3 Candle Pattern

3 Candle Pattern - Web cut glass came in tons of gorgeous styles over the years, some dating back more than a century. Candlestick charts are a technical tool that packs data for multiple time frames into single price bars. An inside bar comes next, suggesting consolidation, and. The arrest came following an investigation by the internet. Web three inside up/down: Web candlestick pattern explained. This pattern is formed when three consecutive doji candlesticks appear at the end of a prolonged trend. This can be either a continuation or reversal pattern. The first candlestick of the chart pattern that needs to appear is a bullish candlestick with. This doji’s pattern conveys a struggle between buyers and sellers that results in no net gain for either side. Wait until candle 3 closes above 1 and 2 before you go along. Browse available scents, like clean cotton, vanilla bean, and apple harvest. Technically, although the pattern is known as 3 bar play pattern, it consists of four candles rather than three in some formations. It consists of three consecutive bearish candlesticks. Multiple candlestick patterns (part 3) the morning. Web cut glass came in tons of gorgeous styles over the years, some dating back more than a century. Candlestick charts are a technical tool that packs data for multiple time frames into single price bars. The first candlestick of the chart pattern that needs to appear is a bullish candlestick with. This pattern will cut back on trading opportunities. Web three inside up pattern. An inside bar comes next, suggesting consolidation, and. Multiple candlestick patterns (part 3) the morning star and the evening star are the last two candlestick patterns we will be studying. Owning a candle shop doesn’t mean you’ll spend your days making candles at home. It is one of the safest patterns to play in the. Daniels will return to the stand on thursday after detailing the liaison she says she had with donald j. Web the three white soldiers pattern can appear after an extended downtrend and a period of consolidation. Web three inside up/down: This can be either a continuation or reversal pattern. The bullish engulfing pattern is formed of two candlesticks. Wait until candle 3 closes above 1 and 2 before you go along. The first candle should be found at the. Further, the 3 bar play can be either a trend. Web sanku (three gaps) pattern: Daniels will return to the stand on thursday after detailing the liaison she says she had with donald j. Daniels will return to the stand on thursday after detailing the liaison she says she had with donald j. Though the second day opens lower than the first, the bullish market pushes the price up, culminating in an obvious win for buyers. It is one of the safest patterns to play in the market. This triple candlestick pattern indicates that. For a valid three inside up candlestick formation, look for these properties: Wait until candle 3 closes above 1 and 2 before you go along. Web three white soldiers is a bullish candlestick pattern that is used to predict the reversal of the current downtrend. This pattern will cut back on trading opportunities and prevent overtrading. There are a ton. Technically, although the pattern is known as 3 bar play pattern, it consists of four candles rather than three in some formations. It consists of three consecutive bearish candlesticks. Web the three white soldiers pattern can appear after an extended downtrend and a period of consolidation. The following chart shows an example of a three inside up pattern: Mastering the. Technically, although the pattern is known as 3 bar play pattern, it consists of four candles rather than three in some formations. A type of candlestick pattern that signals a reversal in the current trend. Web sanku (three gaps) pattern: The characteristics of this pattern are defined by: For this reason, we want to see this pattern after a move. The characteristics of this pattern are defined by: The arrest came following an investigation by the internet. A type of candlestick pattern that signals a reversal in the current trend. Browse available scents, like clean cotton, vanilla bean, and apple harvest. Web three inside up pattern. This doji’s pattern conveys a struggle between buyers and sellers that results in no net gain for either side. The following chart shows an example of a three inside up pattern: Gaps (a general term used to indicate both. When a three outside up candlestick pattern appears at the right location, it may show: The first candlestick is long and bearish, indicating that the market is still in a downtrend. The first candle should be found at the. Web candlestick pattern explained. Gingham checks are all the rage and this timeless pattern will boost coffee mornings. Web there are 108 trades, the average gain per trade is 0.71%, the cagr is 2.6%, the time invested in the market is 5%, the win ratio is 80%, the max drawdown is 14%, and the profit factor is 2.8. Signals link in bio #buyandsell #forexsignals #groupsignal #charts #pattern #tradingview #metatrader5 #. Web the three black crows candlestick pattern, or simply the black crows pattern, signals a likely shift from a bullish to bearish market trend and is recognized as a negative configuration. Mastering the art of reading these charts can significantly enhance your trading strategy, providing insights into market sentiment, trends, and potential reversals. Web three white soldiers is a bullish candlestick pattern that is used to predict the reversal of the current downtrend. This candlestick pattern is pretty similar to the lower highs and lower lows pattern. Select candles for your shop. Though the second day opens lower than the first, the bullish market pushes the price up, culminating in an obvious win for buyers.

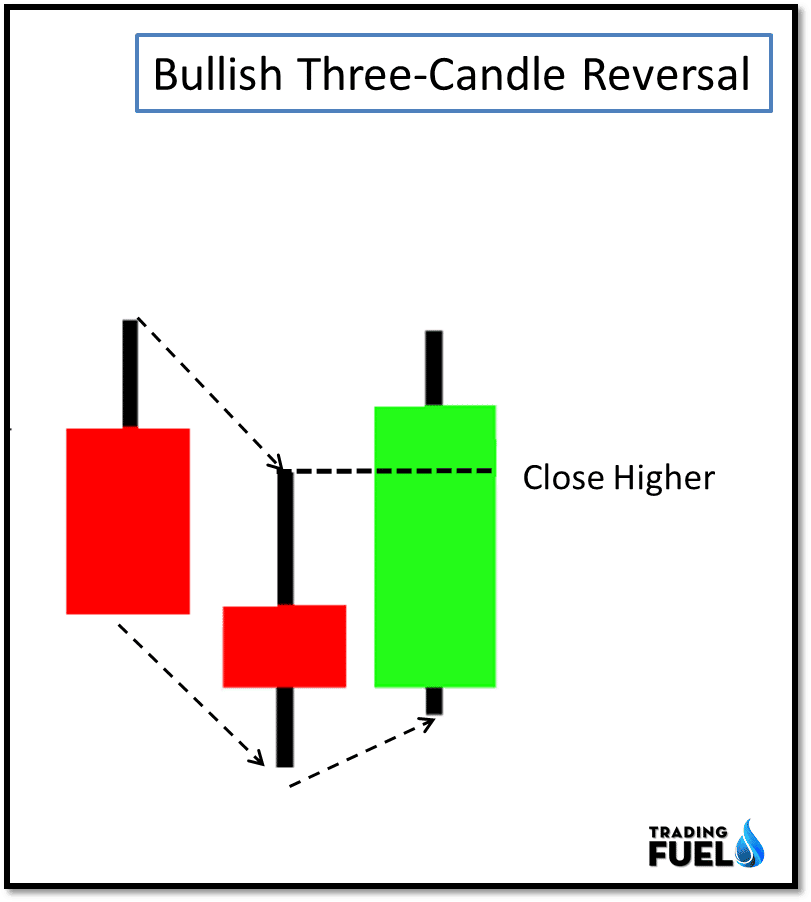

An Overview of Triple Candlestick Patterns Forex Training Group

What Is Three White Soldiers Candle Pattern? Meaning And How To Use

Three+ Candle Patterns ChartPatterns Candlestick Stock Market

10 Price Action Candlestick Patterns Trading Fuel Research Lab

Candlestick Patterns The Definitive Guide (2021)

How To Trade Forex Effectively With Three Inside Up Candlestick Pattern

What Is Three Inside Up Candlestick Pattern? How To Trade Blog

![Candlestick Patterns The Definitive Guide [UPDATED 2022]](https://www.alphaexcapital.com/wp-content/uploads/2020/04/Bullish-Harami-Candlestick-Patterns-Example-by-Alphaex-Capital-1030x1030.png)

Candlestick Patterns The Definitive Guide [UPDATED 2022]

Candlestick Patterns The Definitive Guide (2021)

Candlestick Patterns The Definitive Guide (2021)

Technically, Although The Pattern Is Known As 3 Bar Play Pattern, It Consists Of Four Candles Rather Than Three In Some Formations.

There Are A Ton Of Ways To Build Day Trading.

A Type Of Candlestick Pattern That Signals A Reversal In The Current Trend.

Web Three Inside Up Pattern.

Related Post: