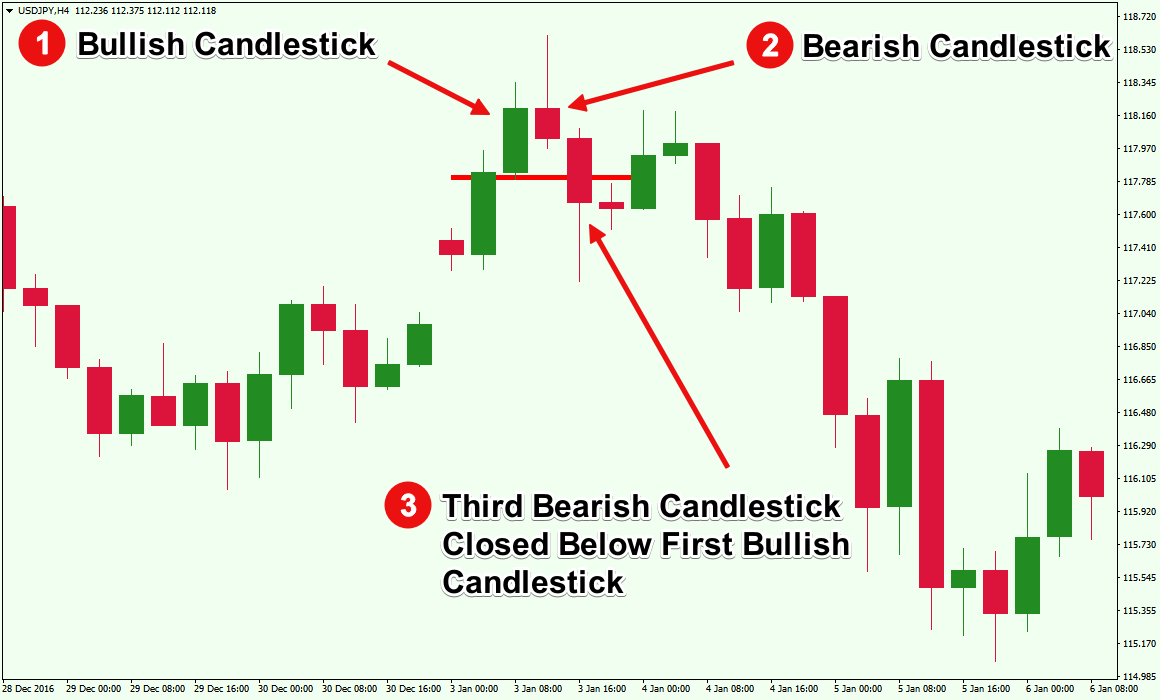

How To Trade Forex Effectively With Three Inside Up Candlestick Pattern

Candlestick Pattern Book Candlestick Pattern Tekno

![Candlestick Patterns The Definitive Guide [UPDATED 2022]](https://www.alphaexcapital.com/wp-content/uploads/2020/04/Bullish-Harami-Candlestick-Patterns-Example-by-Alphaex-Capital-1030x1030.png)

Candlestick Patterns The Definitive Guide [UPDATED 2022]

What Is Three Inside Up Candlestick Pattern? How To Trade Blog

An Overview of Triple Candlestick Patterns Forex Training Group

Most Reliable Candlestick Pattern

A Type Of Candlestick Pattern That Signals A Reversal In The Current Trend.

Web The Three Black Crows Candlestick Pattern, Or Simply The Black Crows Pattern, Signals A Likely Shift From A Bullish To Bearish Market Trend And Is Recognized As A Negative Configuration.

The First Candle Should Be Found At The.

Web Very Few Bullish Candlestick Patterns Work, But This Article Presents 3 Bullish Candlestick Patterns That Work.even Though Candlesticks Are A Popular Charting Method, Very Few Patterns Have Any Predictive Value.

Related Post: