3 Candlestick Pattern

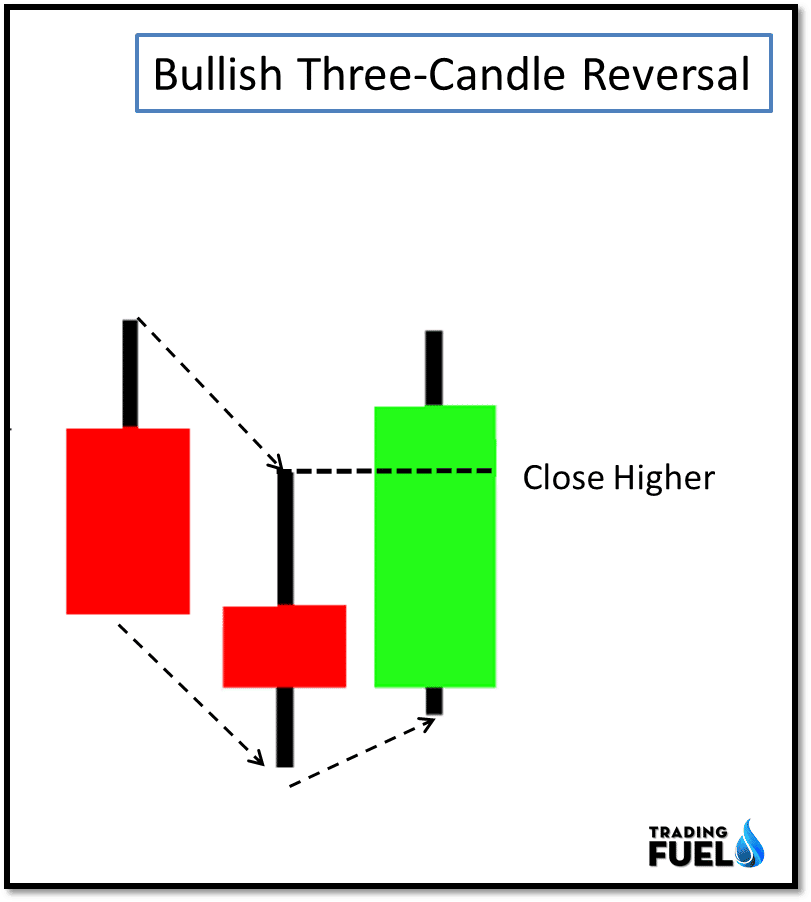

3 Candlestick Pattern - Web learn all #candlestickpatterns analysis for #stockmarket trading & #technicalanalysis in 3 free episodes. Table of contents [show] what are candlestick charts? The falling three methods is a bearish,. The elements of a candlestick. The following candlestick closes below the opening of the first candlestick. The decisive (fifth) strongly bullish candle. The candles—with gaps between them—may. It is found at the end of a downtrend and it is a clear indication of a shift in the balance from the sellers to the buyers. This can be contrasted with the rising three methods. The third candlestick closes above the high of candlestick 1. The up version of the pattern is bullish, indicating the price move lower may be ending and a move higher is starting. The pattern consists of three consecutive. Web the three inside down candlestick pattern is the opposite of the three inside up pattern and indicates a trend reversal found at the end of an uptrend. The pattern requires three. Web understanding the three inside up/down candlestick patterns. The three soldiers pattern is a reversal pattern. This can be contrasted with the rising three methods. Nifty ends 98 points higher on friday to form an inside bar candlestick pattern. The morning star is a buy indicator. Technically, although the pattern is known as 3 bar play pattern, it consists of four candles rather than three in some formations. The candles—with gaps between them—may. The following chart shows an example of a three inside down pattern: The three soldiers pattern forms as follows: The falling three methods is a bearish,. Candlestick charts are a visual representation of market data, showing the high, low, opening, and closing prices during a given time period. The following chart shows an example of a three inside down pattern: It typically represents a shift in momentum, with the price moving in the opposite direction after a sustained trend. But for all intents and purposes, we’ll. The candles—with gaps between them—may. Nifty ends 98 points higher on friday to form an inside bar candlestick pattern. The evening star is similar to the. It is also sometimes called the “three advancing soldiers” or “three white soldiers”. Table of contents [show] what are candlestick charts? The pattern consists of three consecutive. Web stock market highlights: The nifty50 bounced back and rose 97 points to close at 22,055 on friday. The three soldiers pattern forms as follows: Over time, individual candlesticks form patterns that traders can use to recognise major support and resistance levels. The pattern requires three candles to form in a specific sequence,. The candles—with gaps between them—may. 👉 open free demat account on angel broking: And other three candlestick patterns are continuation patterns, which signal a pause and then the continuation of. It is also sometimes called the “three advancing soldiers” or “three white soldiers”. It is also sometimes called the “three advancing soldiers” or “three white soldiers”. Web three soldiers candlestick pattern. 👉 open free demat account on angel broking: Web some three candlestick patterns are reversal patterns, which signal the end of the current trend and the start of a new trend in the opposite direction. This is painting a broad stroke, because. The morning star is a buy indicator. It is also sometimes called the “three advancing soldiers” or “three white soldiers”. The following chart shows an example of a three inside down pattern: Table of contents [show] what are candlestick charts? Signals link in bio #buyandsell #forexsignals #groupsignal #charts #pattern #tradingview #metatrader5 #. The third candlestick closes above the high of candlestick 1. The three soldiers pattern is a reversal pattern. The nifty50 bounced back and rose 97 points to close at 22,055 on friday. 👉 open free demat account on angel broking: Over time, individual candlesticks form patterns that traders can use to recognise major support and resistance levels. This is painting a broad stroke, because the context of the candle formation is what really matters. Purposecandlestick charts are a key tool for the technical analysis. Web three soldiers candlestick pattern. The setup candle, confirmation candle, and trigger candle. The setup candle is the first candle in the pattern and sets the stage for a potential reversal. And other three candlestick patterns are continuation patterns, which signal a pause and then the continuation of. Web what is the 3 candlestick rule? The morning star is a buy indicator. The pattern consists of three consecutive. Technically, although the pattern is known as 3 bar play pattern, it consists of four candles rather than three in some formations. The elements of a candlestick. It typically represents a shift in momentum, with the price moving in the opposite direction after a sustained trend. Web there are three types of candlestick interpretations: The three soldiers pattern forms as follows: The up version of the pattern is bullish, indicating the price move lower may be ending and a move higher is starting. The third candlestick closes above the high of candlestick 1.

10 Price Action Candlestick Patterns Trading Fuel Research Lab

An Overview of Triple Candlestick Patterns Forex Training Group

Candlestick Pattern Book Candlestick Pattern Tekno

What Is Three Inside Up Candlestick Pattern? How To Trade Blog

![Candlestick Patterns The Definitive Guide [UPDATED 2022]](https://www.alphaexcapital.com/wp-content/uploads/2020/04/Bullish-Harami-Candlestick-Patterns-Example-by-Alphaex-Capital-1030x1030.png)

Candlestick Patterns The Definitive Guide [UPDATED 2022]

What Is Three White Soldiers Candle Pattern? Meaning And How To Use

Candlestick Patterns The Definitive Guide (2021)

How To Trade Forex Effectively With Three Inside Up Candlestick Pattern

![Candlestick Patterns Explained [Plus Free Cheat Sheet] TradingSim](https://www.tradingsim.com/hubfs/Imported_Blog_Media/CANDLESTICKQUICKGUIDE-Mar-18-2022-09-42-46-01-AM.png)

Candlestick Patterns Explained [Plus Free Cheat Sheet] TradingSim

Bullish Rising Three Methods Candlestick Candle Stick Trading Pattern

Web Stock Market Highlights:

Web The Third Candlestick Is A Bullish Candlestick That Should At Least Pass The Halfway Point Of The First Bearish Candle.

The Decisive (Fifth) Strongly Bullish Candle.

Web Understanding The Three Inside Up/Down Candlestick Patterns.

Related Post: